ESG has taken a serious foothold in the investing world and continues expanding, with $51.1 billion inflows into some variety of sustainability funds in 2020, a twofold increase over 2019 and 10 times the amount for 2018, reports the Wall Street Journal .

Source: Original Postress-this.php?">The Argument for ESG in Retirement Plans

Despite its rapid growth, only 2.6% of 401k plans included an ESG option in 2019 according to the Plan Sponsor Council of America.

Those in favor of including an ESG option in retirement plans believe that if investors have an interest, they should be able to pursue that interest. Above and beyond that, the ESG arena is one that is growing exponentially, and denying access because of a bias that ESG funds are only about investing in a way that feels good instead one that brings returns is unfounded.

Professor Aaron Yoon, an assistant professor of accounting and information management at the Kellogg School of Management at Northwestern University, found in his research that companies that have good ratings on “financially material” ESG issues, which are ESG issues relevant to the sectors that they operate within, will give increased stock returns. It’s research that is backed by an S&P analysis from March 2020 to March 2021 that tracked 19 ESG ETFs and mutual funds that had over $250 million in AUM. All outperformed the S&P in a range from 0.2-27.9 percentage points.

Opponents of adding ESG investment options into 401k options lay the basis of their arguments on the fact that there is no standardization within ESG reporting and requirements within the U.S. While it can make comparing ESG funds akin to comparing apples and oranges, the SEC is taking a closer look at creating a baseline for the data that companies have to report for ESG, as well as holding them accountable to their reporting.

Professor Yoon also argues that including ESG investing options for 401ks would be an added pressure on companies to be more transparent about their processes and reporting. More investors equates to more attention, and the greater the attention within the ESG space, the faster that changes and industry standards could be implemented.

“That would be good not only for 401(k) plans in determining the best fund choices, but it will also provide much-needed transparency for all investors who want to put their money into ESG,” said Yoon.

ESGA Invests in Equities, Is Part of the Larger ESG Push

With increasing interest in ESG and a push for ESG options in new spaces like 401ks, ESG investing is at the forefront of many investors’ minds. A benefit to one segment of ESG investing is a benefit to the whole, and increasing attention to the space by the SEC signals the increasingly important role this particular type of investing is playing in markets.

- 5.1-channel 80-Watt powerful surround sound system

- 4K60, 4K120AB and 8K60B HDMI 2.1 with HDCP 2.3 and...

- Dolby Vision, Hybrid Log-Gamma and BT.2020

- Supports enhanced media and gaming - ALLM, VRR

- YPAO automatic room calibration

- Low-Profile Modern Design - Clean silhouettes,...

- Powerful Performance - Brilliant clarity,...

- Simple Setup, Streaming & Control - Get setup and...

- 5.1-Channel Sound - Experience a powerful...

- 6 Total Speakers - Full-range drivers deliver...

Last update on 2024-04-05 / Affiliate links / Images from Amazon Product Advertising API

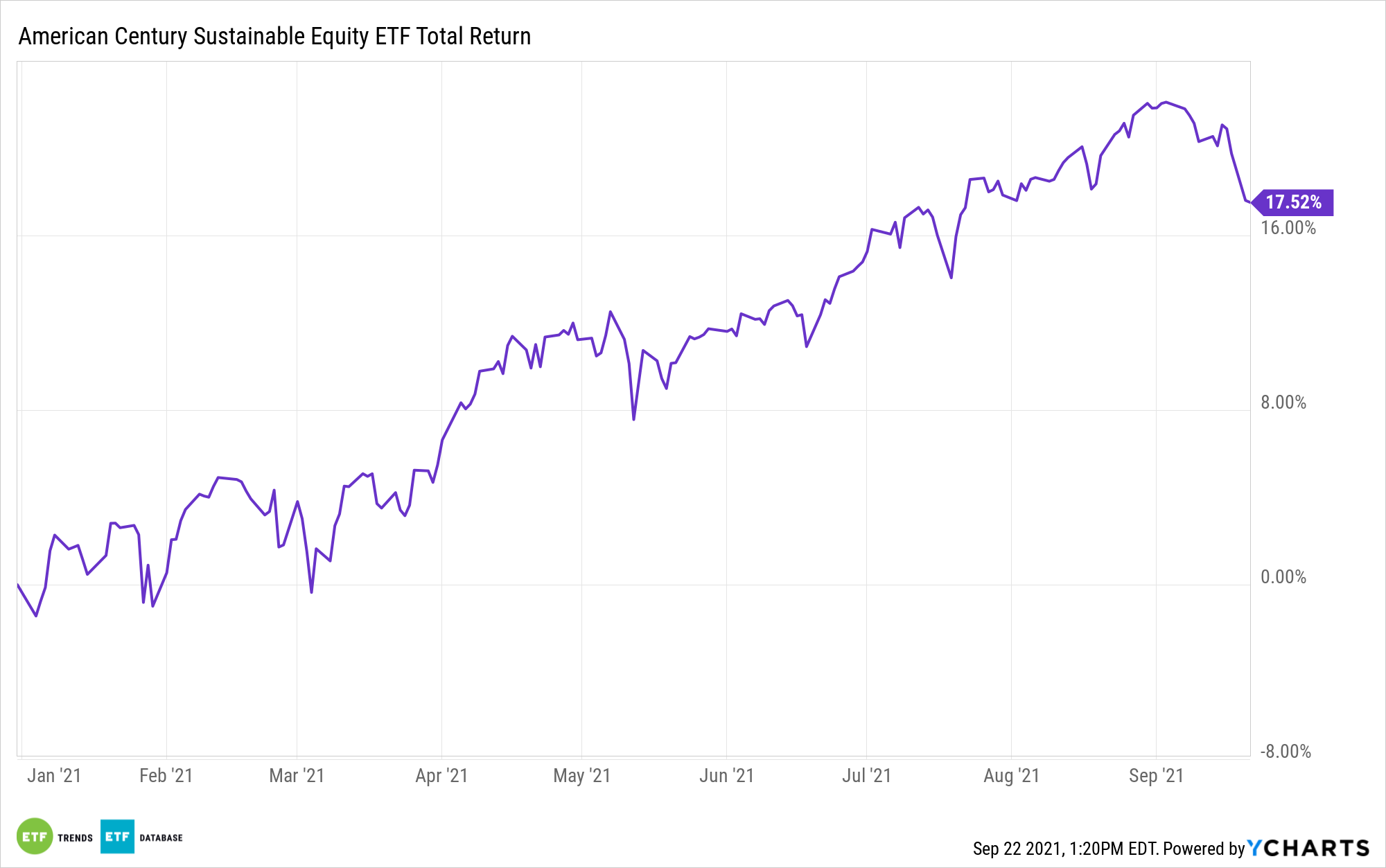

The American Century Sustainable Equity ETF (ESGA) measures the ESG performance of a company, weighing environmental impact as one of the major factors for qualification. It goes a step beyond, though, and it also looks at the other aspects of ESG, such as turnover of employees and corporate leadership, to name just a few. The fund invests in U.S. large-cap companies with large growth and value potential that rank highly on ESG metrics.

ACI’s proprietary model assigns a score to each security for financial metrics and a separate score for ESG metrics, then combines them for an overall score.

The highest-scoring securities are selected within each sector, creating a portfolio with strong performance and higher ESG ratings than the stocks in the S&P 500 Index.

The fund is a semi-transparent ETF, meaning that allocations are disclosed on a quarterly basis, not daily. As of its last disclosure, ESGA held companies like Alphabet (GOOGL), Home Depot (HD), and Microsoft (MSFT).

- SAMSUNG USA AUTHORIZED - Includes 2 Year Extended...

- Samsung 85 Inch DU8000 Crystal UHD LED 4K Smart TV...

- UHD Dimming | Auto Game Mode (ALLM) | Alexa...

- SAMSUNG TIZEN OS: Stream your favorite shows, play...

- BUNDLE INCLUDES: Samsung DU8000 Series 4K HDR...

- SAMSUNG USA AUTHORIZED - Includes 2 Year Extended...

- Samsung 75 Inch DU8000 Crystal UHD LED 4K Smart TV...

- UHD Dimming | Auto Game Mode (ALLM) | Alexa...

- SAMSUNG TIZEN OS: Stream your favorite shows, play...

- BUNDLE INCLUDES: Samsung DU8000 Series 4K HDR...

Last update on 2024-04-05 / Affiliate links / Images from Amazon Product Advertising API

ESGA has a total annual fund operating expense of 0.39% and total assets of $145 million.

For more news, information, and strategy, visit the Core Strategies Channel.