The VanEck BDC Income ETF (NYSEARCA:BIZD) invests in business development companies, hence the ticker and name, which are companies that are basically lenders but don't get regulated as heavily as banks. In order to dodge the onerous regulations, they play the role of helping generate economic value by investing in smaller private businesses that might be more poorly banked. Additionally, the BDC must offer to provide operational and business advice, and act somewhat as a partner to the customers they lend to so that they succeed. The upshot is that rates tend to be pretty high on their loans because credit risk and liquidity is automatically worse. Also, the debt also includes more junior than traditional bank-originated business debt, which again highlights the purpose of BDCs who are able and willing to provide more leverage to businesses who might need it for their capital structure. The result is a high yield portfolio, and incidentally one that is quite well positioned in the current rate environment. Credit risk is there, but duration risk isn't, so not bad.

BIZD Breakdown

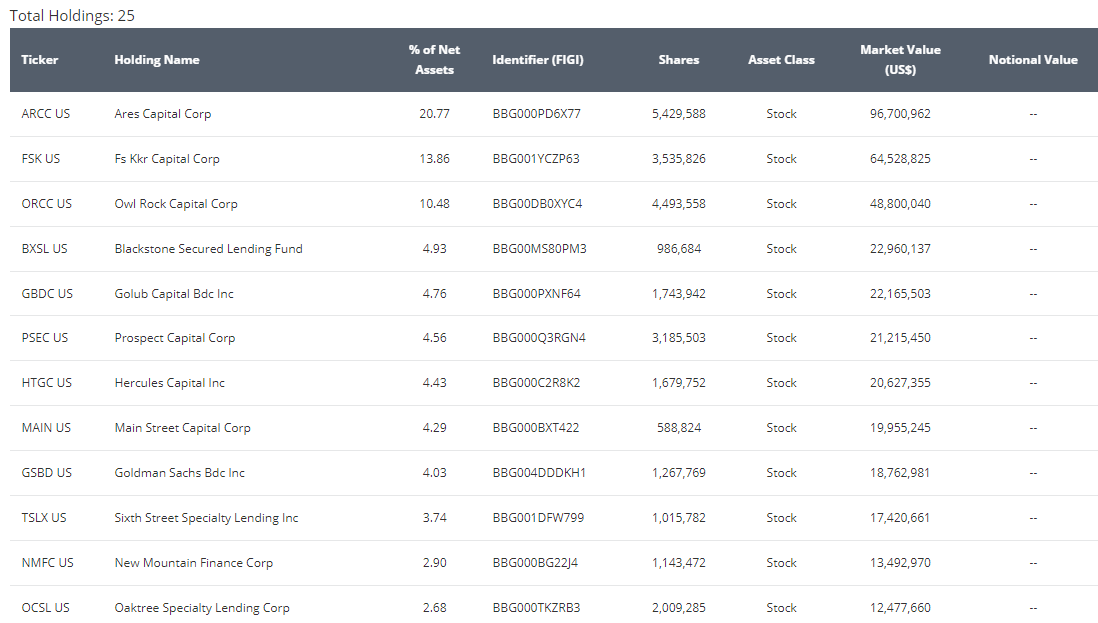

Top Holdings (VanEck)

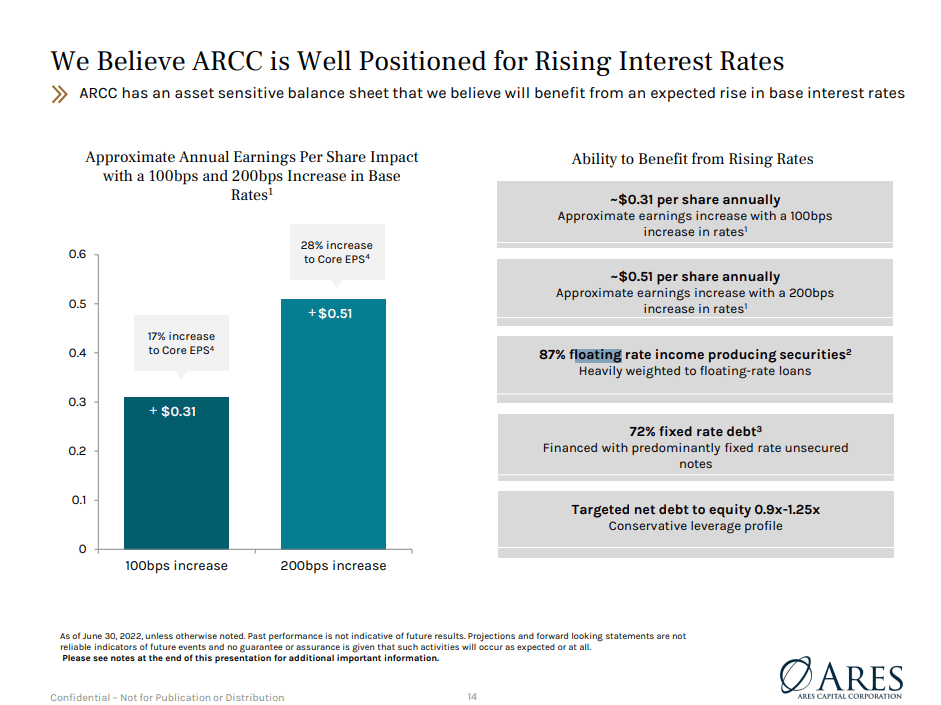

The first four already account for almost 50% of the portfolio, so we will focus on them to paint the picture of the ETF. What we see broadly across these companies is firstly that almost all their assets under management are invested in debt securities, usually in a diversified base of companies. The percentage of floating rate assets is very high. The lowest of the top holdings has a 87% allocation to floating rate debt, and that company was Ares Capital Corp (ARCC). Others have much higher rates, the last two of the top four have 100% invested in floating rate securities.

- A masculine fragrance with a fusion of sandalwood,...

- FRESHEN YOUR LIFE: Fiber Can is LITTLE TREES...

- MORE THAN JUST A CAR AIR FRESHENER: Freshen up at...

- LONG-LASTING FRAGRANCE EXPERIENCE: Specialized...

- SLIDE LEVER TO ADJUST STRENGTH: Slide the lever on...

- UV SHIELDING - Provide your baby with protection...

- SIMPLE UNIVERSAL INSTALLATION - Experience...

- THIS SET INCLUDES- 2 transparent car window...

- DURABLE MESH MATERIAL & STURDY WIRE- Rely on...

- GIVE THE BEST BABY GIFT- Need a baby shower gift...

- SAFETY ESSENTIAL CAR ACCESSORIES: If your car is...

- PRACTICAL AND PERFECT CHRISTMAS GIFT: A surprise...

- SAFE AND DURABLE TOOL KIT: This bag is made of...

- EVERYTHING YOU NEED FOR CAR SAFETY IN ONE BAG:...

- SUITABLE FOR MOST EMERGENCIES: This roadside...

- ✔ADJUSTABLE STRAP & COLLAPSIBLE SHAPE – The...

- ✔MAGNETIC SNAPS: There are 4 metallic magnetic...

- ✔HARD-WEARING LEAKPROOF INNER LINING – This...

- ✔MULTIPURPOSE – This car garbage bin can be...

- ✔GREAT COMPATIBILITY – An effective solution...

Ares Highlights (Investor Presentation 2022)

The other quality we notice is that these businesses typically have a high proportion of their liabilities at fixed rates, which actually gives them operating leverage with respect to rising rates. Ares has the most extreme figure with the debt in their BDC being 72% fixed rate. The Blackstone Secured Lending Fund (BXSL) has 55% which is still very high on the liability side.

Remarks

The takeaway is that the upside is coming from variable rate assets and rather fixed rate liabilities. On the risk side in the portfolio, the majority of the debt in all their portfolios is first-lien secured debt, so the risks certainly aren't astronomical. But the businesses they invest in tend to be pretty leveraged, and the high yields reflect that defaults are somewhat likely. Ultimately, these are companies that play in the leveraged finance space. The YTM currently is around 8-10% for all these debt portfolios.

Similarities across the portfolio are exposure to healthcare and software and services. Those sectoral allocations together tend to account for about one third of their overall assets. While high leveraged lending is a known risk, the concern going forward is with the economy. While the US is much more resilient to the current geopolitical problems, costs of living are rising, and unemployment must rise in order for the current rates of inflation to be tackled. There will be pressures on businesses. Nonetheless, the 12% distribution yield of this portfolio will flex with higher rates. There's no duration risk to speak of, but consider that if this recession is more than garden variety, there is going to be some problems on the credit side.

While we don't often do macroeconomic opinions, we do occasionally on our marketplace service here on Seeking Alpha, The Value Lab. We focus on long-only value ideas, where we try to find international mispriced equities and target a portfolio yield of about 4%. We've done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, us at the Value Lab might be of inspiration. Give our no-strings-attached free trial a try to see if it's for you.