jetcityimage

The iShares 1-5 Year Investment Grade Corporate Bond ETF (NASDAQ:IGSB) has a decent YTM, a little higher than what you'd expect from its risk class. It might have something to do with duration risks, where investors in corporate bonds may be speculating differently from the broader bond market on how interest rates will evolve, putting more weight on the scenario that rate hikes are more long lasting. Since it won't be a long wait to get past the certain rate hikes into the area where continued rate hikes will be more speculative, IGSB could be a decent idea at that point in time. For now, it's a pass.

IGSB Breakdown

Let's have a quick look at what constitutes this ETF.

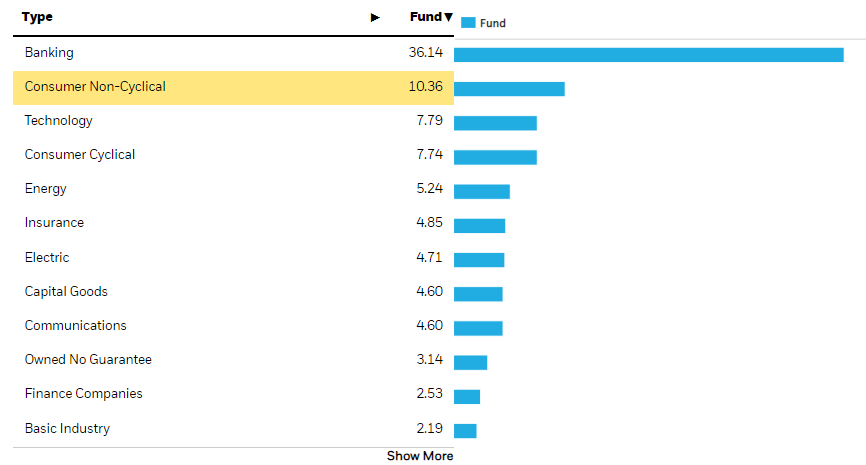

Sectors (iShares.com)

The issuers are primarily banks, whose credit quality and earning potential is liable to rise on account of superior exposure to interest rate hikes relative to some other sectors, where the environment is less conducive to earnings growth.

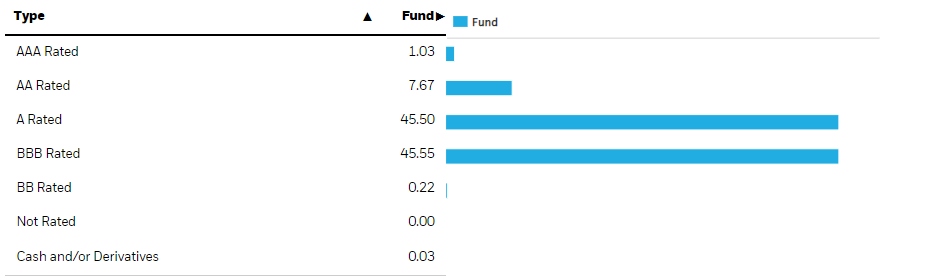

Credit Ratings (iShares.com)

No products found.

Credit ratings are also important to assess when measuring the YTMs on these bonds against the risk-free rates. We see that the ratings are somewhere between A and BBB, so certainly investment grade.

Duration risk is something to be persistently aware of when it comes to fixed income, because we are in a rate hike cycle and it is hard to call its end. The duration is not low at 2.6 years, meaning a 2.6x sensitivity in price to increases in interest rate. Naturally, convexity effects blunt this blow on higher hikes, but for the rate hike ranges we are currently expecting, i.e. a maximum of 3% or so more, this short-hand is effective and accurate enough.

Remarks

Let's begin with credit rating. For A and BBB bonds, historical data shows that a premium between 26 bps and 57 bps is appropriate for the credit risk. The current YTM is actually 5.5%, which is about a 120 bps premium on the 2-year treasury rate, which is the closest risk-free comp. In other words, the bonds in this portfolio seem a fair bit undervalued. The premium is more consistent with a BB bond, which is where you get below investment grade – so the difference between junk and non-junk.

That bodes well for this ETF. Why would this be the case? Perhaps the duration risk we mentioned earlier. It's possible that the way corporate bond investors are valuing this portfolio is different from the way investors in Treasuries are valuing things as implied by a flat yield curve. The flat yield curve essentially still predicts that 4% is the rate to be expected over the next few years, and that much higher interim rates, even for six months or a year, should not be expected. The recent jobs report indicates that inflation, the report for which will be released today, will likely run hot and incur another rate hike. There are long term cost-push factors related to structurally lessened economic cooperation that may keep rates at higher levels. To some extent, investors have already priced this in with the yield curve having been shifted upwards.

Long story short, duration risks to this portfolio and an almost certain expectation that rates are going to rise some more this year and perhaps for a long portion of the duration of the underlying bonds may be the reason for the apparent discount.

No products found.

The thing is, and we discuss this in this other article in more detail, if inflation is really supply side then won't declines in the pressures from some supply side factors perhaps lead to abating inflation even where jobs are hot? It's a hard call, but with rates having advanced a few points now, calling the top is becoming a more reasonable thing to preoccupy yourself with.

It's a hard call, so what we think is that investors can definitely expect one or maybe two more rate hikes before the situation becomes very ambiguous. Until then, we'd stay on the sidelines, but we're keeping an eye out.