The German economy is on the rebound this year as production gets back underway.With inflation also decelerating, led by lower energy prices, the consumer is in much better shape.An increasingly likely ‘soft landing' scenario bodes well for the DAX Germany ETF.

DAX: A ‘Goldilocks' Scenario Is Back On The Table For Germany (NASDAQ:DAX)

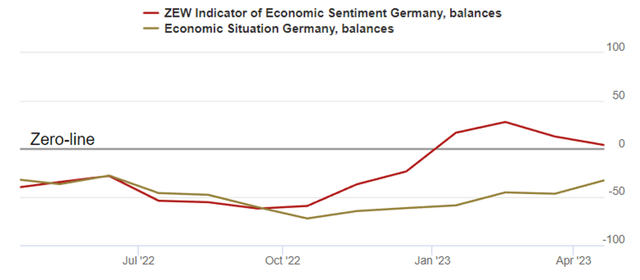

he ZEW economic expectations index may have fallen unexpectedly in April given the print coincided with contagion concerns post-Credit Suisse (CS) failure, but it shouldn't detract from Germany's momentum in recent months. The more important gauge, in my view, remains the current conditions index, which saw another month of improvement in April, as well as the easing of inflation expectations (the first time in months). Also supporting the German bull case are the above-trend industrial output, as well as the GDP boost from higher trade volumes. And with auto manufacturing gaining momentum as supply chain disruptions ease, a ‘soft landing' economic scenario seems increasingly likely. Alongside a backdrop of lower energy prices, a robust labor market, and pent-up investment, all signs point to a better-than-expected year for corporate earnings. To mitigate any lingering headwinds from ECB tightening, positioning via more resilient, blue-chip funds like the Global X DAX Germany ETF (NASDAQ:DAX) makes sense, in my view.

Fund Overview – Low-Cost Exposure to a Blue-Chip German Portfolio

The US-listed Global X DAX Germany ETF seeks to track, before expenses, the yield and price performance of the German DAX index, comprising the 40 largest German blue-chip stocks trading on the Frankfurt Stock Exchange. The ETF held ~$59m of net assets at the time of writing and charged a 0.2% expense ratio, making it one of the more cost-effective options for US investors looking to access German equities. A summary of key facts about the ETF is listed in the graphic below:

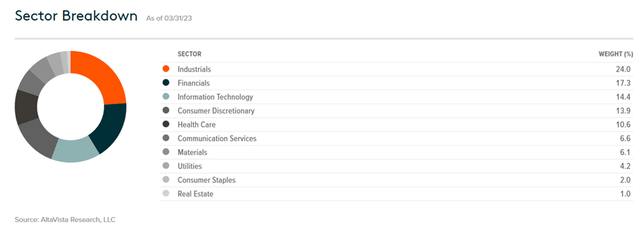

The fund is spread across 40 holdings, with Industrials making up the largest sector allocation at 24.0%, followed by Financials at 17.3% and Information Technology at 14.4%. On a cumulative basis, the top five sectors accounted for ~80% of the total portfolio, making DAX a relatively top-heavy single-country Euro ETF. While the fund's heavy industrials component means its equity beta stands at 1.27 to the MSCI EAFE (EFA), a proxy for developed markets ex-North America, its beta is only slightly higher vs. the S&P 500 (SPY) at 1.08 and <1 relative to the more volatile MSCI Emerging Markets (Original Post>

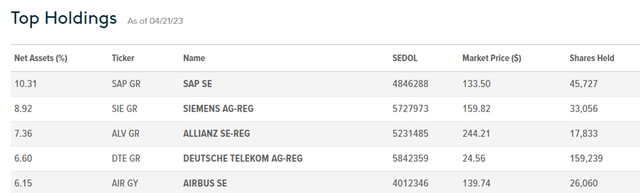

The single-stock allocation of DAX highlights the quality of its portfolio, with the fund's top-five list featuring industry titans. The top holding is German software company SAP SE (SAP) at 10.3% of net assets, followed by industrial conglomerate Siemens (OTCPK:SIEGY) at 8.9% and financial services company Allianz (OTCPK:ALIZF) at 7.4% of the portfolio. Rounding out the top five are Deutsche Telekom (OTCQX:DTEGY) at 6.6% and aerospace multinational Airbus SE (OTCPK:EADSF) at 6.2%. In total, the five largest holdings contribute ~39% of the overall portfolio. In line with the fund's focus on industrial giants with good cash flow but limited growth runways, the underlying portfolio trades at ~12x earnings and ~1.4x book, screening fairly relative to the portfolio's ~12% return on equity.

Fund Performance – Steady Through-Cycle Appreciation with a Decent Yield

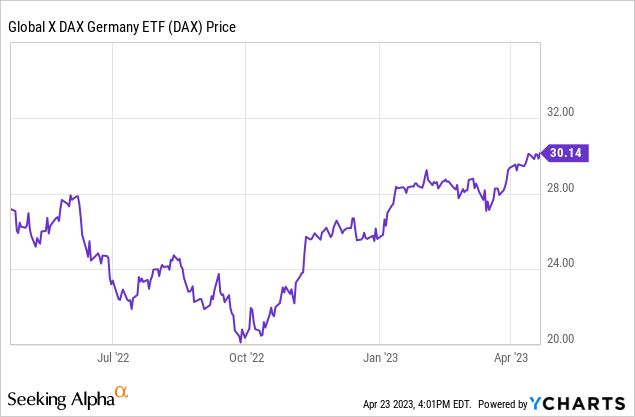

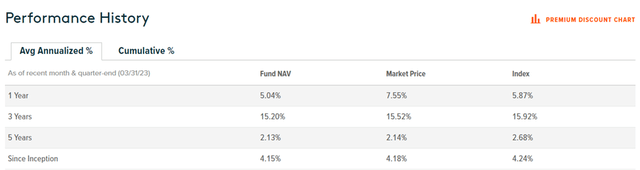

On a YTD basis, the ETF has appreciated by 12.9% and has annualized at a steady 4.2% pace in market price and NAV terms (including reinvested dividends) since its inception in 2014. Given the cyclical nature of its industrial holdings, the fund's performance has been volatile – last year saw a double-digit % drawdown in H1 before recovering in H2 on hopes of a China reopening boost. Zooming out, the three and five-year return profile stands at 15.2% and 2.1%, respectively, while on a one-year basis, the fund has returned 5.0% in NAV terms.

| Preview | Product | Price | |

|---|---|---|---|

|

Galway Bay Long Sleeve Golf Rain Jacket - Three Layer Long Sleeve Golf Jackets for Men, Lightweight... |

$200.00 |

Buy on Amazon |

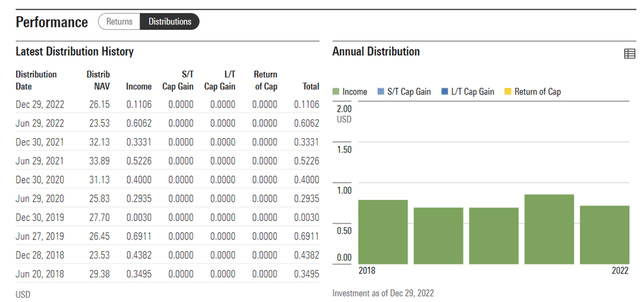

The semi-annual distribution, derived entirely from income, stands out. With the fund's holdings in blue-chip names with solid cash generation underpinning much of the shareholder return, the distribution yield has remained steady even through the COVID-impacted years. And at a trailing yield of 3.1%, DAX offers an attractive return. While the fund's distribution was slightly off the 2021 peak last year, an eventual global demand and earnings recovery (likely post-2023 when the global monetary tightening cycle ends) should get income growth back on track.

Recent Economic Data Points Offer Reasons for Optimism

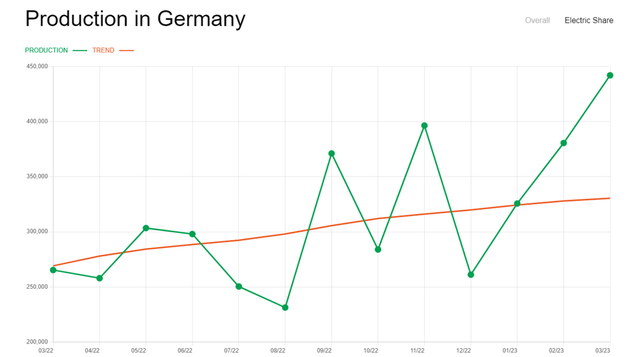

Amid the supply chain challenges over the last year, German industrial and manufacturing earnings have suffered despite the record backlogs typically cited on earnings calls. We are likely nearing an inflection point, however, as highlighted by monthly figures from the VDA (i.e., the German Carmakers' Association) showing accelerated auto production. As semiconductor shortages continue to ease and pent-up retail and fleet demand come through after years of capacity limitations, an auto-led earnings recovery could be on the cards. Domestically, the consumer is in much better shape as well – not only has inflation peaked, but consumer confidence is also on the rebound, signaling a potential GDP boost from consumption near-term. Beyond the purchasing power benefits for the consumer, lower energy prices also bode well for the margin outlook of DAX's industrials-heavy portfolio. The combination of a manufacturing sector rebound, accelerating consumer momentum, and falling inflation make a ‘soft landing' the most likely economic outcome, in my view.

- 🌴 Material: Chiffon, 100%Polyester ; Lightweight, soft and comfoy material

- 🌴 Features: Long sleeve chiffon lace mini dress for women spring, summer and fall, crew neck, long lantern sleeve, zipper closure, elastic waist, a-line and slim fit style, elegant ruffle design, this cute fall mini dress will make you more beautiful and lovely!

- 🌴 Occasions: Fall casual short dress suitable for you to party, holiday, school, date, cocktail, coming home, and daily life. Believe you will love it and get lots of compliment!

- 🌴 Garment care: Hand wash in cold water recommend, hang dry, low temperature ironing if necessary

- 🌴 Size Note: 0-2, 4-6, 8-10, please refer to our sizing information in the picture description to choose your size. Thanks for your understanding

That said, Germany is still in the midst of a rate hike cycle amid ‘sticky' core inflation across the Euro area. So even with the German economy improving, monetary tightening won't be done anytime soon; this tends to drive slowing growth as higher funding costs weigh on domestic investment and overall demand. A key area to monitor is housing – more tightening could hit construction/homebuilding investment disproportionately, particularly with property prices already cooling. But the ZEW expectations index, which tracks financial market sentiment on economic conditions, has been outperforming in recent months. The strong April's current conditions index was another key positive (despite the economic sentiment gauge moving lower), while inflation expectations also fell for the first time in months. So even though the ECB's hawkish commentary signals more hikes, the German economy is well-positioned to withstand any shocks.

A' Goldilocks' Scenario is Back on the Table for Germany

The ZEW economic expectations report fell short of consensus expectations this month, but the German bull thesis remains intact. Digging deeper, the current conditions index continued to improve while inflation expectations fell for the first time. Higher industrial production and trade volumes also bode well for real GDP growth going forward, adding a welcome buffer against any consumption headwinds. With the near-term setup also boosted by fading energy inflation and higher investments following the post-COVID normalization of global supply chains, I remain upbeat on German earnings growth this year. At ~11-12x earnings (~1.4x book) for a portfolio of high-quality German names well-positioned to weather the cycles, the low-cost DAX ETF is worth a look.