Market woes have created a buying opportunity for the Schwab U.S. Dividend Equity ETF. Diversification matters now more than anything and the fund could provide stability. Investors can presently secure an attractive 3.6% dividend yield.

SCHD: Why I Doubled My Investment In This 3.6% Yielding Dividend ETF

With equity valuations under pressure following the failure of Silicon Valley Bank last month, passive income investors have an opportunity to buy undervalued, broadly diversified exchange-traded funds like the Schwab U.S. Dividend Equity ETF (NYSEARCA:Original Post>

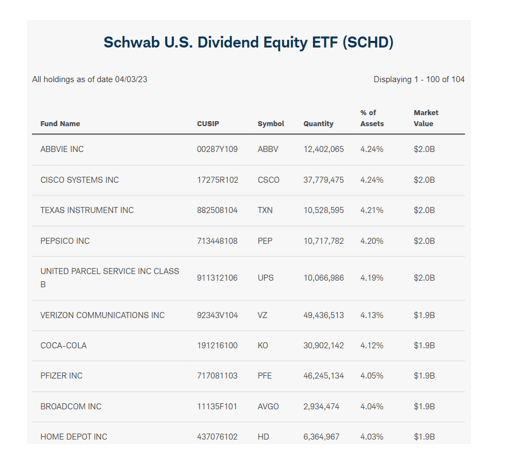

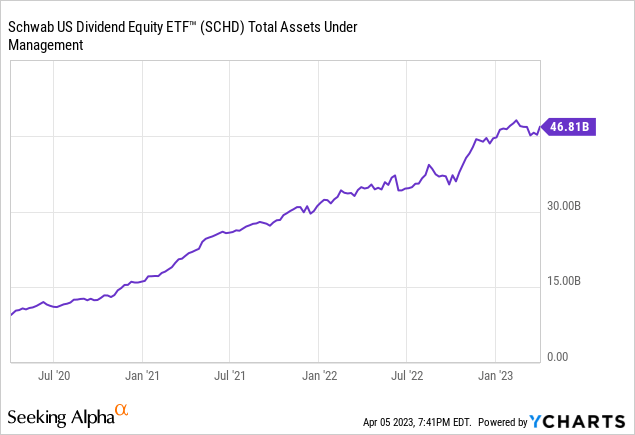

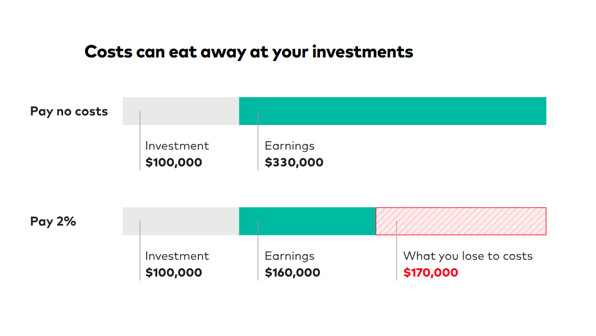

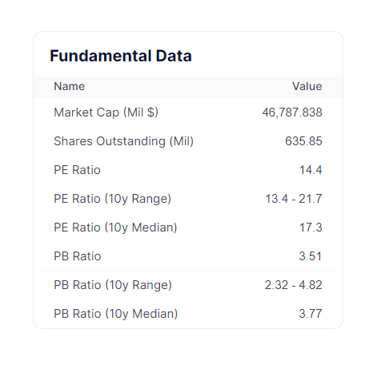

On my most recent purchase of SCHD, I received a 3.6% dividend yield and, more importantly, a very high degree of diversification in terms of the fund’s underlying assets. With market volatility increasing and the likelihood of a bank crisis increasing in recent weeks, I believe diversification, stability, and predictability are the three most important values for passive income investors right now. Fortunately, the SCHD meets all three criteria and should provide strong value and consistent distributions to passive income investors even during difficult market conditions. The main reason I doubled my position in the Schwab U.S. Dividend Equity ETF last week is that market volatility and fear have both increased significantly since Silicon Valley Bank failed in March. As a result of the bank’s shocking collapse, there is widespread concern about the valuation of many companies, and many stocks have seen significant valuation haircuts since the beginning of the crisis. With that said, I believe passive income investors would make no mistake in buying or overweighting high-quality passive income instruments such as the Schwab U.S. Dividend Equity ETF, owing to the fund’s ability to provide much-needed stability. The Schwab U.S. Dividend Equity ETF is broadly diversified, with the fund’s managers primarily investing in S&P 500 stocks with a long history of paying and growing dividends. The Schwab U.S. Dividend Equity ETF invests in well-managed companies such as AbbVie (ABBV), Pfizer (PFE), Cisco Systems (CSCO), and The Coca-Cola Company (KO), as it tracks the Dow Jones U.S. Dividend 100 Index. The ETF has historically had very low tracking error (the difference between fund returns and benchmark returns) and has consistently outperformed the underlying Dow Jones U.S. Dividend 100 Index. The fund is well diversified because no investment holding in the ETF accounts for more than 4.24% of assets. The fund’s top ten holdings include some of the largest and most well-known companies in the United States, many of which have decade-long operating histories. The Schwab U.S. Dividend Equity ETF is one of the largest large-cap S&P 500-focused exchange-traded funds in its category, with $46.54 billion in assets under management as of 3 April 2023. In addition to diversification, the SCHD provides passive income investors with a large fund asset base. Large funds also have an easier time attracting new investor capital, and the long-term trend in asset accumulation is positive. The Schwab U.S. Dividend Equity ETF has a low expense ratio of 0.06%, which is one of its most appealing features. The SCHD has a very competitive fee structure, with many mutual funds and even some ETFs charging close to 1%. Investment fees are more important than investors realize, and the lower the costs, the better the total return performance of investors. Management fees compound (and deplete investment value) over time, and the average investor can lose tens of thousands, if not hundreds of thousands, of dollars in foregone investment returns over their lifetime. According to Vanguard, a 2% annual investment fee results in $170,000 in lost investment income over a 25-year investment period. Because of the March correction in ETF and equity prices, investors can now purchase the Schwab U.S. Dividend Equity ETF at a lower P/E multiple than just a few months ago. The weighted-average P/E ratio of the ETF has dropped to 14.4x from more than 15.5x last month. The P/E ratio of the fund is also very close to the lower end of the 10-year average range of 13.4x to 21.7x. For example, because the Schwab U.S. Dividend Equity ETF is a U.S.-focused investment fund, passive income investors who invest in SCHD forego returns that could be obtained in emerging markets. In terms of diversification, I believe there are few better options than the Schwab U.S. Dividend Equity ETF, which is well-diversified and has a very low expense ratio. I received a 3.6% dividend on my most recent purchase of Schwab U.S. Dividend Equity ETF, and you can, too. The exchange-traded fund is well-diversified, has a strong focus on the United States, and its net asset value has recently fallen in line with the broader market. Having said that, I believe the market consolidation represents an excellent opportunity to purchase the Schwab U.S. Dividend Equity ETF at a lower valuation multiple, close to its 10-year low P/E valuation range. Above all, I value dividend stability and predictability right now, and because the Schwab U.S. Dividend Equity ETF only invests in safe, large-cap securities, I believe the SCHD can provide the stability and predictability that many investors require during times of increased market volatility.

Enjoyed this article?

Sign up for our newsletter

to receive regular insights and stay connected.

Why I Am Buying The Schwab U.S. Dividend Equity ETF

Size Matters

Very Low Expense Ratio

Weighted-Average P/E Ratio Has Dipped

Investment Risks With Schwab U.S. Dividend Equity ETF

My Conclusion