DKosig

Originally posted on March 06, 2024

By Adila McHich

At A Glance

As uncertainty continues to surround commodity markets, traders are searching for ways to navigate an environment with new risks emerging almost daily. More of them are finding their tool of choice in short-term options.

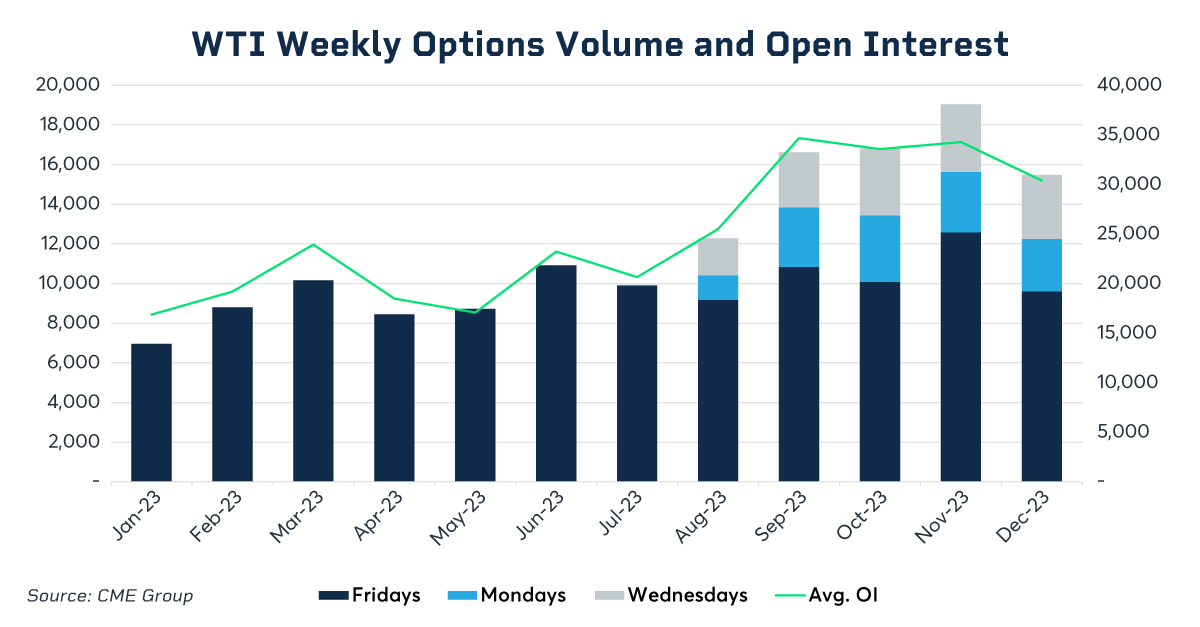

These refer to a class of options with shorter tenors than the conventional options, which typically expire monthly. In the oil market, WTI weekly options have become the fastest-growing energy products at CME Group, reaching record highs in trading volume.

WTI Crude Oil Weekly options volume continues to break records.

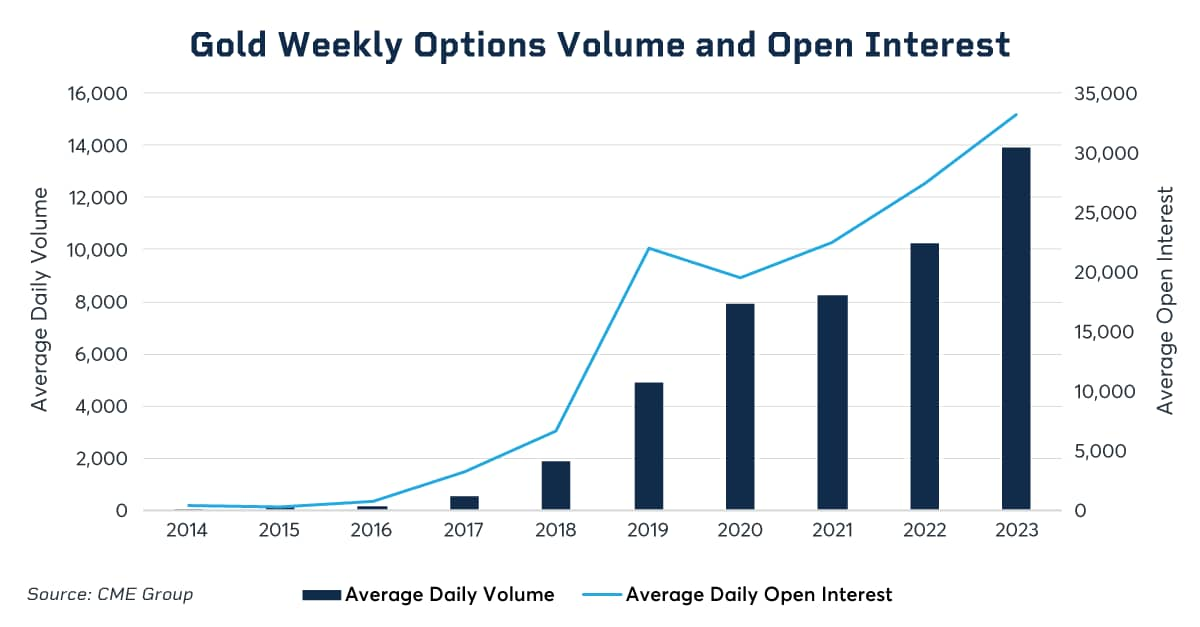

Gold weekly options reached new highs in 2023

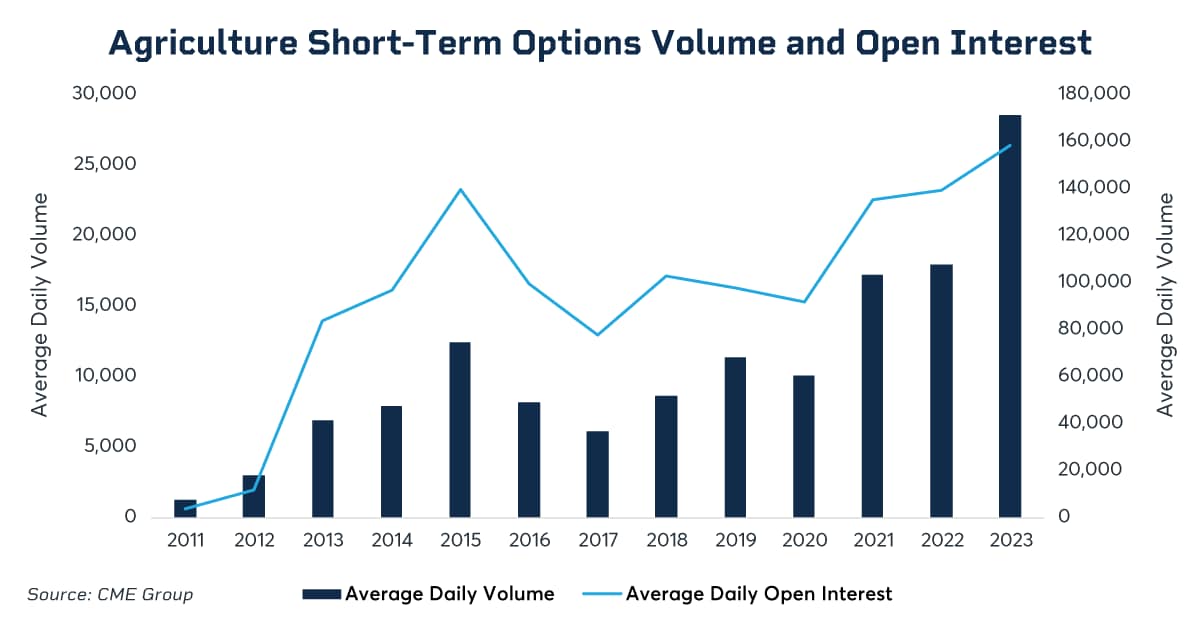

Agriculture Short-Term Options volume continues to reach new records

Why Have Short-Term Options Become Popular?

The short tenor provides more flexibility to traders to adjust their portfolios more frequently in response to sudden market events regardless of their time horizons. In addition, short-term options have lower premiums because there is less time for market conditions to change. The increased interest and fast adoption of short-term options are attributed mainly to these reasons:

Rising Interest Rates: The current economic environment is characterized by a high degree of uncertainty. Central banks around the world have embarked on increasing interest rates to curb inflationary pressure which has subsequently discouraged investment and consumer spending. Also, high debt levels are adding another layer of uncertainty to the economic picture. These market conditions have increased the volatility of commodities prices.

- ➤【 HIGH-PERFORMANCE CAR JUMP STARTER...

- ➤【 SMART CORDLESS INFLATOR WITH LCD SCREEN 】...

- ➤【 ESCORT YOUR SAFETY 】Thanks to the...

- ➤【 ALL-IN-ONE JUMP STARTER 】Say goodbye to...

- ➤【 WHAT YOU GET & WARRANTY 】YabeAuto YA70...

- 【UNIVERSAL FIT KIT】- The kit contains 23 types...

- 【TOP QUALITY】- These car retainer clips are...

- 【PREFECT FOR WHAT YOU NEED】 - Up to 680 pieces...

- 【BONUS ACCESSORIES】- We provide different size...

- 【WIDE APPLICATION】- Professional push clips...

- Powerful Car Jumper Starter - The Scatach 011 jump...

- Advanced Safety Features - Easy to opearte, and...

- Portable Design - This portable car battery...

- Respond to Emergencies - Portable power bank with...

- What will you Get ? - Scatach 011 Car Starter...

- 【What You Get】1*Tactical Molle Seat Back...

- 【Military Molle System - Lots Of...

- 【Durable and Long Lasting】 MOLLE seat back...

- 【Tactical Seat Covers Universal】 The size of...

- 【Guarantee】If you're not 100% satisfied with...

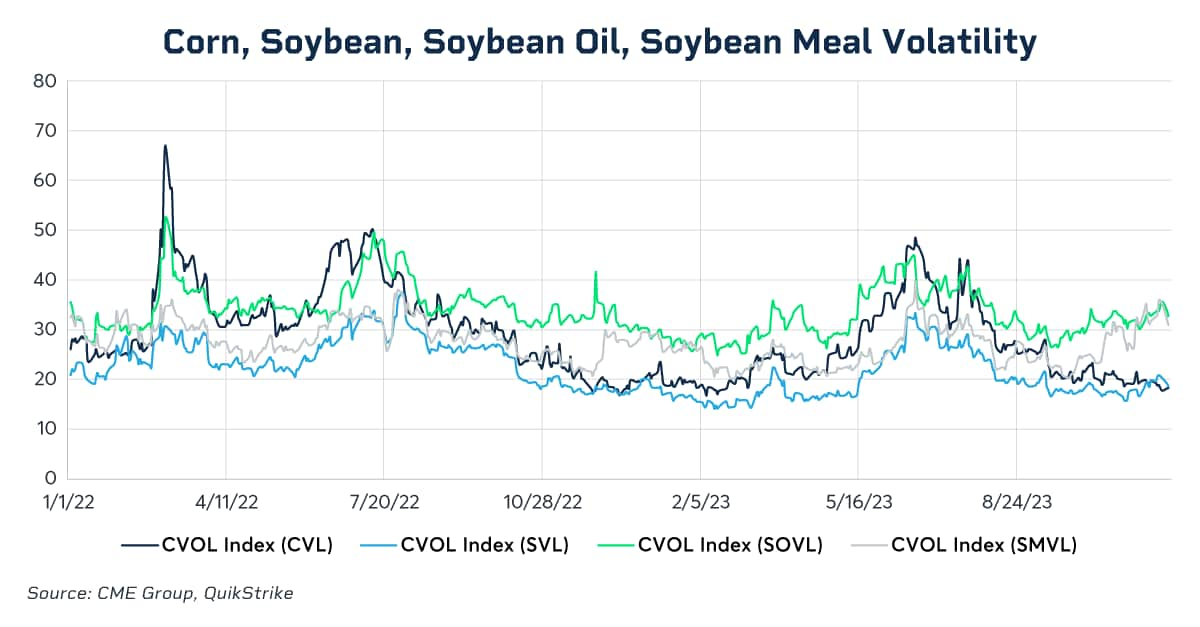

Weather Events: Weather has heightened the volatility of certain commodities, especially the soybean market, where drought impacted both the 2023 U.S. harvest and the 2024 Brazil harvest. For illustration, the chart below shows the heightened volatility of the soybean market, reflected in the CME Group Volatility Index known as CVOL. This tool measures the expected volatility implied from options prices based on the collective market sentiment of future price movements.

Drought and weather events in key soybean-producing regions have induced volatility in these markets.

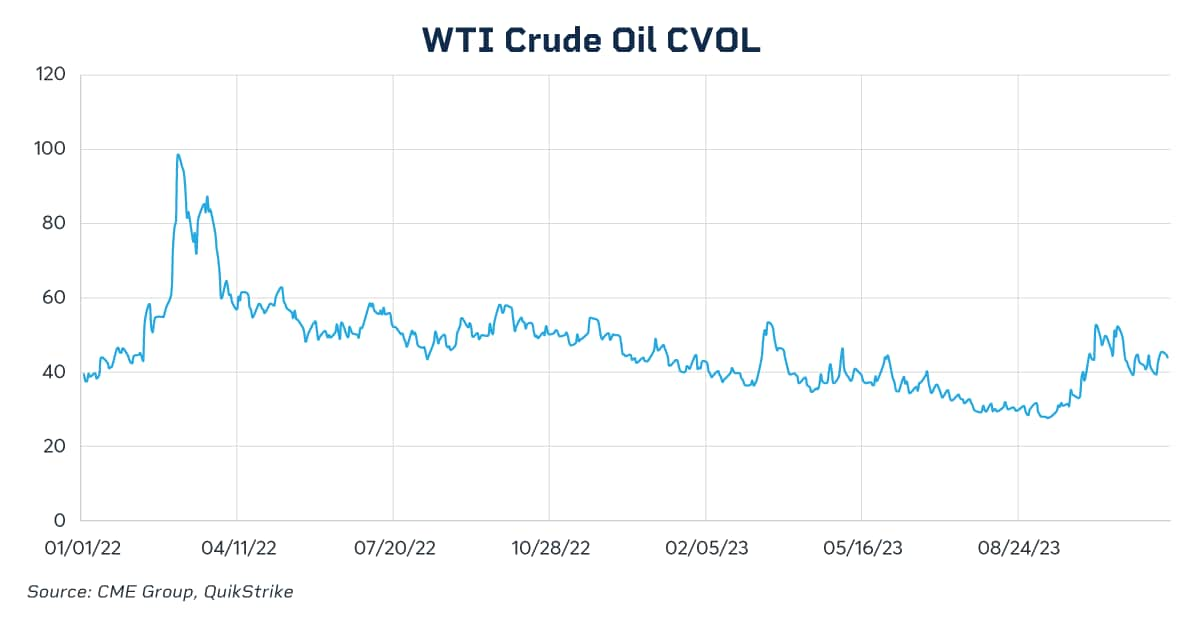

Elevated geopolitical risk: The Russo-Ukrainian war has considerably impacted commodities and caused supply disruptions in oil, natural gas, corn, and wheat. For example, oil prices reached $120 per barrel in March 2022. Wheat rose to $12 per bushel while corn spiked to $8 per bushel in March 2022. Prices have since fallen, but they are still higher than before the war. On the other hand, the Israeli-Palestinian conflict and the Red Sea attacks are increasingly destabilizing the region and impacting oil prices.

WTI CVOL jumps, signaling traders brace for more turbulence in the oil market

Listing of new set of expiration dates: The expansion of short-dated options has offered greater customization opportunities for traders. This optionality allows traders to mitigate short-term risks of either macro or commodity-specific market events in a precise fashion. The extensive listing has attracted a wide range of market participants with different risk profiles and trading strategies. In addition, more frequent listing of expirations enhances market efficiency and price discovery function because the market has more data points to determine the fair price.

In the trading world, uncertainty creates the need for flexibility. With plenty of risks to manage across commodities, activity in short-dated options should continue to be a gauge of how traders are viewing commodity markets.

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.