Federal Reserve hikes have led to higher interest rates on most bonds, and higher dividend yields on most bond funds, including those focused on TIPs. SCHP is a simple TIPs index ETF and offers investors a strong, inflation-protected 6.9% dividend yield. SCHP currently yields more than an I Bond, the widest spread in decades

I Bonds Vs. TIPs: Which High-Yield, Inflation-Protected Security Is Best For 2023? (TIP)

I Bonds have been one of the most popular investments of the year, and with good reason. I Bonds are issued by the U.S. government, the most credit-worthy institution in the world, and offer investors strong, inflation-protected yields with zero interest rate risk or fluctuations in invested capital. I Bond returns have averaged around 8.0% during the year, significantly outperforming most relevant asset classes, including equities, bonds, and treasury inflation-protected securities, or TIPs.

I Bonds had a fantastic 2022, mostly due to skyrocketing inflation, but historically low interest rates also played a part. There were very few bonds or asset classes offering competitive yields earlier in the year, but there are several now. Of these, TIPs stand out.

TIPs offer investors strong, inflation-protected yields of around 1.8% plus inflation, versus 0.4% plus inflation for I Bonds. TIPs offer comparable inflation protection relative to I Bonds at higher yields, a significant advantage. TIPs are also somewhat riskier, more volatile securities, with quite a bit of interest rate risk. Both asset classes are good investments, but TIPs are slightly better, due to their higher yields. The iShares TIPS Bond ETF (NYSEARCA:TIP) is a simple TIPs index ETF, offers investors a strong, inflation-protected 6.9% yield, and is a buy.

I'll be focusing on comparing these two asset classes next. I have a more in-depth article on TIPs here, and one on I Bonds Original Post>

TIP – Quick Overview

TIP is a simple index ETF investing in treasury inflation-protected securities, or TIPs.

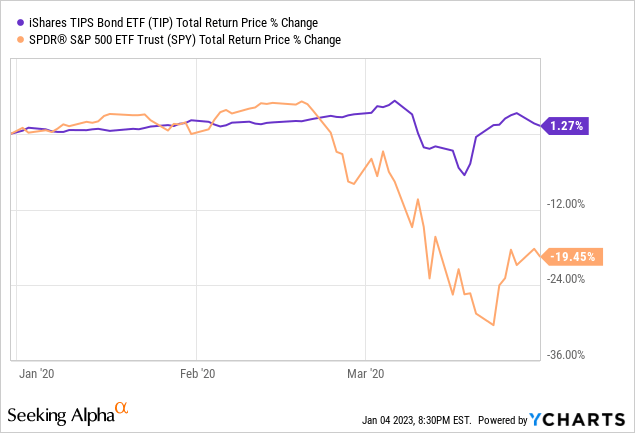

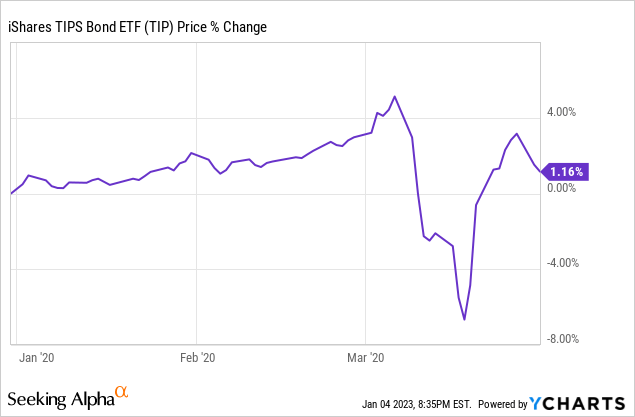

TIPs are issued by the U.S. Treasury and backed by the full faith and credit of the U.S. government. Default risk is effectively nil, barring an unprecedented U.S. government default. Expect approximately zero losses during downturns and recessions. As an example, TIP saw gains of around 1.3% during 1Q2020, the onset of the coronavirus pandemic.

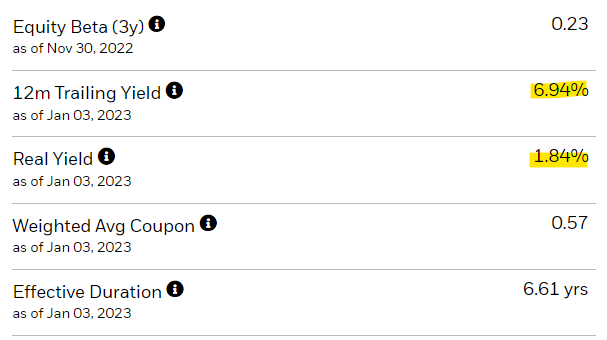

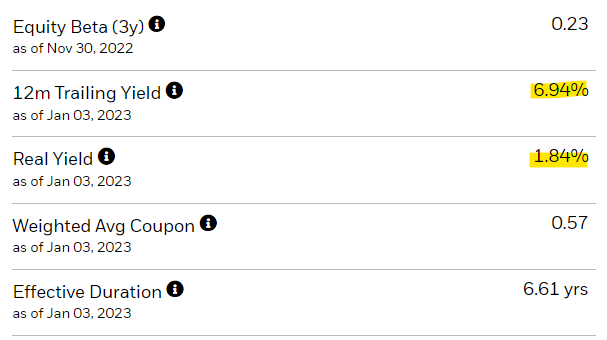

TIPs are inflation-protected securities, seeing higher interest rate payments when inflation is high, which translates into higher dividends for the fund. TIP currently sports a trailing twelve month yield of 6.94%. Future dividends should be roughly equal to 1.84% plus inflation, as per fund data.

TIPs are bonds, and so see lower market prices / capital losses when interest rates increase.

To summarize, TIP invests in treasury inflation-protected securities, with all that implies.

With the above in mind, let's have a look at how TIPs stack up relative to I Bonds.

TIP versus I Bonds – Similarities

Extremely Low Credit Risk

Both TIPs and I Bonds are issued by the U.S. Treasury, and backed by the full faith and credit of the U.S. government. Credit risk is effectively nil, barring an unprecedented U.S. government default. Expect zero long-term capital losses or default rates.

Expect approximately zero short-term capital losses / share price declines for both asset classes during adverse economic scenarios, including downturns and recessions. TIP could plausibly post gains during these scenarios, due to a flight to quality effect. As an example, the fund's share price increased by 1.2% during 1Q2020, the onset of the coronavirus pandemic, as fearful investors bought treasuries, boosting their price.

I Bonds have fixed capital, like a savings account or CD, so investor capital will never fluctuate.

Inflation Protection

Both TIPs and I Bonds are protected against inflation, and see strong returns when inflation is high and rising.

For TIP, returns take the form of higher cash dividends to shareholders.

For I Bonds, returns take the form of higher interest rates, which are retained by the government / bond until an investor closes their position.

Although the specifics vary, the end result is the same: strong returns when inflation is high and rising.

Protection from inflation is a self-evident positive, and one which is particularly important in the current inflationary environment.

Strong Yields

Both TIPs and I Bonds are currently offering investors very strong yields, as inflation is high.

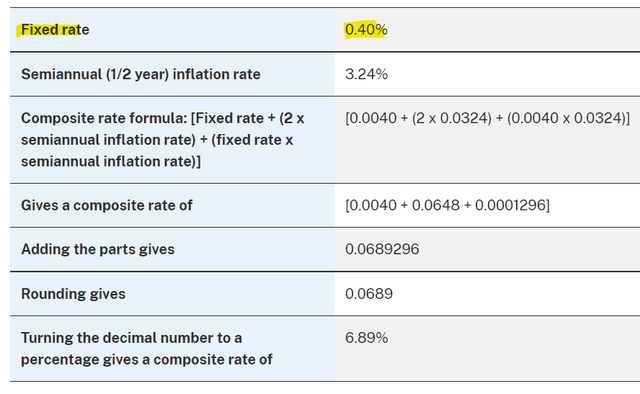

I Bonds currently yield 6.89%. I Bond yields are set semi-annually, based on prevailing inflation rates. Interest rate is paid semi-annually as well. Prevailing rates will reset in 2023, so investors have through April 2023 to lock-in a 6.89% yield for six months.

TIP currently yields 6.94%. TIP's monthly dividend payment will fluctuate every month, due to fluctuations in the fund's underlying generation of income, inflation rates, interest rate movements, and due to normal ETF dividend fluctuations. TIP's dividend yield will also fluctuate due to the changes in the fund's share price.

In general terms, TIPs and I Bonds are very similar asset classes, with similar characteristics and behaviours: both offer strong, inflation-protected yields with very low credit risk. There are, however, some small differences between them. Let's have a look at these, starting with the differences that benefit TIP.

TIP – Benefits and Advantages

Higher Dividend Yield

TIP currently yields slightly more than I Bonds, with a 6.94% yield versus 6.89%. Although the difference is small, it is material to investors, in my opinion at least. Importantly, the difference is likely to widen moving forward, due to the way these rates are set.

I Bonds currently yield 0.40% plus inflation. That currently adds up to 6.89%, due to prevailing inflation rates. A more in-depth explanation of how said rate is calculated follows.

TIP currently yields 1.84% plus inflation. That added up to 6.94% these past twelve months, due to past inflation and interest rates. Bear in mind, past returns were a bit weaker than expected, as interest rates were much lower in the past.

TIP yields 1.84% plus inflation, I Bonds yield 0.40% plus inflation, so TIP yields 1.44% more than I Bonds. Dividend yield metrics show a narrower gap, as TIP's dividend yield is for the past twelve months, and fund yields were lower in the past.

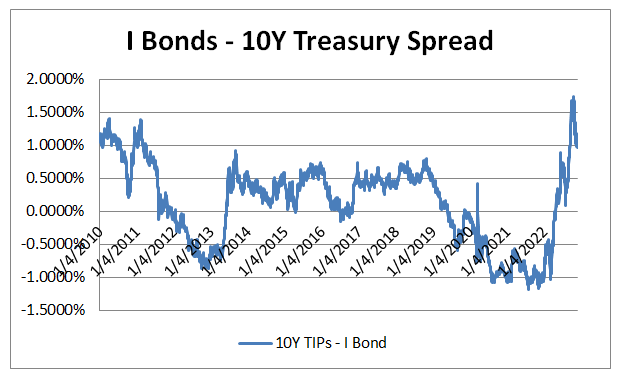

TIP should yield 1.44% more than I Bonds moving forward, a very respectable difference, and an important advantage for the fund and its shareholders. Importantly, spreads have significantly widened these past few months, and are at their widest levels in decades. TIPs very rarely yield 1.0% more than I Bonds, and when they do, spreads almost always close in months.

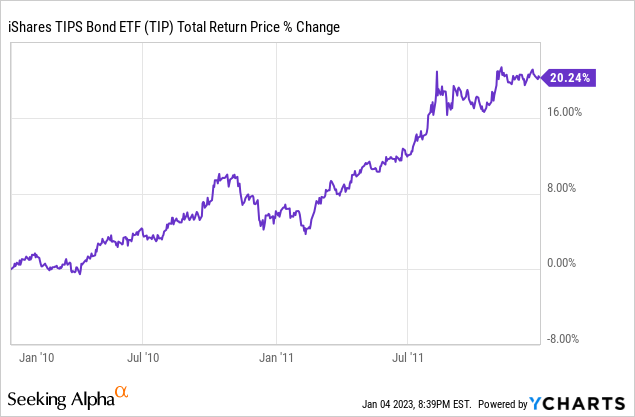

As a final point, last time TIPs yielded +1.0% more than I Bonds was in 2010-2011, during which TIP delivered double-digit annual returns as spreads narrowed / bond prices rose.

Conditions have materially changed since, so TIP might not necessarily perform as well this time around, but the historical track-record is encouraging.

Liquidity

TIP is an ETF, with the liquidity that entails. Investors can buy and sell into the fund in a manner of minutes and should receive any cash proceeds in their bank account in, at most, a few days.

- Amazon Prime Video (Video on Demand)

- Jim Parsons, Rihanna, Steve Martin (Actors)

- Tim Johnson (Director) - Tom J. Astle (Writer) -...

- English (Playback Language)

- English (Subtitle)

- ✨【Night Lights Plug into Wall】: 0.5 watts,...

- 💕【Dusk to Dawn Sensor Night Light】:...

- 🐋【Personalized Night Light】:Takes the space...

- 🌃【Widely Used】: This plug in night light...

- 💡【Satisfied Service】If you’re ready to...

Last update on 2024-04-05 / Affiliate links / Images from Amazon Product Advertising API

I Bonds, on the other hand, have a minimum holding period of one year. Investors also forfeit three months of interest if they sell before five years have passed. I Bonds are an incredibly illiquid investment, only appropriate for medium and long-term investors.

TIP's greater liquidity is a significant benefit for the fund and its shareholders, and one which is particularly important for short-term investors and traders. Liquidity seems particularly important right now, as inflation is normalizing. If inflation were to crash, TIP's investors could quickly sell their position, and pivot towards other asset classes. I Bond investors would be stuck with their bonds for at least one year.

Potential Capital Gains

TIP invests in treasuries, which are investment securities with market prices. Prices can move for a myriad of reasons, including changes in inflation, interest rates, market sentiment, and the like. Bond prices are quite low right now, as interest rates have skyrocketed all year. As interest rates stabilize bond prices should increase, leading to higher share prices for TIP, and capital gains for its shareholders.

I Bonds have fixed capital, so there are no potential capital gains, unlike for TIP.

TIP's potential capital gains are something of a benefit for its investors, but said gains are far from certain, and might not materialize.

To summarize, relative to I Bonds, TIP yields more, has higher potential capital gains, and is more liquid, all important benefits and advantages. TIP does have its fair share of negatives and disadvantages as well. Let's have a look at these.

TIP – Negatives and Disadvantages

Interest Rate Risk

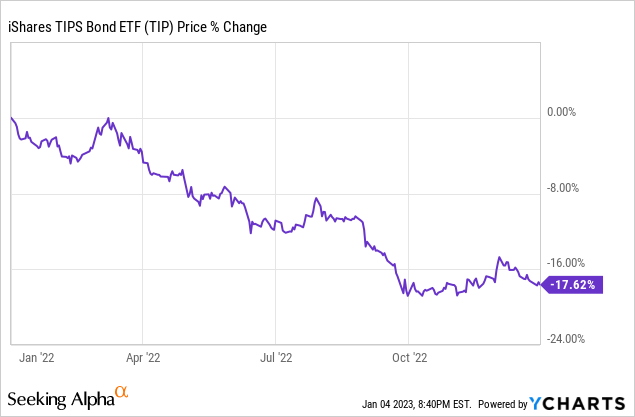

TIP prices can increase, leading to capital gains for shareholders, but they can also decrease, leading to capital losses for the same. TIP prices could plausibly decrease for a myriad of reasons, but higher interest rates are key. Investor demand for TIP's 6.9% dividend yield is quite high right now, but would almost certainly weaken if rates were to significantly increase. If investor demand weakens, prices should follow suit, leading to capital losses for TIP and its investors.

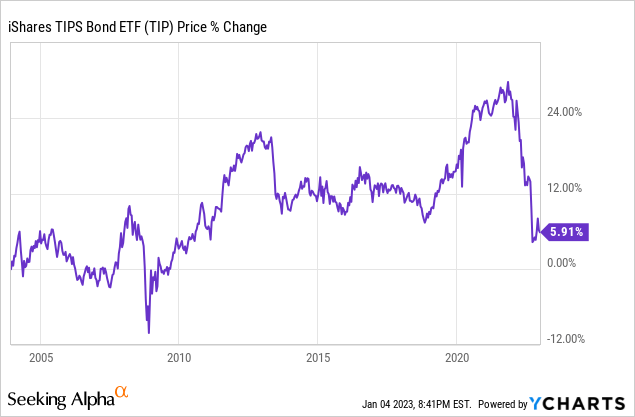

Interest rates rose during 2022, and TIP saw significant capital losses, as expected.

I Bonds have fixed capital, so investors will not experience any capital losses if interest rates were to increase.

TIP's interest rate risk is a significant negative for the fund and its shareholders, and a key disadvantage relative to I Bonds.

Volatile Share Price

TIP's share price is quite volatile, fluctuating from $100 to $130 a share since inception. Single-digit movements are common, double-digit movements are uncommon, but do sometimes occur. Stability is rare, and generally short-lived.

I Bonds have fixed capital, so investor capital does not fluctuate.

TIP's volatile share price is a negative for the fund and its shareholders, and an important disadvantage relative to I Bonds.

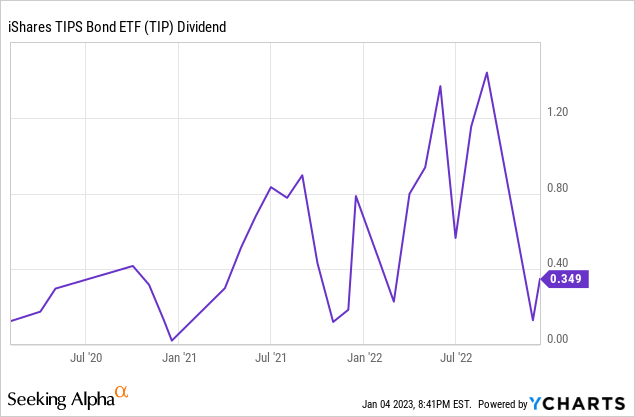

Dividend Volatility

TIP's dividends are incredibly volatile, with significant fluctuations every month.

Dividend volatility is due to inflation and interest rate volatility, as well as normal ETF dividend volatility.

I Bond interest rates also fluctuate, but by quite a bit less than TIP. At the same time, I Bond interest rates only reset every six months, so investors can lock-in a 6.9% yield for six months. There is no such lock-in for TIP.

- AIRTIGHT LIDS & 3 GRATER ATTACHMENTS The airtight...

- NON-SLIP SILICONE BOTTOMS The rubber on the bottom...

- NESTING BOWLS & DISHWASHER SAFE These kitchen...

- 6 SIZES BOWLS & EXTRA KITCHEN TOOLS SET The range...

- DURABLE STAINLESS STEEL The stainless steel...

- ✅FOOD GRADE SILICONE -- Made of food-grade...

- ✅NO BEND & NO BREAK & HEALTHY FOR COOKWARE --...

- ✅HIGH TEMPERATURE WITHSTAND:The Silicone Cooking...

- ✅33 DURABLE WOODEN HANDEL KITCHEN UTENSILS SET -...

- ✅BEST KITCHEN TOOLS :One- piece stainless steel...

Last update on 2024-04-11 / Affiliate links / Images from Amazon Product Advertising API

TIP's volatile dividends are an important negative for the fund and its shareholders, and a disadvantage relative to I Bonds.

In my opinion, TIP's higher yield and potential capital gains more than outweight the fund's higher level of risk and volatility, but others might disagree. I Bonds do seem like a more stable, less risky choice, so might make more sense for more conservative investors and retirees.

Conclusion

I Bonds and TIPs are similar securities, both of which offer investors strong, inflation-protected yields with very low credit risk.

I Bonds seem like the more stable, less risky choice.

TIPs seem riskier, but with higher potential yields and returns.

In my opinion, TIPs are the stronger investment opportunity on net, but both remain broadly similar choices, and buys.