It’s often said that small cap value is one of the most potent factor combinations, one which handsomely rewards investors over the long-term. How well that thesis plays out over time remains to be seen, but for investors in 2021, small-cap value is obliterating other factors.

Source: Why Is Small Cap Value Trouncing Other Combos in 2021?

One particular asset to watch is the Invesco S&P SmallCap 600 Pure Value ETF (RZV).

Research from Dimensional Fund Advisors cited by the Financial Times indicates for the six months ending March 31, the gap between small cap value and large cap growth is as wide as its been since 1943.

Through the first five months of 2021, RZV is living up to the billing. The Invesco exchange traded fund is higher by 47.7%, as of June 1. The S&P 500 and the S&P 500 Growth Index are up 12.6% and 7.8%, respectively.

What’s Fueling RZV?

Pinpointing the catalysts for RZV’s staggering outperformance this year isn’t difficult. For example, the fund has Original Postroduct-detail?audienceType=Investor&ticker=RZV" target="_blank" rel="noreferrer noopener">a 21% weight to financial services stocks. Smaller banks, including some RZV components, lagged when low interest rates suppressed net interest margins. With Treasury yields nearly doubling in the first quarter, RZV’s bank stock exposure is working in investors’ favor. Additionally, smaller banks as seen as fertile territory for consolidation.

A 17.36% weight to consumer discretionary names gives RZV some leverage to the reopening trade while a nearly 9% weight to energy stocks – though not massive – is enough to give investors some participation in energy’s status as the best-performing sector this year.

- Tobias, Andrew (Author)

- English (Publication Language)

- 320 Pages - 04/19/2022 (Publication Date) - Harper...

- Reference Guide, Investment Lawyer's (Author)

- English (Publication Language)

- 46 Pages - 07/12/2019 (Publication Date) -...

Last update on 2024-04-05 / Affiliate links / Images from Amazon Product Advertising API

The fund is trouncing the Russell 2000 Value Index by 1,800 basis points this year. Value as a whole may also be growing more meaningful for investors.

“The 200-plus funds in the large cap value Morningstar category over the 10-year period ending March 31 had average price-to-book ratios ranging from 1.2 to nearly 4.5,” according to Dimensional. “That variation means not all funds in the category shared the same experience when the value premium appeared.”

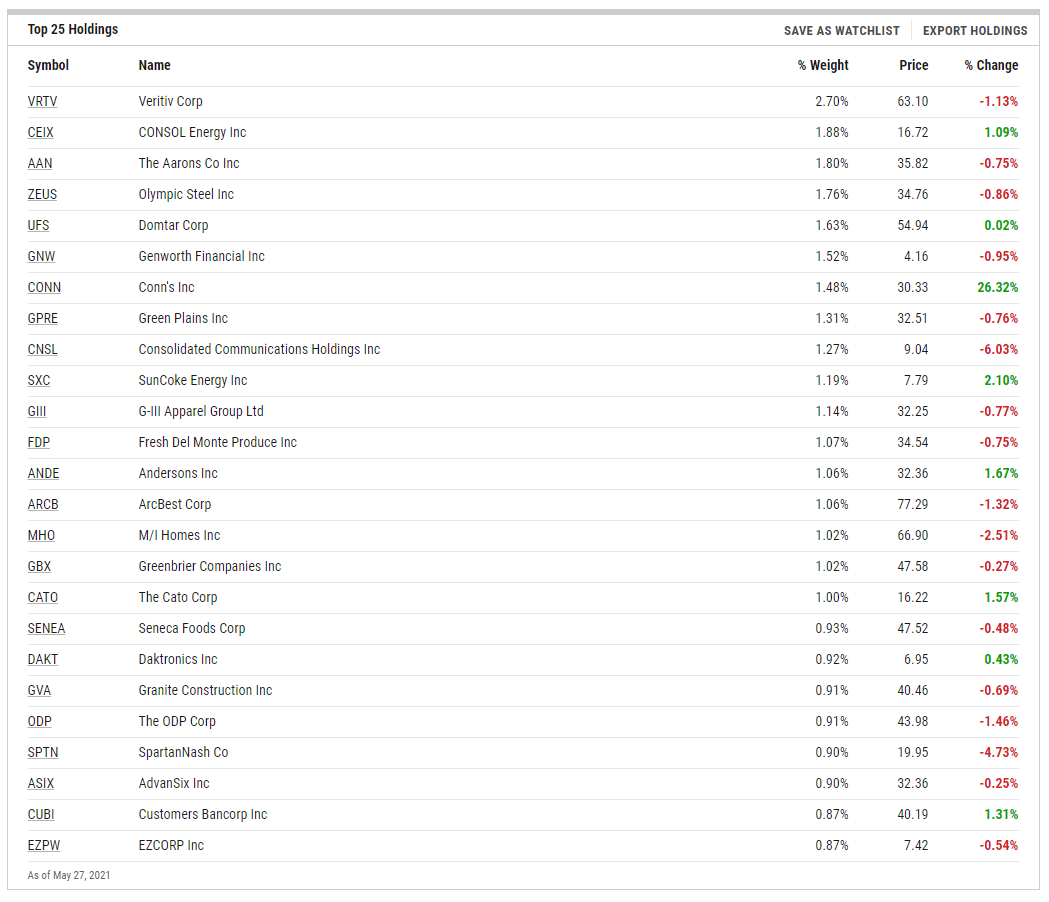

For its part, the $375.2 million RZV is a passive fund that tracks the S&P SmallCap 600® Pure Value Index. That benchmark focuses on book value-to-price ratio, earnings-to-price ratio, and sales-to-price ratio. RZV has 167 components.

For more news, information, and strategy, visit the ETF Education Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.