EYLD invests in emerging market equities with strong shareholder yields. Income is strong, valuations low, and performance reasonably good. Fundamentals are improving too, and rapidly.

EYLD: 6% Dividend Yield, Improved Fundamentals, Cheap Valuation – Buy

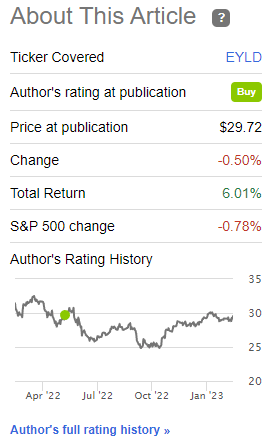

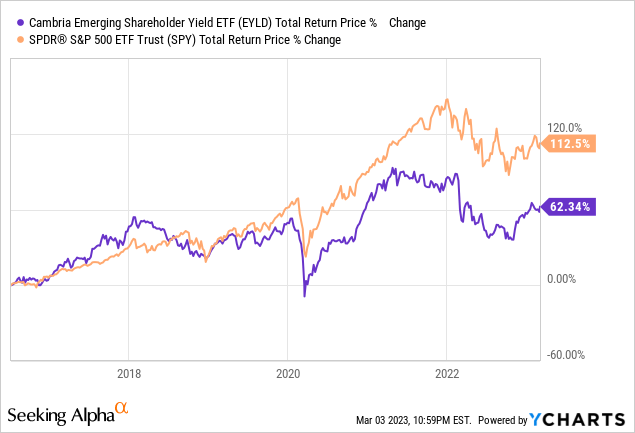

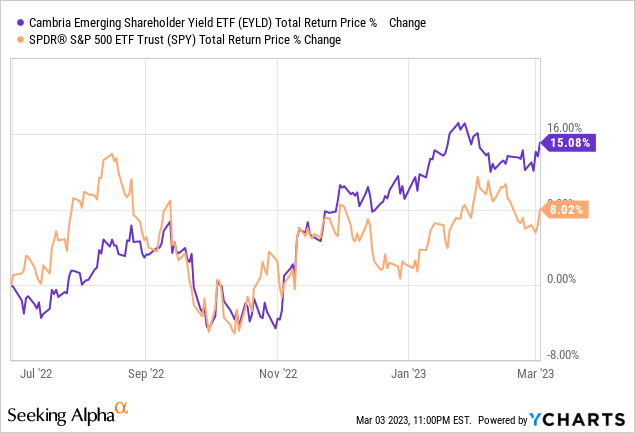

I last covered the Cambria Emerging Shareholder Yield ETF (BATS:EYLD), which invests in emerging market equities with strong shareholder yields, in mid-2022. In that article, I argued that EYLD's strong dividend yield and cheap made the fund a buy. The fund has outperformed since, in-line with expectations.

Since my previous article, EYLD's income and performance track-record have both increased, while its valuation has somewhat decreased. Fund fundamentals remain roughly the same, but slightly stronger.

EYLD's strong 6.8% dividend yield, cheap valuation, and improved fundamentals, make the fund a buy.

EYLD – Quick Overview and Investment Thesis

A quick overview of the fund before a more in-depth look at how it has performed these past few months, and at its improved fundamentals.

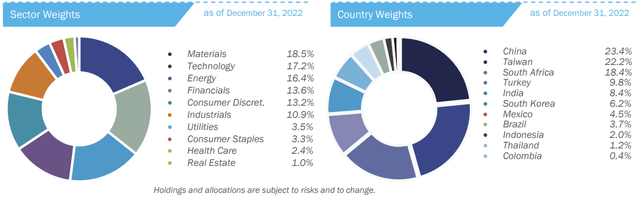

EYLD is an emerging market equity ETF. It is actively-managed, but follows a well-defined investment process, so functions as more of a niche, targeted index fund in practice.

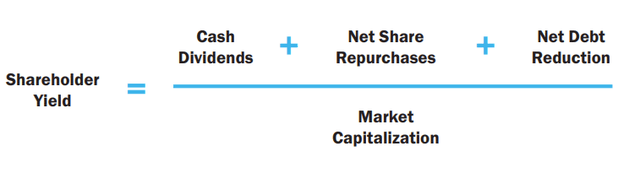

In simple terms, EYDL invests in emerging market equities with strong shareholder yields. Stocks must meet liquidity, valuation, and quality criteria. Expensive stocks are excluded from the index, as are heavily indebted ones. It is an equal-weighted index, with 100 holdings.

Shareholder yield is defined as follows.

EYLD's actual, in-depth investment methodology is as follows.

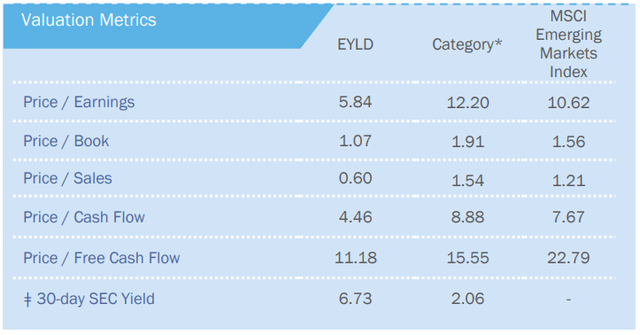

EYLD does not seem to estimate or report an average shareholder yield for its portfolio, an important oversight in my opinion. The fund does report several valuation and cash-flow metrics, and does extremely well in this regard. Pretty confident that the fund's shareholder yield is quite strong too.

EYLD is quite diversified within its market niche, with investments in around a dozen countries and 100 equities, and with exposure to most relevant industry segments. As EYLD targets a small, niche market segment, it remains a risky investment, diversification notwithstanding. Small position sizes are ideal, in my opinion at least.

EYLD's investment thesis is quite simple. The fund offers investors a strong 6.8% dividend yield and a cheap valuation, so income, capital gains, and total returns are, potentially, all quite strong. Focusing on companies with strong shareholder yields helps too, as these companies are returning a lot of cash to investors, which underpins returns and reduces risk (not a lot can go wrong with receiving a dividend or paying back debt).

EYLD's fundamentals have always been more or less the same, as the fund's investment strategy all but ensures strong yields and cheap valuations. Nevertheless, these do vary, and have improved as of late. Let's have a look.

EYLD – Improved Fundamentals

Cheaper Valuations

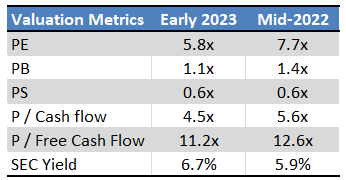

EYLD generally trades with a low price and valuation, but the exact figures do vary, and sometimes for the better. The fund's valuation has decreased these past few months, across most relevant metrics.

EYLD's cheaper valuation benefits investors in two key ways.

First, cheaper valuations means potential capital gains are stronger, a significant benefit for shareholders.

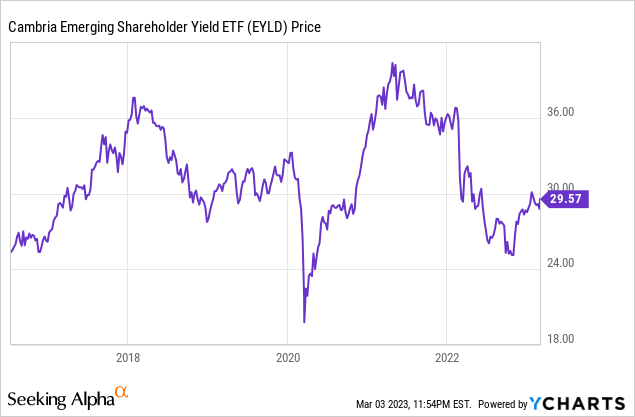

On a more negative note, gains are somewhat contingent on valuations normalizing, which is not guaranteed, and which has mostly not happened in the past. EYLD's share price is up from its mid-2022 lows, but the fund has still not fully recovered from the pandemic.

On a more positive note, focusing on companies with strong shareholder yields helps matters. Dividends, share buybacks, and debt reduction all benefit investors even if valuations remain cheap, and the fund's underlying holdings engage quite strongly in these actions / initiatives.

Second, valuations growing cheaper implies strong growth in the fund's underlying holdings, at least assuming low portfolio turnover. Although I was unable to find precise turnover figures, fund holdings have not significantly changed these past few months, so strong underlying holding growth seems likely.

EYLD's improved valuation benefits the fund and its investors, and makes the fund a stronger investment opportunity now than in the past.

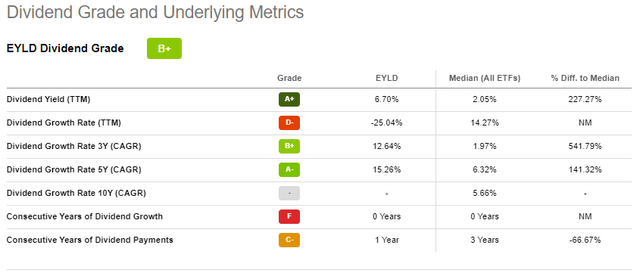

Stronger Income, But Volatile

EYLD's underlying holdings generated 5.9% in income per year in mid-2022, as per the fund's SEC yield. Income has increased to 6.8% as of December 2022, a double-digit increase. EYLD currently sports a TTM dividend yield of 6.8%, not too dissimilar from its SEC yield. It is unclear to me how much of said increase was due to dividend growth in the fund's underlying holdings, and how much of it was due to a (possible) decline in the fund's share price, due to peculiarities in how SEC yields are calculated.

| Preview | Product | Price | |

|---|---|---|---|

|

Galway Bay Long Sleeve Golf Rain Jacket - Three Layer Long Sleeve Golf Jackets for Men, Lightweight... |

$200.00 |

Buy on Amazon |

In any case, EYLD's higher income is an important benefit for the fund and its shareholders. Income benefits investors directly: higher income means more dividends to spend or re-invest.

Income also benefits investors indirectly, insofar as it makes total returns less dependent on market whims or investor sentiment. CAPEX or buybacks should lead to capital gains, but markets are not perfectly rational, and there is no guarantee that this will be the case. Investors receive dividends regardless of what the market thinks or does, and can help underpin returns during bear markets and other adverse market scenarios.

The distinction above matters, both in theory and practice. EYLD has seen no capital gains these past few months, even as its earnings increase and its valuation plummets. EYLD's investors have received their dividends, and these led to outperformance even as share prices remain low, and capital gains non-existent.

EYLD's share price could remain flat moving forward, no guarantees there, but the dividends boost returns regardless.

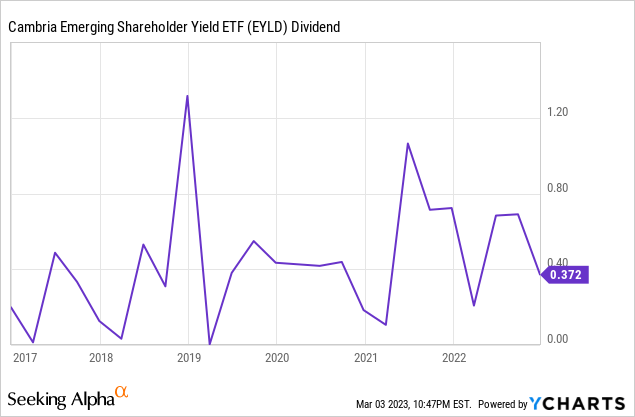

On a more negative note, emerging market equities sometimes have irregular dividend payment schedules, which results in volatile dividend payments for EYLD.

Volatile dividends are something of a negative, especially for retirees who might depend on dividends for their expenses and retirement.

Dividend volatility also makes it difficult to analyze and forecast the fund's expected dividends. As an example, the fund paid an uncharacteristically high dividend in 3Q2021. Said dividend boosted the fund's yield to 9.3% in mid-2021. Said yield was technically accurate, but much higher than the actual income generated by the fund, 5.9% as per its SEC yield. Said yield was also not particularly indicative of the dividends investors should have expected, with the fund yielding 6.8% right now. As an aside, I should have noticed these issues in my last article, but I did not. The yield was accurate, and it seemed fine to me, but the volatility was readily apparent regardless.

Although EYLD's lower TTM dividend yield could be construed as a negative, as the reduction was almost entirely due to dividend volatility, I don't really see it that way. EYLD is producing more in income now than before, so fundamentals have improved, even if the figures don't necessarily reflect that. EYLD's dividends are lower than I thought, but that is not a negative per se. The volatility itself remains a negative, and does complicate matters for investors.

On a more positive note, EYLD's dividends have seen very healthy, double-digit growth since inception. Dividend volatility does mean these figures are, well, volatile, so take them with a grain of salt.

EYLD's strong 6.8% dividend yield and growing income are important benefits for the fund and its shareholders.

Stronger Performance

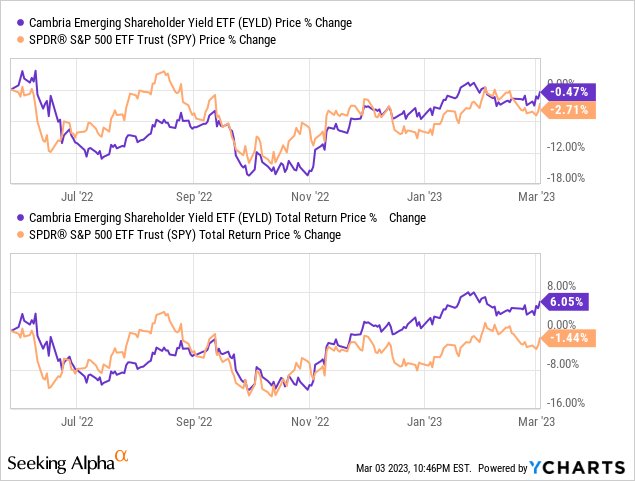

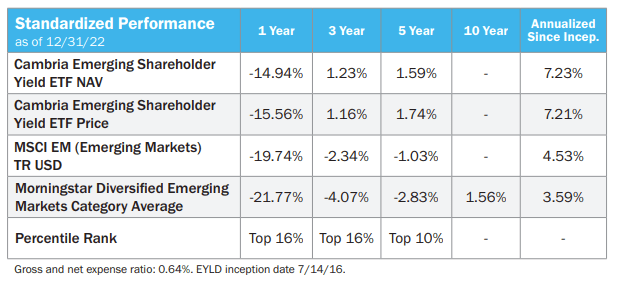

EYLD's performance track-record is reasonably good, with the fund outperforming relative to its index since inception, and for all relevant time periods.

- 🌴 Material: Chiffon, 100%Polyester ; Lightweight, soft and comfoy material

- 🌴 Features: Long sleeve chiffon lace mini dress for women spring, summer and fall, crew neck, long lantern sleeve, zipper closure, elastic waist, a-line and slim fit style, elegant ruffle design, this cute fall mini dress will make you more beautiful and lovely!

- 🌴 Occasions: Fall casual short dress suitable for you to party, holiday, school, date, cocktail, coming home, and daily life. Believe you will love it and get lots of compliment!

- 🌴 Garment care: Hand wash in cold water recommend, hang dry, low temperature ironing if necessary

- 🌴 Size Note: 0-2, 4-6, 8-10, please refer to our sizing information in the picture description to choose your size. Thanks for your understanding

On a more negative note, EYLD has significantly underperformed relative to the S&P 500 since inception. Underperformance was entirely due to subpar emerging market equity performance.

On a more positive note, EYLD's has improved as of late, with the fund outperforming relative to the S&P 500 since around mid-2022. Performance is very volatile, somewhat inconsistent, but the outperformance is definitely there. Outperformance was due to stronger emerging market equity performance, and EYLD's higher yield.

EYLD's improved performance track-record was a direct benefit for investors in the past and is (partial) evidence of the fund's strong fundamentals and investment thesis. EYLD looked like a strong investment in mid-2022, and the fund has outperformed since. EYLD looks like a strong investment opportunity today, and could outperform moving forward too. Although this is technically always the case, having proof is important, and can boost an investor's confidence, including my own.

Conclusion

EYLD's strong 6.8% dividend yield, cheap valuation, and improved fundamentals, make the fund a buy.