By Roman Chuyan, CFA In this article, I review the recent rise in yields and in inflation expectations, and what it might mean to bond and equity investors. Treasury yields have jumped sharply so far in 2021 on concerns about rising inflation.

Source: Will Inflation Rise? And What It Means for Stocks and Bonds

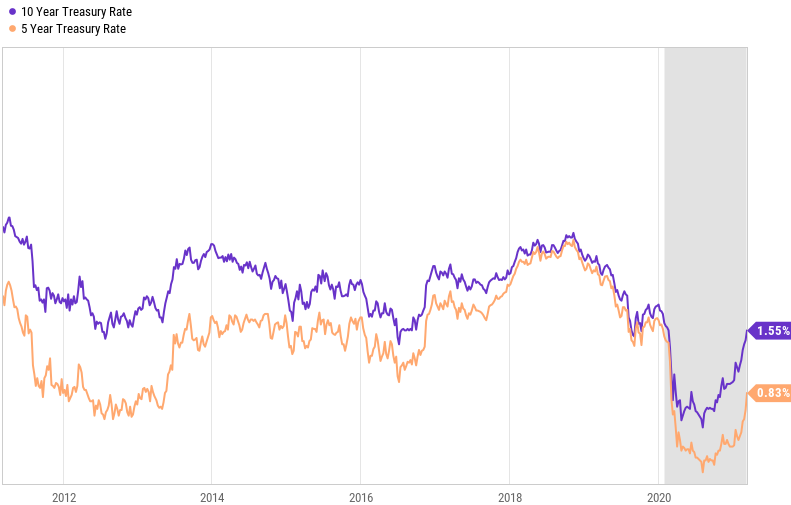

The 10-year yield jumped by around 60 basis points to 1.55%, and the 5-year increased by over 45 bps to 0.83% (see chart below). Are inflation concerns justified?

Treasury Rates, 10 Years

Source: Ycharts

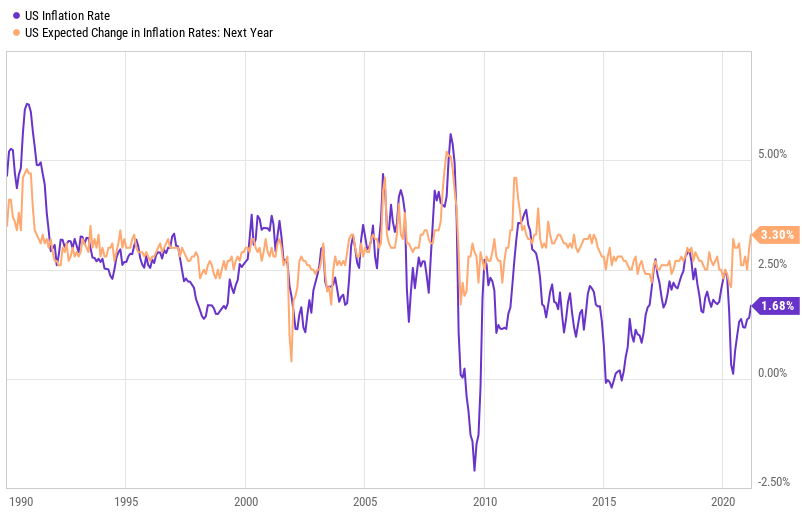

In fact, the 1-year inflation expectation has surged to 3.3%, as the following 30-year chart shows. Actual inflation has not yet fully recovered, however, after plunging during the early-2020 lockdown crisis. While total inflation rose to 1.7% in February (the purple line on the chart below) due to rising energy prices, core inflation, excluding food and energy, dropped to 1.3% in February from 1.6% in December. This 30-year chart also illustrates that inflation expectations overestimated actual inflation for about 10 years.

Inflation and Inflation Expectations, 30 Years

Source: Ycharts

Economists have split views on this (as always). Capital Economics thinks that “Biden’s proposed $1.9tn fiscal stimulus package would add to a growing list of reasons to brace for a possible upside inflation surprise,”[1] while TS Lombard remains adamant that “the consensus is wrong – no inflation this year… Short term inflation fears are extremely overdone.”[2]

Rising inflation and interest rates are of concern to bond investors. Bond prices, which move opposite to rates, would drop further if rates continue to rise. However, there isn’t yet evidence of inflation rising significantly (and core inflation is actually falling). We at Model Capital think that inflation might rise moderately later this year. However, the market might have already priced-in this possibility.

In addition, Fed officials have repeatedly indicated that they will keep the funding rate near zero until at least late-2022. The European Central Bank just announced that it would boost its bond buying to stem rate rise, and the Fed is expected to do the same at its meeting next week. While we think that it’s prudent to shorten duration this year, as a practical matter, we think that managers shouldn’t panic as the market might present a better opportunity to do so in the coming weeks.

- New Store Stock

- Rivan, Maria (Author)

- English (Publication Language)

- 208 Pages - 04/14/2020 (Publication Date) -...

- The Editors of National Geographic (Author)

- English (Publication Language)

- 112 Pages - 04/02/2021 (Publication Date) -...

- National Geographic Special - 2017-1-20 SIP...

- English (Publication Language)

- 128 Pages - 01/20/2017 (Publication Date) -...

[1] Source: Capital Economics report, Biden’s Fiscal Plans Add to US Inflation Risk, 3/2/2021.

[2] Source: TS Lombard special report, The Consensus Is Wrong – No Inflation This Year, 3/2/2021.

Equity Market Outlook

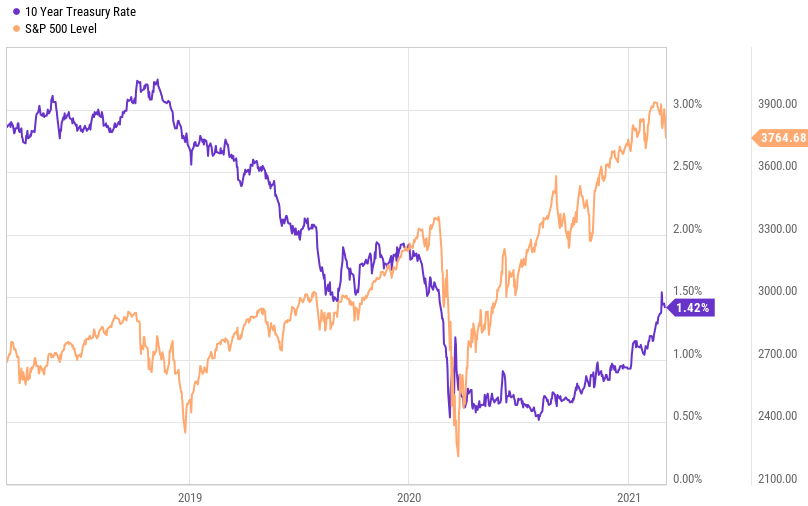

A separate question is what effect, if any, rising rates would have on the stock market. Market volatility has already increased in the past week, and I think stock investors are right to be concerned. Recall that stocks began to drop the moment the 10-year Treasury rate rose above 3.25% in October of 2018 (see chart below). The concern was, and remains, that higher rates would burden the financial system due to enormous debt. It’s my view that this time, the “too-high” rate level will be lower because there’s even more debt and we’ve been conditioned by zero rates in the past year. That critical level may well be around 1.5%-1.6% on the 10-year Treasury.

Treasury Rate & The S&P 500, 3 Years

Source: Ycharts. Investors cannot invest directly in the S&P 500 index.

- Amazon Kindle Edition

- Baldacci, David (Author)

- English (Publication Language)

- 487 Pages - 04/16/2024 (Publication Date) - Grand...

- Amazon Kindle Edition

- Hannah, Kristin (Author)

- English (Publication Language)

- 472 Pages - 02/06/2024 (Publication Date) - St....

- Amazon Kindle Edition

- Elston, Ashley (Author)

- English (Publication Language)

- 348 Pages - 01/02/2024 (Publication Date) - Pamela...

The above chart also reminds us that the S&P 500 plunged by almost 20% by Christmas of 2018, despite rates pulling back. So, rising yields initially triggered a stock market downturn, and it then proceeded due to high market valuation.

We’re in a similar situation today. As I wrote in this recent article, the 6-month return forecast for the S&P 500 by Model Capital’s fundamentals-based Equity Model remains significantly negative, due primarily to extremely high market valuation – the model calculates that the S&P 500 is overvalued by 17% over a 6-month horizon. So, once a correction begins, it could be significant.

About Model Capital Management LLC

Model Capital Management LLC (“MCM”) is an independent SEC-registered investment advisor, and is based in Wellesley, Massachusetts. Utilizing its fundamental, forward-looking approach to asset allocation, MCM provides asset management services that help other advisors implement its dynamic investment strategies designed to reduce significant downside risk. MCM is available to advisors on AssetMark, Envestnet, SMArtX, and other SMA/UMA platforms, but is not affiliated with those firms.

Notices and Disclosures

- This research document and all of the information contained in it (“MCM Research”) is the property of MCM. The Information set out in this communication is subject to copyright and may not be reproduced or disseminated, in whole or in part, without the express written permission of MCM. The trademarks and service marks contained in this document are the property of their respective owners. Third-party data providers make no warranties or representations relating to the accuracy, completeness, or timeliness of the data they provide and shall not have liability for any damages relating to such data.

- MCM does not provide individually tailored investment advice. MCM Research has been prepared without regard to the circumstances and objectives of those who receive it. MCM recommends that investors independently evaluate particular investments and strategies, and encourages investors to seek the advice of an investment adviser. The appropriateness of an investment or strategy will depend on an investor’s circumstances and objectives. The securities, instruments, or strategies discussed in MCM Research may not be suitable for all investors, and certain investors may not be eligible to purchase or participate in some or all of them. The value of and income from your investments may vary because of changes in securities/instruments prices, market indexes, or other factors. Past performance is not a guarantee of future performance, and not necessarily a guide to future performance. Estimates of future performance are based on assumptions that may not be realized.

- MCM Research is not an offer to buy or sell or the solicitation of an offer to buy or sell any security/instrument or to participate in any particular trading strategy. MCM does not analyze, follow, research or recommend individual companies or their securities. Employees of MCM may have investments in securities/instruments or derivatives of securities/instruments based on broad market indices included in MCM Research.

- MCM is not acting as a municipal advisor and the opinions or views contained in MCM Research are not intended to be, and do not constitute, advice within the meaning of Section 975 of the Dodd-Frank Wall Street Reform and Consumer Protection Act.

- MCM Research is based on public information. MCM makes every effort to use reliable, comprehensive information, but we make no representation that it is accurate or complete. We have no obligation to tell you when opinions or information in MCM Research change.

- MCM DOES NOT MAKE ANY EXPRESS OR IMPLIED WARRANTIES OR REPRESENTATIONS WITH RESPECT TO THIS MCM RESEARCH (OR THE RESULTS TO BE OBTAINED BY THE USE THEREOF), AND TO THE MAXIMUM EXTENT PERMITTED BY LAW, MCM HEREBY EXPRESSLY DISCLAIMS ALL WARRANTIES (INCLUDING, WITHOUT LIMITATION, ANY IMPLIED WARRANTIES OF ORIGINALITY, ACCURACY, TIMELINESS, NON-INFRINGEMENT, COMPLETENESS, MERCHANTABILITY AND/OR FITNESS FOR A PARTICULAR PURPOSE).

- “Model Return Forecast” for 6-month S&P 500 return is MCM’s measure of attractiveness of the U.S. equity market obtained by applying MCM’s proprietary statistical algorithm and historical data, but is not promissory, and, by itself, does not constitute an investment recommendation. Model Return Forecasts were calculated and applied by MCM to its research and investment process in real time beginning from 2012. For periods prior to Jan 2012, the results are “back-tested,” i.e., obtained by retroactively applying MCM’s algorithm and historical data available in Jan 2012 or thereafter. Source for the S&P 500 actual returns: S&P Dow Jones.

- Index returns referenced in MCM Research, if any, are gross of any advisory fees, fund management fees, and trading expenses. Fund or ETF returns referenced, if any, are gross of advisory fees and trading expenses. Returns will be reduced by fees and expenses incurred.