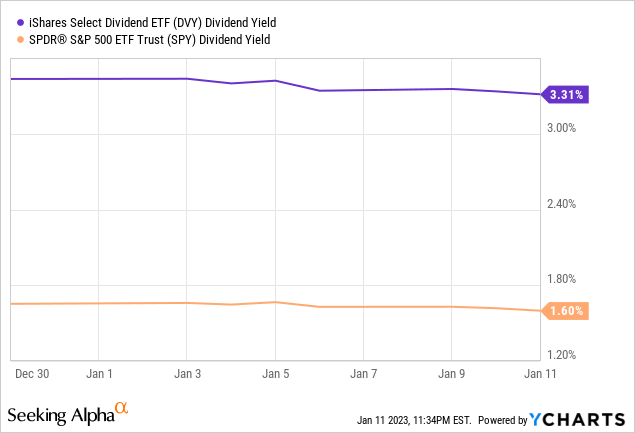

DVY is one of the largest U.S. dividend equity index ETFs in the market. The fund offers investors an above-average 3.3% yield, an incredibly cheap valuation, and has significantly outperformed YTD. Outperformance is set to continue, in my opinion at least.

iShares Select Dividend ETF: 3.3% Yield, Strong Performance

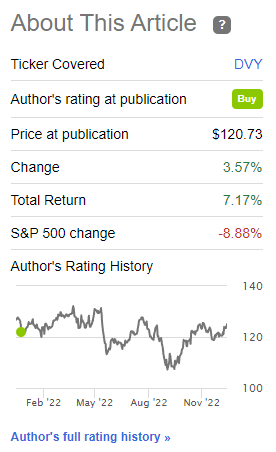

I last covered the iShares Select Dividend ETF (NASDAQ:DVY), one of the largest U.S. equity dividend ETFs in the market, close to one year ago. In that article, I argued that DVY's diversified holdings, strong dividend growth track-record, above-average dividend yield, and cheap valuation, made the fund a buy. Since then, the fund has seen solid dividend growth and outperformed relative to the S&P 500, a solid combination.

Since then, the fund's potential total returns have improved too, as the fund now sports a higher yield and a cheaper valuation. DVY remains a well-diversified fund with a good dividend growth track-record, above-average dividend yield, and cheap valuation, and so the fund remains a buy.

DVY – Basics

- Investment Manager: BlackRock

- Underlying Index: Dow Jones U.S. Select Dividend Index

- Dividend Yield: 3.34%

- Expense Ratio: 0.38%

- Total Returns 10Y: 11.49%

DVY – Overview

DVY is a U.S. dividend equity index ETF, tracking the Dow Jones U.S. Select Dividend Index. It is a relatively simple index, which selects the 100 highest-yielding U.S. equities with positive dividend growth and adequate dividend coverage ratios. As with most indexes, applicable securities must also meet a basic set of inclusion criteria. It is a yield-weighted index, the higher the yield the greater the weight, with security and industry caps meant to ensure a modicum of diversification.

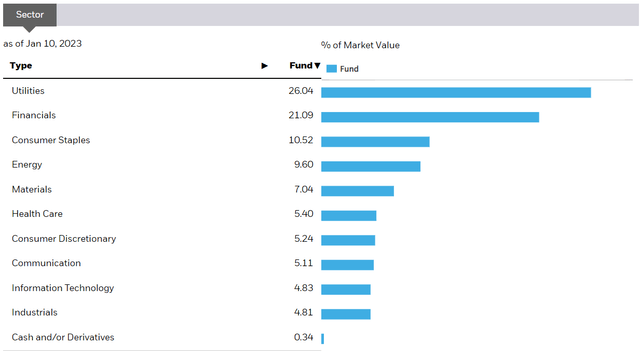

DVY's underlying index is reasonably broad, which results in a reasonably well-diversified fund, with exposure to all relevant industry segments.

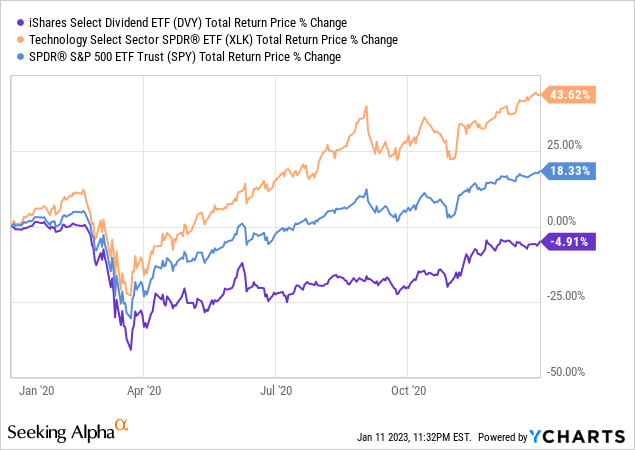

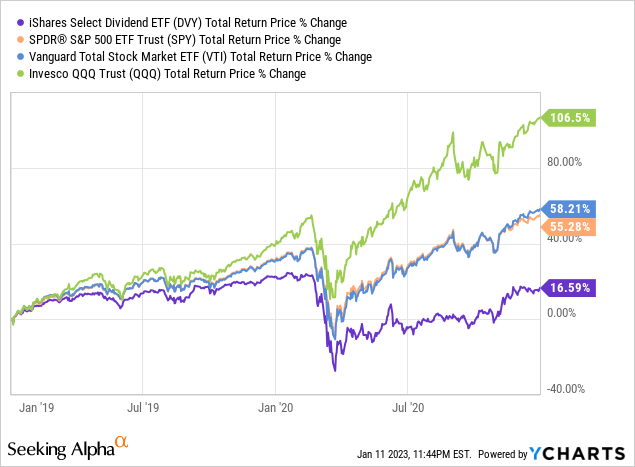

As is the case for most dividend ETFs, DVY is overweight old-economy industries like utilities and financials, due to their above-average yields and dividend growth track-records. On the flipside, the fund is significantly underweight tech, as said industry tends to focus on growth, not on dividends. DVY's industry exposures have important implications for shareholders. The fund tends to underperform when tech outperforms, as was the case during 2020, during which the coronavirus pandemic was in full swing.

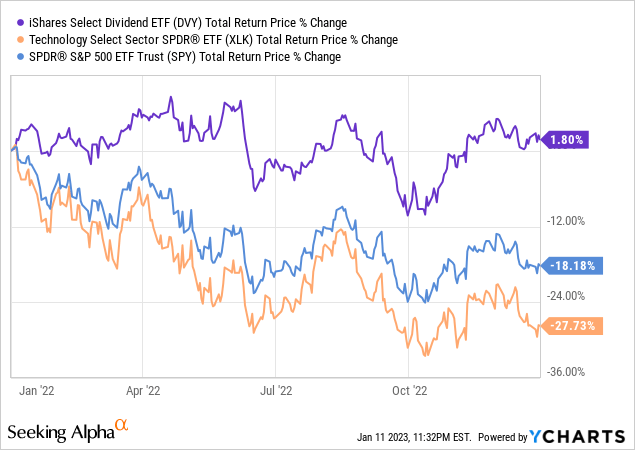

The fund tends to outperform when tech underperforms, as was the case in 2022, during which tech valuations started to normalize.

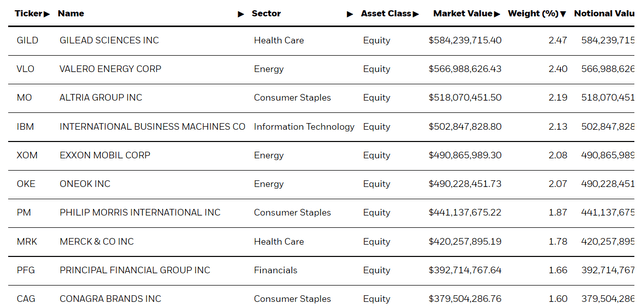

DVY currently invests in 98 holdings, slightly below their target of 100, almost certainly a short-term phenomenon as the fund finishes rebalancing their portfolio / buying new stocks. Largest holdings are as follows.

As can be seen above, DVY focuses on large-cap U.S. equities with above-average yields. Some of these are household names in dividend investment communities, including Altria (MO), Exxon (XOM), and Philip Morris (PM). Some of these are riskier than the average S&P 500 stock, including, well, these same three companies. Some of these are also mature companies in mature industries with slow growth prospects, including Altria and Philip Morris. In general terms, these are fine companies, and appropriate for most dividend investors. At the same time, growth prospects are lower than average and the possibility of substantial capital gains and significant market-beating returns are a bit low.

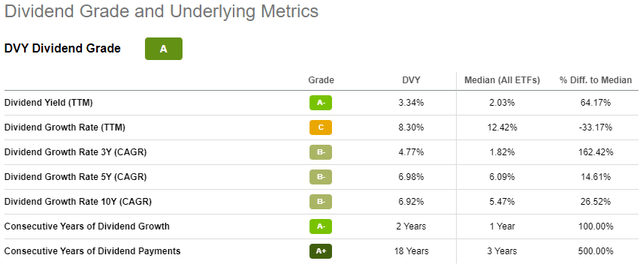

DVY focuses on the highest-yielding large-cap U.S. equities, subject to many conditions, which results in an above-average 3.3% yield. The yield is not all that high on an absolute basis, as the fund's dividend growth and dividend sustainability criteria end up excluding many of the highest-yielding stocks. Still, it is an above-average yield, and a benefit for shareholders.

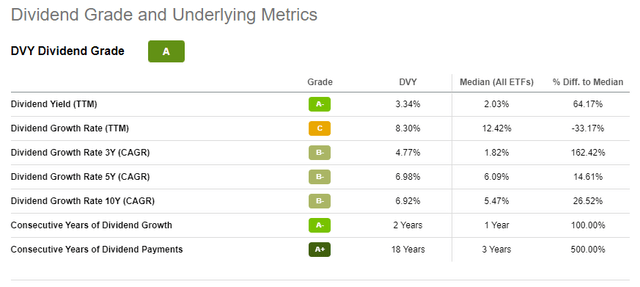

DVY's dividend growth track-record is reasonably good, with high single-digit dividend growth since inception.

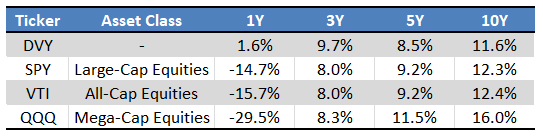

As a final point, as dividend yields are a common valuation metric, valuations fund valuations are quite a bit lower than average. DVY currently sports a PE ratio of 11.6x, compared to 19.8x for the S&P 500, and a PB ratio of 2.2x, compared to 4.0x for the S&P 500.

Let's summarize the above.

DVY is a U.S. dividend equity index ETF with diversified holdings, and above-average 3.3% dividend yield, a good dividend growth track-record, and a cheap valuation. Seems like a perfect fit for income investors and retirees, although perhaps not for those looking for particularly high yields.

DVY – Update on Fundamentals

In keeping with my new approach to fund updates, let's have a look at how DVY's fundamentals have evolved since I last covered the fund.

Improved Market Sentiment

DVY is overweight old-economy industries like utilities and financials, while being underweight high-growth tech. For most of the past decade, investors have been extremely bullish about tech, due to its strong growth and returns prospects, while being indifferent to slower industries, including utilities and financials.

Investor sentiment has completely reversed itself these past few months, due to sky-high tech valuations, higher interest rates, and worsening economic fundamentals. Tesla's (TSLA) 2.6% earnings yield made some amount of sense last year, with 0% interest rates and a stimulus-fueled economy, less so now, with T-bills yielding +4.2% and with a worsening economy (luxury car sales could decrease). Investors have grown weary of Tesla and other frothy growth / tech names, while growing more bullish about old-economy industries and value stocks. DVY focuses on the latter, so benefits from said trend. Which brings me to my next point.

Improved Performance Track-Record

- Tobias, Andrew (Author)

- English (Publication Language)

- 320 Pages - 04/19/2022 (Publication Date) - Harper...

- Reference Guide, Investment Lawyer's (Author)

- English (Publication Language)

- 46 Pages - 07/12/2019 (Publication Date) -...

Last update on 2024-04-05 / Affiliate links / Images from Amazon Product Advertising API

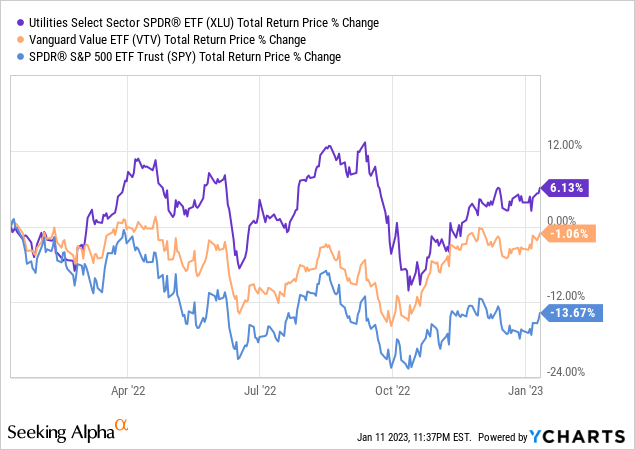

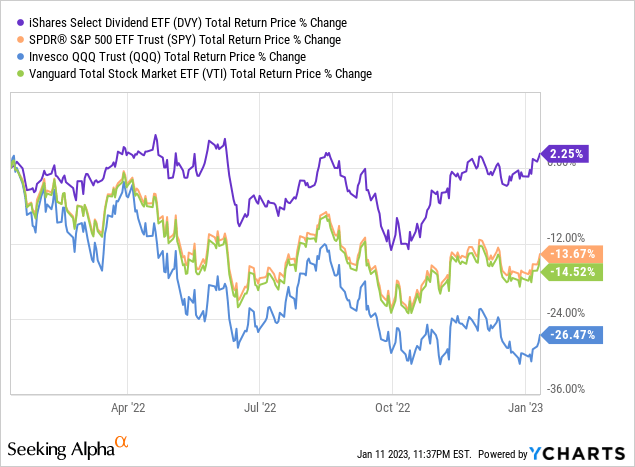

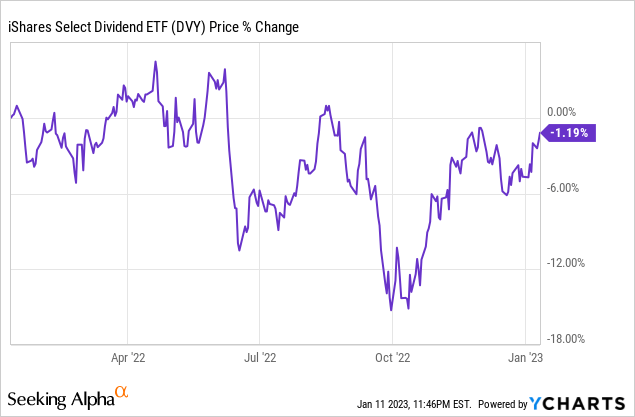

Due to the aforementioned trends in investor sentiment, several old-economy industries, including utilities, and value stocks have outperformed these past twelve months.

DVY is significantly overweight utilities, and is something of a value fund, so the fund has outperformed too, and by quite a healthy margin.

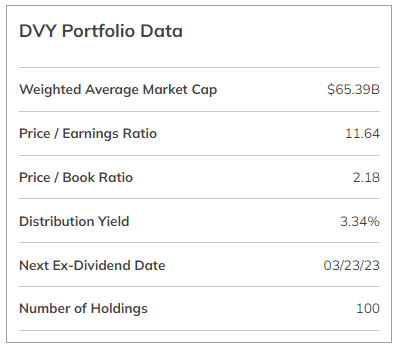

DVY's short-term performance is quite strong, but the fund's long-term performance is somewhat weaker, with the fund slightly underperforming most of its peers for most relevant time periods. There are exceptions, but the broader trend seems clear enough.

On a more positive note, most of the fund's underperformance is concentrated between 2019 and 2020, two years of significant tech outperformance. DVY does not consistently underperform, but it does tend to do so when tech performs particularly well.

In my opinion, DVY's long-term performance track-record is fine, and it has seen significant improvement these past few months. Insofar as current trends continue the fund could continue to perform quite well, which brings me to my next point.

Cheaper Valuation

DVY's valuation has improved these past few months, going from a PE ratio of 19.5x earlier in the year, to 11.6x as of today. The fund's PB ratio has improved as well, from 2.3x to 2.2x.

DVY's cheaper valuation is almost entirely the result of strong earnings and asset growth in the fund's underlying holdings, with fund share prices flat for the year.

DVY's cheap valuation could lead to significant capital gains and market-beating returns moving forward, contingent on market sentiment improving. Importantly, and as previously mentioned, sentiment has improved and the fund has outperformed. DVY's cheap valuation led to outperformance in the past, and the fund remains quite cheap, so I expect that outperformance will continue moving forward.

As an aside, I believe that DVY's PE ratio declined, in part, due to issues of timing. Going from 19.5x to 11.6x is a massive drop, and implies implausibly high earning growth rates. Utilities and financials, the fund's two largest industries, have not seen sky-high Original Posterformancesapearningsrevenues.pdf" rel="noreferrer noopener" target="_blank">earnings growth these past few months too. I see no significant change in the fund's industry exposures either. On the other hand, earnings have been quite volatile since the pandemic, so timing could very easily explain the massive drop.

Higher Dividends and Yields

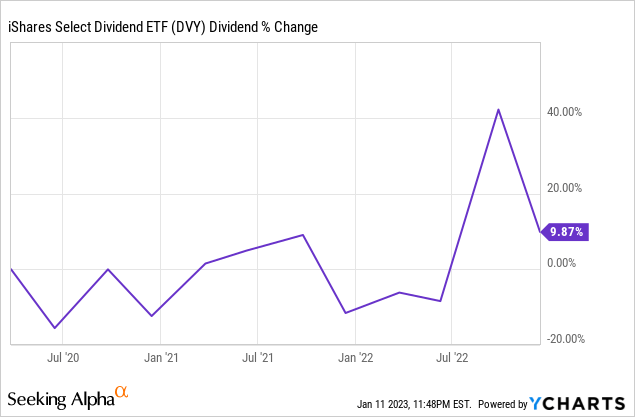

DVY's dividends have seen strong growth these past twelve months, growing 8.3% for the same. Fund dividends have also seen healthy growth since inception, and for most relevant time periods.

On a more negative note, DVY's dividends are quite volatile, much more so than average. Dividend volatility sometimes makes it hard to estimate and analyze a fund's dividend growth, although this does not seem to be the case for DVY, at least not right now.

DVY has performed exceedingly well YTD, and with the fund sporting a cheaper valuation and higher dividends than in the past, I believe that the fund will perform exceedingly well in the future.

Conclusion

DVY's diversified holdings, strong dividend growth track-record, above-average 3.3% dividend yield, and cheap valuation make the fund a buy.