RyanKing999/iStock via Getty Images

As Spider-Man and Batman deliver record box office performances, our fascination for superheroes remains as strong as ever.

Superpowers don't have to come in the shape of a red cape with flying abilities. Heroes also exist in our day-to-day lives. We've come to appreciate them even more during the emergence of a global pandemic that killed millions of people.

Superheroes are inspiring because they show traits that can fuel fantastic success stories. They demonstrate extraordinary abilities, moral conviction, great courage, and have a mission to serve.

The investing world has its very own version of superheroes: Buffett, Munger, Lynch, Templeton, Bogle, the list goes on. They have created significant wealth for themselves, but also others. In addition, they have empowered millions of investors by sharing their hard-earned lessons and have helped democratize sound investing principles.

Today, I want to focus on the traits demonstrated by these exceptional investors. They are critical to underline when market volatility is extreme and test our best intentions.

These seven principles are the closest thing to superpowers you'll find in a successful investor. They are the traits you want to channel in these trying times.

Let's review.

1) Monk-like Patience

We live in a world where we expect instant gratification.

If you feel like watching a show, you can stream it immediately. Whatever food you're craving can be delivered to your door in less than an hour if you live in a big city. Amazon Prime offers same-day delivery. These new ways to consume have raised expectations and make us less likely to be keen on watching a multi-year process unfold.

In the world of investing, crypto has also set a new bar in terms of volatility and returns you can achieve in a short amount of time. Many young investors seek returns via day trading and use leverage to maximize short-term returns. Unfortunately, the process is not repeatable and usually ends with a margin call. Warren Buffett puts it perfectly when talking about leverage:

If you're smart you don't need it and if you're dumb you shouldn't be using it.

Many new investors feel discouraged if they don't see results after a few months of investing. Any stock that's not meaningfully up after a year or two is considered “dead money,” despite the overwhelming evidence that some of the best market performers can trade sideways for years. It usually comes from setting the wrong expectations from the start.

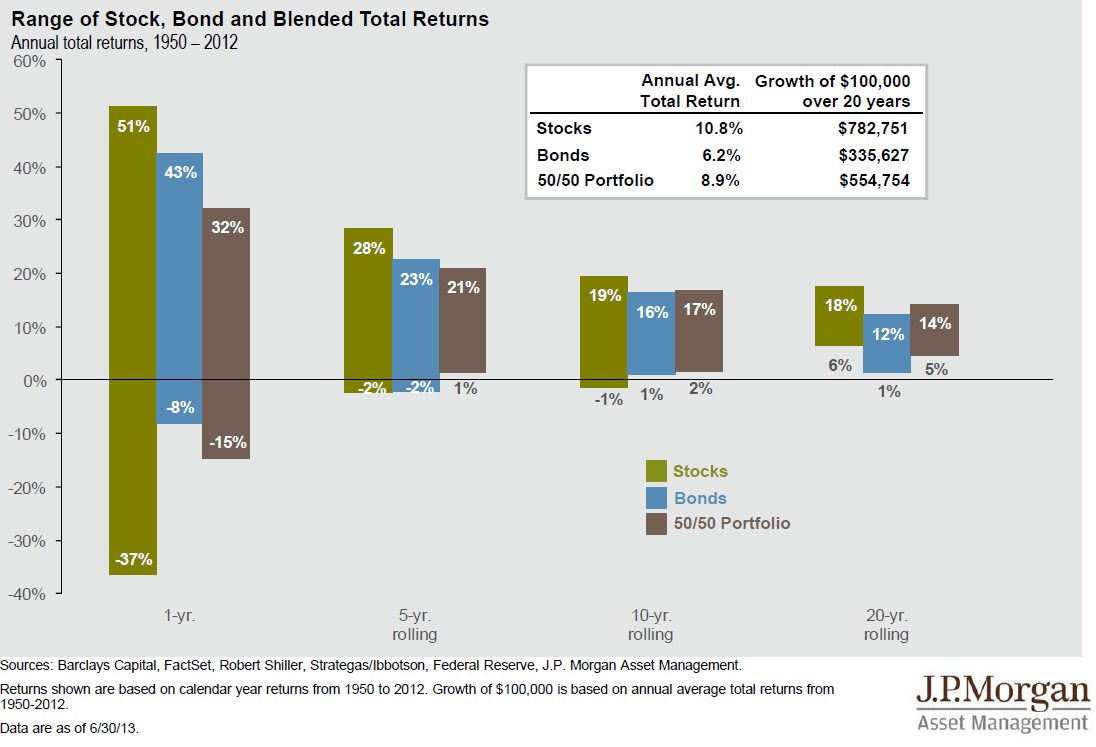

The chart below shows the range of annual returns for stocks and bonds based on the holding period. Over a 1-year timeframe, the range of outcomes can be extreme, from a loss of -37% to a gain of 51%. However, the longer the time horizon, the less likely you will lose money. Over a 20-year rolling period, investing in stocks always leads to positive returns. Even the worst period tested had a 6% average annual return.

What should remain with you?

If you invest in a diversified mix of stocks and ETFs, the longer the holding period, the smaller the range of outcomes gets. And the risk of losing money diminishes as you expand your time horizon.

Two main factors drive the growth of a portfolio:

- The money we put to work.

- The number of years we keep it invested.

Time is your most potent ally in investing. The longer your time horizon, the more influential the force of compound interest becomes. Great long-term investing is 1% buying, 99% waiting. In this context, patience is the first superpower of a successful investor.

As explained by Charlie Munger:

It's waiting that helps you as an investor, and a lot of people just can't stand to wait. If you didn't get the deferred-gratification gene, you've got to work very hard to overcome that.

Historically, the market has gone up over time, with an average 10% annual return over the last 95 years for the S&P 500 (SPY) benchmark and 73% of the years being positive.

You can double your money every seven years if you match the 10% annual returns delivered by the stock market. Stay invested for 28 years, and you've returned 16 times your money.

Thomas Phelps, the author of the book 100 to 1 in the Stock Market, has provided valuable lessons to appreciate the power of compounding.

A 100-bagger is a stock that returns 100 times your initial investment. That means a $10,000 investment would turn into $1 million. You wouldn't need to find a lot of investments like this to achieve your investing goals. If you ever hope to have a 100-bagger in your portfolio, you might wonder how long it would take to get there. The higher the compound annual growth rate, the fewer years you need to get there. It's simple math.

Phelps has a table in his book that lists the annual returns and how many years it would take before you get a 100-bagger:

| Annual returns | Years needed to 100X |

| 14% | 35 years |

| 17% | 30 years |

| 20% | 25 years |

| 26% | 20 years |

| 36% | 15 years |

If you hold a stock compounding at 20% annually for 25 years, you return 100 times your money. But if you hold it for 10 years, you only return five times your money.

Phelps explains:

To make money in stocks you must have the “the vision to see them, the courage to buy them and the patience to hold them”.

Patience is the rarest of the three.

2) Great Self-Discipline

Superheroes are driven by a mission to serve. A north star guides them. Without it, they would probably not be able to show up, day in and day out. We all have a different reason why we invest. And defining your goal and mission ahead of the journey can go a long way.

Most people struggle to have consistent discipline in good times. And even more so in stressful times. Investing should be a lifelong commitment, not a short-lived experience every few years. Without a consistent approach, you might end up doubling down or capitulating at the worst possible time.

The stock market can be a very stressful and frustrating place. Staying calm and focused during periods of turmoil is an essential quality for any long-term investor.

In the face of stress, we all have different coping mechanisms. As put by Adam Smith in his book The Money Game:

If you don’t know who you are, this [the stock market] is an expensive place to find out.

Your capacity to cope with volatility will remain an enigma until you have to deal with your entire portfolio falling by 20% or more in a matter of days or weeks.

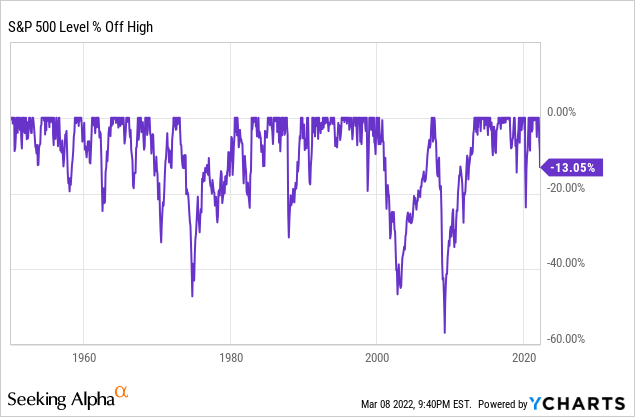

The graph below shows the drawdowns of the S&P 500 in the past 70 years. In the 21st century alone, the market dropped three times by more than 30%, including 2020's decline in March.

The past 70 years have been filled with uncertainty. But those who stuck with their investment strategy through the ups and downs were likely to create tremendous wealth.

As explained in my article dedicated to the 4 Simple Rules of portfolio construction, you shouldn't ask how much volatility you can tolerate. Instead, you should be looking for ways to improve your tolerance for it.

I discussed how investing has a lot in common with dieting or exercising in a previous article. It can be hard to know how to do it right, with many contradicting philosophies.

We all try to stick to good habits and indulge once in a while. Unfortunately, gambling is hazardous to your wealth, like a cigarette is hazardous to your health. Harmless in moderation but devastating if not kept in check.

One of the greatest challenges in investing is that you can destroy years of returns with one poor decision. With this in mind, it's critical to define clear boundaries that can protect your portfolio.

As I've written previously, the most crucial factor in your portfolio returns is your temperament. You don't have to be born with the right temperament. Instead, you can build it over time with a specific set of habits.

In his book Atomic Habits, James Clear explains:

The ultimate form of intrinsic motivation is when a habit becomes part of your identity. It’s one thing to say I’m the type of person who wants this. It’s something very different to say I’m the type of person who is this.

This idea struck a chord with me.

“I'm not a smoker.” That's what I started saying several years ago when I decided never to touch a cigarette again. Using such an affirmative way of asserting it made it part of who I am and what I do. It became a part of my identity.

It might sound obvious to someone who has never smoked, but addictions have a way of creeping back into your life if you don't build protective mechanisms to stay away from them.

Similarly, I have defined several investing habits that have become part of my identity using “I” statements:

- I invest a fixed amount monthly (consistency).

- I don't add to losers (fighting prospect theory).

- I don't sell winners (staying the course).

- I invest for no less than five years (time horizon).

I elaborate more on these rules here.

Being accountable to others is also a great way to stay disciplined.

Since I started my investing marketplace in 2018 (App Economy Portfolio), I share all of my trades with a community of like-minded investors. Every move in my portfolio must now be documented and explained online. When I add a new position, it must come with a 5,000-word bull case. That's an effort I suspect most investors don't undertake.

Having other investors join me on my investing journey set me on a path I'm sure not to deviate from.

When the inevitable market crash happens, having mantras you live by can be the difference between staying the course and having a meltdown. It can empower you to remain disciplined.

Habits are the core that can define your investing journey:

- Your time horizon.

- How you research.

- How regularly you invest.

- How much you save per month.

- How often you check price movements.

Your daily, weekly, and monthly habits are the inputs you control. Recognizing them as such can tremendously boost your odds of success.

3) Humility

There are three main ideas we need to cover around humility:

- Diversifying rather than going “all-in.”

- Recognizing what you don't know.

- Appreciating luck vs. skill.

Humility is the superpower that will protect you from sabotaging your own success and keep you in the game. No matter how high your conviction is, staying humble should lead you to diversify and put you in a position to weather any storm coming your way.

The first way investors can show humility is with their asset allocation. I'm not just talking about their stock portfolio but also how they manage their overall asset allocation. You can have an aggressive stock portfolio strategy while keeping a conservative approach across all of your finances.

For example, Warren Buffett doesn't shy away from having a very concentrated approach at Berkshire (BRK.A) (BRK.B). About 44% of his $351B equity portfolio is in a single company: Apple (AAPL). And the top five holdings represent almost 80% of the portfolio allocation. However, Berkshire also has $144B in cash and cash equivalents on the balance sheet.

Diversification is “the only free lunch” in investing, a quote attributed to Nobel Prize laureate Harry Markowitz. Behind this quote is the idea that diversification can significantly reduce the risks without necessarily compromising returns.

Most investors are well-versed in the idea that they need to build their portfolio on the efficient frontier with the right risk-reward balance.

I tried to answer a simple question in a previous article: How many stocks should you own? I tried to explain that the right number is different for everyone.

In his book The Psychology of Money, Morgan Housel explained the difference between rational and reasonable. A rational decision means making a decision strictly based on what the facts and the numbers say. It all sounds great in concept. The implication is that you let the data decide for you. However, being rational is not always a realistic approach. We all have emotions at play that can get in the way of a sound plan. Sometimes, what would make the most sense for you will be different from the most rational decision. Instead, you need to define what is reasonable for you.

The proper diversification is the one that keeps you in the game over multiple market cycles. That's why portfolio suitability is so essential.

The proper amount of diversification is the one you can stick with for years or decades on end. Finding the adequate allocation by geography, sector, category, and at the company level is a matter of personal preference.

The more you know what you're doing and the more certainty you have about a specific investment, the higher your concentration can be.

It's essential to use diversification as a safeguard, a way to prevent you from getting in the way of your portfolio's success. For example, I personally have a max allocation to an individual stock at 8% of my portfolio on a cost basis. It means that if I already invested 8% of the funds added to my portfolio to an individual stock, I cannot add more to it. At that point, I let it run and let my portfolio concentrate for me.

If you focus on your risk allocation from a cost-basis perspective rather than your current value, you will benefit from two leverages:

- It will prevent you from adding too much to your losers.

- It will encourage you to add to your winners, even if they have run a lot.

Having a rule-based approach to diversification can be a lifesaver when emotions run high in the heat of the moment.

The role of diversification is to make sure you stay in the game under all circumstances and keep the compounding of your returns uninterrupted.

Another essential part of humility is being able to say those words: “I don't know.” People endlessly try to make market predictions. They claim that “stocks have more to fall” or that they “don't see any upside in the near term.” This type of reasoning is, at best, an opinion. In his book The Most Important Thing, Howard Marks explains:

If you can't predict the future, the most important thing is to admit it. If it's true that you can't make forecasts and yet you try anyway, then that's really suicide.

It's impossible to know what will happen in the near term. So if you catch yourself trying to guess what stocks might do next week, today is a great day to remember that it's a waste of time. You can't!

- 5.1-channel 80-Watt powerful surround sound system

- 4K60, 4K120AB and 8K60B HDMI 2.1 with HDCP 2.3 and...

- Dolby Vision, Hybrid Log-Gamma and BT.2020

- Supports enhanced media and gaming - ALLM, VRR

- YPAO automatic room calibration

- Low-Profile Modern Design - Clean silhouettes,...

- Powerful Performance - Brilliant clarity,...

- Simple Setup, Streaming & Control - Get setup and...

- 5.1-Channel Sound - Experience a powerful...

- 6 Total Speakers - Full-range drivers deliver...

Last update on 2024-04-05 / Affiliate links / Images from Amazon Product Advertising API

Finally, let's talk about luck vs. skill.

As investors, we all tend to attribute good outcomes to our skills and bad outcomes to sheer luck (or lack thereof).

We choose how to explain the cause of an outcome based on what makes us look best. Unfortunately, this type of bias limits our ability to learn from our mistakes. Hindsight bias can be very damaging over time since it can:

- Cause us to wrongly assign blame (I couldn't have known!).

- Cause us to be overconfident (perceived vs. actual performance).

- Prevent us from learning from knowledge (I did nothing wrong!).

- Make us judge others too harshly (they only have themselves to blame!).

It's critical to appreciate the role of luck in our investing journey. Because once you do so, you are empowered to maximize the odds in your favor.

Luck is the residue of design.

This quote attributed to English poet John Milton (and later on to Baseball Hall of Famer Branch Rickey) has been used by many motivational speakers. Ultimately, putting the odds in your favor matters immensely more than any edge you may have.

The process matters immensely more than the outcome when making an individual investment decision. Annie Duke perfectly sums it up in her book Thinking in Bets:

What makes a decision great is not that it has a great outcome. A great decision is the result of a good process, and that process must include an attempt to accurately represent our own state of knowledge. That state of knowledge, in turn, is some variation of “I’m not sure.”

Create systems to recognize your odds rather than relying on individual excellence.

4) Independent Thinking

You can borrow ideas and opinions, but you can't borrow conviction.

Peter Lynch, the legendary former manager of the Magellan Fund at Fidelity, says we should invest in what we know. He's focused on a business story, with a thesis built on well-grounded expectations of what the company can achieve over the years and how it may positively impact the fundamentals.

Warren Buffett and Charlie Munger are well known for sticking to their “circle of competence.” They have no problem relegating an idea to the “too hard pile” if they don't fully understand it and can't form an opinion on their own.

The better you understand a business, the more likely you'll invest in a company that suits your portfolio. And when the inevitable pullbacks occur, you'll be much more inclined to weather the storm.

5) Child-like Curiosity

The best trait to discover outstanding investment opportunities isn't a superior IQ or incredible mathematical skills. Instead, it comes from a much more powerful tool: Curiosity.

Curiosity is the drive, the catalyst, that will bring you knowledge. If you are not eager to learn about businesses, new secular trends, and discover new companies, investing in individual stocks is probably not for you.

Buffett and Munger are known for spending their entire day reading. That's the training of these superheroes. So while Bruce Wayne is doing pushups and burpees, Warren and Charlie sit in a comfortable chair. They read voraciously across a wide range of content:

- SEC filings (S-1, 10-K, 10-Q, and so on).

- Shareholder letters.

- Investor presentations.

- Biographies.

- History books.

- Business books.

Content that may seem unlikely to help you find the next great stock can be what can unlock neuro pathways and put it all in context. Many great investors like to think analogically. They transpose the lessons from one business to another. They try to recognize patterns in management and strategy that have proven successful before.

You cannot build this type of insight overnight. However, there is a point where it all “clicks,” and you connect the dots. Think of Neo in the Matrix when he starts seeing the code.

A curious mind will lead you to discover more companies. Ultimately, it's a numbers game. Peter Lynch explains:

I’ve always said that if you look at ten companies you’ll find one that’s interesting. If you look at 20, you’ll find, two; if you look at 100, you’ll find ten. The person that turns over the most rocks wins the game.

You can find the same approach in VCs, maximizing their throughput by meeting with as many founders as possible and making decisions fast.

Your appetite for learning more and going deeper when you come across something interesting will be the fuel of your best investment decision.

6) Cast Iron Stomach

Another essential superpower of the successful investor is the capacity to take the 30,000-foot view. We are only speaking figuratively; no need to be Captain Marvel here.

Charlie Munger sums it up:

If you’re not willing to react with equanimity to a market price decline of 50% two or three times a century … you deserve the mediocre result you’re going to get compared to the people who do have the temperament, who can be more philosophical about these market fluctuations.

As pointed out before by Morgan Housel, stock market sell-offs happen all the time. Recognizing how often market crashes happen can give you a better idea of what you are getting into when investing in equities. Here is the historical frequency of pullbacks identified since 1928:

| Market drawdown | Historical Frequency |

| 10% | Every 11 months |

| 15% | Every 24 months |

| 20% | Every four years |

| 30% | Every decade |

| 40% | Every few decades |

| 50% | 2-3 times per century |

As we go through a turbulent time in the market, remembering that market drawdowns are part of the investing process is essential.

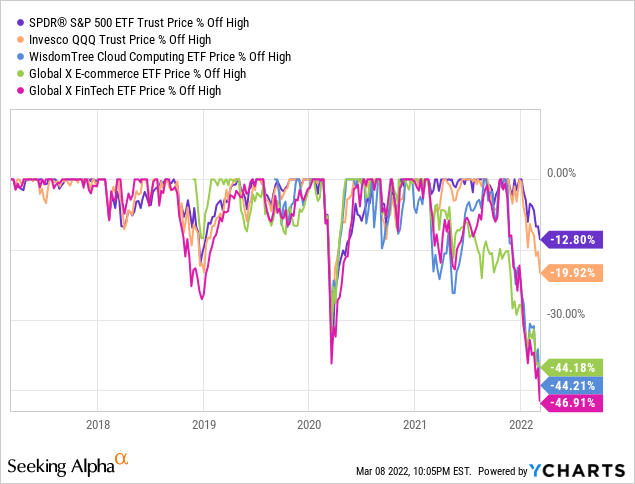

Underneath a 20% market drawdown, individual stocks can be annihilated. For example, many technology and communication stocks are down more than 70% from their previous high, while the Nasdaq (QQQ) is down only 20%. Moreover, entire categories like cloud computing (WCLD), e-commerce (EBIZ), and fintech (FINX) are down 45% or more on average, making the March 2020 market meltdown look like a cakewalk.

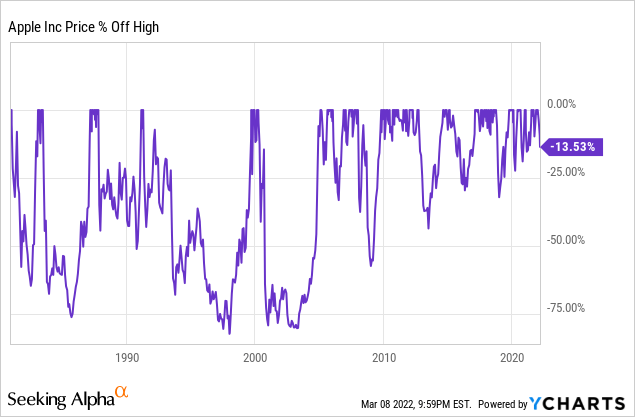

If you think it's proof that these stocks are terrible investments, think again. Look at Apple, one of the best stocks of all time. If you invested in Apple in the past 30 years, you had to deal with two different ~80% sell-offs. The stock dropped more than 50% during the Great Recession and more than 30% every three years in the past decade.

The superpower you need to carry you through these heart-wrenching swings is a cast-iron stomach.

Peter Lynch elaborates on this:

In the stock market, the most important organ is the stomach. It's not the brain. On the way to work, the amount of bad news you could hear is almost infinite now. So the question is: Can you take that? Do you really have faith that 10 years, 20 years, 30 years from now common stocks are the place to be? If you believe in that, you should have some money in equity funds.

There will always be something to worry about.

- In 2016, it was Brexit.

- In 2018, it was trade wars.

- In 2020, it was a global pandemic.

- In 2022, it's inflation, interest rates, and the Russian invasion of Ukraine.

The reality is that worrying doesn't help.

Joel Greenblatt explains:

Unless you buy a stock at the exact bottom (which is next to impossible), you will be down at some point after you make every investment. Your success entirely depends on how dispassionate you are towards short term stock price fluctuations.

We have to accept and live with that. Times of market turbulence and uncertainty can generate emotional reactions. It can be tempting to significantly rebalance a portfolio or sell a stock just because it's down 50% in the past year. That's the definition of panic. If you let your emotions run your portfolio, you are likely to capitulate at the worst possible time.

Peter Lynch adds:

The trick is not to learn to trust your gut feelings, but rather to discipline yourself to ignore them. Stand by your stocks as long as the fundamental story of the company hasn’t changed.

7) Flexibility – The Ability To Change Your Mind

The capacity to change our minds when the facts change is the last superpower we are channeling today.

In investing, the concept of strong opinions loosely held is a great thing. A successful investing journey should improve over time as we gain more experience. As put by the late George Bernard Shaw:

Progress is impossible without change; and those who cannot change their minds cannot change anything.

- SAMSUNG USA AUTHORIZED - Includes 2 Year Extended...

- Samsung 85 Inch DU8000 Crystal UHD LED 4K Smart TV...

- UHD Dimming | Auto Game Mode (ALLM) | Alexa...

- SAMSUNG TIZEN OS: Stream your favorite shows, play...

- BUNDLE INCLUDES: Samsung DU8000 Series 4K HDR...

- SAMSUNG USA AUTHORIZED - Includes 2 Year Extended...

- Samsung 75 Inch DU8000 Crystal UHD LED 4K Smart TV...

- UHD Dimming | Auto Game Mode (ALLM) | Alexa...

- SAMSUNG TIZEN OS: Stream your favorite shows, play...

- BUNDLE INCLUDES: Samsung DU8000 Series 4K HDR...

Last update on 2024-04-05 / Affiliate links / Images from Amazon Product Advertising API

You will make mistakes. Either by picking terrible investments or ignoring outstanding ones. There are usually two ways you can change your mind and act upon new information about an investment:

- Turning negative: An easy way to change your mind is to stop adding to a money-losing investment. Depending on your original bull case and your portfolio consideration, it can be best to part ways with an investment when the business doesn't qualify anymore to be in your portfolio. I struggle with this because I rarely ever sell.

- Turning positive: When you see a company you've ignored in the past firing on all cylinders, it's not too late to reconsider your position. It's generally a mistake to believe you are too late or that you have “missed the boat.” A perfect example is Apple, a four-bagger just in the past five years.

It reminds me of a classic quote from Charlie Munger on mistakes:

Most of Berkshire's success grew from stupidity and failure that we learned from. I hope that makes you feel better about your own life.

- Learn from your mistakes and identify what you would do differently.

- Assess what went well when the significant gains occurred. Repeat it.

I apply these principles by ensuring I don't get in the way of my portfolio's success. For example, I let my losers become a small part of my portfolio by not adding to them (doing less of what doesn't work). And I let my winners compound into a large part of my portfolio without interruption and add to them (doing more of what works).

David Gardner likes to use a fantastic analogy when he talks about one of the core traits of his investing philosophy, “add up instead of double down:”

You know, in some ways investing is like a horse race. Here's the trick. You're allowed to invest during the race. And so once Secretariat gets up by about 10 lengths halfway through […] you're allowed to put money in the race right then. And guess who I'm going to bet on? I'm betting on Secretariat. And Secretariat might choke, and you don't always win this way, and when you don't, it does hurt. But in my experience, the guys that are out ahead [the horses, the investors, the companies], they tend to keep on winning.

As long as the total amount invested in an individual investment remains within the acceptable range previously defined, it's always a good idea to add to a winner. The best ideas often already sit at the top of your portfolio.

Bottom Line

Not all superpowers belong in the Marvel Multiverse.

We are surrounded by ordinary human beings that have demonstrated extraordinary abilities in their investment process. Taking inspiration from them can help you improve your returns over a lifetime of investing.

By knowing the traits of legendary investors, you are more likely to be self-aware when you are about to make a big mistake.

Creating a habit structure that nurtures your curiosity and helps you keep perspective can be the difference between success and failure.

What about you?

- Which one of these traits do you find the most challenging to adopt?

- Which one is the most important to you?

Let me know in the comments!