SUMMARY In our view, international markets are less efficient, creating opportunities for active portfolio management. We believe a passive approach to international investing may lead to unintended sector concentrations. A surprising number of the best performing stocks in a given year are based outside of the US.

Source: Original Postress-this.php?">International Investing: Why We Believe Active Management Works – An Interview with Chautauqua Capital Management

One of the great joys of being a part of a firm like RiverFront is access to some of the most thoughtful, intelligent, and grounded minds in the asset management space. This comes not only within our own walls, but also with other firms who we’ve been fortunate enough to count as partners.

One such partner is Boulder, CO-based Chautauqua Capital Management, a division of Robert W. Baird. Chautauqua is a boutique international and global asset manager which has managed relatively concentrated, high-conviction international stock portfolios since 2006, and shares RiverFront’s cultural emphasis on humility and intellectual curiosity. We recently had an opportunity to pick the brain of David Lubchenco, a partner at Chautauqua, on the always-entertaining, always-controversial topic of international investing. Chautauqua’s investment views are the product of a team-based approach, and herein David neatly summarizes the team’s collective sentiments.

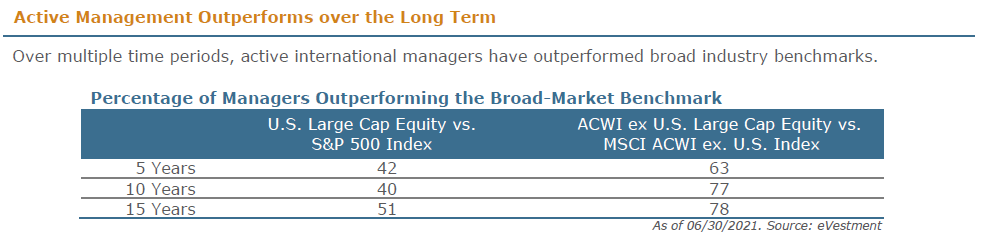

Chris Konstantinos: We hear all the time in the United States that active US managers consistently underperform their benchmark, and that outperforming the S&P 500 is difficult to do consistently. Is this dynamic different internationally?

David Lubchenco: Statistically, over the past 5, 10, and 15 years, most US managers have underperformed their benchmark. However, the majority of international managers have had higher success rates outperforming their benchmark – as illustrated below (see chart).

Past performance is no guarantee of future results. Shown for illustrative purposes. Not indicative of RiverFront portfolio performance. Index definitions are available in the disclosures.

We believe this is because investing internationally is different. International markets are less efficient, their index composition differs from the US indexes and the composition of public companies within international indices are different, providing unique opportunities for active managers of international portfolios. For example, in many countries, the local stock market indices are dominated by current or former state-owned enterprises (SOEs) which are often uncompetitive and have serious corporate governance issues.

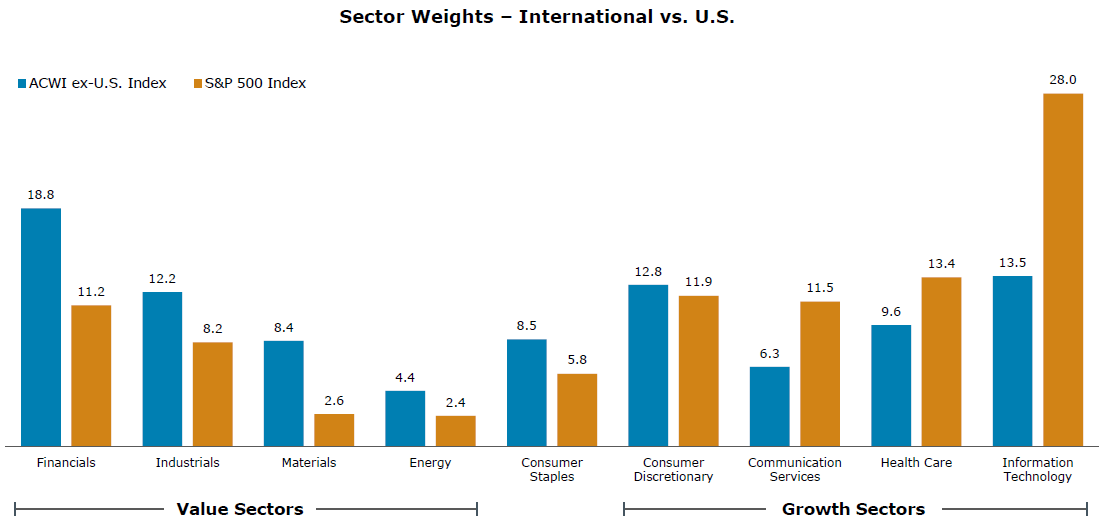

I have to say I concur. David, talk to us a little bit about the sector composition differences you see between US indexes and abroad? Do you think this helps contribute to the greater success money managers have had outperforming benchmarks overseas?

The sector composition differences between the US indexes and abroad are one of the main contributing reasons why we believe an active approach to international investing is critical. As you can see below, the MSCI ACWI ex-US international index is significantly overweight traditional “value” sectors facing long-term structural and macroeconomic headwinds, while it is underweight “growth” sectors relative to the S&P 500. The MSCI ACWI ex-US index’s underweight to information technology, health care, and communication services accounts for a large portion of the index’s underperformance versus the S&P 500 index over the past several years.

Source: MSCI, Standard & Poor’s. Sector exposure (%) provided as of 08.31.2021. Shown for illustrative purposes. Not indicative of RiverFront portfolio performance. Index definitions are available in the disclosures.

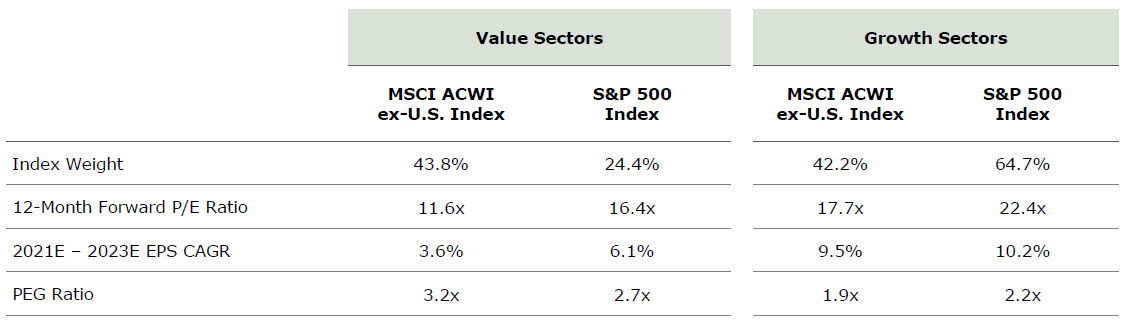

Drilling down and looking at relative valuations within the value and growth sectors yields some interesting observations. First, international growth is cheaper than US growth on both an absolute PE and a growth-adjusted basis. Second, international and US value sectors are cheaper than their growth counterparts on PE, but more expensive on a growth-adjusted basis.

Source: Bloomberg. Sector index weights are as of 08.31.2021 and index pricing and consensus EPS estimates are as of 10.04.2021. Past performance is no guarantee of future results. Shown for illustrative purposes. Not indicative of RiverFront portfolio performance. Index definitions are available in the disclosures.

Can you talk to what the opportunity set for investing looks like outside of the US? I find that there’s some general misconceptions here among investors who feel that the US has an ironclad monopoly on great companies.

One important reason to broaden your portfolio and to invest internationally is the expanded opportunity set that worldwide investing offers. Approximately 96% of the world’s population, 85% of the world’s economic activity (75% based on nominal GDP), and 66% of public companies with market capitalizations greater than $5 billion are outside the US – yet most US investors are under-invested in international companies. On top of that, if you look at the top performing 50 stocks in the MSCI All Country World Index (ACWI), each of the past 11 years, on average, 77% of the time these companies are found outside the US.

- 5.1-channel 80-Watt powerful surround sound system

- 4K60, 4K120AB and 8K60B HDMI 2.1 with HDCP 2.3 and...

- Dolby Vision, Hybrid Log-Gamma and BT.2020

- Supports enhanced media and gaming - ALLM, VRR

- YPAO automatic room calibration

- Low-Profile Modern Design - Clean silhouettes,...

- Powerful Performance - Brilliant clarity,...

- Simple Setup, Streaming & Control - Get setup and...

- 5.1-Channel Sound - Experience a powerful...

- 6 Total Speakers - Full-range drivers deliver...

*YTD as of 09.30.2021. Source: FactSet, eVestment. Top performing 50 stocks based on companies in the MSCI All Country World Index. Shown for illustrative purposes. Not indicative of RiverFront portfolio performance. Index definitions are available in the disclosures.

Said another way, the US does not have a monopoly on competitively advantaged companies with long growth runways ahead of them. By adding international exposure, investors can gain exposure to these companies, many of which do not have a US comparable and often can be purchased at more attractive valuations relative to their growth potential and profitability than can be had in the US.

Do you believe there are diversification benefits to international investing for US-centric investors?

Absolutely. Despite higher correlations since the late 1990s, an allocation to international equities is still an effective diversifier and thus deserves a place in client portfolios. Studies have shown that international allocations up to 40%, can reduce volatility by up to 5% versus an all-US equity portfolio. After all, the most efficient portfolio (one that has the highest risk-adjusted return) is not necessarily the one with the highest return.

I think your efficiency comment is a point that is often not well understood by investors.

One could make the case that globalization and US/international correlations may have peaked as evidenced by Brexit, trade wars, the associated rise of economic nationalism, and corresponding barriers to cross-border movement of capital, labor, and fragmentation of global supply chains. If these trends continue then the diversification argument for higher international allocations will be even stronger going forward.

Anything else you’d want to make US investors aware of when investing internationally?

There is a perception that international companies are “riskier”. But just because a company is headquartered outside the US doesn’t make it riskier, particularly in an actively managed portfolio. The risk of losing money in an investment is a function of a company’s financial strength, growth outlook, competitive positioning, and valuation. If you dig one layer deeper, you will find many international companies that dominate their respective industries that have superior growth outlooks, stronger balance sheets, and can be purchased at lower valuations than their US counterparts.

- SAMSUNG USA AUTHORIZED - Includes 2 Year Extended...

- Samsung 85 Inch DU8000 Crystal UHD LED 4K Smart TV...

- UHD Dimming | Auto Game Mode (ALLM) | Alexa...

- SAMSUNG TIZEN OS: Stream your favorite shows, play...

- BUNDLE INCLUDES: Samsung DU8000 Series 4K HDR...

- SAMSUNG USA AUTHORIZED - Includes 2 Year Extended...

- Samsung 75 Inch DU8000 Crystal UHD LED 4K Smart TV...

- UHD Dimming | Auto Game Mode (ALLM) | Alexa...

- SAMSUNG TIZEN OS: Stream your favorite shows, play...

- BUNDLE INCLUDES: Samsung DU8000 Series 4K HDR...

About Chautauqua Capital Management:

Formed in January 2009, Chautauqua Capital Management offers insightful, focused International Growth and Global Growth Equity investment strategies to help investors achieve their financial goals.

In January 2016, Chautauqua Capital Management became a division of Baird, an employee-owned global financial services firm with a demonstrated commitment to asset management. Baird is nationally recognized as a great place to work and fosters a culture based on one powerful principle: keeping clients first.

This combination, while enabling Chautauqua Capital Management to remain an autonomous investment boutique, provides Chautauqua with the strength and security of a leading financial partner. The partnership has allowed Chautauqua to hire and retain talent, create mutual fund vehicles for our strategies, and most importantly, by joining Baird, Chautauqua Capital investment team members are better able to focus on investing.