This is the second most overvalued sector, and no industry looks really attractive. The most overpriced one is personal care products. Fast facts on iShares Global Consumer Staples ETF, an international alternative to XLP.

iShares Global Consumer Staples ETF: Consumer Staples Dashboard For March (NYSEARCA:KXI)

Current Data

The next table shows the metrics and scores as of last week's closing. Columns stand for all the data named and defined above.

| VS | QS | EY | SY | FY | ROE | GM | EYh | SYh | FYh | ROEh | GMh | RetM | RetY | |

| Staple/Food Retail | -19.88 | -12.79 | 0.0313 | 1.9723 | 0.0188 | 14.60 | 19.12 | 0.0418 | 1.9066 | 0.0303 | 16.60 | 22.12 | -4.22% | -4.97% |

| Food | -11.23 | 4.49 | 0.0505 | 0.6636 | 0.0133 | 18.56 | 29.38 | 0.0456 | 0.6642 | 0.0239 | 15.40 | 33.22 | -1.19% | 11.99% |

| Beverage | -5.97 | -22.50 | 0.0293 | 0.2869 | 0.0161 | 16.57 | 45.51 | 0.0361 | 0.2673 | 0.0172 | 24.09 | 52.78 | -2.44% | 7.29% |

| Household prod. | -12.72 | -23.31 | 0.0513 | 1.1900 | 0.0052 | 10.45 | 37.95 | 0.0456 | 0.8789 | 0.0373 | 17.26 | 40.88 | -9.46% | -34.75% |

| Personal care | -36.38 | 0.67 | 0.0290 | 0.3408 | 0.0075 | 18.53 | 62.88 | 0.0378 | 0.4480 | 0.0197 | 20.98 | 55.64 | -1.47% | 0.30% |

| Tobacco | 31.21 | -39.38 | 0.0684 | 0.7755 | 0.0174 | 8.38 | 50.80 | 0.0588 | 0.4741 | 0.0153 | 34.54 | 52.39 | -7.26% | 0.35% |

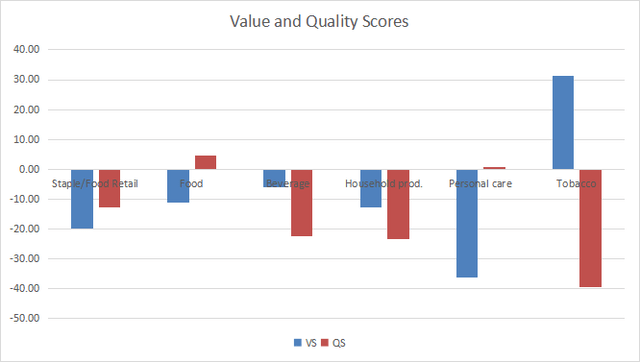

Value And Quality Chart

The next chart plots the Value and Quality Scores by industry (higher is better).

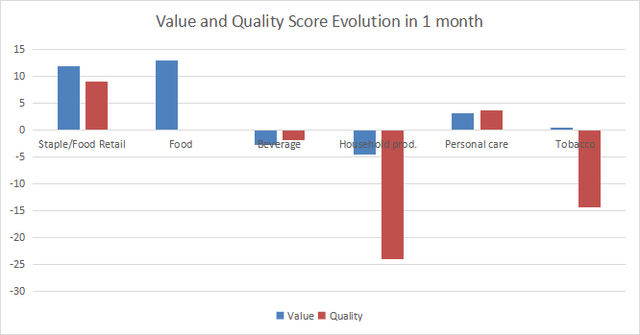

Evolution Since Last Month

Valuation has improved in food and retail. Quality has deteriorated in household products and tobacco.

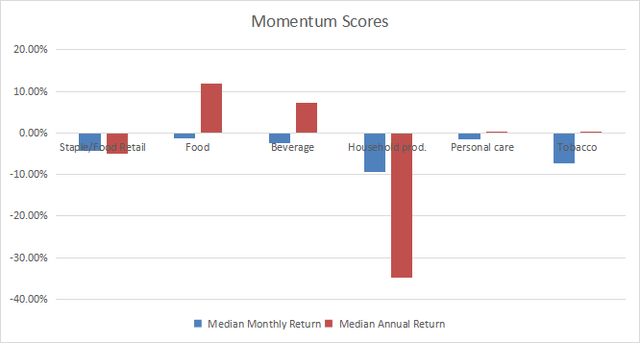

Momentum

The next chart plots momentum data.

Interpretation

According to my S&P 500 monthly dashboard, consumer staples are the second most overvalued sector after industrials. The tobacco industry is undervalued by about 30% relative to 11-year averages. However, this is offset by the worst quality score in the sector. A note of caution about sample size: there are only five tobacco companies in my reference universe, so statistics in this industry aren't the most reliable. Other subsectors are overvalued by 6% to 36%, and quality metrics don't justify it. Personal care is the most overvalued one.

Fast Facts on KXI

The iShares Global Consumer Staples ETF was launched on 09/12/2006 and tracks the S&P Global 1200 Consumer Staples Capped Index. It has 95 holdings and a 12-month distribution yield of 2.07%. The total expense ratio of 0.40% is more expensive than for U.S. index ETFs like XLP, whose fee is 0.10%. About 55% of asset value is invested in U.S. companies and 33% in Europe. Large and mega-cap companies represent 90% of asset value.

The next table lists the top 10 holdings with fundamental ratios. The portfolio is quite concentrated: their aggregate weight is 49.4%.

| Ticker | Name | Weight% | EPS growth %TTM | P/E TTM | P/E fwd | Yield% | Exchange |

| PG | Procter & Gamble Co. | 8.67 | 0.63 | 25.10 | 24.51 | 2.56 | NYSE |

| OTCPK:NSRGY* | Nestlé SA | 8.31 | -46.04 | 32.87 | 21.85 | 2.70 | Switz. |

| PEP | PepsiCo, Inc. | 5.34 | 16.90 | 27.52 | 24.37 | 2.61 | NASDAQ |

| COST | Costco Wholesale Corp. | 4.61 | 9.73 | 35.80 | 33.65 | 0.74 | NASDAQ |

| KO | The Coca-Cola Co. | 4.33 | -2.59 | 27.50 | 23.22 | 3.05 | NYSE |

| WMT | Walmart, Inc. | 4.23 | -12.32 | 32.34 | 22.58 | 1.65 | NYSE |

| PM | Philip Morris International, Inc. | 4.06 | -0.20 | 16.41 | 15.14 | 5.33 | NYSE |

| UL* | Unilever PLC | 3.57 | 12.32 | 16.08 | 17.98 | 3.56 | London |

| OTCPK:LRLCY* | L'Oréal SA | 2.82 | 15.32 | 36.22 | 32.23 | 1.57 | Paris |

| DEO* | Diageo PLC | 2.74 | 6.66 | 22.87 | 21.18 | 2.08 | London |

- A masculine fragrance with a fusion of sandalwood,...

- FRESHEN YOUR LIFE: Fiber Can is LITTLE TREES...

- MORE THAN JUST A CAR AIR FRESHENER: Freshen up at...

- LONG-LASTING FRAGRANCE EXPERIENCE: Specialized...

- SLIDE LEVER TO ADJUST STRENGTH: Slide the lever on...

- UV SHIELDING - Provide your baby with protection...

- SIMPLE UNIVERSAL INSTALLATION - Experience...

- THIS SET INCLUDES- 2 transparent car window...

- DURABLE MESH MATERIAL & STURDY WIRE- Rely on...

- GIVE THE BEST BABY GIFT- Need a baby shower gift...

- SAFETY ESSENTIAL CAR ACCESSORIES: If your car is...

- PRACTICAL AND PERFECT CHRISTMAS GIFT: A surprise...

- SAFE AND DURABLE TOOL KIT: This bag is made of...

- EVERYTHING YOU NEED FOR CAR SAFETY IN ONE BAG:...

- SUITABLE FOR MOST EMERGENCIES: This roadside...

- ✔ADJUSTABLE STRAP & COLLAPSIBLE SHAPE – The...

- ✔MAGNETIC SNAPS: There are 4 metallic magnetic...

- ✔HARD-WEARING LEAKPROOF INNER LINING – This...

- ✔MULTIPURPOSE – This car garbage bin can be...

- ✔GREAT COMPATIBILITY – An effective solution...

Ratios: Portfolio123.

* I refer to the US tickers to link to Seeking Alpha ticker page, but the fund holds shares in primary exchanges.

Since inception, KXI has underperformed the U.S. consumer staples benchmark XLP by 1.8 percentage point, and shows a higher risk measured in maximum drawdown.

| Total Return | Annual Return | Max Drawdown | Sharpe | |

| KXI | 237.44% | 7.65% | -42.27% | 0.57 |

| XLP | 337.66% | 9.37% | -32.39% | 0.71 |

In summary, KXI is an ETF for investors seeking international exposure in consumer defensive stocks. It is not currency-hedged, which may be a bad point or a good one depending on one's expectation about the dollar. The portfolio is quite heavy in the top two holdings: PG and Nestle represent 17% of asset value together. These are time-tested companies, but investors who want a more diversified portfolio may prefer the Invesco S&P 500 Equal Weight Consumer Staples ETF (Original Post>

Dashboard List

I use the first table to calculate value and quality scores. It may also be used in a stock-picking process to check how companies stand among their peers. For example, the EY column tells us that a food company with an earnings yield above 0.0505 (or price/earnings below 19.80) is in the better half of the industry regarding this metric. A Dashboard List is sent every month to Quantitative Risk & Value subscribers with the most profitable companies standing in the better half among their peers regarding the three valuation metrics at the same time. The consumer staples stocks below are part of the list sent to subscribers at the beginning of this month.

It is a rotational model with a statistical bias toward excess returns on the long-term, not the result of an analysis of each stock.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.