The HIO fund primarily invests in high yield junk bonds.It pays an attractive 9.5% distribution yield.However, with the fund only earning 5 and 10Yr average annual returns of 2.0% and 2.8%, HIO is a classic amortizing ‘return of principal' fund.

HIO: Unlevered Junk Bond Fund Paying More Than It Earns (NYSE:HIO)

The Western Asset High Income Opportunity Fund (NYSE:HIO) is an unlevered high-yield closed-end fund (“CEF”) that aims to provide high current income from a portfolio of mostly junk bonds.

Although the fund pays an attractive 9.5% distribution yield, there is a big gap between the fund's historical returns and its distribution rate, which suggests the HIO fund is an amortizing ‘return of principal' fund. I believe investors should seek junk bond exposure elsewhere.

Fund Overview

The Western Asset High Income Opportunity Fund aims to provide high current income from a portfolio of primarily high-yield corporate debt securities. The fund manager, Western Asset Management, is a subsidiary of Legg Mason. Legg Mason itself was acquired by investment giant Franklin Templeton in 2020.

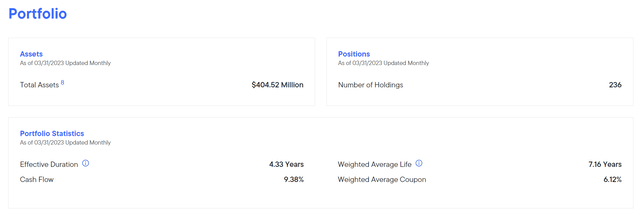

Unlike similar closed-end funds, the HIO fund does not employ leverage to enhance returns. The HIO fund had $405 million in net assets as of March 31, 2023 and charged a 0.91% expense ratio.

Portfolio Holdings

The HIO fund's portfolio contains over 200 holdings with a portfolio effective duration of 4.3 years (Figure 1).

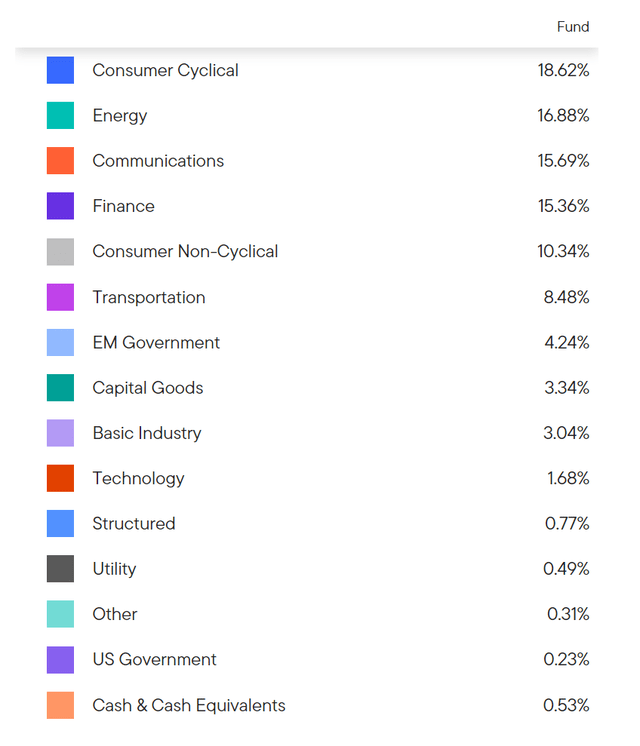

Figure 2 shows the sector allocation of the HIO fund. The fund's 5 largest sector weightings are Consumer Cyclical (18.6%), Energy (16.9%), Communications (15.7%), Finance (15.4%) and Consumer Non-Cyclical (10.3%).

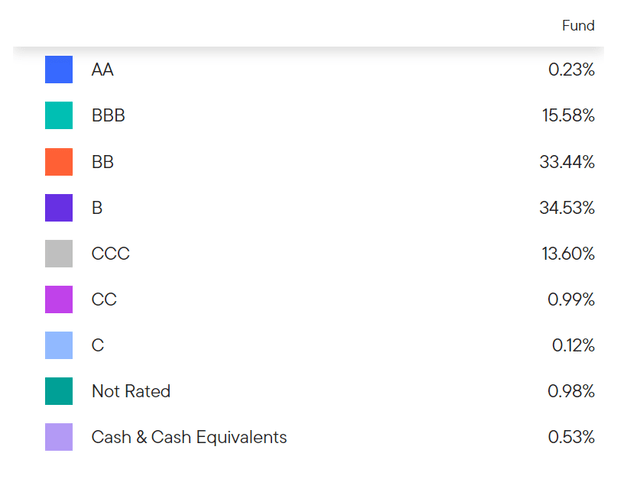

The HIO fund's credit quality allocation is primarily centered around securities rated BB (33.4%) and single-B (34.5%). It also contains 15.6% BBB-rated securities and 13.6% CCC-rated securities (Figure 3).

Returns

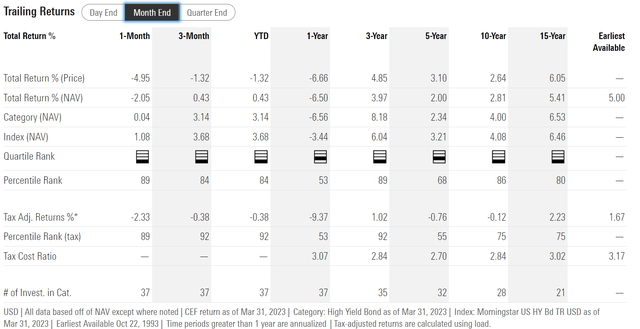

Figure 4 shows the historical returns of the HIO fund. The fund's historical performance has been very modest with 3/5/10/15Yr average annual returns of 4.0%/2.0%/2.8%/5.4% respectively to March 31, 2023.

Overall, the fund has been ranked 3rd or 4th quartile against peer funds in the Morningstar category High Yield Bond across all historical time-frames.

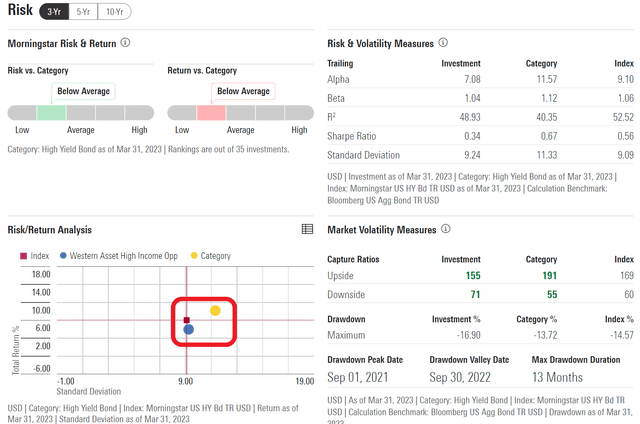

Although the HIO fund has underperformed peers, one redeeming factor for the fund is that it has historically experienced lower volatility, with a 3 and 5Yr trailing volatility of 9.2% and 9.7% respectively (Figure 5).

Distribution & Yield

The HIO fund pays a generous monthly distribution that is currently set at $0.03 / share or an annualized yield of 9.5%. On NAV, the fund is yielding 8.5%.

While the HIO fund's distribution looks attractive, my main worry is that the fund may not be earning its distribution, with a current distribution rate of 8.5% of NAV compared to 3 and 5Yr average annual returns of only 4.0% and 2.0%.

Funds that do not earn their distributions are called ‘return of principal‘ funds and are characterized by a long-term amortizing NAV, as the funds must liquidate NAV to sustain their too high distribution rates. Over time, this depletes income earning assets and makes future distributions harder to maintain, creating a negative spiral.

- Amazon Prime Video (Video on Demand)

- Jim Parsons, Rihanna, Steve Martin (Actors)

- Tim Johnson (Director) - Tom J. Astle (Writer) -...

- English (Playback Language)

- English (Subtitle)

- ✨【Night Lights Plug into Wall】: 0.5 watts,...

- 💕【Dusk to Dawn Sensor Night Light】:...

- 🐋【Personalized Night Light】:Takes the space...

- 🌃【Widely Used】: This plug in night light...

- 💡【Satisfied Service】If you’re ready to...

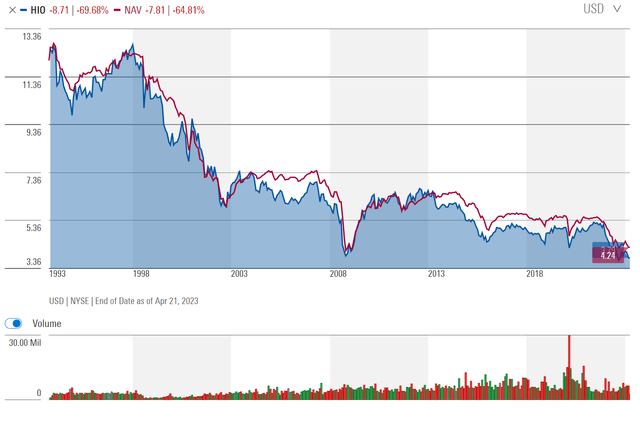

Unfortunately, the HIO fund exhibits a classic amortizing NAV pattern with NAV declining at a 2.1% CAGR in the past 2 decades from $6.56 in March 2003 to $4.24 most recently (Figure 6).

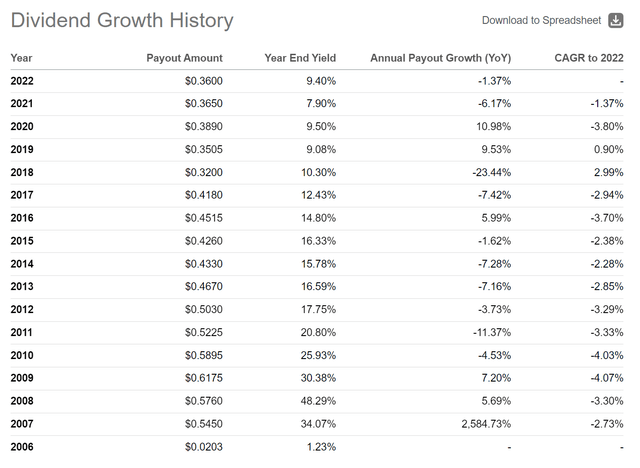

Furthermore, its annual distribution has shrunk at a 2.7% CAGR since 2007 (Figure 7).

Long-term investors in HIO would have suffered declines in both principal and income.

HIO vs. Peers

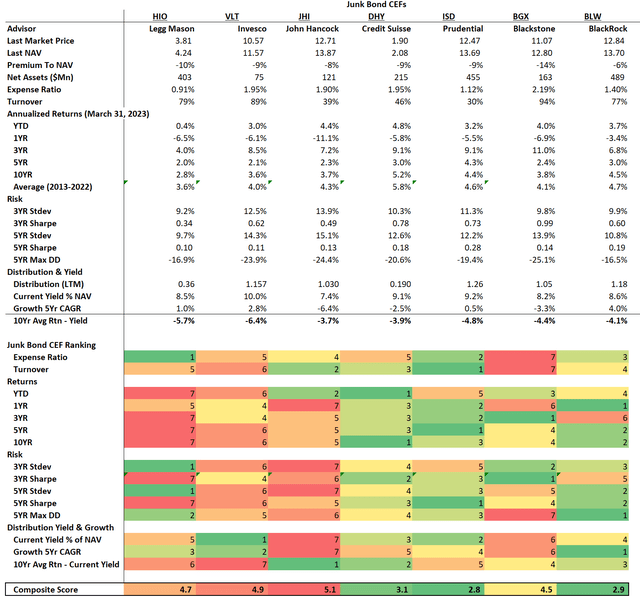

How does the HIO fund score against peer CEFs that focus on high-yield junk bonds? Figure 8 compares the HIO fund against peers using a proprietary scorecard I developed.

In terms of structure, the HIO fund is the cheapest, charging only a 0.91 expense ratio.

However, in terms of long-term performance, the HIO lags behind peers, with the worst average annual returns on 3/5/10Yr time frames.

Low returns is partly compensated by lower volatility, as the HIO fund has the best 3 and 5Yr volatility compared to peers. However, the returns differential is too large, leading to HIO having the worst Sharpe Ratios compared to peers.

- AIRTIGHT LIDS & 3 GRATER ATTACHMENTS The airtight...

- NON-SLIP SILICONE BOTTOMS The rubber on the bottom...

- NESTING BOWLS & DISHWASHER SAFE These kitchen...

- 6 SIZES BOWLS & EXTRA KITCHEN TOOLS SET The range...

- DURABLE STAINLESS STEEL The stainless steel...

- ✅FOOD GRADE SILICONE -- Made of food-grade...

- ✅NO BEND & NO BREAK & HEALTHY FOR COOKWARE --...

- ✅HIGH TEMPERATURE WITHSTAND:The Silicone Cooking...

- ✅33 DURABLE WOODEN HANDEL KITCHEN UTENSILS SET -...

- ✅BEST KITCHEN TOOLS :One- piece stainless steel...

Finally, the fund's current distribution yield as a % of NAV is in the middle of the pack. However, because the HIO fund has one of the weakest long-term returns, it also has one of the worst gaps between returns and distribution rate.

Overall, the HIO fund scores poorly against its peers with weak historical returns and low Sharpe Ratios. For junk-bond funds, I prefer the PGIM High Yield Bond Fund (ISD) that scores well in all categories. I wrote about the ISD fund Original Post>

Conclusion

The Western Asset High Income Opportunity Fund is an unlevered junk bond fund that aims to provide high current income to unitholders. Unfortunately, historical returns for the fund have been very modest, leading to a big gap between its distribution rate, currently set at 8.5% of NAV, and its average annual returns. The HIO fund also scores poorly against its peers with low returns and poor Sharpe Ratios. I believe investors should seek junk bond exposure elsewhere.