Finding value makes for a strong long-term investment, which could be why the VanEck Vectors Morningstar Wide Moat ETF (MOAT) has been seeing strong fund flows the past month. Fundamental analysis involves finding value among companies that have a competitive advantage in their respective marketplace.

Source: This Moat ETF Topped VanEck Fund Flows the Past Month

This is where the MOAT strategy shines. Investors need not pore over market analysis reports.

MOAT does all the value-finding work through the convenience of an ETF wrapper. Additionally, the strategy looks for companies that can maintain their advantages over time, which is ideal for investors with a long-term investment horizon.

MOAT, which is up over 50% the past year and 17% thus far in 2021, seeks to replicate as closely as possible the price and yield performance of the Morningstar® Wide Moat Focus Index. The fund normally invests at least 80% of its total assets in securities that comprise the fund’s benchmark index.

The index is comprised of securities issued by companies that Morningstar determines to have sustainable competitive advantages based on a proprietary methodology that considers quantitative and qualitative factors.

“This ETF tracks an index of companies that have ‘wide moats’ or sustainable competitive advantages that are very difficult for competitors to breach,” an ETF Database analysis suggested. “These firms could make for great long term investments as they generally rely on either brand name power, have high switching costs, or use the ‘network effect’ to prevent new entrants. Not surprisingly, the fund has a heavy focus on giant and large cap firms, in other words, those that have exploited their advantages to the utmost.”

- A masculine fragrance with a fusion of sandalwood,...

- FRESHEN YOUR LIFE: Fiber Can is LITTLE TREES...

- MORE THAN JUST A CAR AIR FRESHENER: Freshen up at...

- LONG-LASTING FRAGRANCE EXPERIENCE: Specialized...

- SLIDE LEVER TO ADJUST STRENGTH: Slide the lever on...

- UV SHIELDING - Provide your baby with protection...

- SIMPLE UNIVERSAL INSTALLATION - Experience...

- THIS SET INCLUDES- 2 transparent car window...

- DURABLE MESH MATERIAL & STURDY WIRE- Rely on...

- GIVE THE BEST BABY GIFT- Need a baby shower gift...

- SAFETY ESSENTIAL CAR ACCESSORIES: If your car is...

- PRACTICAL AND PERFECT CHRISTMAS GIFT: A surprise...

- SAFE AND DURABLE TOOL KIT: This bag is made of...

- EVERYTHING YOU NEED FOR CAR SAFETY IN ONE BAG:...

- SUITABLE FOR MOST EMERGENCIES: This roadside...

- ✔ADJUSTABLE STRAP & COLLAPSIBLE SHAPE – The...

- ✔MAGNETIC SNAPS: There are 4 metallic magnetic...

- ✔HARD-WEARING LEAKPROOF INNER LINING – This...

- ✔MULTIPURPOSE – This car garbage bin can be...

- ✔GREAT COMPATIBILITY – An effective solution...

Varied Sector Exposure without the Heavy Concentration

Under the hood of MOAT are top holdings that don’t exceed more than 3.12% of the ETF’s funds under management as of this writing. The fund’s current top holding is Wells Fargo, followed by Alphabet Inc and Cheniere Energy.

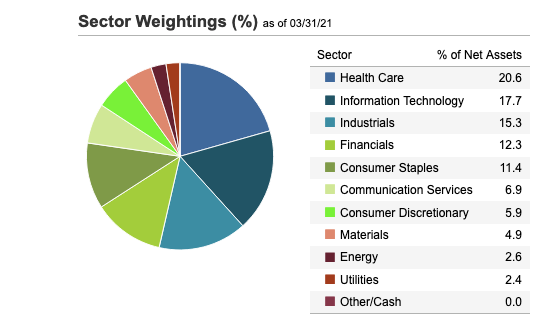

Additionally, MOAT investors snag exposure to sectors like healthcare, which certainly saw strength during the pandemic. Healthcare tops the sector allocations with about 21%, while information technology, another strong performer, comprises 18% of the fund.

Industrials, which constitutes 15% of MOAT’s exposure, is another rising sector. The threat of rising rates could also be coming to the forefront, which could spark financials, a sector making up 12% of the fund.

For more news and information, visit the Beyond Basic Beta Channel.