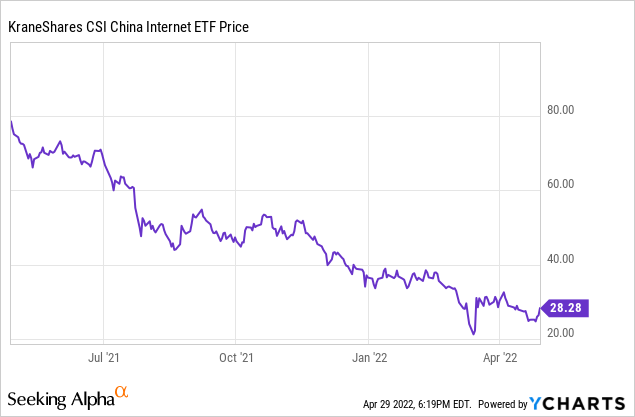

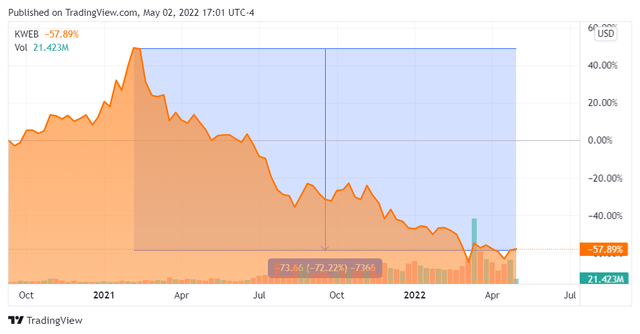

The KraneShares CSI China Internet ETF (NYSEARCA:KWEB) has dropped 71% from its highs since February 2021. The reason for the correction was the tightening of state regulation of the Chinese technology sector in accordance with the general goals of the authorities to improve the industry, reduce systemic risks, and increase transparency. I expect that the reduction of pressure on technology companies from the Chinese government and regulators won't encourage foreign investors to become interested in Chinese assets again.

About ETF

KWEB is an exchange-traded fund that tracks the CSI Overseas China Internet Index. This index includes the largest Chinese tech companies that are listed mainly in the United States and Hong Kong.

The fund's shares dropped massively over the past year. But thanks to verbal intervention by the Chinese government and financial regulators, the fund's shares managed to rebound from the bottom.

As of 04/27/2022, the fund's portfolio includes 50 companies. The ETF has a rather narrow focus: the portfolio does not include hardware developers and release software, only software and information technology stocks.

The fund has AUM of $5.06 bln and takes an annual fee of 0.76%.

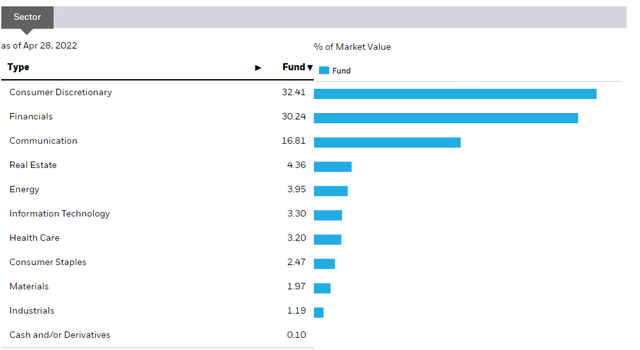

Technology services accounts for almost 60% of all holdings and Retail trade makes 23.7%.

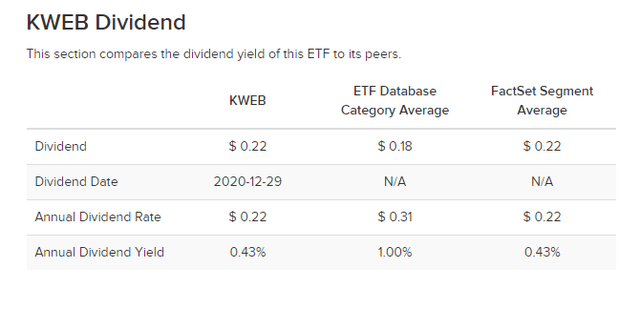

Dividends

KWEB distributes dividend payments at the end of the year. The average annual dividend yield on shares over the life of the fund (8 years) is 0.90%, with the last 2 years of payments being quite low. Still, it adds to the fund's appeal given that tech companies for the most part rarely pay out dividends.

Growth factors

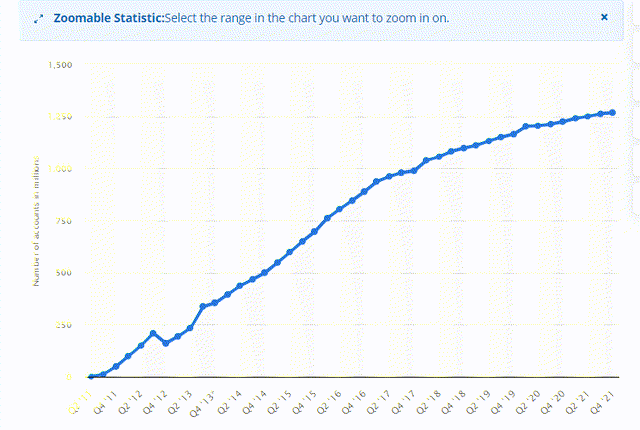

Supporting the development of the digital economy continues to be a key policy priority for China. Currently, the digital economy accounts for 40% of GDP, while China's technology and internet sector accounts for 40% of the weight of the MSCI China index. In China, 30% of all retail sales go through online companies. These companies have rapidly changed China's economy and are vital to its success.

The fund earlier focused on the American market rather than on Hong Kong's. In 2022 the situation changed due to increased geopolitical risks for the Chinese companies whose stocks are traded on stock exchanges in the United States. Since the beginning of this year, the fund began to gradually transfer assets to Hong Kong. The securities with a dual listing in Hong Kong and the United States, by the beginning of March, had already been fully transferred to Hong Kong – this applies to Alibaba (BABA), JD.com (JD), Baidu (BIDU), NetEase (NTES), Bilibili (BILI). As for the companies that are listed only in the US, the fund has significantly reduced their share in the portfolio. Nevertheless, the fund's portfolio still includes more than half of such companies (28 in all), whose securities are traded on American markets. The largest of them are Kanzhun (BZ), Pinduoduo (PDD), KE Holdings (BEKE), Full Truck Alliance (YMM), Lufax (LU), Vipshop (VIPS), Tencent Music Entertainment. It is likely that in the near future the fund's portfolio will be replenished with stocks traded on the Hong Kong Stock Exchange. Also, in the current conditions, it is possible to reorient the fund and add companies from the mainland exchanges of Shanghai and Shenzhen to the portfolio. Going further, the fund could be one of several available options for investing in fast-growing Chinese Internet companies on US exchanges.

The Chinese market can become an alternative for investors who prefer emerging markets, but in the context of the escalation of the conflict in Ukraine, there are limited opportunities for investment in the markets of Russia and Ukraine. When it comes to investing in the European stock market, investors are also cautious, fearing that the sanctions and restrictions imposed against the Russian Federation will have a negative effect on European companies as well. Chinese companies can potentially benefit both from the sales suspension of European companies in the Russian market and the money flow from European assets.

In 2019 the healthcare sector underwent a regulatory restructuring of some of the main industries. Systems have been put in place to drastically reduce the cost of generic drugs. Then, the MSCI China Health Care index fell 35% from May 2018 to January 2019. As the positive results of the reforms began to show, the index rose by 104% in about 1.5 years. There are slight parallels between the tech sector now and the health sector three years ago.

The Chinese Internet sector is characterized by a significant volume of online retail sales: in 2021 retail e-commerce sales value amounted to around $2,49 trillion, representing a 15 percent year-on-year growth. This number is expected to climb up to the $3,6 trillion mark in 2025. China's internet sector is estimated at $1.8 trillion versus $861 billion in the US, with only 70.4% internet penetration versus 85.8% in the US.

Risks

The main risk is the delisting of Chinese companies' securities from US exchanges. This will limit the ability of companies to raise funds from outside and impact capitalization. We can recall December 2020, when the Ministry of Commerce added 10 issuers to the black list and the delisting procedure for major Chinese telecoms China Telecom, China Mobile and China Unicom was initiated.

In 2021, the Chinese government had actively taken on the regulation of the technology sector and the Internet industry in the country, issuing new legislative initiatives and restrictions that should contribute to the recovery of the industry and the protection of user data. However, in fact, the new measures negatively affected most of the players in the sector. In September, Tencent and Alibaba were ordered by regulators to stop blocking external links on their apps. Previously, Chinese technology companies actively practiced such blockings of each other's links in order to avoid excessive marketing of competitors' applications and services. But, according to regulators, such a policy infringes on the interests and rights of users. For providers, the new measures may mean increased competition in Internet services.

The geopolitical situation in Taiwan may worsen in light of the latest statements by the leaders of China and the United States, which will have negative consequences for the Chinese economy and stock market.

China is currently experiencing another major outbreak of coronavirus. As a result, major cities, including Shanghai and Shenzhen, have limited business activity, which can only exacerbate supply chain problems. If the lockdown drags on, it could have a negative effect on economic growth in China.

KWEB – Largest Holdings

| The company | Allocation |

| Tencent | 10.92% |

| Alibaba | 9.59% |

| JD | 7.85% |

| Meituan | 7.20% |

| Baidu | 6.85% |

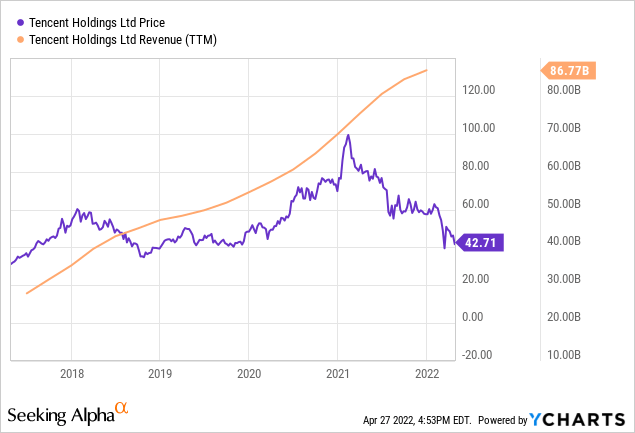

Tencent Holdings

Tencent (OTCPK:TCEHY) is a Chinese investment holding and one of the world's leading technology companies headquartered in Shenzhen. Tencent operates in such areas as social networks, online games, online entertainment and daily services, electronic payments, cloud services, digital business solutions, online advertising, etc. The company owns almost all the most popular mobile applications in China.

Gaming Market

Tencent expects to maintain the loyalty of current users and attract new players by introducing new game genres and current trends in the gaming industry. In 2017, the Chinese government began to regulate the country's online gaming industry, and since then, Tencent has been actively promoting a healthy gaming environment. A system is currently in place to allow parents to manage underage gaming activities, verify players' real names, control playtime and spendings. The next block of innovations was announced in August 2021. Game time for minors is now limited to 1 hour on weekdays and 2 hours on official holidays and weekends, and in-game purchases are prohibited for players under 12 years of age. however, in the long term, the new requirements of the Chinese government will have a minimal negative impact on Tencent, as players aged 12 to 16 years old account for 2.6% of the total revenue of the gaming industry in China, and only 0.3% for players under 12 years old.

Advertising Growth

From 2016 to 2020 Tencent's online advertising revenue CAGR was 32% while maintaining a 20% growth rate in 2020 amid the pandemic. Tencent's online advertising market share in China is 11%, while Weixin/WeChat, QQ, Tencent Video and Tencent News account for 17% of all ads placed on Chinese Internet platforms. It is worth adding that 36% of all the time that Chinese citizens spend in apps created by Tencent. Thus, the company's opportunities for advertising monetization are quite extensive.

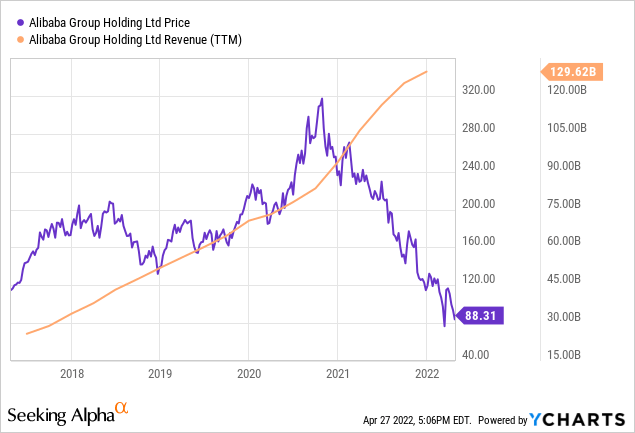

Alibaba

Alibaba is one of the largest public companies in China, operating in the field of e-commerce and IT. Founded in 1999, today it has grown into an entire empire.

The company has an impressive portfolio of assets that now make up an entire ecosystem. The most significant of them:

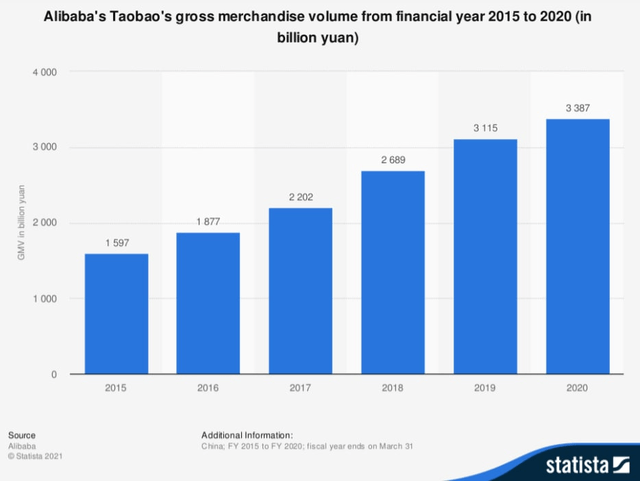

Taobao and Tmall. These are the main assets of Alibaba, complementing each other. The “center” of the ecosystem is Taobao (in FY2020, according to Statista, its turnover amounted to ~480 b$ or 48% of the total, +9% y/y), this is not just a marketplace, but a social e-commerce platform that combines online sales and a social network with various interactive elements, such as video streaming and short videos, which are gaining special popularity today. Through Taobao, users can also access other ecosystem portals, incl. Tmall is a marketplace for branded products from both Chinese and foreign manufacturers. In 2020, turnover on Tmall reached 450b$. As of March 2021, the marketplace had more than 250,000 brands, including 80% of the Fortune Top 100. The combined annual active users amount on the two platforms in 2021 was 811 million.

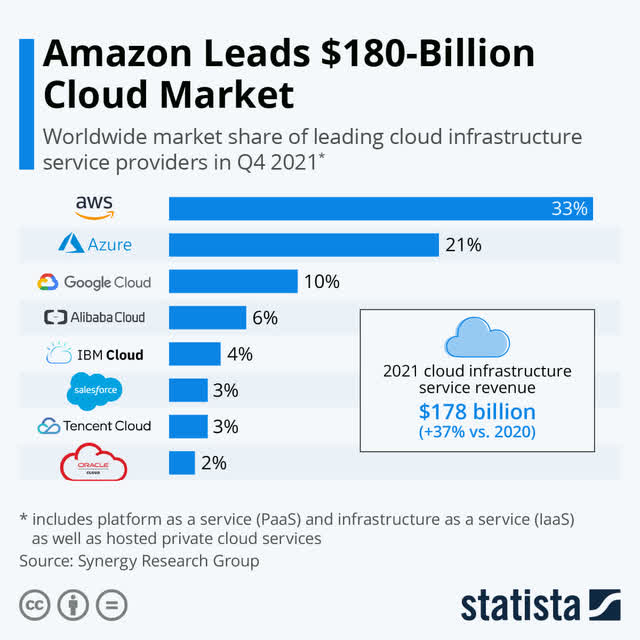

Alibaba Cloud. Launched in 2009, today the service is one of the four largest cloud service providers in the world and 3rd in the IaaS industry. Over the past 12 months, revenue amounted to $10.8 bln, an increase of 1016% from 2017 and the share in revenue increased from 4% to 10%. The capacity is used both for subscription and for their own purposes, for example, Alibaba Cloud played an important role during the 11.11 sale period to ensure the stability of all platforms under record loads. The service currently has over 4 million paying users. The cloud technology market remains one of the fastest-growing and promising. It reached $445 bln in 2021 and is projected to increase to $947 bln by 2026, an annual increase of 16%.

Ant Group and Alipay. Ant Group is one of the company's most valuable assets, since 2019 Alibaba has held a 33% stake in the holding. It is a giant in the global fintech industry, its activities (through its subsidiary Alipay) include transaction processing, lending, insurance, online banking, investments, etc., customers are more than 1 billion individuals and 80 million small businesses, the volume of transactions processed by the platform amounted to unimaginable 18.6 t$, for comparison: PayPal (PYPL) has 1.2 t$, Visa (V) has 2.3 t$. The total amount of loans issued reached 339 b$, the amount of assets under management – 645 b$ (included in the ~ top 40 management companies in the world). It is noteworthy that about 70% of Alibaba's total turnover (~840 b$) is generated through transactions through Alipay.

Alibaba Scale

Alibaba is one of the leaders not only in Chinese but also in global E-commerce. In 2020, the total turnover (GMV) on all platforms of the giant reached an unthinkable 1.24 t$ – this is more than 50% of all online sales in China and ~ 25% of the global e-commerce market. Alibaba alone generates almost 12% of China's GDP and about 1.5% of global GDP through its marketplaces, while the company's GMV is more than 92% of all countries' GDP and is approximately on par with Mexico, Australia, South Korea and Russia. In terms of turnover in 2020, Alibaba became the world's largest retailer, the main “western” rival in the person of Amazon took 13% of the industry with ~475 b$ in total sales on the site, the share of the next competitor – JD – was 9%. In 2022, the company is highly likely to enter the top 40 largest corporations by revenue from the Fortune Global 500 list.

The company has succeeded in other areas as well. Speaking about the cloud business, the issuer's share in the address market at the beginning of 2021 was 6% (+2 p.p. from 2018), fourth place after Amazon, Microsoft and Google. In China, the retailer holds the absolute leadership with a share of 34%.

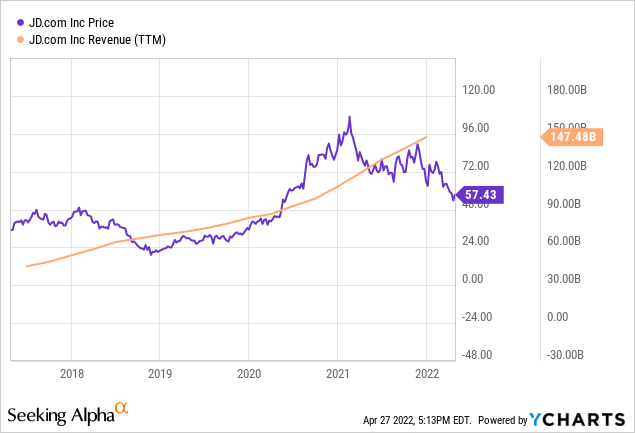

JD.com

JD is an e-commerce company. It is one of the two largest online B2C retailers in China, in terms of transaction volume and revenue, as well as a member of the Fortune Global 500 and Alibaba's top competitor.

| Preview | Product | Price | |

|---|---|---|---|

|

Galway Bay Long Sleeve Golf Rain Jacket - Three Layer Long Sleeve Golf Jackets for Men, Lightweight... |

$200.00 |

Buy on Amazon |

JD Plus is the main advantage

JD is actively developing a paid subscription for customers, which can significantly increase the number of loyal customers. The JD Plus program was launched five years ago and now has over 20 million members. At the same time, Amazon's experience suggests that this is not the limit. Amazon Prime has attracted more than 150 million subscribers and allows you to protect yourself from competition from smaller companies.

JD Plus is China's first e-commerce membership program. It gives customers access to shopping discounts and free shipping coupons, as well as discounted prices on many items. This has been made possible through collaborations with over 600 leading brands.

It is also worth considering that loyal customers spend more on the site. The average check for customers with JD Plus is $1,400 per year, compared to $600 for non-subscription customers.

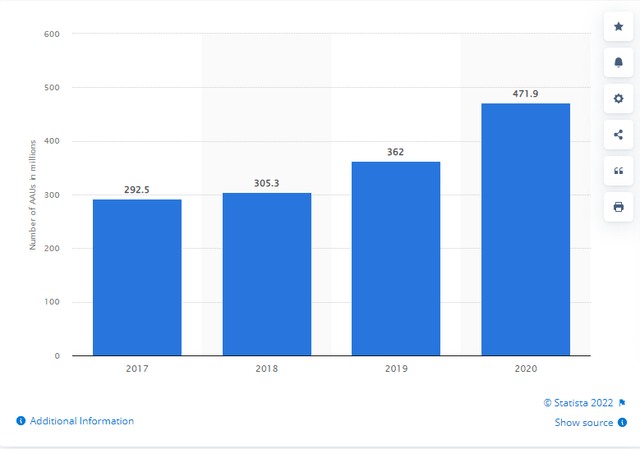

JD's active customer base grows at CAGR of 32%.

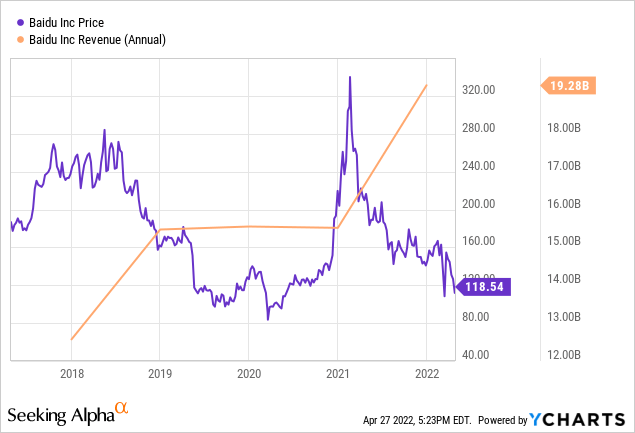

Baidu

Baidu is a company that provides web services, the main of which is the search engine of the same name – the leader among Chinese search engines.

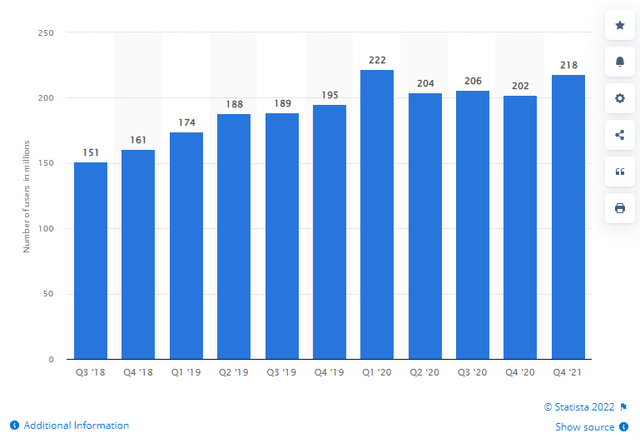

Baidu tries to counter Tencent by attracting users to its mobile app through various mini loyalty programs. Baidu's main growth driver is DuerOS, the virtual assistant that powers its smart speakers and other devices. Baidu is now one of the leading smart speaker manufacturers in China. However, they had to sell their speakers at deep discounts in order to take the lead and overtake Google products.

According to StatCounter, Baidu controls 84% of China's search market.

Apollo

The autonomous driving segment has made great strides under the Baidu Apollo project. The project is now expanding to work in more challenging environments such as downtown streets. Robotaxis can bring huge economic benefits in terms of cost savings on labor costs. The Chinese government has already expressed its interest in this program. Apollo L4 (an open-source technology platform for autonomous vehicles) has recently accumulated over 10 million test miles (+189% YoY) and received 411 autonomous driving permits, demonstrating the breadth of Apollo's geographic reach and the possibilities of various test scenarios.

Performance

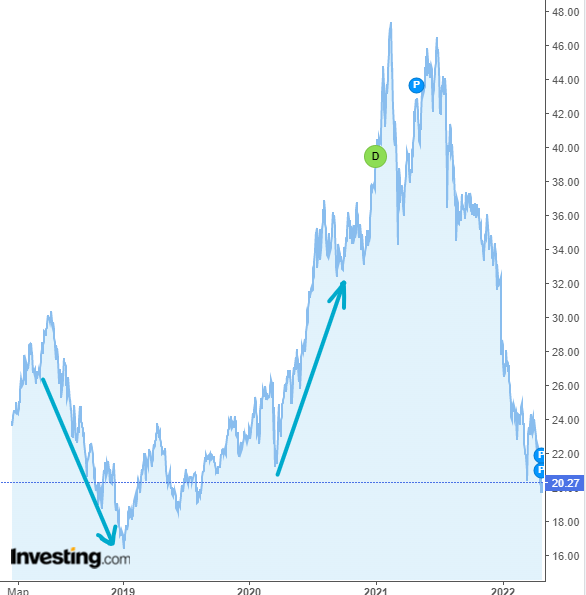

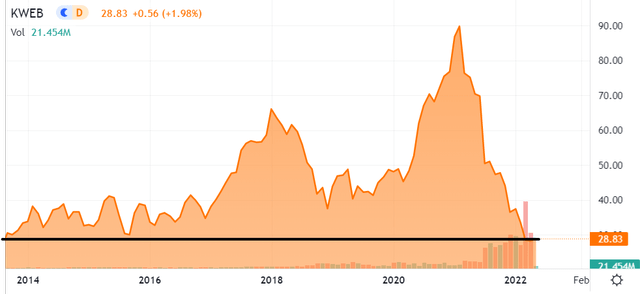

KWEB hit the all-time high in February 2021 at the level of $103.51. It slumped, however, by 18%, just a month after this. Since then, the Chinese market has been falling desperately for more than a year. Now KWEB is down 71% from its highs.

ETF shares are now trading at 2013 levels

Alternatives

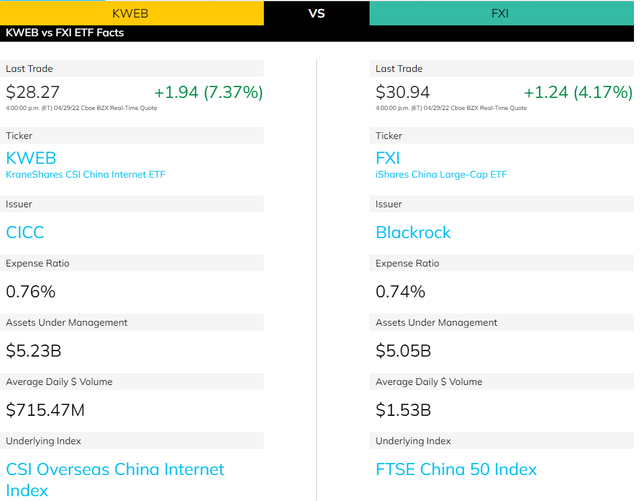

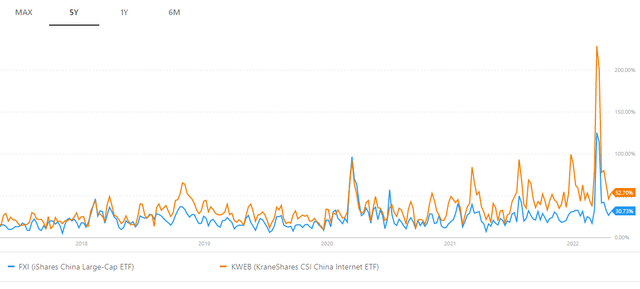

The closest peer of KWEB in terms of assets under management is iShares China Large-Cap ETF (FXI) by Blackrock, which tracks FTSE China 50 Index. KWEB launched on 07/31/13, while FXI debuted on 10/05/04.

KWEB VS FXI

- KWEB and FXI have the AUM of $5.23 bln and $5.05 bln respectively

- KWEB has an expense ratio of 0.76%. FXI's ER is 0.74%. The 0.02% difference is not critical.

- KWEB has historically outperformed its peer.

- FXI has 30% of its holdings in Financials. A lot of these are state-owned banks. These companies would be the main targets of US sanctions if the aggravation of relations between the countries happens.

- FXI's volatility is currently 30.73%, which is below KWEB's volatility of 52.70%. The chart below compares the 10-day moving volatility of FXI and KWEB.

Although the FXI's volatility is lower than KWEB's, KWEB surely has more significant upside potential, since it bets on the fastest growing sector in China – IT, while FXI bets on the whole market.

Valuation

The latest quarterly reports from Chinese tech companies were very weak. The low growth rate of financial indicators in 2021 is partly due to the high base in 2020, as well as new regulations in the industry. Investors fear this trend will continue.

The situation with Russian ADRs has seriously affected the attitude towards Chinese stocks. Now investors are looking at them in a completely different way. If earlier the complete ban on the sale of shares for non-residents looked like nonsense, now it is a new reality. In case of any escalation, the Chinese Communist Party can use the Russian experience. Many foreign funds, due to the aggravation of situations and sanctions against the Russian Federation, have already lost billions, now everyone is looking at the risks associated with China from a different angle.

- 🌴 Material: Chiffon, 100%Polyester ; Lightweight, soft and comfoy material

- 🌴 Features: Long sleeve chiffon lace mini dress for women spring, summer and fall, crew neck, long lantern sleeve, zipper closure, elastic waist, a-line and slim fit style, elegant ruffle design, this cute fall mini dress will make you more beautiful and lovely!

- 🌴 Occasions: Fall casual short dress suitable for you to party, holiday, school, date, cocktail, coming home, and daily life. Believe you will love it and get lots of compliment!

- 🌴 Garment care: Hand wash in cold water recommend, hang dry, low temperature ironing if necessary

- 🌴 Size Note: 0-2, 4-6, 8-10, please refer to our sizing information in the picture description to choose your size. Thanks for your understanding

Given the CCP's attitude towards investors, Chinese assets are likely to continue their sell-off. That's why I put a ‘Sell' mark on this ETF and the Chinese market overall. Frankly, I don't even think that if delisting and geopolitical risks would go away, KWEB will be a Buy or even Hold. China's economic slowdown and uncertainty about the government's next steps will likely keep investors away from the Chinese market.

Conclusion

The Chinese IT sector is one of the fastest-growing sectors. IT companies benefit from the constantly increasing demand in the country.

There is a chance that reduced pressure on technology companies from the Chinese government and regulators may encourage foreign investors to become interested in Chinese assets again since fundamental technology corporations are quite attractive in double and triple-digit financial growth rates.

Investing in China always comes with lots of risks, but now, when nobody knows what regulators' next move is, it gets even riskier.

Although the ETF has lots of well-managed wide-moat companies, I believe that KWEB is a sell.