Fly View Productions

The ProShares Ultra Financials ETF (NYSEARCA:UYG) tracks an underlying index of large-cap US financials in a typical value weighted fashion. However, it does so with daily 2x leverage, where daily returns are matched with a 2x factor. While leveraged ETFs aren't that well suited for longer-term calls, there is a fair bit to say for how the big guys would benefit from consolidation in banking and a two-tier banking system. The key consideration is that folding assets into a too-big-to-fail umbrella is an easy source of value-add, and that the big financial players get to buy up smaller ones for insolvency multiples.

First, Leveraged ETFs

Because they reset daily after mimicking changes in the index that day by a 2x factor in the case of UYG, there is the problem of value erosion. While a 2% rebound after a 4% drop isn't so bad for the underlying index, having a 6% drop and a 3% rebound is more of a problem. There is a reason why Warren Buffett's #1 rule is, don't lose money. If you lose money, you have less to recover with, meaning for every drop you need a bigger percentage recovery to bring you back to square 1. If an asset drops 33%, you need an almost 50% recovery to recover. If an asset drops 50%, you need 100% recovery to breakeven. Even if the next day is a bigger rebound than what you lost the previous day, with leveraged ETFs it is still less helpful even if the recovery gets doubled because more money was lost the prior day.

If you don't fully understand these risks, do not proceed with a leveraged ETF. They are best used over short durations because of value erosion. They are highly speculative burst instruments.

Links for reference on these risks:

Banking Comments

Regional banking accounts for about 20% of the US banking assets – a little less now with the collapse of SVB which was almost 1% of total US banking assets, and a massive regional player. Solvency issues and deposit beta risks mean that the no-brain move is to have assets at too-big-to-fail institutions instead of regional banks. While some regional banks will survive, there remains no real reason to prefer a regional bank except for the need of these institutions to provide better savings rates – the risks are higher after all. With the advantages of being a big player, and the fact that regional companies typically get banked by regional players, the whole banking system is likely become more of a two-tier system – a more unfair one and simply a natural result of capitalism. With hawkishness continuing, and regulators happy with the solution of regional banks getting absorbed by big players, we should continue to see regional banking failures and more consolidation into the big leagues here and there.

Large institutions provide massive value add to regional banking assets by providing a 2B2F umbrella while getting insolvency multiples. It's an advantaged situation, and while deposit beta is still bad for the big players, it's not a new concern and the lack of recovery in large-cap financials isn't that sensible in our view given the long-term likelihood of rates eventually coming down.

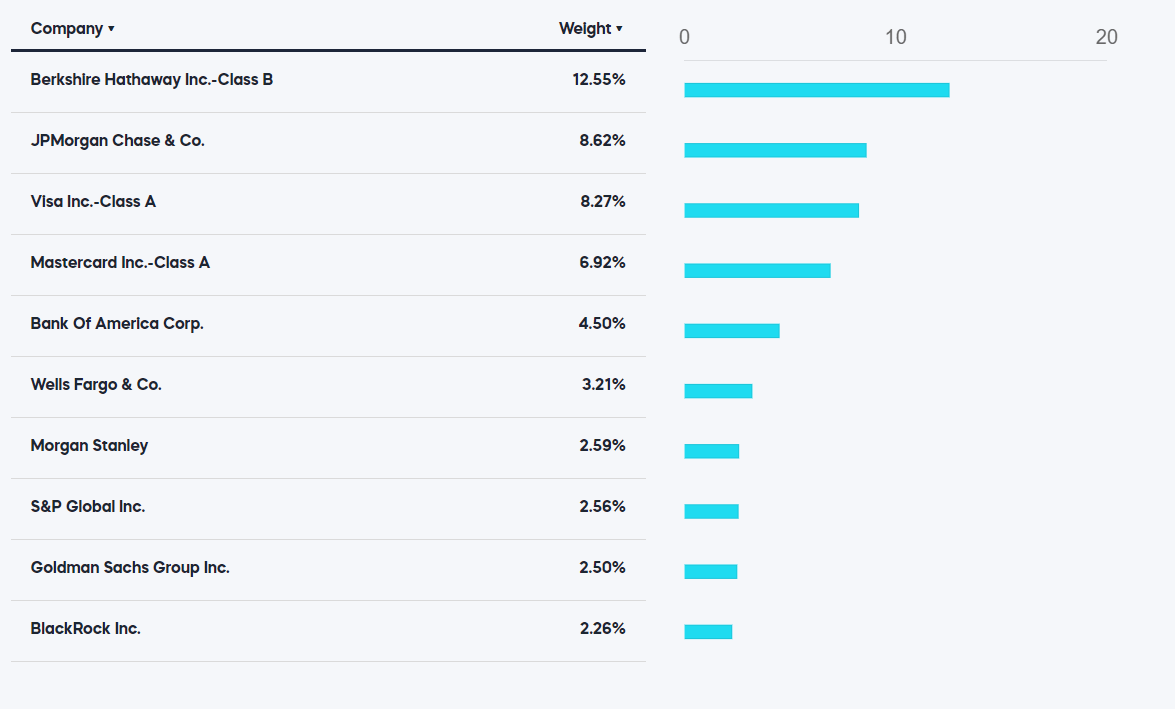

UYG tracks the S&P Select Financials ETF which looks a little like this in its top holdings – large-cap financials, moreover not just banking but insurance.

Top Holdings (proshares.com)

Bottom Line

Insurance occupies some of the UYG exposures. It is neither here nor there – pricing power is good, policy growth continues in our coverage universe and there's no reason to not expect some level of sustained earnings growth, enough to not disappoint markets. Banking, as said, probably has a bit more chance of recovery.

- ➤【 HIGH-PERFORMANCE CAR JUMP STARTER...

- ➤【 SMART CORDLESS INFLATOR WITH LCD SCREEN 】...

- ➤【 ESCORT YOUR SAFETY 】Thanks to the...

- ➤【 ALL-IN-ONE JUMP STARTER 】Say goodbye to...

- ➤【 WHAT YOU GET & WARRANTY 】YabeAuto YA70...

- 【UNIVERSAL FIT KIT】- The kit contains 23 types...

- 【TOP QUALITY】- These car retainer clips are...

- 【PREFECT FOR WHAT YOU NEED】 - Up to 680 pieces...

- 【BONUS ACCESSORIES】- We provide different size...

- 【WIDE APPLICATION】- Professional push clips...

- Powerful Car Jumper Starter - The Scatach 011 jump...

- Advanced Safety Features - Easy to opearte, and...

- Portable Design - This portable car battery...

- Respond to Emergencies - Portable power bank with...

- What will you Get ? - Scatach 011 Car Starter...

- 【What You Get】1*Tactical Molle Seat Back...

- 【Military Molle System - Lots Of...

- 【Durable and Long Lasting】 MOLLE seat back...

- 【Tactical Seat Covers Universal】 The size of...

- 【Guarantee】If you're not 100% satisfied with...

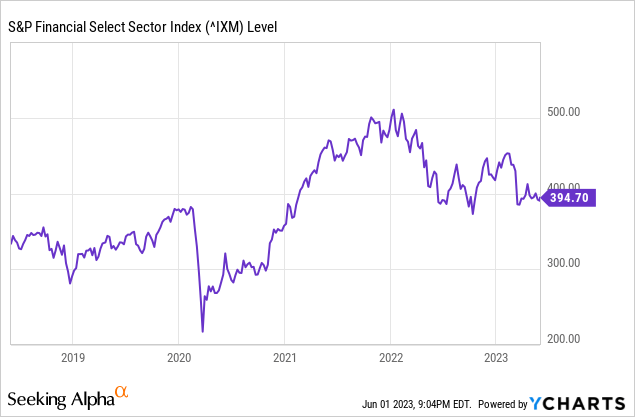

Data by YCharts

Not really recovering from March 2023 levels, with the whole index having stalled some years now since the onset of the pandemic, is not a bad set up considering the corporate benefits that come to the top from a banking consolidation. UYG is mostly exposed to this.

Expense ratios are 0.95%, which is a cheap way to get access to leverage. Of course, value erosion can occur over longer periods due to the daily resets, so UYG may not be the best instrument to capture this banking consolidation factor, but fundamental factors probably play somewhat in favour of this ETF despite broad recessionary pressures.

The IoT Connectivity Landscape