Overview

This report should be considered an update to the 2023 Container Shipping Outlook originally published on Value Investor's Edge. This report is relevant to the following companies: Costamare (CMRE), Danaos (DAC), Euroseas (ESEA), Global Ship Lease (GSL), MPC Container (OTCPK:MPZZF), and ZIM Integrated Shipping (ZIM).

Here we will discuss recent developments for influential factors cited in that outlook, with regard to 2023's market and beyond.

For those reading the public version of this report, an excerpt of 2023's outlook and factors to watch is found below.

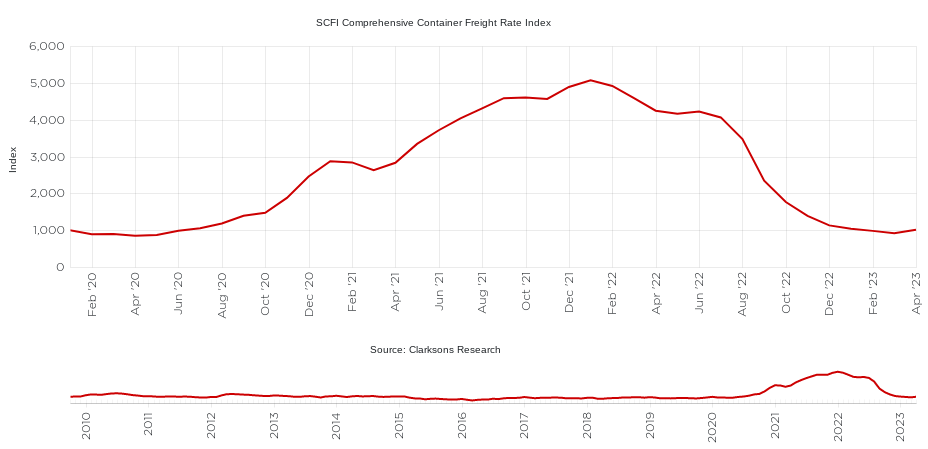

After a precipitous drop in spot rates, the…market now appears to be striking a balance between current supply and demand.

Rates appear to be stabilizing around pre-covid levels which is an encouraging sign, as both supply growth and sustained long-term organic demand side gains (which would disregard unsustainable covid-driven demand and outsized port congestion) would suggest similar levels.

The reestablishing of a baseline before we begin seeing the impact of a thick orderbook and/or a broad economic recovery is extremely helpful since it allows us to gauge market developments without having to account for an ongoing unwinding of this covid/congestion outlier.

Of course, there are lingering impacts. One such factor would be the pulling forward of consumer demand in 2021 and 2022, which has now run its course, leaving us with a sort of demand vacuum in its wake.

This demand vacuum once stood a good chance of being exacerbated by collective central bank action designed to slow the economy. However, if the goal of a meaningful reduction in inflation can be achieved with minimal disruption to the labor market, that exacerbating factor becomes far less concerning.

Therefore, our concerns for 2023's market are relatively straightforward compared to the last couple years, with an emphasis on economic stabilization, trade normalization, the impact of the EEXI, and how well the market can absorb another round of sizable capacity introductions.

Stable, But For How Long?

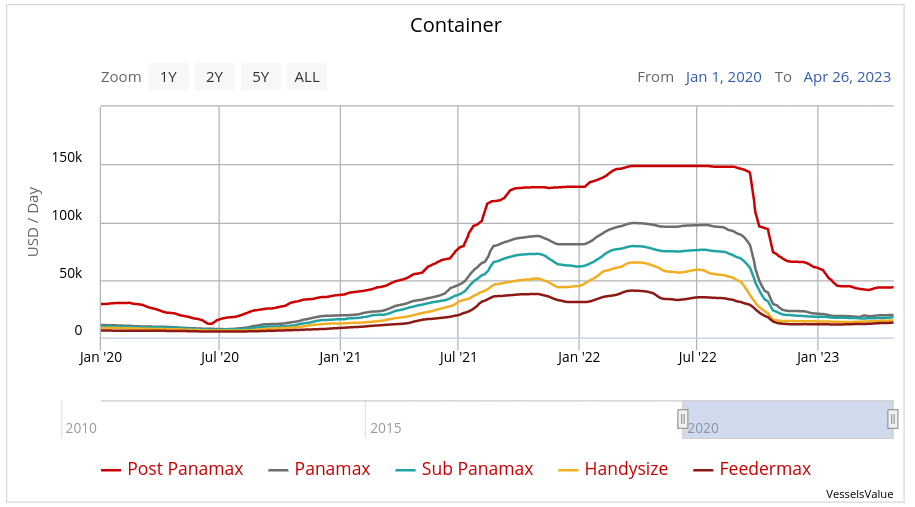

Although 2023 was projected to experience a deteriorating market, the first quarter continued along a path of stabilization, as evidenced by period rates.

VesselsValue

As well as spot rates.

VesselsValue

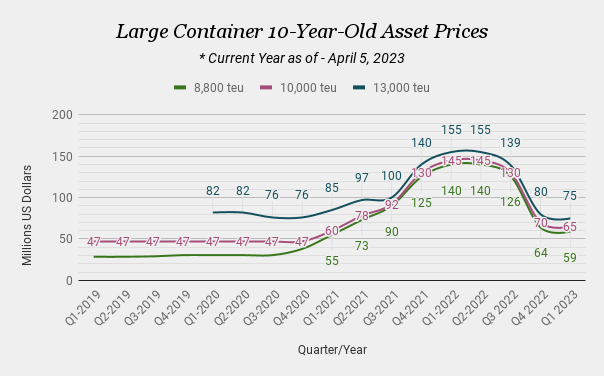

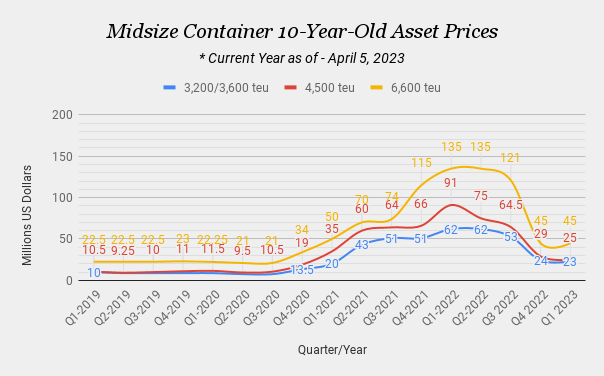

This has also been mimicked by asset values.

VIE

VIE

Before we can move forward, we should understand what exactly is inspiring these rate floors, and by doing so, hopefully gain some insights into its sustainability.

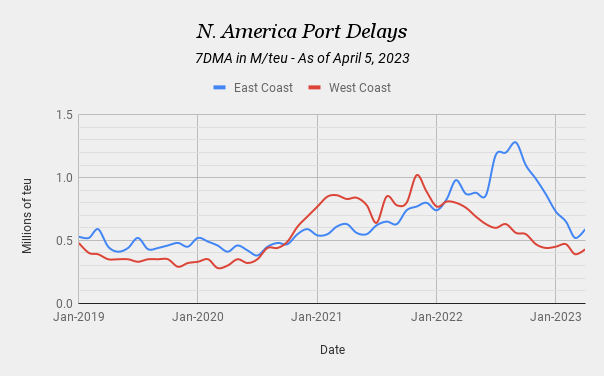

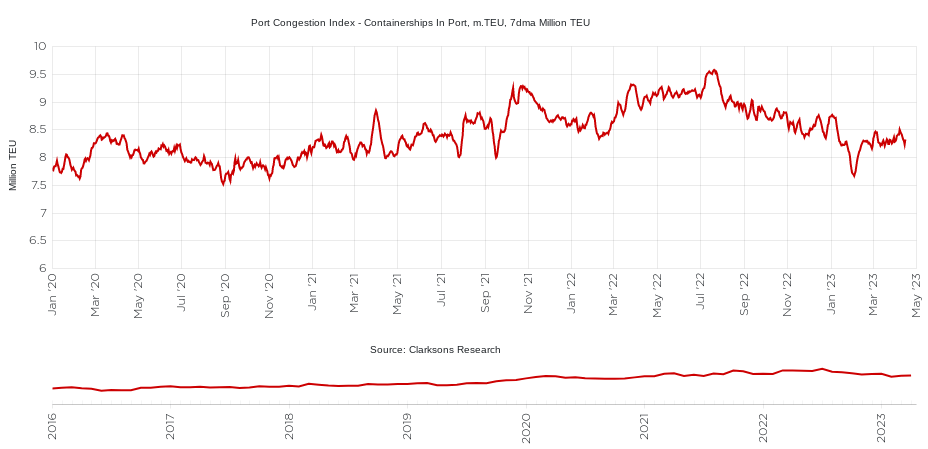

In previous reports we cited port congestion as having a bullish and outsized impact on the market.

The back half of 2022 saw a nearly complete unwinding of this congestion, which was a key factor behind the free fall in rates and consequently asset prices over that same period.

VIE

Clarksons Shipping Intel

The first quarter of 2023 ushered in stability for both port congestion levels and consequently port throughput which alleviated backlogs and retail inventory issues – making it much harder for any port congestion issues to resurface during this cycle, which implies this issue is likely resolved for now.

It is no coincidence that as port congestion unwound, rates were falling in unison. In fact, that was a significant driver. Then, as port operations returned to a somewhat normalized state, rates responded by leveling off.

This suggests that a primary force behind the precipitous rate decline has largely abated, and can only exert minor pressure on the market going forward.

We might add that potential episodes of heightened port congestion just became far less likely moving forward as many facilities/operations had invested in efficiency improvements over the past couple years, which will have legacy impacts.

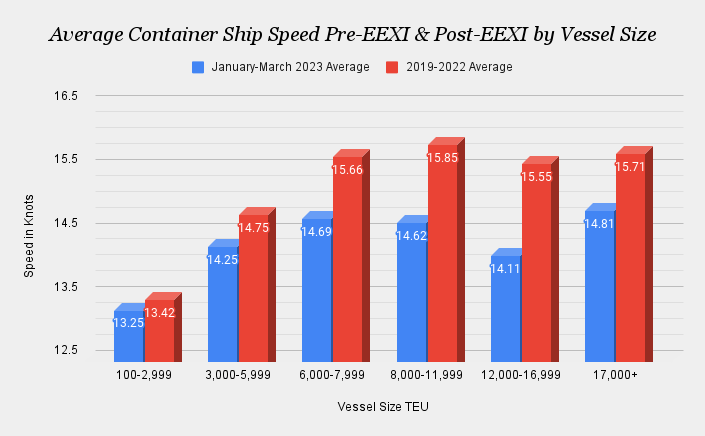

Additionally, we have a one-time speed adjustment courtesy of the EEXI, which has impacted containerships in a profound manner.

In our 2023 outlook, we noted that December of 2022 was already witnessing significant speed adjustments across all classes, likely in preparation for achieving compliance on January 1, 2023.

We also noted that these speed deviations appeared to become more pronounced as we move up in size through the fleet.

Expectations for even greater slowing in 2023 did not disappoint as Q1 numbers confirm a significant shift in speeds has taken hold of the market.

The chart below shows average speeds by class for the four years prior to the implementation of the EEXI and compares them to the first quarter of 2023, post-implementation.

Clarksons Shipping Intel & VIE

For reference, moving from the smallest to largest vessel sizes in the chart above, the percent change in speed comes in at 1.27%, 3.39%, 6.19%, 7.76%, 9.26% and 5.73%.

Since the largest carriers are experiencing the most slowing, this suggests a more acute impact in curtailing overall capacity. Here, rough math shows an approximate 5.09% decrease in available capacity is the result of this slowing.

Again, this 5.09% decrease in capacity came quite abruptly, manifesting in Q4 of 2022 and being solidified in 2023, which created a sort of market shock and likely contributed mightily to the stabilization effort witnessed in Q1 of 2023.

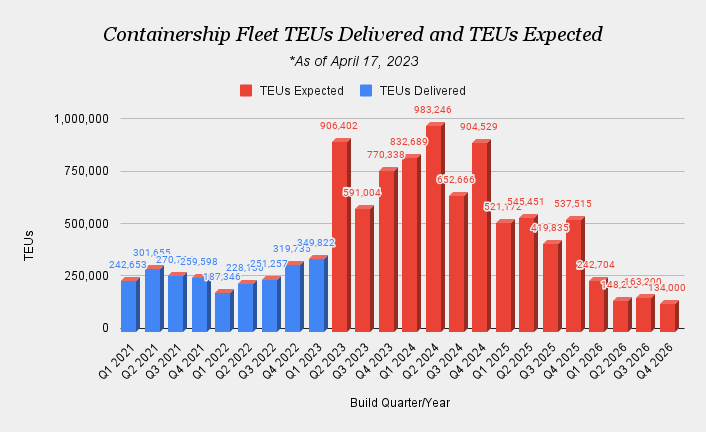

Furthermore, this speed adjusted inspired capacity decrease came against what would be considered manageable capacity additions in Q1 of 2023.

VesselsValue & VIE

However, as the chart above shows, those capacity increases are poised to grow significantly this quarter (Q2), and remain elevated through 2025. We will circle back to the impacts of this in just a bit.

Finally, Q1 of 2023 witnessed growth in cargo mile demand, posting a 4.06% gain over Q1 of 2022. Cargo mile demand growth was something that had eluded this segment over the course of 2022 making this an encouraging sign.

It's also noteworthy that these cargo mile demand gains have been the most pronounced in larger classes.

These factors, the abating of the ill effects of unwinding port congestion, speed adjustments which impacted capacity availability in a quick and meaningful manner, very reasonable capacity additions, and a return of cargo mile demand growth all ushered in this market stability which we are now enjoying.

Moving Forward

At this point, we are removing port congestion from the equation. It has nearly run its full course and the market impacts have almost been completely resolved.

Next, the EEXI was a one-time speed adjustment. While some further corrections are expected once enforcement begins in late 2024 and early 2025, the vast majority of this impact has been felt by the market. Further market shifts are unlikely, however, the sustainability of this shift is deemed permanent. Though we are removing this from the equation going forward, the impact will remain with the market and is now considered part of the overall structure.

Instead of focusing on the EEXI, we should now turn our attention toward the implementation of the CII, which, instead of a design oriented mandate like the EEXI, is focused on operational efficiency and has tightening parameters.

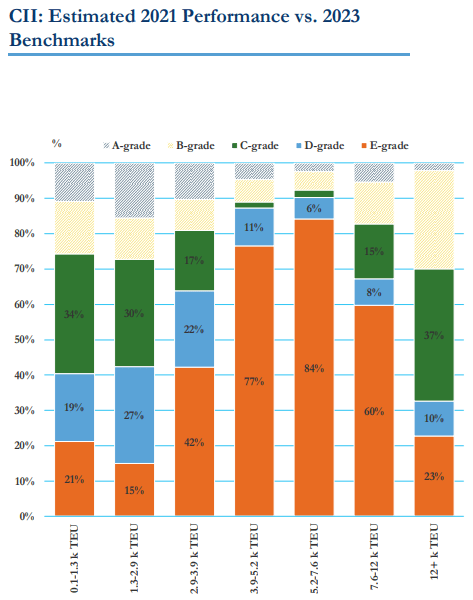

Assessed annually, and on a backward-looking basis, the first ratings are to be determined in 2024, based on 2023 data. Data from 2021 shows that there could be a significant portion of the fleet that will need corrective action, represented by the D and E grades.

Danaos

Here's why the percentage of vessels receiving a possible E rating could make for an interesting 2024.

After the conclusion of 2023, the submission of fuel oil consumption data and attained annual operational CII must be completed by the end of March 2024 (and each calendar year thereafter). To maintain compliance, ships rated as D for three consecutive years will need to develop a Corrective Action Plan to achieve the Required Annual Operational CII (i.e. midpoint of C rating).

But for ships receiving an E rating based on the 2023 collected data, a Corrective Action Plan must be submitted by the end of April 2024, and is to be implemented in 2024 and 2025.

This implies two things. First, it suggests that CII inspired compliance adjustments may already be taking place (in an effort to move from E to D or D to C) and contributing to the fleet's overall speed reduction. Second, it suggests that CII inspired corrective measures for the E rated vessels, which will likely impact fleet speed once again and consequently available capacity, could start relatively quickly for the containership segment, and on a large scale.

- A masculine fragrance with a fusion of sandalwood,...

- FRESHEN YOUR LIFE: Fiber Can is LITTLE TREES...

- MORE THAN JUST A CAR AIR FRESHENER: Freshen up at...

- LONG-LASTING FRAGRANCE EXPERIENCE: Specialized...

- SLIDE LEVER TO ADJUST STRENGTH: Slide the lever on...

- UV SHIELDING - Provide your baby with protection...

- SIMPLE UNIVERSAL INSTALLATION - Experience...

- THIS SET INCLUDES- 2 transparent car window...

- DURABLE MESH MATERIAL & STURDY WIRE- Rely on...

- GIVE THE BEST BABY GIFT- Need a baby shower gift...

- SAFETY ESSENTIAL CAR ACCESSORIES: If your car is...

- PRACTICAL AND PERFECT CHRISTMAS GIFT: A surprise...

- SAFE AND DURABLE TOOL KIT: This bag is made of...

- EVERYTHING YOU NEED FOR CAR SAFETY IN ONE BAG:...

- SUITABLE FOR MOST EMERGENCIES: This roadside...

- ✔ADJUSTABLE STRAP & COLLAPSIBLE SHAPE – The...

- ✔MAGNETIC SNAPS: There are 4 metallic magnetic...

- ✔HARD-WEARING LEAKPROOF INNER LINING – This...

- ✔MULTIPURPOSE – This car garbage bin can be...

- ✔GREAT COMPATIBILITY – An effective solution...

With an onslaught of deliveries expected in 2024 and 2025, the timing of how the CII unfolds could mitigate much of the damage expected from an expected glut of tonnage.

Notice, the use of the word mitigate, instead of negate, in the previous statement.

That's because we must now face a very heavy delivery schedule which will likely overwhelm positive developments of CII inspired capacity adjustments and cargo mile demand growth over in 2024 and 2025, though I am starting to wonder if it will be as bad as many think, or even as I had previously thought. Perhaps the word negate may come into play, after all.

Let's examine that possibility by first showing the amount of capacity being delivered over the next couple years and breaking it down into percentage terms.

VesselsValue & VIE

Recall that expected deliveries are in gross numbers. With vessel retirements playing a role, net fleet growth is typically a bit lower, with 2023's expectations still being around 6.27%.

Consider that 6.27% should be balanced against that lost capacity of 5.09% due to speed adjustments, as well as growing cargo mile demand growth, which for the entire segment is now at exactly 4% YTD as of April 27.

This combination obviously implies market tightening as adjusted capacity additions of 1.16% will not keep pace with 4% cargo mile demand growth. (Of course, this rests on speeds being maintained at a lower pace and sustaining demand growth trends.)

However, this tightening won't immediately translate into an improving market. Instead, we discussed how those speed adjustments already contributed to market stability, and have played out. Therefore, we see the remainder of 2023 presenting a battle between three quarters of well above average deliveries vs. slightly above average cargo mile demand growth. In this regard, we might expect a bit more softening as the year plays out.

As we head into 2024, things could be just as complicated. The degree of market softening toward the end of 2023, will determine just how much of 2024's favorable adjustments will be utilized to stop the bleeding.

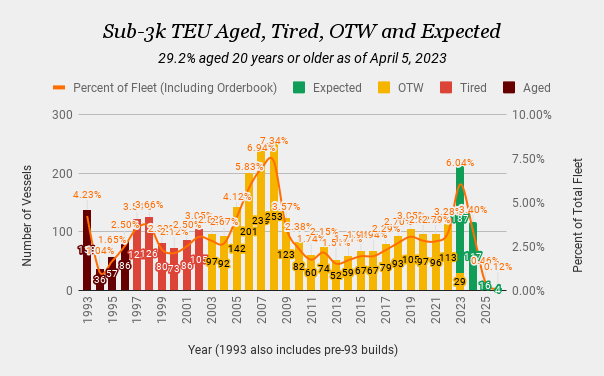

In 2024, the CII will once again inspire speed shifts for those vessels seeking to avoid E ratings but it will also come with the first round of CII inspired scrapping, which is likely to be most pronounced in the small to midsize classes.

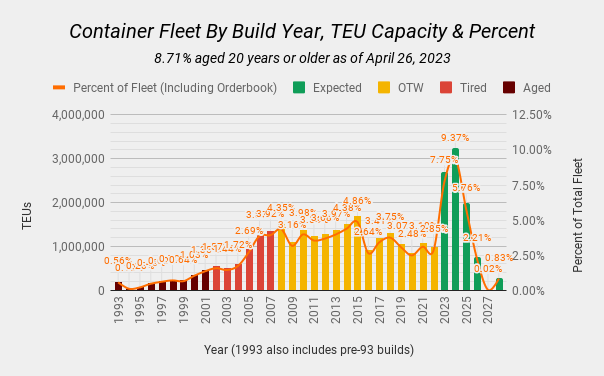

That scrapping in 2024 is projected to bring significant changes to the fleet, especially for the smaller classes. Recall that nearly 30% of the 3k teu and under fleet is composed of vessels 20-years or older.

VesselsValue & VIE

Even though we will be seeing an even greater influx of new tonnage hit the water in 2024, Clarksons Shipping Intel is projecting that the net capacity gain will be smaller than that of 2023. In fact, Clarksons is projecting 6.7% capacity additions in 2023, but only 5.8% in 2024 for the entire container fleet. This is made possible since that sub 3k teu grouping is projected to see a -4.4% decline in 2024 according to Clarksons.

This suggests that ongoing speed adjustments related to CII and average cargo mile demand growth could go a long way in absorbing these net vessel additions in 2024.

Let's also recognize that several market mechanisms stand to play a role in helping the market digest those new additions. Three major alliances control a significant portion of global tonnage and coordinated blanked sailings will help control the available supply. Furthermore, we can expect significant cascading to begin taking place as those vintage sub-3k teu vessels are being sent to the scrapyard. Finally, let's acknowledge that a greater than normal amount of slippage is already taking place in 2023, adding to the likelihood of rolling slippage throughout the year and extending into following years. Ideally, this will roll some of the heavy delivery years of 2023 and 2024 into 2025 and 2026 spreading out the impact of the thick orderbook and allowing the market more leeway to digest this influx of tonnage.

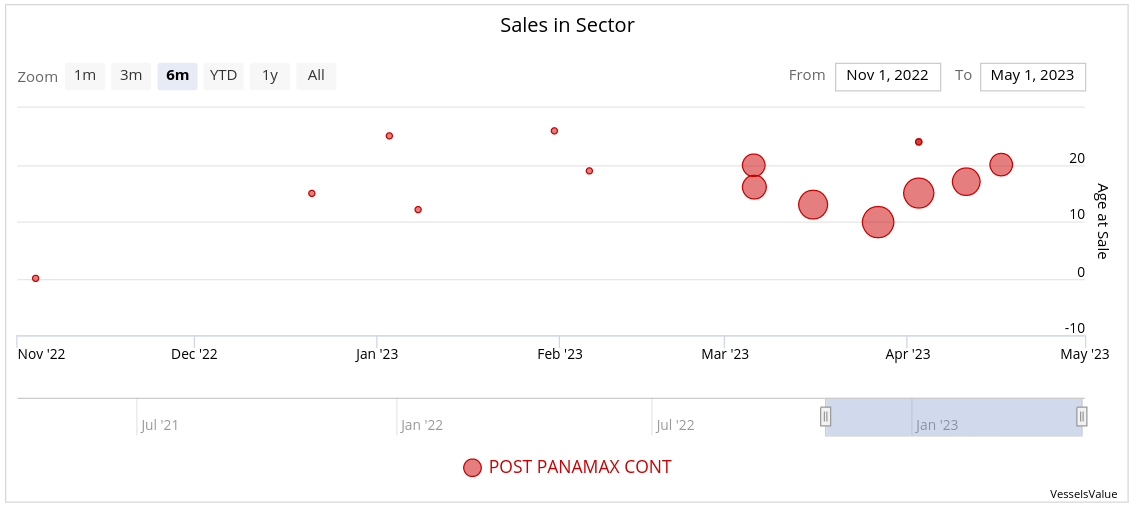

Newbuild orders for larger container vessels are finally trailing off in Mid-March, likely the result of the growing gap between steady newbuild prices and declining asset prices which have reignited interest in the S&P market.

VesselsValue

These reduced orders and a refocus toward on-the-water assets, due to ongoing projections for price gaps favoring second hand assets, should help keep 2025 and 2026 deliveries under control.

While 2025 presents a bit of a challenge, with 5.76% of the total fleet (including orders) set to be delivered, and may grow even more daunting as a few newbuild orders are added and slippage rolls into that year, it still presents a likely year for market consolidation and perhaps a redirection. This would be made possible if demand side trends remain strong and CII inspired slowing continues due to tightening annual restrictions. Remember, this is also around when enforcement begins in earnest for the EEXI as well.

Economy

I maintain that a soft landing is occurring for the US and global economy at large, which is encouraging for containerized demand. Employment remains reasonably strong, inflation is waning, and the overall market structure (which was recently tested by banking issues in the US and Europe) remains relatively sound. Examinations of banks reveal relatively few with high unrealized losses and high uninsured deposits, which would be the combination that has caused recent issues.

This earnings season has provided a positive surprise for major economic bellwethers and the consumer remains relatively healthy. Additionally, real wage growth has recently just turned positive again in the USA. Let's also recognize that every basis increased by central banks recently, now registers as another round of ammunition to combat any future market turmoil.

Issues like slightly rising delinquencies and late payments as well as speculation surrounding a commercial real estate contraction have crept into the picture. But with employment remaining strong and real wage growth returning, the bearish adjustment period forced on the consumer which inspired by these late payments and delinquencies will likely trail off. The commercial real estate debacle could cause some turmoil but it will be nowhere near the Great Financial Crisis for several reasons. During the GFC job losses, speculative credit markets defaults, massive declines in consumer net wealth, and an organic credit contraction all conspired together for this downturn. This all impacted consumption which is typically between 68%-70% of GDP. These elements are largely missing this time around. Let's also recall that residential is by far the largest real estate sector, accounting for approximately 79% of all global real estate value, meaning any contraction in residential would be far more potent than one simply confined to the commercial segment.

I continue to believe the worst is likely behind us but it will be slow going ahead due to a calculated and highly managed central bank directed agenda, which is still heavily focused on stamping out inflation.

Conclusion

Q1 has been marked by a stabilizing market courtesy of several factors: An end to the unwinding of port congestion, favorable speed adjustments, a light delivery schedule early on in 2023, and a return of cargo mile demand growth.

The reestablishing of a baseline for the market before we begin seeing the impact of a thick orderbook is extremely helpful since it allows us to properly gauge market developments from here on out.

Starting from this baseline, and using traditional supply demand analysis, we observe that the potential discrepancy between supply/demand in 2023 and 2024 may not be as pronounced as previously believed.

This is largely due to speed adjustments which led to significant capacity reductions as well as greater than anticipated cargo mile demand growth.

Recall that demand expectations were flat for 2023, but so far the container segment as a whole is posting a 4% cargo mile demand gain, which is most pronounced in the larger classes. This is where speed reductions have also been most pronounced, but also where the largest glut of tonnage is set to hit.

This balancing act is further aided by coordinated alliances which are managing supply through blanked sailings, the potential for significant cascading as older smaller vessels are retired in disproportionate numbers, and ongoing rolling slippage which will make this vessel influx easier to digest.

With second hand asset prices falling precipitously compared to newbuild prices, owners become more likely to redirect their increasingly limited resources toward on-the-water assets as opposed to more expensive newbuilds which, for the larger vessels, may not be delivered until 2026 and beyond.

Overall, I'm personally becoming more open to the possibility that this influx of newbuilds may not be as disruptive to the market as originally envisioned. Of course, there are still many variables which could surface over the next couple years, but nevertheless, these recent developments appear to be encouraging.

The end of 2023 through mid-2024 presents a key timeline for determining the true impact of these developments as well as establishing the foundation for a multi-year outlook as more clarity emerges.