The Schwab U.S. Dividend Equity ETF holds well-diversified, high-quality stocks with economies of scale.SCHD offers reasonable valuations, a high dividend growth rate, and a low expense ratio.With shares trading closer to the 52-week low, SCHD has potentially less downside risk compared to the S&P 500.

It’s been 3 months since I last covered the Schwab U.S. Dividend Equity ETF (NYSEARCA:SCHD) here back in early July, but it seems much longer than that, considering all the economic news that’s happened since then.

For one thing, interest rate uncertainty continues to be a headwind for both stocks and bonds alike, and perhaps that’s one reason for why SCHD has given investors a -3% total return since my last piece, matching the 3% decline in the S&P 500 (SPY) over the same timeframe.

In this piece, I revisit SCHD and discuss why now may be a great opportunity to add to this quality ETF while the bus hasn’t left the station, so let’s get started!

Why SCHD?

Nobody said investing was easy, and unless if you can come up with a world-class computer algorithm that is ever-changing, you’re probably not good at timing market bottoms and peaks. That’s why many investors may adopt an ‘if you can’t beat them, join them’ attitude of sticking with market-beating, higher income ETFs like SCHD.

SCHD, founded by leading asset manager Charles Schwab (SCHW) in 2011, takes the guesswork out of picking individual stocks as it seeks to track the total return of the Dow Jones U.S. Dividend 100 index. The companies that are large enough to be in this index typically carry significant competitive advantages through economic moats and economies of scale.

In addition, they also carry efficient capital structures, as they typically don’t rely on a high share price to do equity raises to fund growth. That’s because SCHD doesn’t hold any REITs or Master Limited Partnerships, many of which do require equity raises to fund growth and pay dividends that are at least partially taxed at the higher ordinary tax rate.

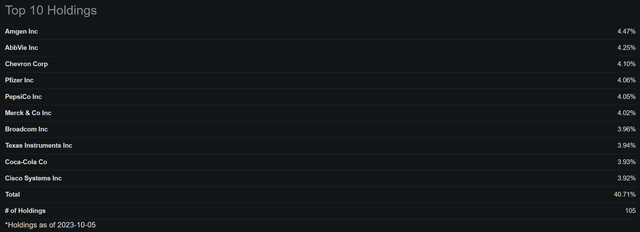

SCHD’s top holdings are well diversified, including higher yielding, moat-worthy names in the pharmaceutical, energy, consumer staples, and technology sectors such as Amgen (AMGN), Chevron (CVX), PepsiCo (PEP), Broadcom (AVGO), and Texas Instruments (TXN). Note that SCHD’s top holdings are subject to change due to market performance, such as the case with its top holding, Amgen, which has seen positive share price performance due to strong operating fundamentals in its last reported quarter.

SCHD has underperformed the S&P 500 with a 4.6% total return compared to SPY’s 17% over the past 12 months. That’s because the latter index’s tech-heavy nature has benefitted from the material rise in the prices of Amazon (AMZN), Google (GOOG), and Netflix (NFLX), among others. However, the valuations of these non-dividend paying companies have gotten stretched as of late, making them more vulnerable to higher interest rates, especially considering that the market is now anticipating a higher for longer rate environment.

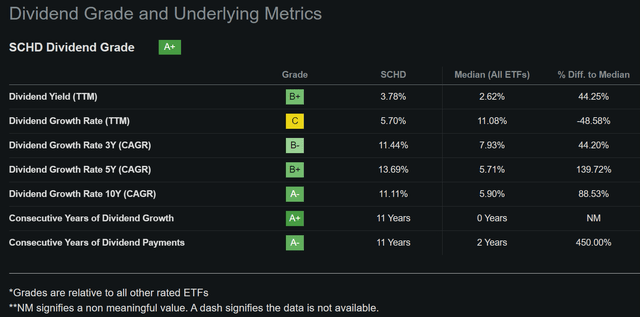

The 3 aforementioned tech giants trade at stretched valuations ranging with PEs of 24x for GOOG, 31x for NFLX, and 57x for AMZN. By comparison, SCHD’s top 3 holdings trade at far more reasonable valuations, with AMGN at 14.6x, AbbVie (ABBV) at 13.4x, and Chevron (CVX) at 11.8x. Some may argue that SCHD’s dividend paying strategy means that the stocks are in slow or no-growth industries. However, that’s simply not the case, considering that SCHD has seen a high dividend growth rate over the long-run with 5 and 10-year Dividend CAGRs of 13.7% and 11.1%, respectively.

As most savvy investors know, a decent dividend yield (SCHD’s current yield is 3.8%) combined with an above-average growth rate and low underlying valuations is a recipe for outperformance over the long run. As shown below, SCHD has outperformed the SPY over the past 3 years from a total return standpoint, with a 36.6% return compared to the 34.1% of SPY.

Risks to SCHD include many of the same ones for the broader market. For one thing, higher interest rates mean that investors have a lot more options to choose from, including high-yielding corporate bonds, Bank CDs, and U.S. Treasuries. This may make it less appealing for investors to buy SCHD’s underlying equity holdings, which are considered to be riskier than fixed income. In addition, risks for a hard landing in the economy are now elevated considering that the Fed’s interest rate hikes may have gone too far, and inflation has potential to cool below the Fed’s targeted 2% rate should consumer sentiment turn negative.

While these are real risks in the economy right now, I believe SCHD’s current share price of $69 already bakes in some of those risks, perhaps even more so than the S&P 500. This is reflected by SCHD now sitting toward the low end of its 52-week trading range.

This appears to be a relative undervaluation compared to the broader market. As shown below, the S&P 500 remains pricey from a technical standpoint, as it sits well above the middle of its 52-week trading range.

Last but not least, SCHD remains a good option for investors who like value, as it charges a low expense ratio of just 0.06%, sitting it well under the 0.48% median across the ETF universe. Having a low expense ratio is important, especially for long-term investors, who would benefit most from SCHD’s high dividend growth rate combined with a low compounding expense ratio.

Investor Takeaway

Overall, trying to time an absolute bottom is an ineffective strategy for long-term investors. Instead, it may be beneficial to adopt an investing strategy of buying a basket of quality companies with strong competitive advantages and efficient capital structures at reasonable valuations, such as those found in SCHD’s holdings.

With its low expense ratio and consistent dividend growth, SCHD can provide stable income and potential long-term outperformance for investors looking to build a diversified portfolio. Plus, I see SCHD as having more upside potential compared to SPY in the near-term, considering that the market has already baked in more risks into the former’s price compared to the latter.

Enjoyed this article? Sign up for our newsletter to receive regular insights and stay connected.