Several years ago, back in fiscal year 2020, I was asked to write about a company Pantheon Resources Plc (OTCQX:PTHRF) which had attracted a whole lot of attention for “discovering” a large amount of reserves. But I favored another Canadian operator whose price was in nearly the same range at the time, Baytex Energy Corp. (NYSE:BTE) even though they delisted from the NYSE before recently rejoining. This article will look at the two companies four years later along with their respective “discoveries”. It gives an oil and gas investor a typical result when comparing a penny stock to an established company whose stock fell into the penny stock range.

The reason was that Baytex Energy had a discovery as well that has been every bit as challenging as Pantheon’s discovery. But it had an ongoing business that, I believed, would see it through while the challenging discovery was worked on while Pantheon had no obvious source of income. Furthermore, as the article noted, some very big “names” had given their share of this “discovery” to the company (Pantheon) for a nominal amount.

Pantheon Resources First

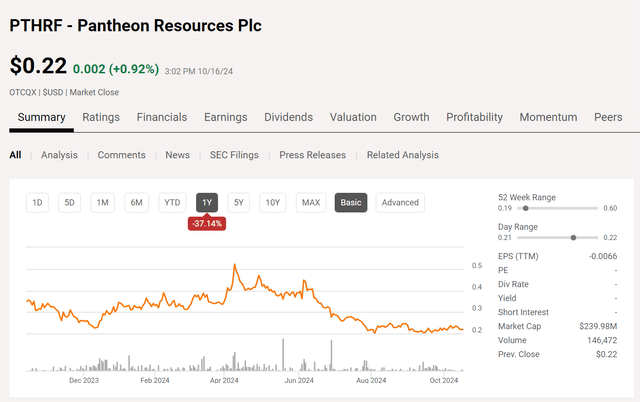

Pantheon Resources’ stock price at first ran up with a lot of oil and gas stocks as the recovery from fiscal year 2020 proceeded. Traders could have made a fortune in this stock as long as they knew when to walk away.

But no rally lasts “forever” unless earnings and cash flow follow.

Pantheon Resources Common Stock Price History And Key Valuation Measures (Seeking Alpha Website October 16, 2024)

As the chart has made clear, earnings, and cash flow clearly did not follow. Instead, there has been one challenge after another with the discovery. The reserve report turns out to not mean much without earnings and cash flow. This industry has a whole lot of reserves that are not cost-competitive to produce. Therefore, a discovery notice of a lot of reserves means little unless those reserves can be profitably produced.

From the chart above, the average investor can guess that this is still a development stage or concept company that is really not much further along than it was 4 years ago. Therefore, there is not a lot of hope for what was the crowd favorite at the time.

Baytex Energy

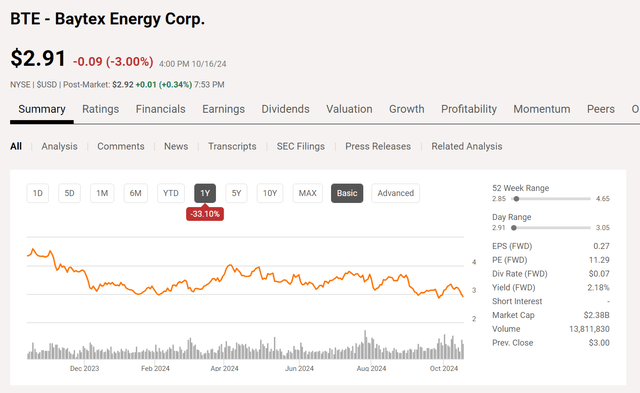

Baytex Energy, on the other hand, had a business that was producing both cash flow and earnings. Even though the fiscal year 2020 hit the industry very hard, this company had a way to recover from it as the stock price shown in the chart below:

Baytex Energy Common Stock Price History And Key Valuation Measures (Seeking Alpha Website October 16, 2024)

The stock is now paying a dividend and has a reasonable price-earnings ratio. Any arguments about valuation are not even close to the arguments made about Pantheon Resources. However, like Pantheon Resources, Baytex has been working on its discovery all these years. But the cash flow from the ongoing business has funded the efforts and now those efforts are heading towards production without a whole lot of outside funding needed.

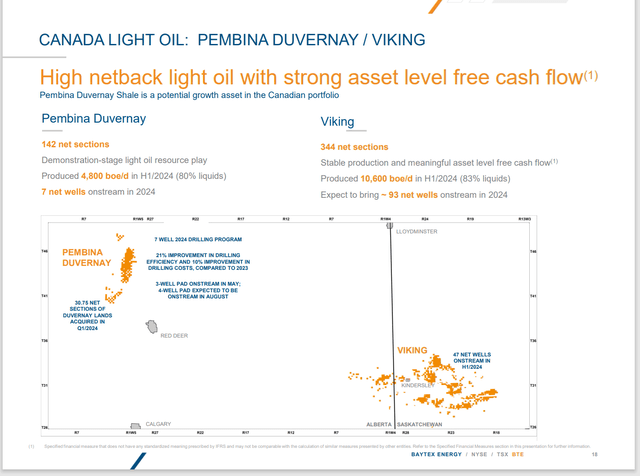

Baytex Energy Summary Of Pembina Duvernay And Viking Acreage Operations (Baytex Energy Corporate Presentation October 2024)

As shown above, the Pembina Duvernay was the discovery mentioned at the time with a whole lot of light oil reserves that the company needed to work on to get the costs to an acceptable level.

As shown above, the “demonstration phase” means that those costs are getting to that level. Long-time readers know that the Duvernay has been an emerging play thanks to technological advances that have revolutionized an old producing area that fell out of favor for a while as other areas gained a cost advantage. Now that process appears to be reversing at least somewhat.

The result is that Baytex Energy is likely to realize the value of the Pembina Discovery announced in the earlier article.

The company also had an advantage in that some of its Eagle Ford acreage was operated by Marathon Oil Corporation (MRO). It turns out this acreage could use some information gleaned as a partner to Marathon Oil in the Eagle Ford. That probably saved a whole lot of costs when it came to coming up with a competitive way to produce these reserves.

But the key idea here is that it took (very roughly) four years to get to the “demonstration stage”. This acreage has contributed next to no earnings or cash flow to Baytex during that whole time period.

Eagle Ford Acreage

In the meantime, Baytex Energy recently acquired more Eagle Ford acreage which also is likely the beneficiary of that partnership with Marathon Oil.

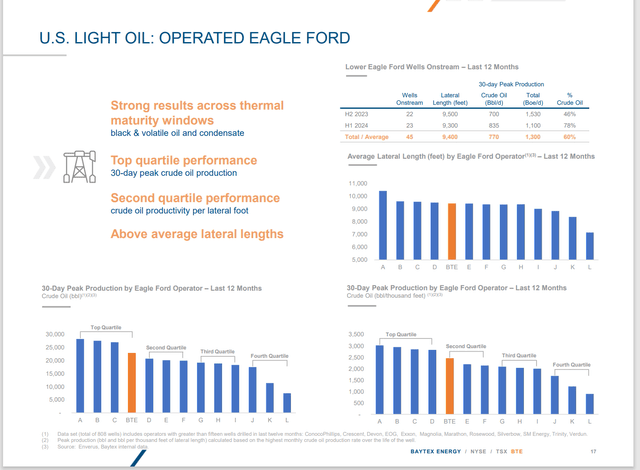

Baytex Energy Operated Eagle Ford Progress Summary (Baytex Energy October 2024, Corporate Presentation)

The operated Eagle Ford progress summary is shown above. Probably the key part of the slide is on the upper right-hand side where the oil percentage of production has shot up. Many operators are not making much (and more than a few lose money) producing natural gas. Therefore, the oil production increase is very material to earnings and cash flow given the current supply and demand conditions for natural gas.

Now management will likely discuss how all of this translates into better corporate profitability as the acquired assets get optimized. But it is clear that the third quarter profit comparison should continue to improve as the time of ownership of these assets lengthens.

Remember that the company inherits the seller’s costs initially. As the improvements shown above become more material, the average cost of production of the acquired acreage drops. Since the first-year production decline of new wells is roughly 60%, most unconventional fields have an average decline rate of 30%. That means that new wells become significant rather quickly.

Furthermore, continuing productivity enhancements as technology advances likely ensure that the average production costs on this acreage will continue to decline for years to come.

Clearwater Discovery

Another advantage that Baytex had was that the cash flow from the Ranger Oil acquisition enabled another discovery that the company could take advantage of right away.

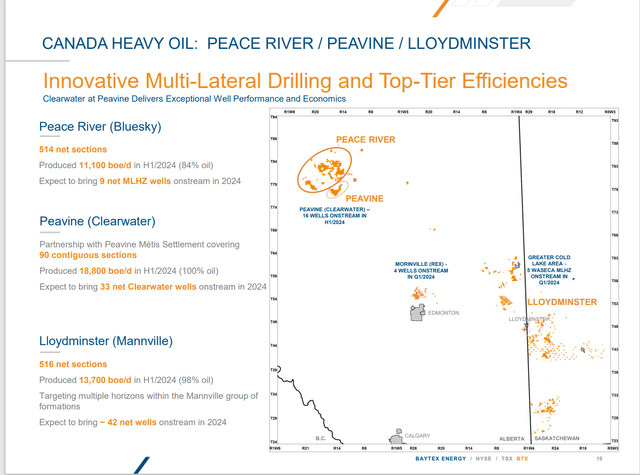

Baytex Energy Heavy Oil Summary (Baytex Energy October 2024, Corporate Presentation)

Back when the first article was written (compared to Pantheon Resources), this was not even a consideration at the time because heavy oil had high breakeven points back then whenever the discount to WTI pricing widened during cyclical downturns. That meant that heavy production got shut in, and the company used the light oil cash flow to get through cyclical downturns.

However, the Clearwater Play wells have exceeded a 500% return in the current environment which is far exceeding anything else in the portfolio. The acquisition of more light production has meant more production of those 500% returns and more cash flow. Baytex “fell into this discovery” by being in the heavy oil business (profitably) while keeping up with industry advances. This is something that Pantheon cannot do without another source of income.

Now this company and others are trying some techniques learned from the Bluesky formation to see if the results are competitive with the Clearwater formation.

Summary

The key is that the ongoing business and resulting cash flow made all of these possibilities possible. Pantheon, on the other hand still has to raise money from time to time to keep going. While Pantheon could still “hit it big” at any time in the future, Baytex Energy has already “hit it big” and may well have the chance to “hit it bigger” thanks to the cash flow generation.

Pantheon Resources still has a going concern clause related to the fact that periodic cash raises are necessary. Management is hopeful to achieve some level of production in fiscal year 2025. But it takes money to get there. The issue with a company like this is that oftentimes, the dilution far exceeds the eventual benefits. Whether that happens with this company depends upon many factors including when the investor decides to invest.

In the meantime, Baytex Energy common has appreciated more than 1,000% from the original article and it has sustained that appreciation. There are plenty of possibilities for the company to build upon the existing business to do even better in the future. This company has solid prospects for the stock price to double at least over the next five years.

Risks

Any upstream company is subject to the volatility and low visibility of future commodity prices. A severe and sustained cyclical downturn could materially change the outlook of the company (like Baytex). In the case of Pantheon, a severe and sustained downturn could render the company’s future sources of income noncompetitive.

Pantheon Resources is subject to a going concern discussion in the financial statements. That alone should disqualify this as an investment idea for most investors. A going concern statement is for professionals with the training to properly handle the situation because they know when to walk away and “not look back ever again”.

Both companies depend heavily upon continuing technological advances to either make or keep ongoing businesses and business ideas competitive. Should those technology advances stop tomorrow, that could have a material effect on the prospects of both companies. It could prove fatal for Pantheon Resources.

The attractiveness, of Pantheon Resources is that there is always one of them that succeeds. This usually encourages a lot of investors to want to be invested in the next success story. But the chances of success of any one company like this are so low that the strategy often fails badly enough to leave the investor broke. There is a world of difference between buying a lottery ticket (if you will) like this company with one-quarter-of-one-percent of the portfolio and going “all in”. Most do not have the discipline to ignore the lure of a company like this to keep the investment small.

A loss of key personnel could materially affect any company’s future.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Enjoyed this article? Sign up for our newsletter to receive regular insights and stay connected.