Since peaking in early 2021, South Korea's market has fallen about 30%, making it one of the worst-performing markets in Asia. This has helped make the country cheap relative to other developed markets, but in this article, I will argue that the iShares MSCI South Korea ETF (NYSEARCA:EWY), which tracks the bulk of the South Korean market, still has significant downside risks due to its sectoral composition and the country's specific exposure to regional geopolitical risk.

How cheap are Korean stocks?

According to iShares, EWY has a P/E ratio of 8.6 and a price-to-book (P/B) ratio of 1. Compare that to an S&P 500 ETF like SPY, which has a P/E ratio of 22.1 and a P/B ratio of 1.0, and South Korea looks very cheap indeed. Following the lead of some research done by Shep Perkins at Putnam a few years ago, I also attempted to calculate EWY's value when adjusted to sectoral and industrial composition. Putnam found that much of the differences in relative valuation between regions was explained by the composition of the indexes being compared. A country index that is saturated with steel and finance companies would have a much lower P/E ratio than one that is packed with Googles and Teslas.

So, if companies in EWY had P/E ratios that matched US P/E ratios for their respective sectors, EWY ought to have a P/E ratio of 23.5, which is roughly three times EWY's current level and near the SPY‘s level. From that perspective, EWY looks like a steal. You get (at first glance) a combination of sectors (dominated by tech) priced well below what a similar combination of US stocks would cost relative to earnings.

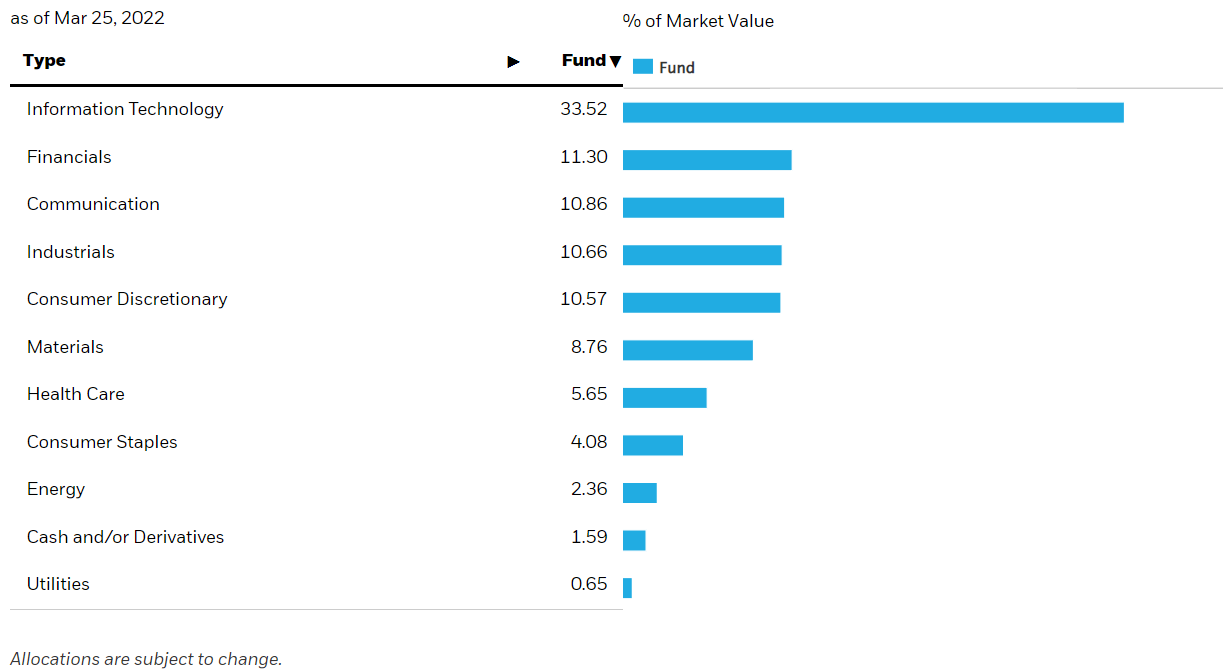

The following chart illustrates EWY's sectoral weighting.

Chart A. South Korea appears to be tech-heavy. (iShares)

But, if you look at the actual holdings of EWY, you can start seeing why this is somewhat misleading. Below are the top 15 holdings of EWY, which comprise just over 55% of the index.

| iShares MSCI South Korea ETF holdings as of 23-Mar-2022 | ||

| Name | GICS Sector | Weight (%) |

| SAMSUNG ELECTRONICS LTD | Information Technology | 20.95 |

| SK HYNIX INC | Information Technology | 6.24 |

| NAVER CORP | Communication | 4.06 |

| KAKAO CORP | Communication | 2.93 |

| SAMSUNG SDI LTD | Information Technology | 2.76 |

| KB FINANCIAL GROUP INC | Financials | 2.45 |

| HYUNDAI MOTOR | Consumer Discretionary | 2.44 |

| POSCO | Materials | 2.35 |

| LG CHEM LTD | Materials | 2.28 |

| KIA CORPORATION CORP | Consumer Discretionary | 1.95 |

| SHINHAN FINANCIAL GROUP LTD | Financials | 1.83 |

| CELLTRION INC | Health Care | 1.68 |

| HANA FINANCIAL GROUP INC | Financials | 1.54 |

| SAMSUNG BIOLOGICS LTD | Health Care | 1.5 |

| HYUNDAI MOBIS LTD | Consumer Discretionary | 1.49 |

Another 98 stocks make up the remaining 45% of the ETF.

The phone-maker Samsung is one-fifth of the index and nearly two-thirds of the information technology sector holdings. According to a variety of sites, including gurufocus.com, it only has a P/E of 11 or 12, well below the Apple's P/E of 29.

The issue is that these companies are not strictly comparable. Apple's primary focus remains on fashionable, high-end smartphones with a growing services component. In contrast, according to Trefis, a bit over a third of Samsung's revenues come from smartphones and telecom equipment, another third from semiconductors, and the remainder from electronic components, TVs, refrigerators, and other appliances.

So, with Samsung, maybe you are getting a “tech company” but not a Google or an Apple.

This brings us back to Putnam's research, which we referenced above, which shows that comparisons are better done across industry groups rather than sectors. Industry group data is not provided in the iShares website's list of holdings, so I tried to approximate the industry groups of each of the companies within the top 65% of EWY and then cross-reference them with Finviz's industry data. Based on this series of rough approximations, that yielded a P/E ratio of 17. That is, you would have to pay 17 times earnings for an equivalent mix of US industries.

From that perspective, EWY (again with a P/E 8.6) relative to an equivalent US combination (with a P/E somewhere in the vicinity of 17) still looks cheap. But, I think this is still overstated.

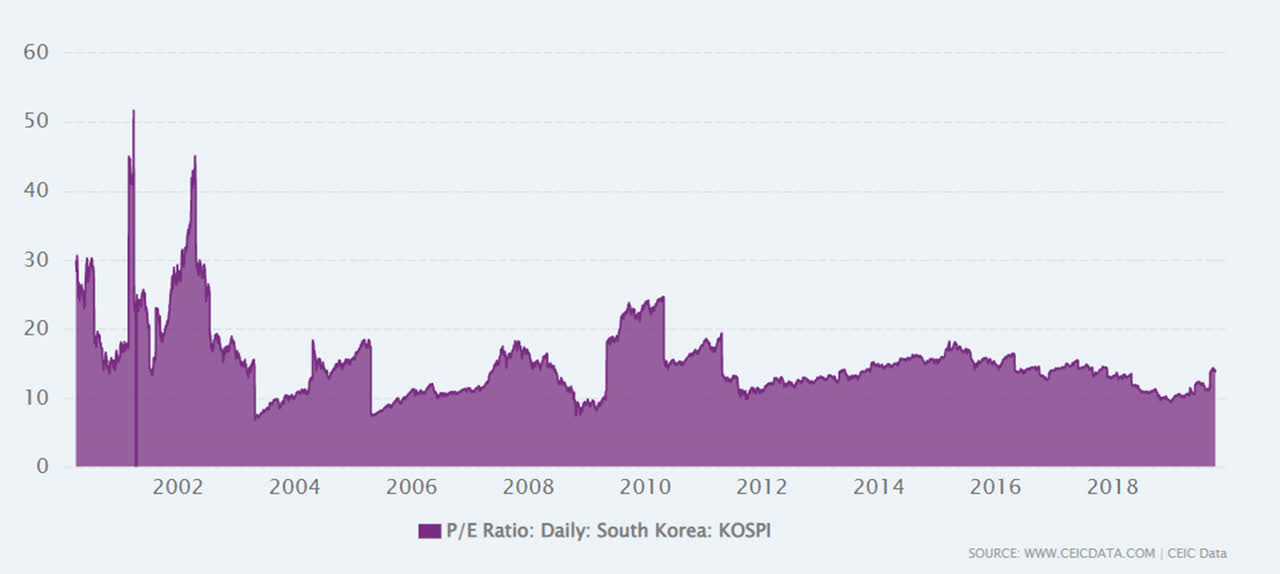

At CEIC data, you can look at the P/E history of the Korea Composite Stock Price Index, or KOSPI, which is a rough equivalent to EWY, which tracks the MSCI Korea 25/50 Index.

Chart B. The KOSPI and EWY are highly correlated with one another. (Stockcharts.com)

CEIC's data suggests that for most of the last two decades, the KOSPI's P/E has traded in the teens, and for much of the last decade, that has been in the low teens.

Chart C. South Korean stock multiples have always tended to be low. (CEIC)

In other words, even with an industry-level comparison (and I confess to having had to wing it), it is still possible that the difference in P/E is overstated and that Korean stocks constitute a value trap, stocks that are priced low for a reason.

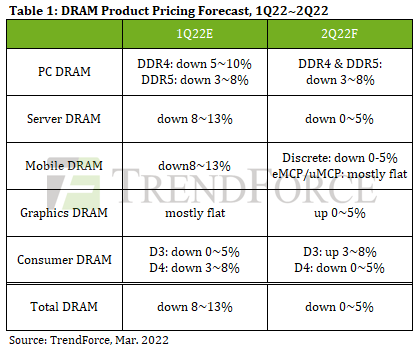

At the end of last year, for example, Trefis reported that Samsung's stock was possibly being held down by the poor outlook for semiconductor memory prices, especially DRAM, “which is the single largest driver of Samsung's profitability”. TrendForce has forecasted that DRAM prices will continue to drop going into the second quarter due to oversupply in some instances and slowing demand in part due to the war in Ukraine.

Chart D. DRAM prices are forecast to continue falling. (TrendForce)

I think there are questions about Korean companies' long-term growth prospects in China, as well, especially as a new, conservative, and relatively anti-China president prepares to take office.

Geopolitical Risk

Although president-elect Yoon Suk-yeol took tough positions on China during the campaign and, since his victory, has shown a desire to align more closely with both Japan and the US, and anti-China sentiment is rising in South Korea, especially among younger voters, Yoon was elected primarily in a battle over domestic issues (e.g., housing, gender, inequality, corruption).

But, geopolitical struggle is likely to increasingly intrude upon his domestic agenda over the course of his five-year term. Renewed ICBM tests in North Korea and rumors of possible new nuclear tests underscore this. Because of the growing chasm between NATO and a web of anti-China alliances in the Indo-Pacific on the one hand and China and Russia on the other, it will be increasingly difficult to isolate North Korea.

Late last week, China's UN ambassador, for example, argued, in a manner resembling China's justifications for Russia's invasion of Ukraine that,

“There is a reason why the situation has come to where it is today. The crux of the matter is that the external security threats to the DPRK [North Korea] have persisted for decades, and their justified security concerns have remained unaddressed throughout the process.”

Although China does not control North Korea, the latter can be used to put pressure on, and perhaps pin down, the Japan-US-ROK alliance, especially in order to free China's hand to badger and ultimately invade Taiwan.

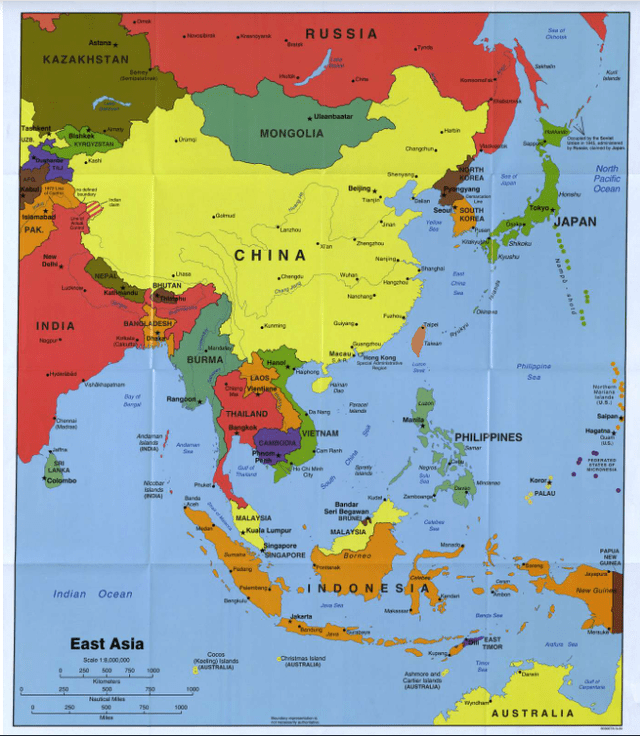

Chart E. With Russia cut off, South Korea is becoming a waterlocked country. (LOC's Public Domain Archive)

While Chinese moves on Taiwan are currently of greater concern to Japan, and historically, South Korea's concerns have been primarily directed towards dealing with North Korea, with some room for squabbling with Japan, were China to succeed in taking Taiwan, South Korea would likely be in greater strategic peril than Japan. Therefore, South Korea is likely going to be forced to take on even greater “strategic clarity” (the current geopolitical buzzword in East Asia) than Yoon has made provision for. China can be expected to continue putting pressure on South Korea to shun strategic clarity in favor of a neutral approach, for example, by removing THAAD (US ballistic missile defense) systems from the peninsula instead of adding more.

Ukrainian officials recently argued that the Russians are likely to try to Koreanize Ukraine, by breaking the country into two parts, but it is just as likely that the Chinese (and Russians) will seek to Ukrainize Korea: neutralize the South or enhance hostilities between North and South if the latter does not bend.

For imperial powers in East Asia, Korea has always been a key battleground, as I mentioned in EWH: Time To Reprice Asia's Geopolitical Risk. China cannot afford for North Korea to reunify with South Korea under Seoul's leadership, and Japan cannot afford for South Korea to become a Chinese vassal. American power has largely kept regional fears and ambitions in check, but as the world becomes less stable, there will be increasing pressure on regional powers to take matters into their own hands, for example by going nuclear.

Ultimately, there is little need to wargame this out. It is just hard to conceive of China setting aside the opportunity to make every effort to pin down Japan, South Korea, and US forces in North Asia, to secure its northern flank, as it works its way towards preparing to grab Taiwan. Therefore, although Taiwan may be the “most dangerous place on Earth“, South Korea is probably in greater immediate-not imminent-danger.

Economic impacts of geopolitical change

Deterioration in the economic relationship between China and South Korea began in 2017, when South Korea agreed to let the US install THAAD. Among the companies that have been hit hard by both official and popular antipathy to Korean products in China is EWY's 24th holding, LG Household & Health Care, Ltd., a cosmetics and consumer staples company. According to a recent article in The Korean Economic Daily, the company has been one of the fastest growing “K-Beauty” companies in South Korea, with half of sales coming out of China. But, demand has fallen for K-Beauty products both because of slowing growth in China related to the country's “zero-COVID” policy and a growing preference for domestic beauty products among younger Chinese consumers. In response, the company has set about acquiring high-end personal care brands in Europe and North America, but this has not prevented the stock from dropping 50% over the last eight months.

| Preview | Product | Price | |

|---|---|---|---|

|

Galway Bay Long Sleeve Golf Rain Jacket - Three Layer Long Sleeve Golf Jackets for Men, Lightweight... |

$200.00 |

Buy on Amazon |

Products linked to the Korean Wave may continue to find eager new consumers in more distant lands, but losing the Chinese market will certainly dampen growth prospects for cultural exports.

Of more immediate concern is the continued supply chain, commodity, and geopolitical crises and their mutual reinforcement. Supply chain disruptions “at all stages of production” were already putting a dent in production last year. Since then, Russian sanctions have only added to Korean businesses' woes according to The Korean Economic Daily:

“Russia is Korea's 10th-largest trading partner, from which the Asian economy imports key raw materials such as crude oil, aluminum and naphtha”.

The majority of goods exported to Europe from Korea were shipped through Russia, transported by sea from Busan to Vladivostok and then by rail across the Eurasian landmass to Warsaw. New routes cost more, and that is on top of rising resource costs, especially energy. A recent survey said, “Seven out of 10 South Korean companies predict they will swing to operating losses if global oil prices soar to $150 a barrel, a survey showed on Sunday.” A similar number expected lower profits for the year.

As I write this, there is news coming out of Turkey of progress in peace talks between Ukraine and Russia. This may produce a ceasefire and perhaps some kind of final peace agreement in the coming weeks. Oil prices appear to be dropping in response, and real progress towards peace is likely to drastically reduce the possibility of the more extreme scenarios that were being imagined in recent weeks. That is certainly welcome for a host of reasons, but this also suggests that acute crisis is going to be replaced by chronic disease.

President Biden only a couple of days ago hoped that the current Russian regime might be replaced by a friendlier group. That was likely always a long shot, but if a sustainable Russia-Ukraine deal were arrived at, that would likely be the new geopolitical reality in East Europe. It is hard to imagine a conclusion to this conflict where Russia agreed to anything less than Ukrainian neutrality. A new iron curtain will be in place, and Ukraine will have effectively placed within the Russian orbit. Russia will have achieved strategic aims that violate the West's insistence that it does not recognize spheres of influence, and a Western-friendly democracy will have been subdued by military force.

Of course, there is neither a ceasefire nor a peace agreement at the moment, and there are likely to be twists and turns along the way, but it seems likely that either Ukraine will be forced to concede to key Russian demands or Russia will escalate the conflict to yet another level. Neither of these alternatives are positive for the long-term reduction in global tensions between the Eurasian landmass (China and Russia) and the “Rimlands” (members of the NATO alliance and the Indo-Pacific clusters), and it seems unlikely Russia would be fully open for business again, although pressure on commodity prices would likely be reduced in case of a peace agreement.

Under a reasonable best-case scenario, South Korea might see reduced commodity pressure, but it is hard to imagine the Vladivostok-Warsaw route reopening to Korean goods, although this depends more on how the West would decide to treat a Russian-Ukrainian agreement than on either Russian or South Korean attitudes. If Vladivostok were closed to South Korean trade, that would make the country all the more dependent on Pacific trade routes that pass China, Japan, and Taiwan.

The situation remains fluid, but the global significance of the war in Ukraine is that it confirms that we are en route to a global bifurcation. Even setting all of these geopolitical considerations aside, however, I think it was likely that South Korean equities were likely to see low returns over the remainder of the decade.

EWY's sectoral mix: good, bad, and ugly

Over the last year, I have been arguing that over the remainder of the decade, tech stocks are likely to underperform the broader market while cyclical sectors-energy, industrials, basic materials-are likely to outperform. This is what has happened in the past after periods when long-term sectoral dispersion has been high, tech has been exceptionally strong and energy weak, and a sudden spike in energy prices occurs. Equity markets as a whole also tend to do poorly.

Korean stocks are tech-heavy and are likely to be influenced by a reversal in the tech sector's fortunes. This goes for both the information technology sector and the communications sector (filled with social media and gaming companies). But, low multiples might soften the blow of a global tech downturn. EWY's industrial components-industrials, autos, basic materials-also might be expected to hold up relatively well long term against other sectors in a tech-led bear market. Korea's consumer discretionary sector, like the US's is primarily made up of car companies, but unlike the US auto sector as a whole (weighed by market cap, this means Tesla), they are not inflated to tech-high mega-cap multiples. I think this ought to give the Korean auto sector (again, setting aside geopolitical influences for now) a relative cushion against a long-term tech decline.

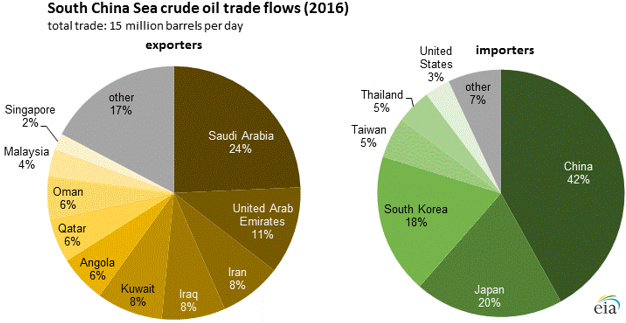

The problem is energy. Korea, one of the top five importers of energy in the world, is entirely dependent on foreign energy. Relative strength in the global energy sector will do very little to benefit the EWY via its meager energy component, and if that supply is further threatened by chaos almost anywhere along the maritime routes that run past Japan and Taiwan, and through the South China Sea. The following two charts from the US Energy Information Agency show crude oil flows to and from the South China Sea.

Chart F. South Korea is extremely dependent on the South China Sea for energy imports. (US EIA)

Chart G. South Korea is one of the largest energy importers in the world. (US EIA)

Liquified Natural Gas (LNG) flows are roughly similar. South Korea is also heavily dependent on coal imports from Australia and Canada.

Chart H. South Korea's energy routes overlap with China's maritime claims. (Radio Free Asia)

In other words, South Korea's energy supply depends on the ability of the US, Japan, India, Australia, and their Indo-Pacific partners, to keep sea lanes open.

- 🌴 Material: Chiffon, 100%Polyester ; Lightweight, soft and comfoy material

- 🌴 Features: Long sleeve chiffon lace mini dress for women spring, summer and fall, crew neck, long lantern sleeve, zipper closure, elastic waist, a-line and slim fit style, elegant ruffle design, this cute fall mini dress will make you more beautiful and lovely!

- 🌴 Occasions: Fall casual short dress suitable for you to party, holiday, school, date, cocktail, coming home, and daily life. Believe you will love it and get lots of compliment!

- 🌴 Garment care: Hand wash in cold water recommend, hang dry, low temperature ironing if necessary

- 🌴 Size Note: 0-2, 4-6, 8-10, please refer to our sizing information in the picture description to choose your size. Thanks for your understanding

The point is, South Korean equities (again, on a relative basis) are not likely to suffer as much as from a bear market in tech as the US will but South Korea is also less likely to receive whatever boost in relative performance might be expected from a revival of the energy sector. In fact, energy could be a decisively negative factor in the South Korean context.

Conclusion

In the last secular bear market in US equities, which coincided with the commodity-boom/tech-bust of the 2000s, EWY outperformed SPY by a considerable margin.

Chart I. South Korea outperformed in the last bear market. (StockCharts.com)

Most of those relative gains have been lost since 2011.

Were there to be another such relative “secular” outperformance in energy and other highly cyclical assets, Korea's sectoral and industrial balance would likely be well-positioned to take advantage of it (on a relative basis), but the dangers of a long-term downturn in global markets alongside ever-increasing geopolitical tensions in both Europe and Asia limit that potential. Korean equities appear to be cheap relative to much of the rest of the world, even when adjustments are made for EWY's industrial mix, but they are likely cheap for a reason, and more reasons are gathering on the horizon.