Overview

For the month of April, the Emerging Markets Bond Fund (Class A, no load) was down -5.01%, based on the net asset value, outperforming by 79 bps of the -5.80% decline in its benchmark, 50% J.P. Morgan Government Bond Index-Emerging Markets (GBI-EM) Global Diversified and 50% J.P. Morgan Emerging Markets Bond Index (EMBI); Year-to-date (YTD), the Fund outperformed its benchmark by 470 bps, with the Fund down -8.87% compared to down -13.57% of its benchmark.

YTD, not owning any Russian assets despite their large benchmark weight is the biggest contributor to outperformance. But, our very low duration of around 4.2 continued to contribute. Month-to-date (MTD), on a country-specific basis, Thailand, China and Poland were our big winners, because we had so little of them! These are classic low yielding EM local currencies that make up a big part of the indices. We don’t like them. In particular, all three countries face growth headwinds from their regions (Eurozone and China) and have low nominal interest rates. It is heartening that this positioning has worked well for us as markets are complex and varied this year, so it is going to be a war every month.

We made big changes. So far this year, we saw higher inflation/policy rates and higher commodity prices as unpriced and we therefore favored emerging markets foreign currency (EMFX) but maintained very low duration. Now, though, we have significantly increased duration and reduced EMFX. As of end-April, we reduced local currency to 35%, our carry remains high at 6.4%, and duration is up about 1 to 4.86. We plan to increase duration to a 6 handle.

South Africa, Indonesia, Brazil, Mexico and Colombia were the Fund’s largest country exposures.

We initiated a big change in stance – we’ve moved from a portfolio that had very low duration and high EMFX to a portfolio that has high duration and low EMFX. Currently, the team’s view is that the bad news of higher policy rates is priced into the front-end of the U.S. yield curve and unlikely to change, but the bad news of growth is not yet priced. As a result, we continue to look to increase low-beta duration and decrease EMFX.

The bad news of higher policy rates is priced into the front-end of the US yield curve and unlikely to change, but the bad news of growth is not yet priced; we are looking to increase low-beta duration and decrease EMFX as a result. We believe recession risks are rising, with a European recession, oil embargo risks and China’s Zero-Covid uncertainties adding to U.S. Federal Reserve (FED) rate hikes as headwinds. And, the Fed is unlikely to change its policy path soon. The fast increase in policy rates is with us all year (the pricing of the policy rate and the rhetoric behind the policy), we think. But who doesn’t know that the Fed is activated? That’s why we think we are getting closer to stability in long-end U.S. treasuries. Policy rates should remain priced for a hawkish Fed, and any death-rattles for the long bond should be bought (we’d say 3%-3.5% on the U.S. 30-year). However, what the market hasn’t fully digested, we believe, are the risks to growth. And we think that recession risks are mounting and unanticipated by the market. This means a complicated market. To simplify them, we come away from meetings looking to increase low-beta spread duration and decrease some EMFX.

Policy rates reflect likely policy path – it’s time to accumulate duration. Fed funds futures price in hikes and two cuts in 2023! Even futures are pricing in an end to the hiking cycle. A hawkish Fed is already priced, and the real Fed funds rate could already be at neutral. We’d add that financial conditions were already significantly tighter going into this hiking cycle.

Emerging markets (EM) have hiked pre-emptively, this time; if the Fed is early, late or whatever, EM has built in a cushion. For the first time, EM central banks have pre-empted Fed hikes. They are normally more hawkish, but in this latest episode they are also more preemptive. They entered the Russia/Ukraine crisis having already tightened monetary policy.

But unlike the bad news of higher policy rates, the bad news of weaker growth has not been appreciated by the market. We were looking at a nascent global recovery just before the Ukraine invasion; the ratio of new orders to finished goods was rising, pointing to a hopeful future. The supply chain shocks that created inflationary pressures and upward pressure on policy rates were fading. The worst was behind us. Then Russia invaded Ukraine. And the supply chain issues arguably got worse, because the Russian dimension now intersects closely with the Chinese. Anyway, those shock waves are well-discussed, with the complexity of fertilizer production a popular example of how important Russia’s exit from global commodity markets is.

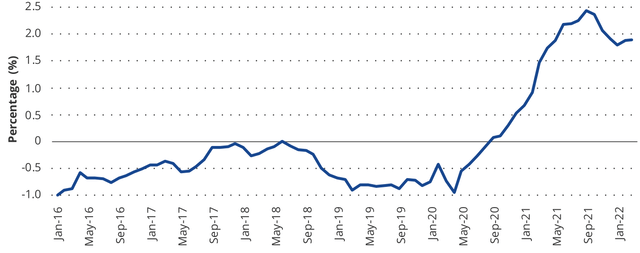

Exhibit 1: Is It Safe to Go in?:

Citi Global Supply Chain Pressure Index

Source: Bloomberg. Data as of March 31, 2022.

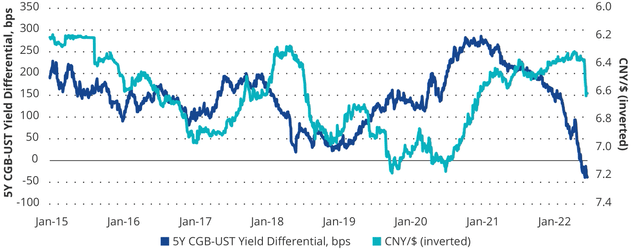

We think all of this maps to growth risks, in particular the risk of a European recession; China also seems to have political incentives that trump economic ones, adding to slowdown risks. We think embargo risk is high and markets are unprepared. We also think that Chinese authorities are going to continue to be less growth-focused due to political concerns as well as respect for the limits of leverage. On top of this, the U.S. fiscal impulse is declining. All of these conspire to work against global growth. We argued in our “Evergrande is Spreading” article that there’s risk to the renminbi (CNY), which seems to be materializing. Exhibit 2 shows that CNY downside pressures are getting exacerbated by the sharp rise in U.S. rates.

Exhibit 2: Would You Buy Chinese Bonds at Lower Rates Than Treasuries?

CNY and China-U.S. Rate Differential

Source: Bloomberg. Data as of May 4, 2022.

- NINJA BLENDING ANYWHERE: Blast through frozen...

- LARGE CAPACITY: Makes up to 18 oz. of your...

- PREMIUM COLORS: Choose a color that best fits your...

- EASY TO CARRY: Take your drink on the go with a...

- SIP LID: Easy-open sip lid lets you blend and...

- ALL-IN-ONE BREAKFAST SOLUTION: Start your day off...

- SPACE SAVER: Our compact breakfast maker machine...

- COFFEE MAKER: This coffee maker brews up to 4 cups...

- FAMILY-SIZED GRIDDLE: The large non-stick griddle...

- NOSTALGIA: From designs inspired by early 19th...

So what? A weak Eurozone and China keep us away from a lot of EMFX, wary of spread duration, and attracted to low-beta duration. That’s the bottom line of how we’ve positioned for the coming environment. A weak Eurozone means an European Central Bank (ECB) that will be torn between hiking along with the Fed versus hiking into a recession. That will not be supportive of central/eastern European local bond markets that make up a big portion of the benchmark. A weak China means limited growth upside in Asia, and because Chinese market rates may face upward pressure, it’s hard to see tailwinds to Asian local currency bonds. And we worry about Latin currencies, as they are high-beta in a risk-off environment. What this leaves us with is a bias to reduce local currency exposure overall, in favor of increasing exposure to long-duration low-beta EM in USD. We’re maintaining our low-duration high-yielding USD exposures.

Exposure Types and Significant Changes

The changes to our top positions are summarized below. Our largest positions in April were South Africa, Indonesia, Brazil, Mexico and Colombia:

▪ We increased our hard currency sovereign exposure in Ukraine and Turkey. The Ukrainian government consistently shows willingness to honor its debt obligations. We recognize that continuing military actions pose risks and create uncertainty, but Ukraine’s relatively light schedule for the next several months bodes well for the technical test score for the country. Turkey’s idiosyncratic policy mix is one of the main reasons why we stay away from local debt, but the country’s sovereign debt is now attractively valued, while the unorthodox FX framework somewhat reduced pressure on the international reserves. In terms of our investment process, this improved the technical test score for the country.

▪ We also increased our hard currency sovereign exposure in Qatar and Saudi Arabia. Both countries are among the key beneficiaries from higher oil prices due to Russia’s invasion of Ukraine – especially as regards growth, fiscal positions and external balances. Saudi Arabia also demonstrates consistent structural efforts to strengthen governance and diversify the economy from oil. In terms of our investment process, this improved the economic, policy and technical test scores for the country.

▪ Finally, we increased our hard currency sovereign exposure in Pakistan, Honduras and Democratic Republic of the Congo. Pakistan’s politics remains volatile, but the country’s bonds are attractively valued (the highest initial allocation bucket #1), and it is on track to get an extension of the IMF program until mid-2023. In the meantime, the central bank is trying to maintain a tight monetary policy stance, which should help to alleviate external pressures. In terms of our investment process, this improved the policy test score for the country. As regards Honduras, the peaceful transition of power and the government’s supportive stance towards the private sector (as well as the favorable impression during the IMF meetings) strengthened the policy test score for the country. Democratic Republic of the Congo is making a good progress towards an IMF deal, and its bonds were very attractively valued, improving the country’s policy and technical test scores.

▪ We reduced our hard currency sovereign exposure in Hungary and local currency exposure in Poland. In Hungary, the ruling party’s re-election with a larger than expected margin, and signals that it may get embroiled in the Russia/Ukraine war in addition to political/legal complications with the EU – which can potentially cost it disbursements from the EU’s recovery funds – worsened the country’s policy/politics test score. Poland is very exposed to the fallout from the Russia/ Ukraine war – the recent cutoff of Russian gas supplies shows that upside inflation risks can prove more persistent. The government’s expansionary fiscal stance can created additional technical issues for local debt. In terms of our investment process, this negatively affected the technical and policy test scores for the country.

▪ We also reduced our local currency exposure in Brazil, hard currency corporate exposure in Moldova, and hard currency sovereign exposure in Angola. The Brazilian réal’s super-stretched net long positioning means that it can easily get caught in the global selloff on the back of China growth concerns. Against the backdrop of the deteriorating technical test score, we decided to take partial profits on this position which worked extremely well early in the year. In Moldova, we sold a corporate bond after the company lost access to sea after Russia attacked Ukraine.

- Protect Your Kitchen Appliances: This toaster dust...

- Universal Size: two sizes available, S-11.4 ''L x...

- Material: high-quality and durable hemp-like...

- Easy to Use & Clean: There is a hanging rope on...

- Exquisite Gifts: Our bread machine dust cover has...

- Durable metal housing with soft matte premium...

- Dimension: 17.0"x21.2"x12.2" (Length x Width x...

- Large 12.4" glass turntable

- 15 Digital Preset Functions

- Touch-activated display

▪ Finally, we reduced local currency exposure in Malaysia and Thailand. Malaysia can easily get affected by the Chinese renminbi’s depreciation, as the ringgit has one of the highest correlations with CNY on multiple time horizons. This worsened the technical test score for the country. In Thailand, we swapped from local to quasi-sovereign exposure due to “twin” concerns about the Chinese renminbi’s depreciation and the impact of China’s zero-COVID policy on tourism. Both factors worsened the country’s technical and economic test scores.

Average Annual Total Returns (%)

| As of April 30, 2022 | 1 Month† | 3 Month† | YTD | 1 Year | 3 Year | 5 Year | Life |

| Class A: NAV (Inception 7/9/12) | -5.01 | -7.59 | -8.87 | -12.50 | 0.93 | 1.48 | 1.22 |

| Class A: Maximum 5.75% Load | -10.48 | -12.90 | -14.11 | -17.53 | -1.04 | 0.28 | 0.61 |

| Class I: NAV (Inception 7/9/12) | -4.89 | -7.49 | -8.70 | -12.19 | 1.24 | 1.78 | 1.51 |

| 50 GBI-EM GD / 50% EMBI GD | -5.80 | -12.31 | -13.57 | -15.19 | -2.48 | -0.47 | 0.84 |

| As of March 31, 2022 | 1 Month† | 3 Month† | YTD | 1 Year | 3 Year | 5 Year | Life |

| Class A: NAV (Inception 7/9/12) | -0.74 | -4.06 | -4.06 | -5.00 | 2.75 | 2.64 | 1.77 |

| Class A: Maximum 5.75% Load | -6.45 | -9.58 | -9.58 | -10.46 | 0.74 | 1.43 | 1.15 |

| Class I: NAV (Inception 7/9/12) | -0.84 | -4.01 | -4.01 | -4.79 | 3.06 | 2.92 | 2.05 |

| 50 GBI-EM GD / 50% EMBI GD | -1.21 | -8.24 | -8.24 | -7.95 | -0.51 | 0.99 | 1.47 |

† Monthly returns are not annualized.

FOOTNOTES

1 Carry is defined as Current Yield. 30-Day SEC Yield for Class A was 6.34% as of 4/30/2022.