2020 is destined to become a year that will be remembered just by mentioning two digits, much like ’87, ’01, and ’08 have become synonymous with the events of each respective year. All someone will need to say is “remember ’20,” and we’ll know everything that number entails—from the pandemic to the presidency, and a lot in between.

Source: Outlook 2021 – The Start of a Transformation

My outlook for this year is more significant than any in the recent past when events from one year to the next were little more than shades of gray. This year, I believe, we’re witnessing the start of a transformation and evolution—economically, politically, and socially.

To create an outlook report that is consumable and consistent with how most people like to receive information these days, I begin with an outline (see cover page), then add a brief explanation and maybe a few charts. Over the next weeks and months, I will follow up with blog posts and details on topics—and probably will get into the weeds with over-explanations and analogies. Stay tuned!

Content continues below advertisement

2020 In Review

2020 began with more uncertainty in the economy than the markets and the experts suggested, as the acceleration of economic data slowed compared to past quarters. The Astor Economic Index® (AEI), our proprietary method of measuring economic growth, started to decline, suggesting lower exposure to stocks as 2020 began. However, as I also pointed out in our 2020 Outlook: “The support beams in today’s diversified economy are … strong enough even to withstand and recover from the impact of a tragic event should one occur.” No one could have predicted the events of 2020. At any time, the best anyone can do is prepare for the economic environment, particularly if the economy appears to be in a position such that unforeseen events would likely have an exaggerated impact on risk assets.

As the pandemic accelerated, recession-like data quickly emerged, and by the end of Q1 2020 we witnessed the fastest decline and contraction ever recorded in the U.S. Within weeks, 20 million jobs were lost, and GDP contracted by more than 30% q/q annualized. The AEI declined quickly in step with deteriorating economic data. Accordingly, we reduced equity exposure in our portfolios. Aggressive relief and stimulus programs were implemented at lightning speed. An economic recovery began, and the market exploded to the upside. Ten million jobs were quickly added, and GDP recovered with a 30% increase in Q2 2020. The AEI identified this shift and bounced back, and we increased equity exposure gradually throughout the remainder of the year—ultimately ending 2020 at levels higher than the beginning of the year.

The efficiencies we spoke about in 2020, and the ability to be more efficient in becoming efficient, took hold at breakneck speeds. This was not just videoconferencing like Zoom, Meets, FaceTime, etc. We saw a societal change in how we consume, spend, and produce. From curbside pickup, remote work, home learning, and even online weddings, it was clear that society and the economy were changing.

The stimulus programs helped propel the stock market higher, with huge increases in money supply, debt, and savings. This, combined with a changing economy, will be the ingredients for determining what could be ahead in 2021. Top of the list: substantial changes in inflation and long-term interest rates, and the performance of assets other than stocks and bonds (finally).

The pandemic created a “suppression” of the normal economic forces, as if the mechanics of how the economy normally works had been turned off. It was not a typical boom/bust cycle, in which an expansion leads to oversupply and extended valuations that limit more capital being invested, resulting in lower worker productivity and shrinking profits. Typically, this corrects by reducing the workforce and eliminating excess supply; eventually worker productivity returns along with profit. Companies can then afford to hire more workers to increase supply, leading to higher employment levels, which in turn increases demand for goods and services. And so the cycle begins again. This time, however, things were different. The pandemic “suppressed” these economic forces, requiring substantial intervention by the government.

Stimulus and Relief Programs

The Federal Reserve and Treasury acted quickly with programs such as the Payroll Protection Program (PPP), the CARES Act, forgivable loans, and extended and increased unemployment benefits. Fed actions included dropping interest rates to zero, as well as purchasing bonds of all ratings and pumping unlimited liquidity into the banking system. They did everything except for buying actual stocks and houses. For its part, the federal government also did anything and everything to incentivize companies to continue to employ people and pay workers regardless of their productivity. If employees had to be laid off, unemployment benefits were increased; if

people could not afford to purchase basic necessities, the government actually gave them money to keep up consumption. This happened quickly and essentially with no limits or calculation of a desired outcome or goal.

Liquidity

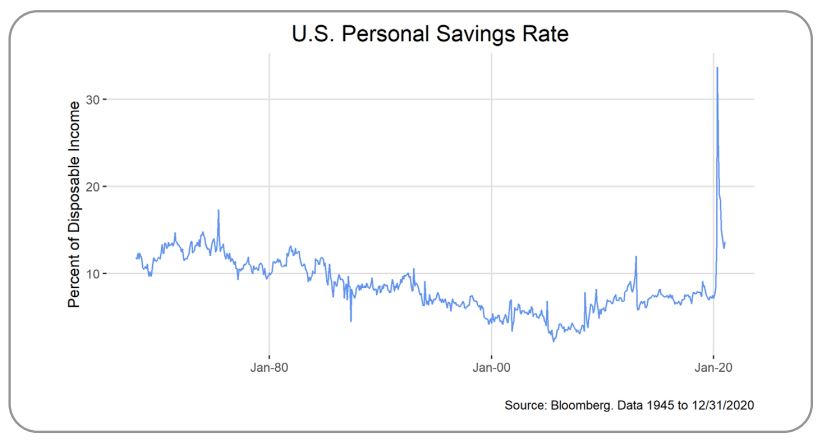

For every $1.00 in the system in January 2020, there was $1.40 in the system by December 2020. Money supply exploded as seemingly limitless liquidity entered the banking system. When consumption slowed, the savings rate ballooned—reaching record levels with trillions of dollars on deposit at banks.

Little attention was being paid to these numbers or calculations of the future consequences. If there was a debate at all, it was political not mathematical. As long as short-term goals of increasing employment and supporting a stock market rally were achieved; the future impact could be worried about later.

Stock Market

The stock market found a bottom on March 23, 2020 and recovered nicely. In this type of environment, it only made sense that money found its way into the best-yielding asset classes with the perceived best risk/reward outcome, and stocks were high on that list.

Investors zeroed in on companies with strong enough balance sheets to wait it out until the economy was back in full force. Also, there were other companies that actually benefited from the pandemic and the trends in work- from-home, exercise-at-home, shop-from-home, learnat-home, etc. And still there were companies that benefited from all the support and relief programs available, even if their core business had not been in good shape beforehand.

Although there was some correlation between improving economic fundamentals and the stock market rally, most would say that the market recovered faster than the data dictated. So, other than the market being forward-looking and hugely optimistic about the vaccine and the future, what else could be behind the rally? How long could all this be sustainable?

Dividend Yield of Stocks vs. Yield on U.S. Treasuries

To reiterate, a form of economic recovery took place, along with additional liquidity, all of which greased the wheels of the market. However, I contend that the acceleration of the rally is due to another factor, also indirectly created by the liquidity: That is, the differential between the stock market dividend yield and the yield on 10-year treasuries.

The veracity of this lies in the math. When the stock market was down more than 30% (which occurred, from the Feb. 19, 2020 record high to the March 23 low), with a dividend yield of 2% on stocks, and 7-10 year treasuries up 6.38% with a yield as low as 54 basis points, investors faced an essential question: Should they invest in an asset with a yield of 2%, or in an asset with a yield of essentially 0% over 10 years? A 2% annual dividend yield on stocks, compounded daily over 10 years is an additional 22%, which can appear pretty attractive and a nice cushion for an asset class already down 30% and most likely to be higher in 10 years— let alone 50% higher in 6 months. A yield of just over zero, if held for 10 years could deliver a negative return if inflation is factored into the picture—especially with rates doubling already by year end creating a loss on the bonds if sold early.

Suddenly, the dividend returns on stocks started driving investment in equities far more than earnings, revenues growth, profitability, P/E ratios, and all the rest. To be clear, I am not suggesting that dividend yield was the sole reason for the rally; rather, I believe that the velocity of the upward move in equities was due to the highly favorable dividend yield for stocks compared to the much lower yield on treasuries. To many investors, with stocks down double digits, this seemed like a no brainer; even with stocks down single digits or flat, the math still works.

However, as stocks continue to rally, the current dividend yield could decline, and as the economy, recovers the safety premium (risk off) of bonds also declines; thus, yields go up. In my view, this is what stalls the stock market rally. As stocks continue to rally, their dividend yields will decline to levels that make bonds attractive when weighed against the risk in stocks; or else yields rise to make bonds look attractive. In my view, the most likely outcome is a little of one and a lot of the other. This could create a garden variety correction. But if the economic

fundamentals stall and the AEI declines, then it could be the beginning of the feared double dip recession.

That said, as we are well into Q1 2021, both seem to be far off, with larger gains in stocks likely ahead before the party ends.

Rates

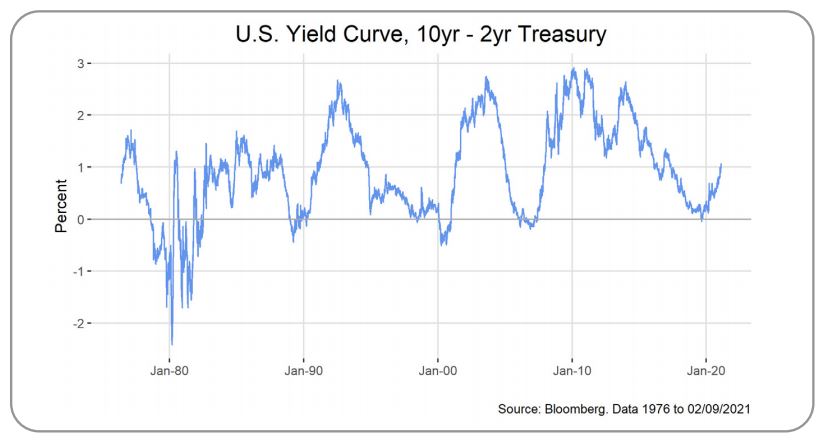

Interest rates will have a significant role in the continued recovery and asset performance for a while. The genie is out of the bottle (and has been for many years) that the economy is controlled by interest rates and liquidity. In my opinion, long-term bond yields could rise and do so significantly! There are many ingredients in the mix for higher rates: trillions of dollars of debt that need to be floated, inflation likely to accelerate, and even risk premiums on U.S. debt possibly rising. While rates are at historic lows, we have to remember that 40 years ago (May 1981, to be exact) rates were 20% and inflation was over 10%. Bond prices are not positively sloped like stock prices (they don’t always go down). Interest rates oscillate — meaning, they go from low to high and back again. It has been a half-century round trip, albeit with some pops along the way, but we have gone from below 1% to 20% and back. It has been a long time, and many might not even acknowledge it, but rates do go up and inflation surpasses 2%.

Will rates ever get that high again? I don’t know, but in my view, the long-term trend of consistently declining rates is coming to an end. Short-term rates not so fast, but higher longterm rates and a widening yield curve are about to begin, in my view. The impact of higher rates on asset allocation and performance of other assets is about to change.

Inflation

As I recall from one of my early classes in Economics 101, one simple definition of inflation is too much money chasing too few goods. Well, we sure got that! Money entering the system excessively used to be referred as “helicopter money,” conjuring up the image of dropping buckets of dollar bills out of a helicopter. Now, I refer to this windfall as “mailbox money” that actually (not figuratively) showed up in people’s mailboxes. With supply chains broken down and production slowed or even halted, there were too few goods. It is obvious to me that this

imbalance will eventually be inflationary—too much money chasing too few goods.

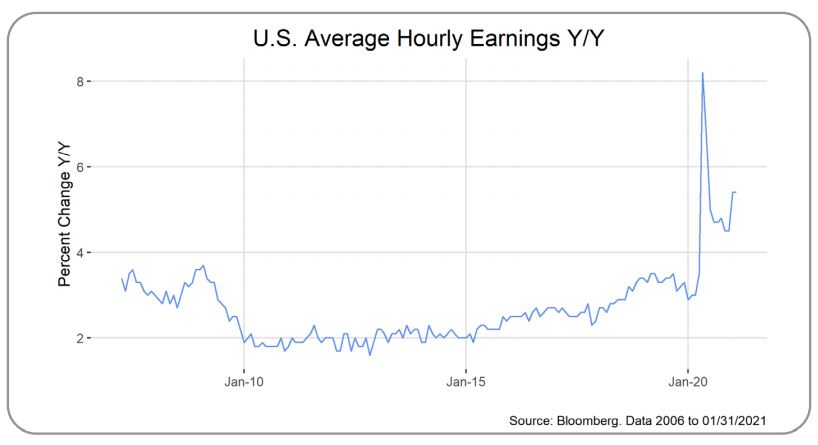

Another component to inflation is rising wages, which is on my radar now, given the drive to raise the federal minimum wage to $15 an hour. While that may not actually cause wages to rise, the year-over-year increase in wages ticked up 5.4% in January, which will eventually create higher prices of goods and services—another reason to expect higher future inflation.

- 5.1-channel 80-Watt powerful surround sound system

- 4K60, 4K120AB and 8K60B HDMI 2.1 with HDCP 2.3 and...

- Dolby Vision, Hybrid Log-Gamma and BT.2020

- Supports enhanced media and gaming - ALLM, VRR

- YPAO automatic room calibration

- Low-Profile Modern Design - Clean silhouettes,...

- Powerful Performance - Brilliant clarity,...

- Simple Setup, Streaming & Control - Get setup and...

- 5.1-Channel Sound - Experience a powerful...

- 6 Total Speakers - Full-range drivers deliver...

Last update on 2024-04-05 / Affiliate links / Images from Amazon Product Advertising API

With higher inflation, purchasing power is going to decline substantially. Your dollar won’t buy the same amount of goods and services it once did. A dollar earned by a unit of labor or the risk taken to invest cannot be worth the same as a dollar that shows up in your mailbox.

As for now, the Fed has finally achieved its goal of getting inflation above 2%. It has been a concern for a long time, since before the Great Financial Crisis. We have had a multi-decade deflationary expansion.

With higher inflation in the cards, I believe that the prices of anything denominated in dollars or infinite supply will likely skyrocket as the economy recovers.

Asset Allocation 2.0

Asset allocation, going back several decades (all the way to Moskowitz and Modern Portfolio Theory), has been viewed traditionally as some balance between stocks and bonds. Diversification of a portfolio was accomplished by allocating a certain percentage to stocks (riskier assets) and the remainder to fixed income (less risk). For the last several decades it worked surprising well—almost unnaturally so—as stocks and bonds either went up in tandem, or one went up while the other went down. Rarely did both go down at the same time.

News flash: that does not always happen with stocks and bonds, and it’s not even the longterm correlation between the two. It is possible for both stocks and bonds to go down, simultaneously. These two assets perform differently—and for different reasons:

Equities are positively sloped. As such, they have a positive expected return over time. However, equities are also subject to substantial volatility, which opens the door to the “risk of ruin” as a possible outcome.

Bonds oscillate, as do interest rates—from high rates to low rates and back again, although, as I said earlier, it can take a long time to make the round trip. As much as we can accept that stocks are positively sloped, we can embrace the fact that rates oscillate.

While the Fed is pegging short-term rates at essentially 0%, they do not have the same control over the long end. Rates will have to go up to attract demand for fixed income assets, given that the Fed can only realistically buy so many bonds without creating an economy that looks like Modern Money Theory is its new mandate. (In short, MMT states that, as long as the federal debt can be serviced, it doesn’t matter how high it goes.)

Given these changes, asset allocation must go beyond stocks/bonds. Asset allocation must be viewed through the lens of multiple assets that have not made their way into most investors’ portfolios—whether currencies, metals, energy, or other non-traditional assets. The rationale behind allocation must be more than “buy this asset because it’s going to go up…” There will likely be new relationships between asset classes that will need to be evaluated as part of a portfolio’s construction and their correlation.

As noted, assets with limited supply or priced in dollars are likely to appreciate. Currencies in countries that produce commodities are also likely to do well. The currencies of countries with better balance sheets and commodity reserves, such as the Australian dollar, should perform well. Gold, but more importantly silver and copper, appear to be starting a long-term trend higher. Building materials like lumber, steel, etc. should enjoy healthy price runs. All these assets along with some exposure to TIPS, which are inflation adjusted bonds, could add diversification and enhanced performance beyond traditional stock/bond allocations.

Fundamental Changes and Unknown Risks

As I stated in the opening, I believe we are entering a period of economic, political, and social change. Some of the fundamental changes we will likely see are:

In-person without the person. We have all had our fill of Zoom, Meet, Team, etc. But these technologies are just the start. The hologram will be here before we know it. Looking ahead, I believe new technologies will more closely replicate the in-person experience of another person—far beyond just being able to communicate on a screen.

Changing the relationship between labor and capital. It is one thing to give money to people who lose their jobs because of a pandemic. But it is quite another to use that tool because the unemployment rate is 10%. Will it come to that? As we have seen, the Fed is more than willing to provide unlimited liquidity—whether to the foreign exchange swamp market, to protect LIBOR (or whatever replaces it), or to support banks. Everything, it seems, is too big to fail. But the Fed directly supporting individuals is a fundamental change—and it could reflect a changing obligation to the workforce that marks a shift in the relationship between labor and capital.

Pandemic aftermath. The pandemic could very well create policies and economics to prevent future contagion, which will be very similar to climate change initiatives. Not only in scope— but also in the likelihood of naysayers. However, there could be so called false alarms that can unintended consequences.

- SAMSUNG USA AUTHORIZED - Includes 2 Year Extended...

- Samsung 85 Inch DU8000 Crystal UHD LED 4K Smart TV...

- UHD Dimming | Auto Game Mode (ALLM) | Alexa...

- SAMSUNG TIZEN OS: Stream your favorite shows, play...

- BUNDLE INCLUDES: Samsung DU8000 Series 4K HDR...

- SAMSUNG USA AUTHORIZED - Includes 2 Year Extended...

- Samsung 75 Inch DU8000 Crystal UHD LED 4K Smart TV...

- UHD Dimming | Auto Game Mode (ALLM) | Alexa...

- SAMSUNG TIZEN OS: Stream your favorite shows, play...

- BUNDLE INCLUDES: Samsung DU8000 Series 4K HDR...

Last update on 2024-04-05 / Affiliate links / Images from Amazon Product Advertising API

Unlimited is not unlimited. We use the word “unlimited” frequently—unlimited liquidity, unlimited asset purchases by the Fed…. But there is a limit on unlimited. There is no such thing as a perpetual motion machine. The concept of unlimited debt and a limitless deficit are, in my view, scary thoughts. There will be consequences.

Conclusion

Liquidity and rates are the keys to the continued pace of the stock market rally. We need to keep a close eye on interest rates and dividend yields, because if they converge that will likely slow or even stop this rally. Furthermore, if that occurs while economic actively slows dramatically, a recession could be in the cards. And I believe that is a real possibility.

Across the economy, much of the workforce is not back to work, and some might be gone forever. The Covid-19 vaccines that have been seen as the silver bullet are likely to have issues (from distribution challenges to mutating strains of the virus), which may not have been fully factored into forecasts. Rolling out a program intended to meet the needs of over 350 million people in the U.S. is going to be more challenging than originally projected, as are the unknown potential side effects.

On the economic front, the inflation I have discussed is likely to significantly impact asset values, which could cause tremendous market dislocations. The budget deficits and huge debt loads will be further headwinds. This all adds up to caution—eyes on the road and fingers on the trigger.

However, given the amount of liquidity in the system, and with the principles of capitalism at work, we can create a new era when efficiencies, better deployment of capital and labor, and emerging trends in what we produce and consume all will have an enormous impact on how productive we become.

These forces have the potential to result in large increases in GDP and a reversion to growth rates not seen in decades. We just need to endure the pain that will precede reaping these benefits.