I have followed the relationship between QQQ and DIA for some time, and I have found it to be one of the more insightful indicators I use. So, when I see that QQQ has outperformed DIA by nearly 19% over the past three months, I know something historic is taking place. This is very year 2000-like.We could be setting up for a continued period of significant return spread between these two major indexes. That should get investors' attention.

QQQ Outperforms DIA: Time To Be Cautious… And Flexible

I closely track hundreds of market indicators. One that I feel does not get as much attention as it deserves is the period performance gap between the Invesco QQQ Trust (NASDAQ:QQQ) and the SPDR Dow Jones Industrial ETF (NYSEARCA:DIA). As with other indicators I find valuable, it is what happens at the extremes that often have the greatest implications for investment strategy and security selection.

As investors, we are used to thinking of the bond market in terms of analyzing “spreads.” Whether it is the yield differential between one US Treasury maturity and another, or between different rating levels of corporate bonds, the fixed income market is a spread-driven market. As I will show below, some key parts of the stock market, including the relative performance of QQQ and DIA, also are a market where the spread between two securities can tell us a lot about where future returns are likely to come from.

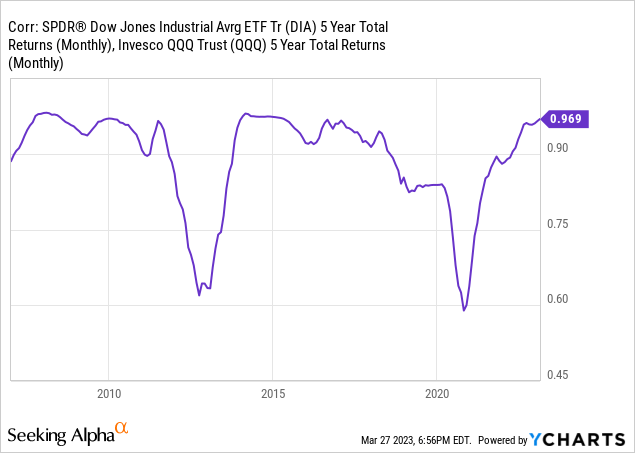

Over longer periods – the Dow and Nasdaq are highly correlated most of the time. Below shows that even though the Nasdaq is juiced with tech stocks and the Dow is filled with comparatively stodgy blue chips in a wide mix of industries (not to mention a quirky, price-based weighting system), they tend to run in the same direction eventually.

History is being made right now. Best to take notice.

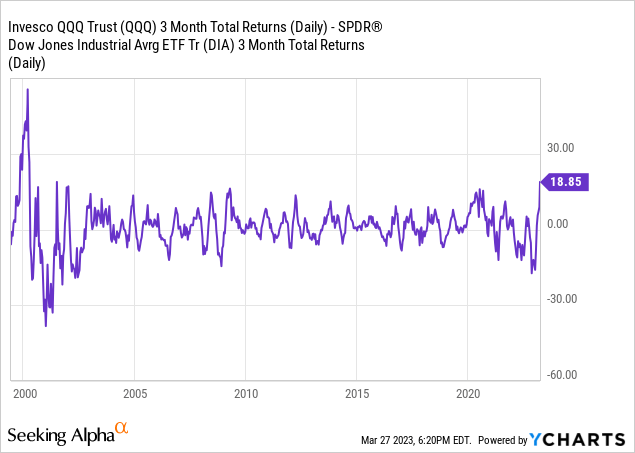

And while QQQ tends to dominate the Dow during some of the more frantic bull market phases, the Dow will often represent a relatively low volatility oasis during tougher phases of the stock market cycle. But more recently, the QQQ's degree of outperformance of DIA has been so strong, it has only occurred one other time this century. Take a look at this chart, which shows rolling 3-month returns on a daily basis. This is the performance “spread” between QQQ and DIA. Simply put, how much QQQ's return outpaced that of DIA over a 3-month time frame. So, when the purple line is above zero, QQQ outperformed. When it is below zero, DIA outperformed.

Focus on the far right side of the chart, the current period. During the three months ended March 24, 2023, QQQ bested DIA by nearly 19%! How often does that happen? Almost never. Other than a few brief periods of a few days, the only time this century when QQQ outperformed DIA by at least 17% in a 3-month period was in late 1999 through January of 2002, That is the period better known as when the Dot-Com Bubble burst. That followed an extended period, years in fact, when the tech-heavy Nasdaq 100 dominated nearly every other equity investment on the planet. Just like we have seen for several years leading up to now.

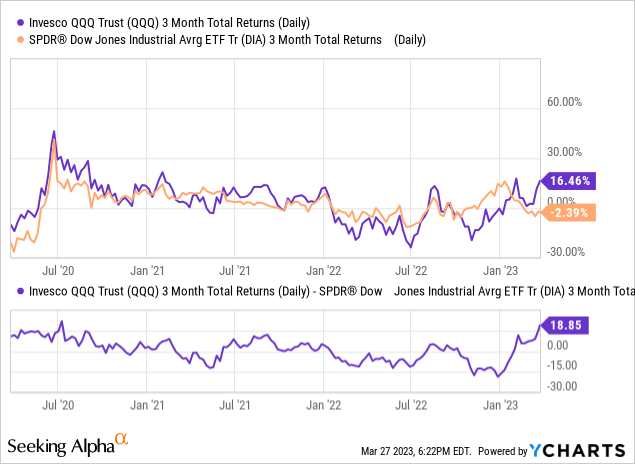

Above you can see the same information over the past 3 years, but I've included the 3-month rolling returns of QQQ and DIA in addition to the spread. This relationship has flip-flopped since the pandemic hit in 2020. And DIA dominated QQQ for stretches of 2022, outperforming it for the year by a wide margin. But my focus here is what is happening now, and its implications for the next several months to years. And what I see is a historical rarity.

Will the QQQ rocket ship crash to earth, or keep flying?

QQQ's past three months have probably made some stock market investors think that the Fed will pivot, FAANG stocks (which are heavily represented in QQQ) have the strength to withstand a pending recession due to their fortress balance sheets and cost cuts from slashing jobs this year. QQQ's portfolio is not cheap at 26X trailing earnings, but with DIA trading at just under 20X that same measure, and earnings estimates likely to head lower as 2023 continues, nothing is “cheap” right now.

But that has not stopped investors from boosting the Nasdaq to an impressive return to start 2023. The Dow, meanwhile, has seen the bloom of 2022's relative outperformance come off the rose, so to speak. As you can see in that chart above, its 3-month return is actually negative. Up 16% versus down 2% in just 3 months, for 2 of the 3 most popular stock market indexes, along with the S&P 500 and SPDR® S&P 500 ETF Trust (SPY) should strike any investor as out of the ordinary. And, it is that indeed. It occurs so rarely that we have to go back to the Dot-Com era. And to me, any time I see something and realize that pairing (Dot-Com and now), I think about all of the corroborating evidence that makes us old-timers think back to that era. Because it was a lot like today, mostly because investor attitudes were frequently that of looking for a Fed pivot, better-than-expected tech earnings, bailouts of whoever messed up and blew up, and even some of the commercials of that era and today. After all, QQQ has its own ad series, urging investors to “become an agent of innovation.” If you are old enough to remember Stuart, the kid in the commercial who wanted to crush the stock market, much to the skepticism of his father in law, you know what I'm talking about.

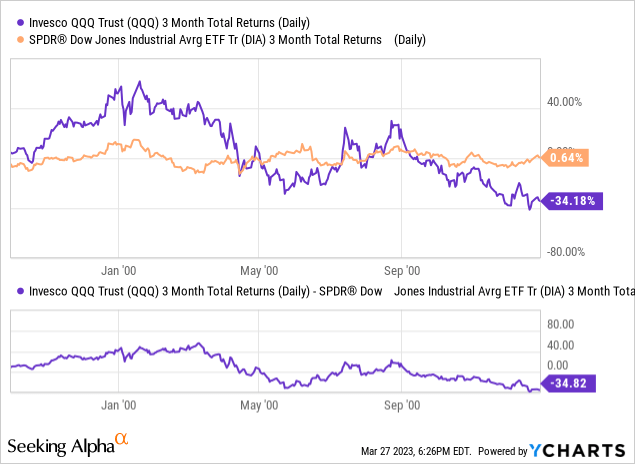

Back to the charts, here is what that bygone era looked like in terms of the QQQ versus DIA 3-month rolling return relationship. The left side of the above chart shows that in late 1999, as was the case recently, QQQ burst higher versus DIA, and peaked at an astonishing 3-month performance spread of around 40%. In fact, QQQ was popping by that much at a time when DIA was enduring a period in which its returns were relatively flat.

Then came the bursting of the bubble in March, 2000. And it didn't end until three years later, in March of 2003. For the first part of that bear market period, DIA's flattish performance looked better and better as the year 2000 went on. As the chart above shows, the fourth quarter (final 3-month rolling return data point) saw a QQQ collapse of 34%, while DIA snuck out a positive return. The rest of the story is, well, history. 2000 started the first time that the stock market fell for 3 consecutive years in modern investing history.

Stock market outlook: Look both ways before you invest

What's the implication for the current stock market, in 2023 and into next year? That depends on where we are in the cycle. QQQ could keep roaring and outperform DIA by even more before it's over. But then I think it will be over. That is, if it is not over sooner. The bottom line is that this spread behavior between two popular market measures reflects both a tug of war between “the good times are rolling again” (QQQ) and “I better get an umbrella before the storm hits (DIA).” The back and forth over the past year has been particularly head-scratching for folks who are used to seeing these two market measures much more in sync.

I see two possible follow-on scenarios to the historic QQQ outperformance we have just seen. It's very possible both could occur, with the first preceding the second. But the second is, if not inevitable, highly probable.

1. QQQ continues to fly higher into the spring, spurred by continued investor speculation that the Fed's rate hike cycle is over, or nearly over. That overcomes all of the unresolved issues that plague the current market, including mounting recession indicators, earnings risk, stubbornly-high inflation, spiking consumer and government debt, and rising geopolitical tensions from Russia and China.

- 5.1-channel 80-Watt powerful surround sound system

- 4K60, 4K120AB and 8K60B HDMI 2.1 with HDCP 2.3 and...

- Dolby Vision, Hybrid Log-Gamma and BT.2020

- Supports enhanced media and gaming - ALLM, VRR

- YPAO automatic room calibration

- Low-Profile Modern Design - Clean silhouettes,...

- Powerful Performance - Brilliant clarity,...

- Simple Setup, Streaming & Control - Get setup and...

- 5.1-Channel Sound - Experience a powerful...

- 6 Total Speakers - Full-range drivers deliver...

Last update on 2024-04-05 / Affiliate links / Images from Amazon Product Advertising API

2. They say that the Fed raises rates until they break something. They just did. They broke the long-term rhythm and peace of the US banking system. Bailout news relief is enough to produce another bear market bounce, led by QQQ. After all, by my count, we've had 20 failed rallies since the S&P 500 market peak back on January 4, 2022 (chart below, with start of each rally marked with a red arrow).

That says to me that the burden of proof is on the bulls, not the bears. Bear markets are not simply price declines. They also are characterized by periods like the current one, where nothing much happens, even if there's a lot of drama that makes us think that something happened. In reality, the S&P 500 has gone “net nowhere” in nearly a year.

But there's something going on that is notable, and causes me to lean on the side of caution, and frankly at an uncommonly high level of caution. That's the QQQ-DIA relationship. Because when something just happened that rarely occurs, and the only other time this century it did occur with any sustainability was the most spirit-breaking period of our investing lifetimes (2000-2003), how can any investor not at least acknowledge the risk?

How to capitalize

Here's how I'm handling my own belief that QQQ trouncing DIA is a warning sign, while also acknowledging that the recent historically-high QQQ outperformance, and lagging DIA returns so far this year, can possibly go on a while longer. I'm exposed to both. In my personal account, I currently own call options on QQQ, just in case its dominance lasts a bit longer. But I also own put options on a variety of market segments I consider to be at particular risk right now, as well as owning “tail risk” ETF positions such as Cambria Tail Risk ETF (TAIL) and ProShares VIX Short-Term Futures (VIXY). I also have a lot of T-Bills and short-term Treasury ETFs. And I'm always actively watching for more ways to, as I say, “play offense and defense at the same time.” I think these times demand it. That may seem more short-term oriented to some, but as I see it, taking heavy long positions at this stage of the market cycle is akin to hoping the long list of market threats just goes away. I also have written up opinions on many ETFs, which can be found by clicking on my Seeking Alpha profile page, just as you would do with any other contributor.

I'll be as happy as the next investor to see QQQ fly higher into the spring, or even through summer (call options do nicely when that happens). After all, as was the case in 2000, the real bearish action might not occur until later in the year. But I think it's inevitable. Still, I don't think any investor should run their entire portfolio based on expecting a singular outcome. Stay flexible, and balance reward and risk.

But most importantly, pay close attention to things that only seem to happen before market mayhem ensues. Even if this time is different, the cost of not acknowledging that risk is historically high right now can be devastating, especially for those in retirement or approaching it.

- SAMSUNG USA AUTHORIZED - Includes 2 Year Extended...

- Samsung 85 Inch DU8000 Crystal UHD LED 4K Smart TV...

- UHD Dimming | Auto Game Mode (ALLM) | Alexa...

- SAMSUNG TIZEN OS: Stream your favorite shows, play...

- BUNDLE INCLUDES: Samsung DU8000 Series 4K HDR...

- SAMSUNG USA AUTHORIZED - Includes 2 Year Extended...

- Samsung 75 Inch DU8000 Crystal UHD LED 4K Smart TV...

- UHD Dimming | Auto Game Mode (ALLM) | Alexa...

- SAMSUNG TIZEN OS: Stream your favorite shows, play...

- BUNDLE INCLUDES: Samsung DU8000 Series 4K HDR...

Last update on 2024-04-05 / Affiliate links / Images from Amazon Product Advertising API

There was a time, decades ago, when the Dow Jones Industrial Average was king and the Nasdaq was nothing more than a fledgling stock exchange. Today, their relative popularity in the eyes of the investing public has done a role reversal. As such, when the QQQ rallies this hard, this fast, two things are likely: Investors have gotten ahead of themselves, and the thrill will eventually turn to disappointment, or worse.

Ironically, in recent years, DIA has been thrust into the role of “relative safety” relative to the broad stock market, and especially to the Nasdaq. We don't have to look back too far to see that this QQQ vs. DIA relationship cuts both ways. We've seen a record-breaking move during the first quarter of 2023, with QQQ outperforming DIA. Thus, we have to be honest as investors, and acknowledge that even if that trend continues a bit longer, equity market risk remains at an uncomfortably high level. That should direct investors toward finding ways to de-risk their equity portfolios.

Looking more like DIA and less like QQQ as the weeks go on is a good place to start.