By Alejandro Saltiel, CFA, Head of Indexes, U.S.

The WisdomTree International Quality Dividend Growth Index (WTIDG) and the WisdomTree International Hedged Quality Dividend Growth Index (WTIDGH) will have their 10-year anniversary at the end of November.

WTIDG is tracked by the WisdomTree International Quality Dividend Growth Fund (IQDG), while WTIDGH is tracked by the WisdomTree International Hedged Quality Dividend Growth Fund (IHDG), which hedges exposure to international currencies for a USD-based investor. The stock portfolio of both Indexes is the same, with WTIDGH hedging currency exposure using forward currency contracts.

Since its inception, the investment objective of the strategy has remained consistent, providing investors with exposure to companies that look attractive across measures of profitability, like return on equity (ROE) and return on assets (ROA), and earnings growth prospects. Weighting is by Dividend Stream® keep valuations in check.

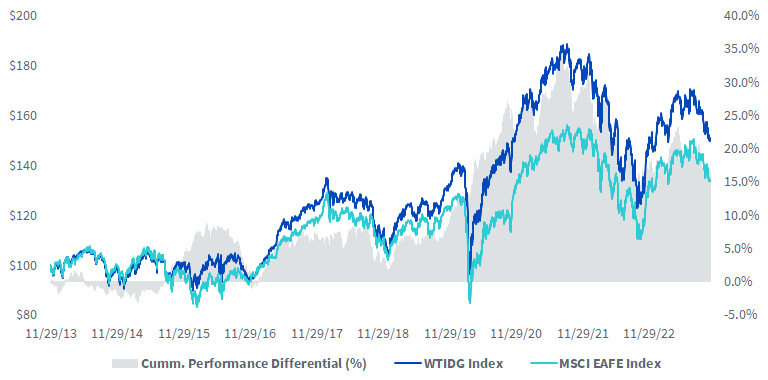

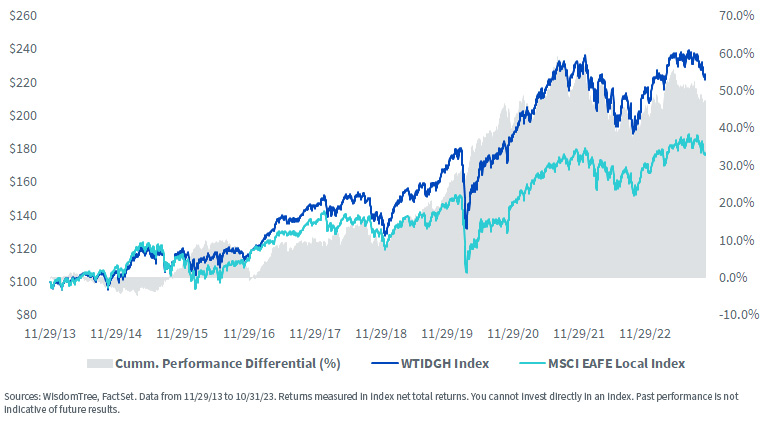

WisdomTree’s way of assessing a company’s quality (profitability) and its ability to grow dividends has allowed WTIDG to outperform the MSCI EAFE Index by 1.22% annually over these almost 10 years. WTIDGH has outperformed the MSCI EAFE Local Index by 2.55% annually during the same period.1

Employing currency hedging during this period had a significant impact on performance, given USD strength. WTIDGH was up 8.48% annually, while WTIDG was up 4.22%. Along with doubling performance, WTIDGH’s annualized volatility was almost 2 percentage points lower (13.02% vs. 14.98%) compared to WTIDG.

For a deeper dive into the impact of currency hedging, refer to a recent blog post by my colleague Bradley Krom.

USD Returns: Growth of $100

For definitions of terms in the chart above please visit the glossary.

Hedged Returns: Growth of $100

WTIDG is part of WisdomTree’s Quality Dividend Growth family, whose oldest index, the WisdomTree U.S. Quality Dividend Growth Index, also turned 10 in April of this year.

Index Methodology

The methodology for WTIDG’s annual rebalance, which happened on November 8, can be explained in the following stages:

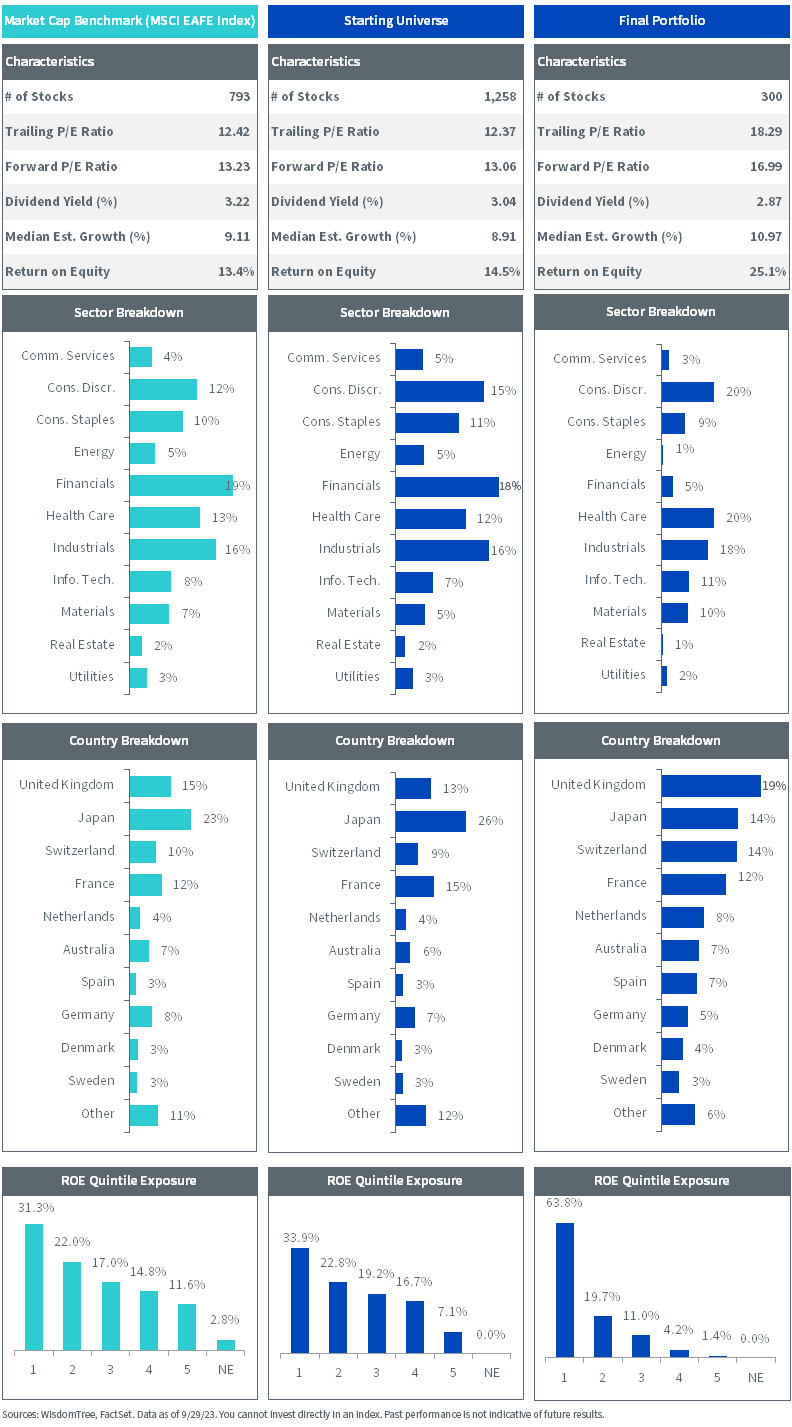

1. Starting Universe: The Index’s starting universe consists of dividend-paying developed international2 equities that meet WisdomTree’s liquidity requirements and whose market caps exceed $1 billion. Companies whose dividend coverage ratios are less than 1 (i.e., dividends exceed earnings) are removed, as are companies flagged as risky by WisdomTree’s Composite Risk Score (CRS).

2. Composite Score Selection: Companies are then ranked based on an equally weighted composite score of growth and quality. Growth is defined as consensus estimated earnings growth over the next one to three years, while quality is calculated as a 50/50 score of the company’s average three-year ROE and ROA. The top 300 companies are selected for the portfolio.

3. Final Portfolio: The 300 companies selected are weighted by Dividend Stream to reflect the proportionate share of aggregate cash dividends. An individual holding cap of 5% is applied prior to a 20% country cap and a 20% sector cap for all sectors except Real Estate (15%).

The chart below highlights the stages of WTIDG’s latest rebalance in November 2023 and compares portfolio characteristics with those of the MSCI EAFE Index (teal).

For definitions of terms in the charts above, please visit the glossary.

- ➤【 HIGH-PERFORMANCE CAR JUMP STARTER...

- ➤【 SMART CORDLESS INFLATOR WITH LCD SCREEN 】...

- ➤【 ESCORT YOUR SAFETY 】Thanks to the...

- ➤【 ALL-IN-ONE JUMP STARTER 】Say goodbye to...

- ➤【 WHAT YOU GET & WARRANTY 】YabeAuto YA70...

- 【UNIVERSAL FIT KIT】- The kit contains 23 types...

- 【TOP QUALITY】- These car retainer clips are...

- 【PREFECT FOR WHAT YOU NEED】 - Up to 680 pieces...

- 【BONUS ACCESSORIES】- We provide different size...

- 【WIDE APPLICATION】- Professional push clips...

- Powerful Car Jumper Starter - The Scatach 011 jump...

- Advanced Safety Features - Easy to opearte, and...

- Portable Design - This portable car battery...

- Respond to Emergencies - Portable power bank with...

- What will you Get ? - Scatach 011 Car Starter...

- 【What You Get】1*Tactical Molle Seat Back...

- 【Military Molle System - Lots Of...

- 【Durable and Long Lasting】 MOLLE seat back...

- 【Tactical Seat Covers Universal】 The size of...

- 【Guarantee】If you're not 100% satisfied with...

Rebalance Highlights

WTIDG’s starting universe already shows a quality tilt coming from removing non-dividend payers and companies whose dividends exceed earnings or are at risk of cutting their dividend payments as identified by the CRS score (higher aggregate ROE than the MSCI EAFE and higher/lower exposure to highest/lowest ROE quintiles).

Upon selecting the 300 best-ranking companies on the composite score of growth and quality and Dividend Stream weighting the basket, the portfolio exhibits stronger quality and growth characteristics. Aggregate ROE exceeds the MSCI EAFE by more than 12%, and the median estimated growth of the portfolio is 2% higher. Almost two-thirds of the weight is allocated to the highest-ROE companies. The valuation of the portfolio is higher than the MSCI EAFE, showing a premium that some of these profitable growers have. And the dividend yield of the basket is in line with the market.

Sectors like Health Care and Consumer Discretionary are over-weights, while Financials are under-weight. The portfolio also over-weights Spain, Switzerland, Netherlands and the UK and under-weights Japan and Germany.

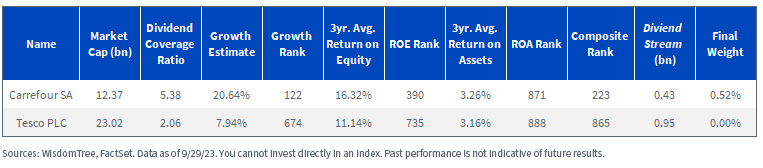

Showing further granularity into the Index methodology, below is an example of the parameters used in the 2023 rebalance for two comparable companies, Carrefour SA and Tesco Plc. Both are Consumer Staples that operate physical and online supermarkets.

Tesco’s revenues are concentrated in the UK, with more than 90% coming from that market. Carrefour’s business is primarily located in France but is more diversified, generating 27% of revenue from the rest of Europe and north of 20% in Latin America.

Carrefour made it into the final portfolio rebalance, while Tesco was not included as it did not rank in the top 300 names on the composite score of growth and quality.

As seen below, Carrefour’s growth estimate over the next three years far exceeds that of Tesco, and along with a higher three-year average ROE, it made it into the top 300 names.

Carrefour’s $430 million of trailing 12-month dividends represents 0.42% of the total $101.26 billion of all 300 names selected into the basket. Thus, its final weight after single stock, country and sector adjustments was 0.52%.

For definitions of terms in the charts above, please visit the glossary.

How to Incorporate IQDG/IHDG into Portfolios

Whatever the view is on currency hedging, we believe that WisdomTree’s methodology of selecting profitable dividend growers in IQDG/IHDG can be a good core exposure for an investor’s international portfolio. A complementing exposure to the WisdomTree Japan Hedged Equity Fund (DXJ) would help address some of the valuation premium that exists for high-quality names and increase exposure to the Japanese market, which we believe has room for further growth. An 80/20 exposure to IQDG/IHDG and DXJ would result in an over-weight to Japan and reduce the position’s trailing P/E to 16.2x.

1 Sources: WisdomTree, FactSet. Data from 11/29/13 to 10/31/23.

2 Developed international countries: Japan, the 15 European countries (Austria, Belgium, Denmark, Finland,

France, Germany, Ireland, Italy, Netherlands, Norway, Portugal, Spain, Sweden, Switzerland, United Kingdom), Israel, Australia, Hong Kong and Singapore.