By Matt Wagner, CFA, Associate, Research

The Fed may not be pulling away the punch bowl just yet, but it’s also not adding more juice to it.

At the conclusion of last week’s FOMC meeting, Fed Chair Powell announced that the committee anticipates three rate hikes in 2022.

Indications that the Fed will more seriously act to combat rampant inflation has led the policy-sensitive 2-Year yield to spike higher.

2-Year U.S. Treasury Yield

Higher rates have caused unprofitable, high-growth companies to fall into a tailspin as far-out cash flows get discounted at higher rates.

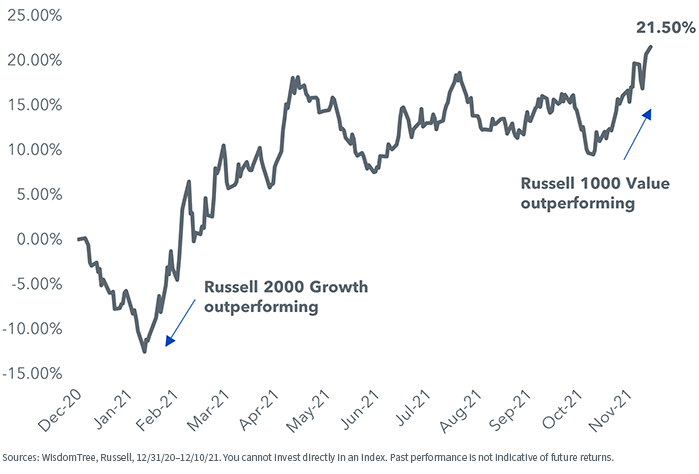

This trend can be seen in the significant outperformance of the Russell 1000 Value Index relative to the Russell 2000 Growth Index over the past several weeks.

Russell 1000 Value vs. Russell 2000 Growth

The interest rate sensitivity, or duration, of equities can be measured by the inverse of the dividend yield of an index (1/dividend yield), or the number of years of dividends it would take to recover the current price.

An index with a higher duration (low-dividend yield) may be more negatively impacted by a move higher in rates. Conversely, a company with a lower duration (high-dividend yield) may be more positively impacted by a move higher in rates.

Since March 2020, the rate sensitivity of high-growth stocks has substantially increased. The equity duration of the Russell 2000 Growth Index has skyrocketed from 107 years to more than 300.

The duration of value stocks has also increased but at a more subdued rate.

Equity Duration (Years)

High Dividends Can Lower Rate Risk

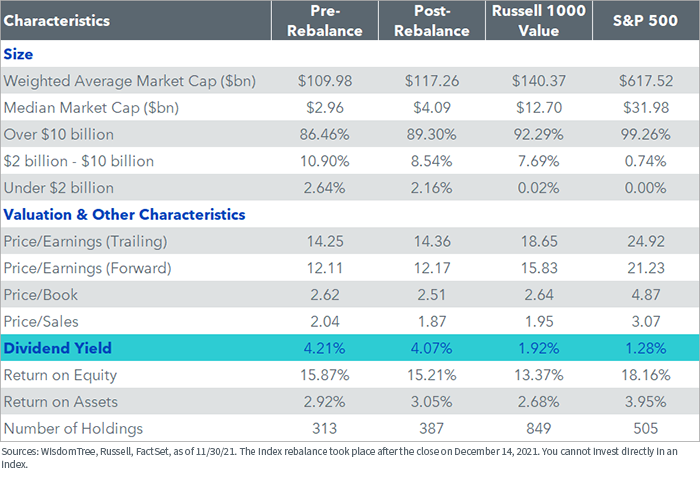

On December 14, the WisdomTree U.S. High Dividend Index executed its annual rebalance. It had a modest impact on the characteristics of the Index.

The Index has a dividend yield greater than 4%—well over twice that of the Russell 1000 Value Index. That equates to a duration of 25 versus the duration of 54 for the Russell 1000 Value.

And the Index also has higher profitability metrics (ROE/ROA) than the Russell 1000 Value Index.

Fundamentals

- A masculine fragrance with a fusion of sandalwood,...

- FRESHEN YOUR LIFE: Fiber Can is LITTLE TREES...

- MORE THAN JUST A CAR AIR FRESHENER: Freshen up at...

- LONG-LASTING FRAGRANCE EXPERIENCE: Specialized...

- SLIDE LEVER TO ADJUST STRENGTH: Slide the lever on...

- UV SHIELDING - Provide your baby with protection...

- SIMPLE UNIVERSAL INSTALLATION - Experience...

- THIS SET INCLUDES- 2 transparent car window...

- DURABLE MESH MATERIAL & STURDY WIRE- Rely on...

- GIVE THE BEST BABY GIFT- Need a baby shower gift...

- SAFETY ESSENTIAL CAR ACCESSORIES: If your car is...

- PRACTICAL AND PERFECT CHRISTMAS GIFT: A surprise...

- SAFE AND DURABLE TOOL KIT: This bag is made of...

- EVERYTHING YOU NEED FOR CAR SAFETY IN ONE BAG:...

- SUITABLE FOR MOST EMERGENCIES: This roadside...

- ✔ADJUSTABLE STRAP & COLLAPSIBLE SHAPE – The...

- ✔MAGNETIC SNAPS: There are 4 metallic magnetic...

- ✔HARD-WEARING LEAKPROOF INNER LINING – This...

- ✔MULTIPURPOSE – This car garbage bin can be...

- ✔GREAT COMPATIBILITY – An effective solution...

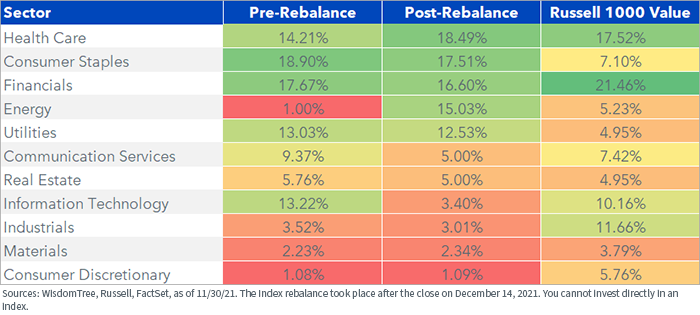

From a sector perspective, the Index added heavily to Energy (+14) and Health Care (+4%) while trimming from Info Tech (-10%) and Comm Services (-4%).

Sector Weights

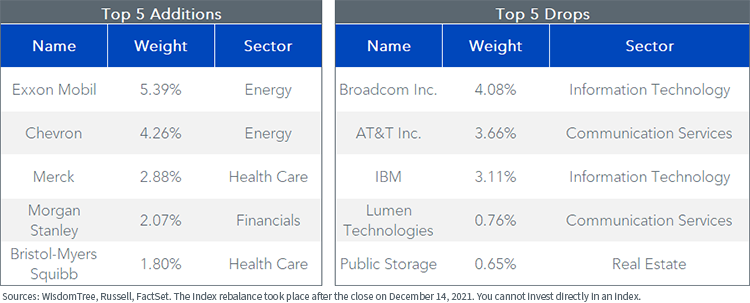

The oil majors Exxon and Chevron were added back to the Index after being removed at last year’s rebalance based on a proprietary screen of dividend riskiness. Combined, these two holdings make up nearly 10% of the 14% addition to the Energy sector.

Broadcom, a steady dividend payer/grower, was removed, as its more than 40% return since last year’s rebalance dropped its dividend yield from 3.24% to 2.55%, removing it from the high-dividend-yield universe.

AT&T (8.71% yield), IBM (5.34% yield) and Lumen Technologies (7.72% yield) were all screened out of the Index based on the Index risk screen. Dropping these names contributed to modestly lowering the overall Index yield from 4.21% to 4.07%, as the Index aims to hold more sustainable dividend payers as opposed to merely the highest yielders.

Top Adds/Drops

WisdomTree has a family of dividend-weighted Indexes, several of which have more than 15 years of live track record.

A Fed hiking cycle is likely to favor value as shorter-duration/high yielders become more attractive with increases in short-term rates. Among WisdomTree’s family of domestic dividend Indexes, the WisdomTree U.S. High Dividend Index fits the bill as having the greatest value/income tilt with a yield advantage of nearly 280 basis points (bps) relative to the S&P 500.

Originally published by WisdomTree on December 22, 2021.

For more news, information, and strategy, visit the Model Portfolio Channel.

Important Risks Related to this Article

Investing involves risk, including loss of principal. Dividend-focused funds may underperform funds that do not limit their investment to dividend-paying stocks. Stocks held by funds may reduce or stop paying dividends, affecting the fund’s ability to generate income. Performance may also be affected by risks associated with non-diversification, including investments in specific countries or sectors. Each individual investor should consider these risks carefully before investing in a particular sector or strategy.