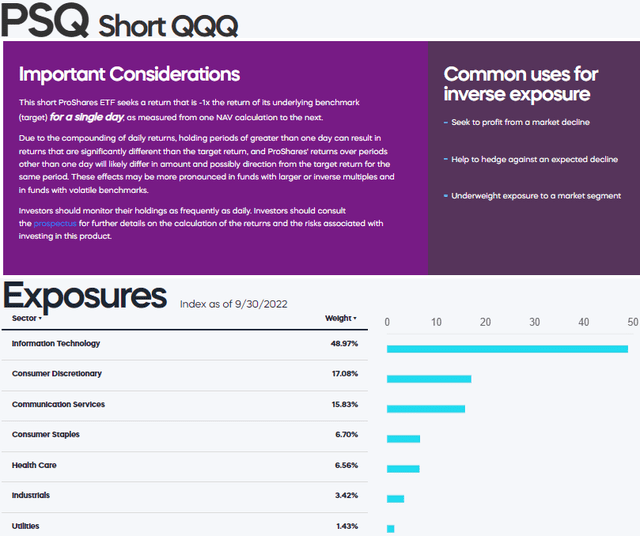

It is improbable that you have come across this strategy, but these are unprecedented times, when even treasuries, which are normally considered safe, need protection (hedging). After considering various options, I opted for Invesco's PSQ, which is an ETF used for shorting the tech stocks forming part of the Nasdaq. To illustrate this hedging strategy, I use an example portfolio consisting of a combined investment in the ETFs EDV and PSQ.

My Hedging Strategy Using ETFs EDV And PSQ

Since the last time I wrote about Vanguard Extended Duration Treasury ETF (NYSEARCA:EDV) in May this year, it has lost 17.7% of its value, sharply contradicting my bullish thesis.

I was wrong in my assumption that recession risks would outweigh higher inflation concerns, and that this would prompt the Federal Reserve to opt for a pause in the pace at which it was hiking interest rates. On the contrary, the Fed Chairman showed strong resolve to bring down inflation during his August speech. He has aggressively hiked rates since, even at the cost of an economic slowdown.

Now, far from selling my position in EDV, or averaging down, I added some ProShares Short QQQ ETF (NYSEARCA:PSQ) shares to my portfolio. This is a hedge in order to navigate a highly uncertain economic cycle where, on the one hand, monetary conditions are getting tighter, while, on the other, there is a higher probability of a recession looming ahead. At the same time, one has to bear in mind that even treasuries are not immune to a liquidity crunch.

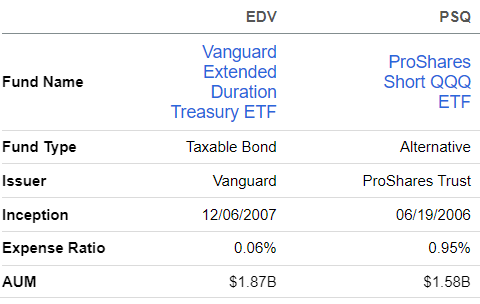

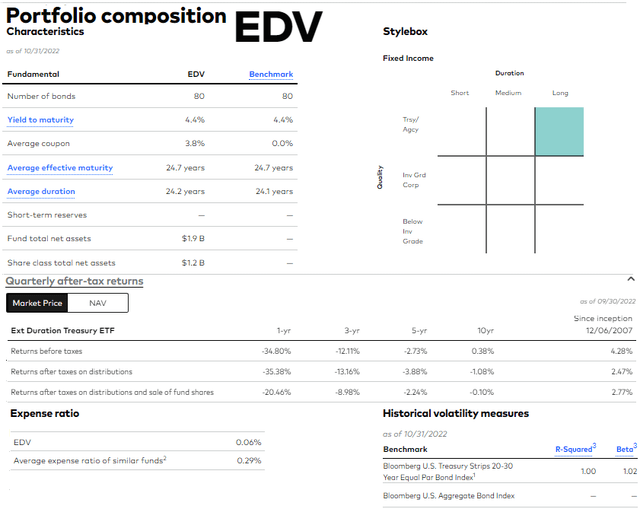

Thus, my objective with this thesis is to provide insights into a hedging strategy making use of a combination of EDV and PSQ shares. The main details of these two exchange-traded funds (“ETFs”) are pictured below.

I start by depicting the current economic environment.

An Unprecedented Economic Environment

The Fed raised its key rates by 75 basis points for the fourth time in a row in November, lifted the benchmark federal funds rate to 3.75%-4%, and hinted at the possibility of smaller hikes. Putting things into perspective, this was its highest level since early 2008, which brings back bad memories of the Great Financial Crisis.

However, this time around, things are different, with the economy continuing to be strong, as indicated by job numbers. Thus, in a way, the Fed literally had its hands forced to hike rates, and also, today, in contrast to 2008, banks are well-capitalized with minimal default risk. Furthermore, the JOLTS (Job Openings and Labor Turnover Summary) for September showed persistent and even surprising strength in the job market, due to the post-Covid pickup in the services economy in addition to resiliency in the healthcare, transportation, warehousing, and utility sectors.

Furthermore, U.S consumers continue to spend, now out of savings made during the Covid lockdowns. Also, commodity prices continue to remain high, as Russian gas supplies are absent from the European energy equation. On the other hand, container shipping costs have dropped by 73% since their January peak, leading to the price of certain imported goods falling, while there have been some highly publicized job cuts by companies like Meta Platforms (META), Twitter, and even Amazon (AMZN). These are two factors that can potentially cause a dovish reaction from the Fed.

However, to be realistic, tech encapsulates only a minor percentage of overall jobs, most of which are to be found in the services sector, namely in leisure and hospitality. It is this sector that created the bulk of the 247K jobs in October while wages grew by 11.2%.

Therefore, the indicators are mixed, but they mainly indicate that inflation will continue to rise, likely to be punctuated by episodic declines and, most likely resulting in the pursuit of a hawkish tone by the Federal Reserve. In this respect, the November 2 meeting implies that interest rates are likely to see an uptrend, albeit at a slower pace. Furthermore, with the Fed squeezing liquidity out of a monetary system that has been used to cheap liquidity conditions for the last decade, economic slowdown risks are now real and there may also be unforeseen events we have never come across.

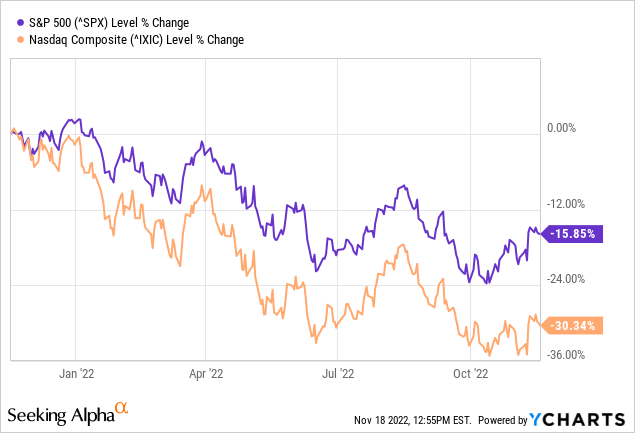

Along the same lines, rising interest rates are already adversely impacting high-growth stocks, many of which tend to be tech names. This is illustrated below with the tech-heavy Nasdaq composite more adversely impacted than the broader market S&P 500 which also includes more “value” names. Conversely, tech's higher valuations are also resulting in the rotation from growth to value which has been gaining steam since April.

This is precisely why I chose PSQ, which provides gains that correspond to the inverse (-1x) of the daily performance of the Nasdaq-100 Index.

Reason For Choosing PSQ And Illustrating The Hedging

Traditionally people used gold for hedging purposes but the strong dollar has been detrimental to precious metals, an asset class which contrary to what many were expecting has not performed well in current market conditions. Moving to bonds, many who traditionally adhered to a 60:40 equity to fixed income portfolio protection strategy have been disillusioned since the beginning of 2021. The reason is again higher interest rates make corporate debt less attractive as an asset class, but, after the Ukrainian conflict and recession fears, U.S. treasuries are viewed as the ultimate hedge since they are guaranteed by the U.S government.

However, they also have not been sparred by volatility, namely in March 2020 when many sectors of the economy including bond markets suffered from challenges pertaining to liquidity. Now, that scary episode when the Covid virus prevailed and everybody was running for cash seems so far away, but, if you take some time to think about it, isn’t the Fed not doing the same thing, by allowing U.S. treasuries and mortgage securities accumulated on its balance sheet to mature without replacing them? This process is called Quantitative Tightening and is exactly the opposite of Quantitative Easing which was in force since 2008.

In these conditions, unless you have sought the refuge of cash, it is important to think out of the box, with a strategy that allows you to continue benefiting from EDV's low fees of just 0.06%, dividend yield of 3.24% (as measured by the trailing 12 months) while getting some protection against volatility.

- New Store Stock

- Rivan, Maria (Author)

- English (Publication Language)

- 208 Pages - 04/14/2020 (Publication Date) -...

- The Editors of National Geographic (Author)

- English (Publication Language)

- 112 Pages - 04/02/2021 (Publication Date) -...

- National Geographic Special - 2017-1-20 SIP...

- English (Publication Language)

- 128 Pages - 01/20/2017 (Publication Date) -...

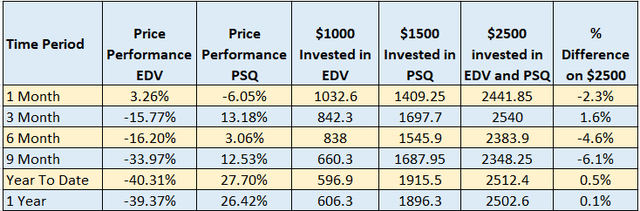

For this purpose, PSQ has worked at mitigating the volatility endured by EDV, at least on a historical basis as shown in the table below. For illustration purposes, this portfolio consists of a $2,500 investment split between EDV at $1,000 and PSQ at $1,500, for periods from one month to one year.

These results show that a combined investment of $2.5K in EDV and PSQ has resulted in gains varying from gains of 1.6% to losses of 4.6% over the different time periods. However, if you add the quarterly dividends of above 3% paid by EDV to these numbers, the losses are reduced. Moreover, investors can choose different proportions of the EDV/PSQ mix to fit their own individual needs, but as seen by the price performance columns above, these two ETFs are inversely correlated as I further explain below using charts.

Another important observation is that the losses (-2.3%) have either decreased or there have been gains (+1.6%) in the last one-month and three-month time periods, compared to higher losses of -4.6% for the last six months. This is no coincidence as tech has been suffering the most, as more and more investors have been rotating from growth to the value strategy.

Some Precautions When Using PSQ

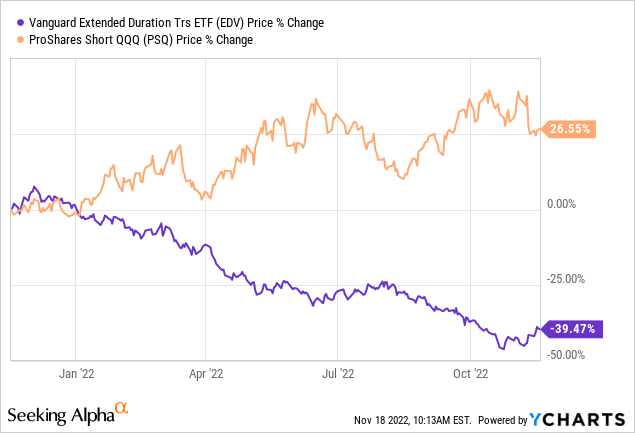

Looking forward, with the Fed likely to continue increasing rates even at a more moderated pace, PSQ is likely to deliver more gains as illustrated by its historical performance in the orange chart below. Here, this ETF's inverse correlation with EDV is telling and forms the basis for hedging where when one asset class goes down, the other goes up.

However, do note that with leveraged shorting ETFs like PSQ comes risks related to the compounding effect whereby while it thrives with downsides in the Nasdaq, it is itself adversely impacted by volatility, like when there is a high degree of market fluctuations for the time period it is traded.

I deliberately used the word “traded” here as you do not invest in this active Invesco ETF which charges 0.95% as fees in the same way as a passive fund like EDV. The reason is compounding, which effectively trims down your gains and this is the reason why it should not be traded over long periods.

Hence, my time horizon is the end of 2022, or, in other words, I will hold on to PSQ till the end of this year before exiting. It also pays dividend yields of 1%, but, the payment history shows that distributions have not been consistent.

EDV Makes Sense, But Hedged

- Amazon Kindle Edition

- Baldacci, David (Author)

- English (Publication Language)

- 487 Pages - 04/16/2024 (Publication Date) - Grand...

- Amazon Kindle Edition

- Hannah, Kristin (Author)

- English (Publication Language)

- 472 Pages - 02/06/2024 (Publication Date) - St....

- Amazon Kindle Edition

- Elston, Ashley (Author)

- English (Publication Language)

- 348 Pages - 01/02/2024 (Publication Date) - Pamela...

Coming back to the objective, this thesis has been to elaborate on a hedging mechanism for long-term government bonds in light of the Federal Reserve tightening liquidity and should continue doing so in 2023 as inflationary pressures persist. The option chosen by the U.S central bank to raise interest rates signifies more pain for longer-duration treasuries, which carry more risks than shorter-duration ones because of the time factor. For this matter, EDV held 80 bonds as of October 30 with the average effective maturity being 24.7 years as shown below.

By comparison, the average effective maturity is Original Postroducts/vgsh/vanguard-short-term-treasury-etf#portfolio">1.9 years for the Vanguard Short-Term Treasury ETF (VGSH), but it yields only 1.16% or about a third of EDV. Thus, for the additional risks premium of owning EDV, the bond investor obtains a higher dividend yield, which is why I am interested in continuing to own long-duration bonds.

At the same time, taking advantage of the fact that tech has lost its shine, both because of its higher valuations and also because it is not immune to economic cyclicality risks, I protect seek protection through PSQ.

Conclusion

Last but not least, before embarking on such a hedging strategy, I backed the observed inverse correlation between EDV and PSQ with a price performance table using historical data. This said, no one knows exactly what the future may look like, especially in the current economic cycle but, as investors, it is our duty to try to identify the maximum number of risks in order to protect our hard-earned cash against volatility.