Investors have long heard about rising electric vehicle (EV). However, there are other ways to participate in the trend beyond dedicated EV stocks like Tesla (NASDAQ:TSLA) and exchange traded funds focusing on those names. More EVs on the road means elevated electric grid needs and accelerated efforts to shore up grids around the world.

Source: Original Postress-this.php?">Gird for Soaring EV Demand With GRID

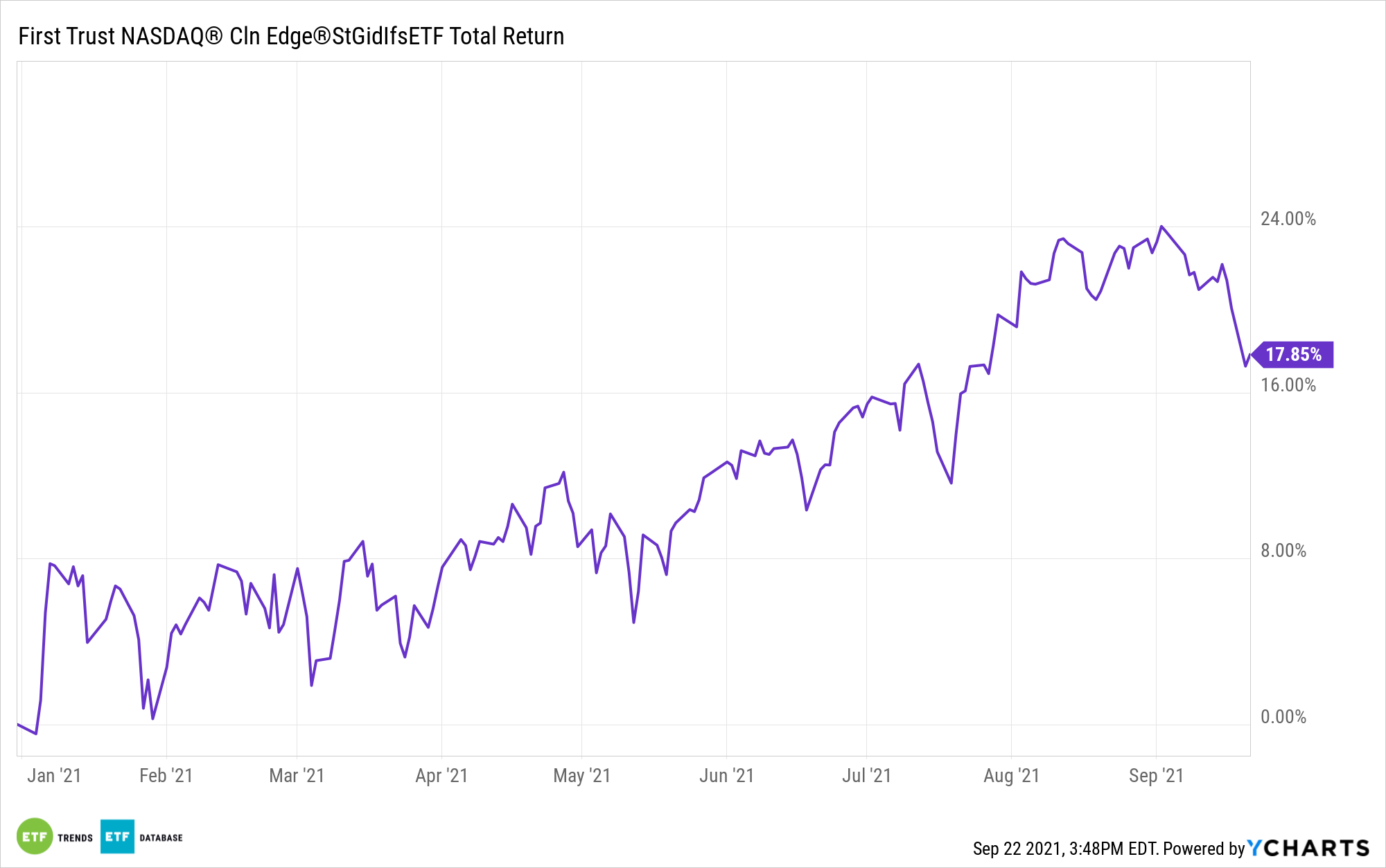

The First Trust/Clean Edge Smart Grid ETF (NasdaqGM: GRID) is a prime example of an ETF at the epicenter of those trends. GRID tracks the NASDAQ OMX Clean Edge Smart Grid Infrastructure Index, which includes companies engaged in all components of the smart grid.

Governments around the world, particularly in the U.S. and Europe, are pushing for increased EV adoption, and with that comes the need for enhancements to power grids so drivers can charge those electric vehicles.

“One simple reason that increased EVs sales may accelerate capital investments in the power grid is that they will increase demand for electricity to charge batteries, offsetting a decline in demand for gasoline,” according to First Trust research. “The Energy Information Administration forecasts that US electricity generation will grow by around 10% from 2020 to 2030, driven mainly by economic growth and offset by efficiency gains.”

GRID is particularly relevant today for multiple reasons. First, one of the primary hurdles facing broader EV adoption is that many vehicle buyers worry about not being able to find a charging station when they’re out on the road. As investments in that infrastructure increase, some GRID components could benefit.

Second, related to that point, a significant percentage of EV charging activity currently occurs at EV owners’ homes, meaning that electrical grids need to be enhanced to meeting rising demand.

- Pfau, Wade (Author)

- English (Publication Language)

- 508 Pages - 03/15/2023 (Publication Date) -...

- Birken, Emily Guy (Author)

- English (Publication Language)

- 240 Pages - 05/11/2021 (Publication Date) - Adams...

- Amazon Kindle Edition

- Holt, Richard (Author)

- English (Publication Language)

- 172 Pages - 07/19/2022 (Publication Date)

Last update on 2024-04-05 / Affiliate links / Images from Amazon Product Advertising API

“Another reason that a transition to EVs may require more investment in the power grid is that 80%-90% of EV charging takes place at home,” adds First Trust. “Patterns of electricity consumption vary by season, but peak demand is typically in the evening, soon after people return home from work, which may also coincide with their desire to recharge depleted EV batteries.”

GRID holds 71 stocks across 10 industry groups, providing investors with the breadth necessary to capitalize on advancements throughout the electrical grid ecosystem. Electrical components makers, conventional electricity generators, and diversified industrial companies combine for 48% of the ETF’s weight.

“GRID is an ETF that invests in companies around the world that that are involved in power grid infrastructure, smart meters, energy management, connected mobility, and related activities. We believe many of these companies will provide the products and services needed for the build out and modernization of the power grid around the world,” concludes First Trust.

For more news, information, and strategy, visit the Innovative ETFs Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.