The Inflation Reduction Act has been approved by Congress and is expected to be signed into law this week. The act contains several provisions that affect our stock valuations in the clean energy and the pharmaceutical industries.

To the upside, the provisions that have had the greatest and most immediate impact on our valuations are contained within the nearly $400 billion spending bill to support the development and build out of clean energy. This is the largest federal government spending increase on alternative energy in U.S. history, and its impact is scheduled to last over the next decade.

To the downside, the act contains various measures to lower prescription drug costs which will be a modest to moderate headwind for the pharmaceutical industry.

Boost to Clean Energy Stock Valuations

This bill dramatically increases federal spending on clean energy. According to Brett Castelli, Morningstar’s equity analyst covering the clean energy sector, there are three key takeaways that investors should focus upon:

- First, the act contains a 10-year extension of solar and wind tax credits. These credits had been scheduled to phase out over the next few years and the 10-year provision provides a significant amount of time for clean energy firms to build and benefit from new capacity.

- Second, incentives have been included to support new technology that had not previously been eligible for tax credits. The two areas that we think will see the biggest benefits are hydrogen and energy storage.

- Third, the act provides incentives for the domestic manufacturing of solar panels and equipment which had largely been imported previously. The provisions in this bill will significantly increase the incentive to manufacture solar panels and inverters domestically.

As such, we forecast that the areas which benefit the most include:

- Residential solar

- Hydrogen

- Energy storage

- Domestic manufacturing

- Clean energy stock valuations

As we incorporate the projected impact of these provisions across our stock coverage universe, we have increased our valuations by up to 20%, or more, depending on the company and its specific product portfolio. Yet, in many cases the market has gotten ahead of itself and the price has surged ahead of our view of the long-term, intrinsic valuation of the company.

Stocks that are both fairly valued and expected to experience the greatest positive impact to their businesses include First Solar (FSLR), Plug Power (PLUG), and SunPower (SPWR).

Keep Lithium Producers in Mind

- New Store Stock

- Rivan, Maria (Author)

- English (Publication Language)

- 208 Pages - 04/14/2020 (Publication Date) -...

- The Editors of National Geographic (Author)

- English (Publication Language)

- 112 Pages - 04/02/2021 (Publication Date) -...

- National Geographic Special - 2017-1-20 SIP...

- English (Publication Language)

- 128 Pages - 01/20/2017 (Publication Date) -...

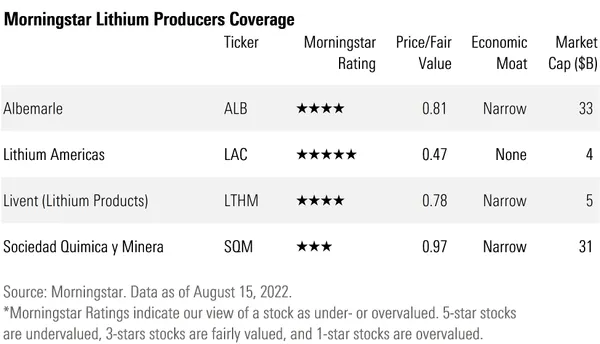

We have previously said that we project lithium prices will remain high for the foreseeable future as demand is expected to outstrip supply over the next decade. We expect that the impact of this bill will only help to bolster our forecast.

The bill provides subsidies for electric vehicles and plug-in hybrids, as long as a minimum proportion of critical minerals, including lithium, comes from the U.S. or its free trade partners. We think this will benefit all lithium producers due to an increase in demand, which should keep the market undersupplied longer. This further bolsters our current view that the lithium market will remain undersupplied throughout the rest of the decade, which will push prices well above the marginal cost of production.

Considering many of the clean energy stocks are already fully valued to overvalued, we think investing in the lithium producers remains one area to capture further upside potential from this spending.

Headwinds to Global Pharmaceutical Stocks

- Amazon Kindle Edition

- Baldacci, David (Author)

- English (Publication Language)

- 487 Pages - 04/16/2024 (Publication Date) - Grand...

- Amazon Kindle Edition

- Hannah, Kristin (Author)

- English (Publication Language)

- 472 Pages - 02/06/2024 (Publication Date) - St....

- Amazon Kindle Edition

- Elston, Ashley (Author)

- English (Publication Language)

- 348 Pages - 01/02/2024 (Publication Date) - Pamela...

The act contains several provisions meant to drive government savings on pharmaceutical spending, mainly through drug price negotiations and inflation caps. According to Karen Andersen, Morningstar’s strategist covering the healthcare sector, there are three key measures that will affect drug company revenues:

- First, shifting Medicare Part D cost-sharing to biopharma firms with more expensive drugs. According to our initial estimates, we see this as a less than 1% reduction to industry U.S. sales. Overall, we don’t expect major changes to our fair value estimates or moat ratings as the changes net out to a moderate negative, which we believe is manageable. In our view, the firms with the highest exposure are those with high-priced medicines for seniors. Those include AbbVie (ABBV), Bristol-Myers Squibb (BMY), and Pfizer (Original Postfe/quote" target="_blank" rel="noopener">PFE).

- Second, penalizing biopharma firms that raise Medicare prices by more than the rate of inflation. We see an approximately 3% hit to industry sales in the U.S. from these inflation caps. Companies that have historically relied on larger annual price increases include Pfizer, Gilead Sciences (GILD), and GSK (GSK), formerly known as GlaxoSmithKline.

- Third, mandatory price cuts on the top selling Medicare drugs that have extended patent protection. If implemented, negotiation on prices for top selling drugs could reduce U.S. industry sales by roughly 5%. The impact would be concentrated among those firms with the top-selling drugs that have high usage by seniors and extended patent life. The negotiated price cuts would begin with 10 Part D drugs in 2026 and ramp up to include additional Part D and Part B drugs thereafter. However, we already project steep declines following the expiration of composition of matter patent, which tends to track closely with the proposed timing of the negotiation. As a result, this proposal could have less of an impact on our fair valuations.