curraheeshutter

The iShares U.S. Oil Equipment & Services ETF (NYSEARCA:IEZ) captures factors related to the underinvestment in oil and currently high levels of oil drilling activity. These stocks are exposed to development activity for energy production in the US shale basins as well as the development of offshore rigs. Key secular factors now drive a growing backlog in this industry that is of the utmost strategic importance. Yields and PEs are high but mainly because on an LTM basis many of these stocks are coming out of what was a relatively depressed period for its markets. These stocks have already reacted similarly to energy companies with direct commodity exposure, but strategic and national interests also drive these companies. Energy prices should stay at permanently higher baseline levels thanks to the economic disintegration, and this should support these companies' markets and their fundamentals. Shares are a buy.

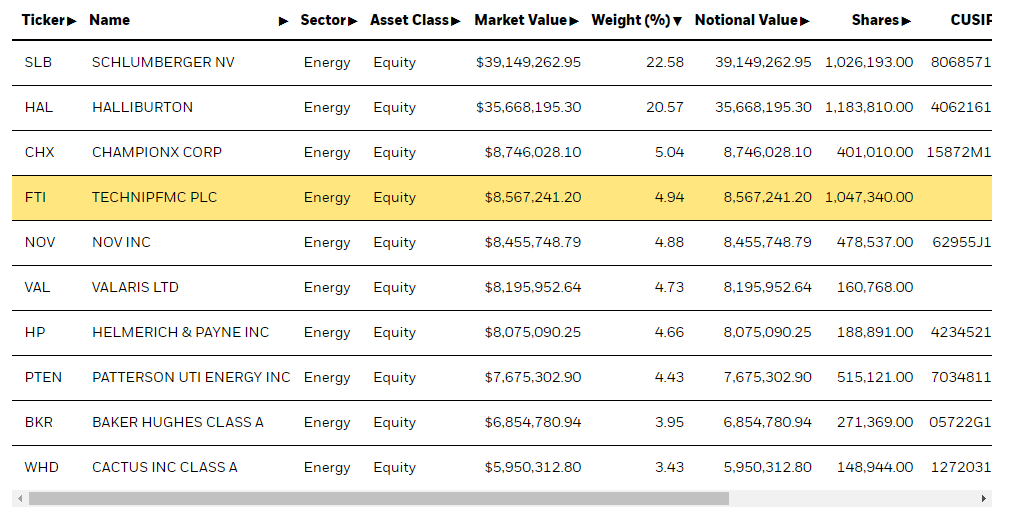

Breakdown of the IEZ

Let's have a look at what's in the IEZ.

Holdings (iShares.com)

The major exposures are Schlumberger (SLB) and Halliburton (HAL). Halliburton provides a lot of services to prepare sites for drilling and fracking, and products and services for improving the productivity of energy production companies including measuring and software products, but also materials for the drills. Similarly, SLB services assets in oil rigs and provides services to determine the ideal location for developing assets, i.e., seismic and geological services. Together these companies account for 43% of the allocations, and they depend heavily on utilization of their services and products, which comes from the intensity of production activity in the oil sector.

Remarks

- A masculine fragrance with a fusion of sandalwood,...

- FRESHEN YOUR LIFE: Fiber Can is LITTLE TREES...

- MORE THAN JUST A CAR AIR FRESHENER: Freshen up at...

- LONG-LASTING FRAGRANCE EXPERIENCE: Specialized...

- SLIDE LEVER TO ADJUST STRENGTH: Slide the lever on...

- UV SHIELDING - Provide your baby with protection...

- SIMPLE UNIVERSAL INSTALLATION - Experience...

- THIS SET INCLUDES- 2 transparent car window...

- DURABLE MESH MATERIAL & STURDY WIRE- Rely on...

- GIVE THE BEST BABY GIFT- Need a baby shower gift...

- SAFETY ESSENTIAL CAR ACCESSORIES: If your car is...

- PRACTICAL AND PERFECT CHRISTMAS GIFT: A surprise...

- SAFE AND DURABLE TOOL KIT: This bag is made of...

- EVERYTHING YOU NEED FOR CAR SAFETY IN ONE BAG:...

- SUITABLE FOR MOST EMERGENCIES: This roadside...

- ✔ADJUSTABLE STRAP & COLLAPSIBLE SHAPE – The...

- ✔MAGNETIC SNAPS: There are 4 metallic magnetic...

- ✔HARD-WEARING LEAKPROOF INNER LINING – This...

- ✔MULTIPURPOSE – This car garbage bin can be...

- ✔GREAT COMPATIBILITY – An effective solution...

They are supported by several trends. First of all, there is visibly higher spending by all sorts of customers and across geographies, including Europe but also West Africa, LatAm and in the US. In general, energy security has become a strategic issue and that has supported growing backlog and growing product delivery volumes for these companies. Growth is now in the mid-double digits, with the companies capable of delivering. Moreover, there is a shortage of capacity. Even the largest OPEC producers don't have much to give in volumes.

US shale is so far one of the less exciting markets in terms of new development and rising productivity. This is primarily because shale oil producers have new capital allocation priorities. It's a lot about buybacks and dividends rather than reinvesting with stranded asset risks and longer construction and development lead times recently. Indeed, SLB's inventories have risen to manage those lead times. In fact, a lot of the NA growth for SLB is coming from deepwater drilling operations, not so much from onshore. Nonetheless, the intensity of drilling and production has risen in shale as well. Every market is good for service companies.

Another thing to appreciate about these oil service companies is their economics. The ETF currently has quite low dividend yields and a high PE above 27x. This is because operating leverage is now kicking in, and LTM figures incorporate still somewhat tentative end-market environments. Pricing and volumes are both benefiting now, supercharging earnings growth. This industry has long been in somewhat of a depression before the energy paradigm shift. We are still below 2019 levels in terms of revenues, but all those impairments of yesteryear are over now that oil is the hottest natural resource. Moreover, pricing is creating substantial margin expansion. OPEX is also rather fixed for both HAL and SLB. Engineering and research costs are falling as these companies proceed to rake it in without expending efforts to innovate, since the customers are now coming to them – no need to do anything fancy.

OPEX control and operating leverage will play in these companies' favor. For SLB in particular, and indeed for many other IEZ elements, backlog that is going to contribute better to margins is now being added. When this gets liquidated later, the profit increases will just kick in further. On the basis of supply dynamics supporting secular growth in fossil fuel development, driven both by commodity price and energy security (have a lot of terminals to fill quickly), IEZ looks solid. With the current upcycle including the development of known assets rather than new ones in shale, where HAL is primarily exposed, for example, producers are looking a lot more rational, so this upcycle could also have a slow burn and resist macro overhang, which still matters for the prospects of oil. But utilization is critical, and when supply is tight, utilizations on oil assets are going to be high, as for the products and services that support those oil producers.

While we don't often do macroeconomic opinions, we do occasionally on our marketplace service here on Seeking Alpha, The Value Lab. We focus on long-only value ideas, where we try to find international mispriced equities and target a portfolio yield of about 4%. We've done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, us at the Value Lab might be of inspiration. Give our no-strings-attached free trial a try to see if it's for you.