AlbertPego

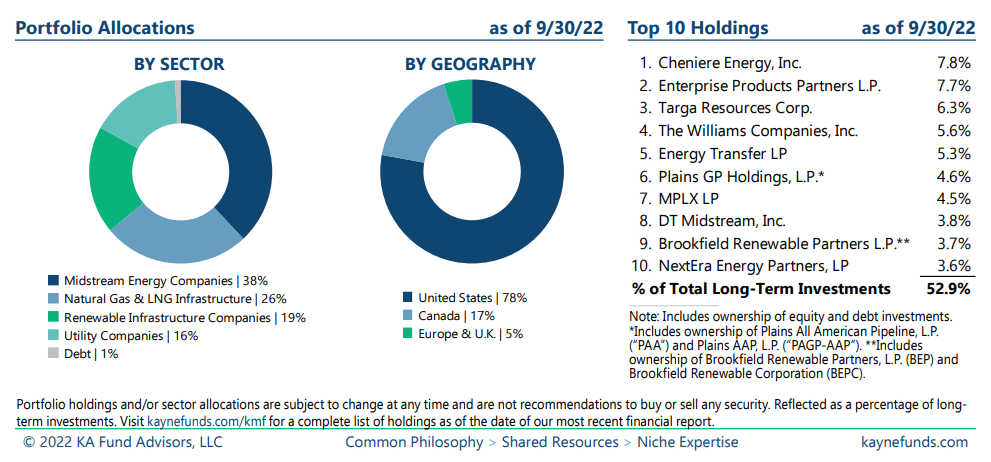

Kayne Anderson NextGen Energy & Infrastructure, Inc. (NYSE:KMF), or the “Fund,” is an energy infrastructure closed-end fund with a strategy to invest in companies that will benefit from the long-term transition to low carbon and renewable energy. However, over the past year, the key performers of its portfolio have benefited from the Russian-Ukraine conflict and the reduction of Russian natural gas exports to the European Union (“EU”), whereas other energy infrastructure investments were losers.

However, according a recent news report, “EU gas storage facilities are close to full, tankers carrying liquefied natural gas (“LNG”) are lining up at ports, unable to unload their cargoes, and prices are tumbling….Prices turned negative because of an “oversupplied grid.'”

But “the region could be in a difficult spot next summer as it tries to replenish its stores ahead of the following winter…'Filling storage ahead of next winter will require the EU to import even more LNG because there is a need to replace lost Russian gas imports for an entire year.'”

Kayne Anderson Fund Advisors.

Kayne Anderson Fund Advisors.

Assets Under Management (“AUM”)

KMF's AUM was about $565 million as of the end of September. According to Seeking Alpha, it is the largest among its peers, which include GER, TYG, NML, CTR and CBA.

Kayne Anderson Fund Advisors

Kayne Anderson Fund Advisors

Kayne Anderson Fund Advisors

Expense Ratio

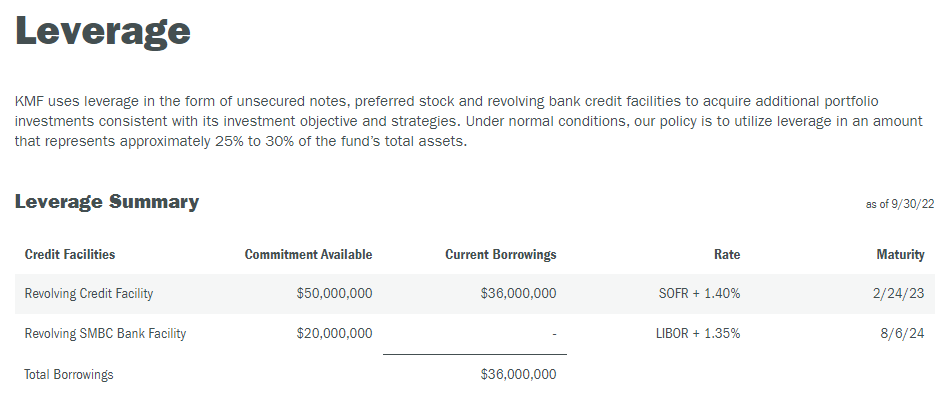

The total Expense Ratio is 3.40%, including management fee and interest costs for leverage.

Seeking Alpha

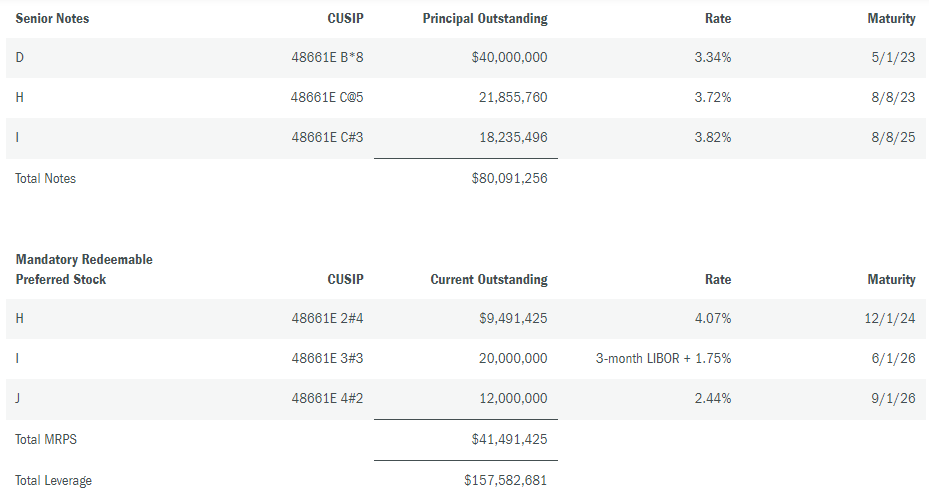

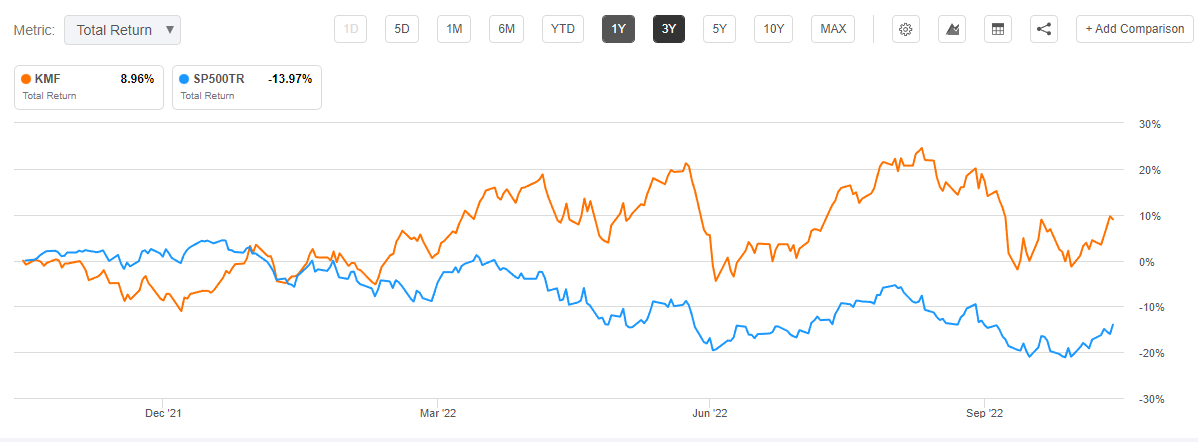

Performance

KMF's longer-term historical performance has been a loss.

Kayne Anderson Fund Advisors

It therefore seriously underperformed a simple investment in the broad equity market.

Seeking Alpha

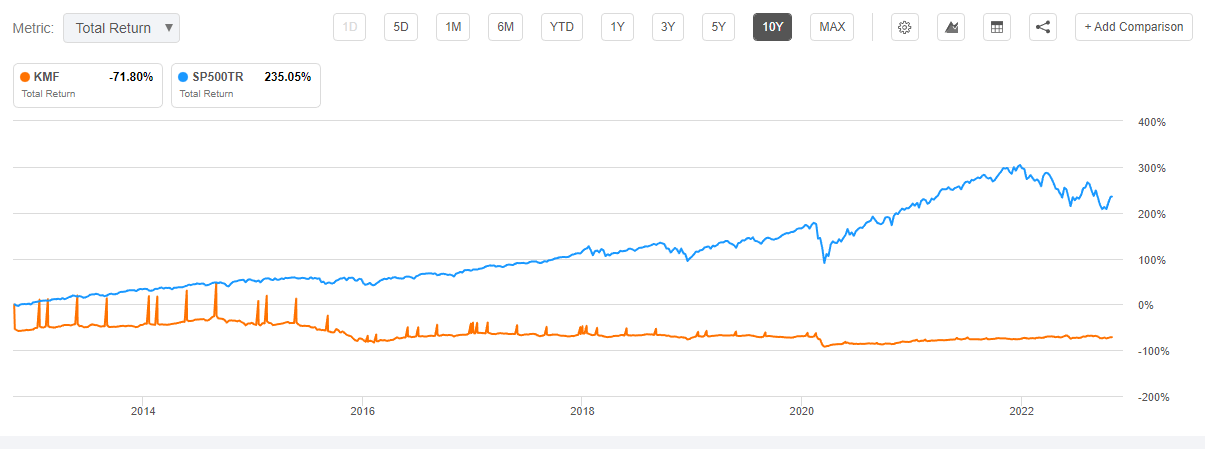

But over the past 12 months, it has outperformed the SP500TR.

Seeking Alpha

- Tobias, Andrew (Author)

- English (Publication Language)

- 320 Pages - 04/19/2022 (Publication Date) - Harper...

- Reference Guide, Investment Lawyer's (Author)

- English (Publication Language)

- 46 Pages - 07/12/2019 (Publication Date) -...

Last update on 2024-04-05 / Affiliate links / Images from Amazon Product Advertising API

KMF's highest sub-sector allocation is midstream energy companies. And its largest holding has become Cheniere Energy Inc. (LNG).

Kayne Anderson Fund Advisors

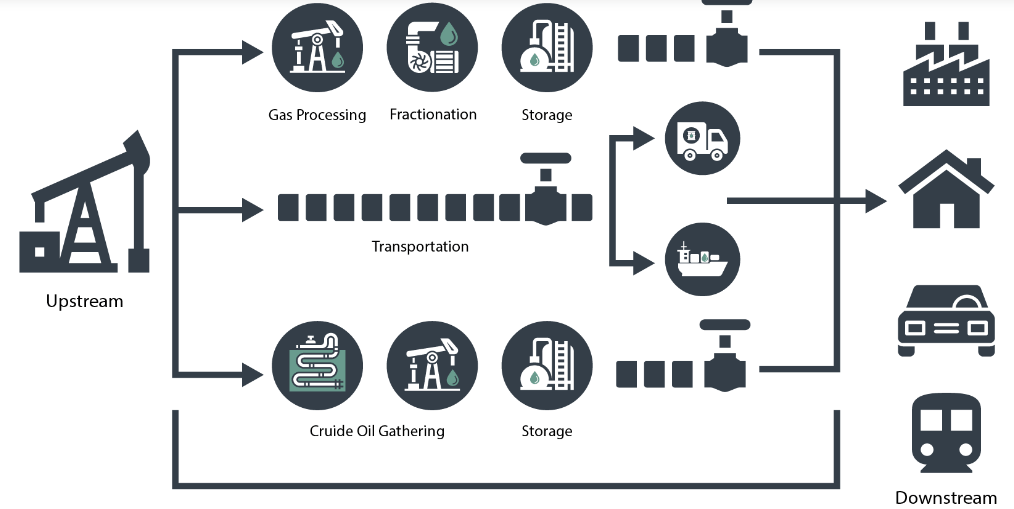

Midstream Energy Infrastructure Business Models

Midstream MLPs and c-corps are involved in the transportation, processing, and storage of oil, natural gas, and natural gas liquids (“NGLs”).

- Transportation: Transportation companies “move energy commodities like oil and natural gas from one place to another. In North America, most energy travels through a pipeline, but it can also move via truck, train, or ship. Pipelines are the cornerstone of energy infrastructure companies.”

- Processing: Processing encompasses any business that “transforms a raw commodity into a usable form. It involves removing impurities like water and dirt from natural gas and separating the natural gas stream into pipeline-quality natural gas and natural gas liquids, which are used as heating fuels and petrochemical feedstocks.”

- Storage: Storage includes tanks, wells, and other facilities both above and below ground. “These assets provide flexibility to the energy economy, so there is propane available for winter heating, gasoline for summer driving, and jet fuel for the holidays.”

Source: HANetf Ltd

North American Energy infrastructure companies primarily earn their revenues from fee-based business models, and do not take direct commodity price exposure. Their revenue equations for most business activities is fairly simple: fee multiplied by volume.

But that makes them indirectly exposed to commodity price trends. And so, if end-user prices spike, as they have, lower demand can translate into lower volumes.

On the volume side, growing production of US oil and natural gas over the last decade has necessitated more energy infrastructure such as pipelines, storage tanks, and processing plants. But if production levels-off or drops in the future, such as in the petroleum sector, volumes could also fall, and a glut of capacity could develop.

Analysis of Top Holdings

In my analysis of the annual returns, KMF had a total return of 8.96 %. The three top performers were Cheniere Energy Inc. at 68.52%, Energy Transfer LP (ET) at 36.88% and DT Midstream (DTM) at 28.16 %. The other holdings in the top ten had lower returns and two had losses. The top ten accounted for about 53 % of the Fund's total allocations and provided a weighted average return of 13.04 %. And I therefore estimate that the Other Holdings had a 47 % allocation which produced a weighted-average loss of about 4 %.

| KMF | Kayne Anderson NextGen Energy & Infrastructure, Inc. | 8.96% | ||

| Top Holdings | Allocation | RoR | Wt. RoR | |

| LNG | Cheniere Energy Inc. | 7.8% | 68.52% | 5.34% |

| EPD | Enterprise Products Partners | 7.7% | 15.64% | 1.20% |

| TRGP | Targa Resources Corp | 6.3% | 24.18% | 1.52% |

| WMB | The Williams Companies | 5.6% | 21.13% | 1.18% |

| ET | Energy Transfer LP | 5.3% | 38.97% | 2.07% |

| PAGP | Plains GP Holdings | 4.6% | 20.62% | 0.95% |

| MPLX | MPLX GP | 4.5% | 22.06% | 0.99% |

| DTM | DT Midstream Inc. | 3.8% | 28.16% | 1.07% |

| BEP | Brookfield Renewable Partners | 3.7% | -25.36% | -0.93% |

| NEP | NextEra Energy | 3.6% | -10.16% | -0.37% |

| Subtotal | 52.9% | 13.04% | ||

| Other Holdings | ||||

| Subtotal | 47.1% | -8.65% | -4.08% | |

| Total | 8.96% |

Source: BRS

LNG

According to its Annual Report, Cheniere Energy, Inc.

is a Houston-based energy infrastructure company primarily engaged in LNG-related businesses. We provide clean, secure and affordable LNG to integrated energy companies, utilities and energy trading companies around the world. We aspire to conduct our business in a safe and responsible manner, delivering a reliable, competitive and integrated source of LNG to our customers.”

LNG has benefited from the impact of the Russian-Ukrainian conflict on natural gas supplies to Europe. Because of that conflict, the EU has decided to diversify its natural gas sources away from Russia to the extent possible now and in the long-term future. Due to LNG's positioning as an exported of Liquified Natural Gas (“LNG”), its future prospects for supplying the EU with natural gas have never been brighter, making it a unique energy infrastructure company.

ET

According to its Annual Report, Energy Transfer

owns a large platform of crude oil, natural gas, and natural gas liquid assets primarily in Texas and the U.S. midcontinent region. Its pipeline network transports about 22 trillion British thermal unit per day of natural gas and 4.3 million barrels per day of crude oil. It also has gathering and processing facilities, one of the largest fractionation facilities in the U.S., and fuel distribution. Energy Transfer also owns the Lake Charles gas liquefaction facility, which it plans to convert into one of the largest LNG export facilities.”

ET is primarily a gas-focused business. They benefited from the impacts of the Russia-Ukraine war because they are well-positioned to capitalize on the additional demand for LNG from US natural gas production. Energy Transfer plans to release earnings for the third quarter of 2022 on Tuesday, November 1, 2022, after the market closes.

DTM

According to its website, DTM Midstream

is an owner, operator and developer of an integrated portfolio of natural gas midstream interstate pipelines, intrastate pipelines, storage systems, gathering lateral pipelines, gathering systems and compression, treatment and surface facilities. Based in Detroit, Michigan, we deliver clean, natural gas to gas and electric utilities, power plants, marketers, large industrial customers and energy producers across the Gulf Coast, Northeastern and Midwestern United States, and into Canada.”

As with ET, DTM is primarily a gas-focused business. They benefited from the impacts of the Russia-Ukraine war. On October 28, 2022, DT Midstream reported strong Third Quarter 2022 Results, announced Phase 3 expansion of Haynesville system and raised its Adjusted 2022 EBITDA Guidance to $810 to $825 million and 2023 Adjusted EBITDA early outlook to $865 to $905 million.

Conclusions

KFM has been a long-term loser when it is measured in total return. And its positive return over the past year has come from a relatively small portion of its investments related to natural gas production via LNG exports. Its long-term energy transition theme played little role.

For energy investors seeking positive returns in this sector, it seems prudent to focus on the expected continuing demand for LNG exports from the U.S., as the EU shifts its natural gas sources away from Russia. Otherwise, higher petroleum product prices and a likely recession are likely to reduce U.S. oil consumption and therefore the volumes fee-based midstream systems depend on for revenues.

Therefore, I would not invest in KFM because I think there are much better alternatives.