VGT invests in tech stocks across small-, mid-, and large-cap stocks. It is probably fairly valued, although the investing landscape is shaping up for an uncertain 2023/24.Recession is certainly a possibility; however, I believe VGT is probably fairly positioned regardless.

VGT: U.S. Information Technology Stocks Are Probably Fairly Valued (NYSEARCA:VGT)

Vanguard Information Technology ETF (NYSEARCA:VGT) is an exchange-traded fund that seeks to track the performance of its chosen benchmark index, the MSCI US Investable Market Information Technology 25/50. This makes VGT a U.S.-only equity fund, focused on technology, across small-, mid- and large-cap stocks. The fund had 372 holdings at the end of November 2022

Although there are slight differences owing to the capping methodology of VGT's benchmark, a substantially similar benchmark is the uncapped version for which certain financial data is available that can help us value VGT. The main difference it seems is a slightly higher weighting to Apple (AAPL), of 22.40% for the uncapped version of VGT's benchmark index versus 20.47% for VGT's benchmark index. Nevertheless, on the whole, I would think that the figures made available for the uncapped index are accurate enough as a starting point.

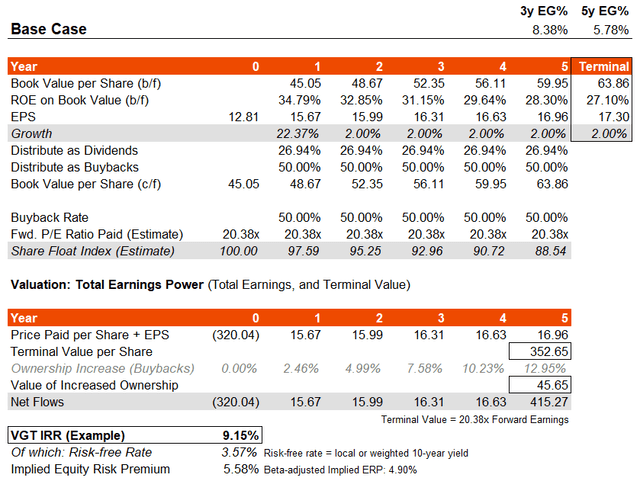

The figures as of December 30, 2022 would suggest that VGT's trailing and forward price/earnings ratios were 24.94x and 20.38x, respectively, with a price/book ratio of 7.09x. The indicative dividend yield was 1.08%. This data would indicate a forward earnings yield of 4.91%, with a forward return on equity of 34.79% (very high). It would also imply dividends of roughly 27% of earnings on a trailing basis, and Yardeni Research suggests that large-caps are distributing roughly 60% of earnings in the form of buybacks. All considered, even if a lot of cash is being distributed to shareholders directly/indirectly, the return on equity is high. This is helped largely by very profitable large tech companies like Apple as mentioned earlier (the largest position of the fund).

The data above from MSCI would also imply forward one-year earnings growth of 22.37%. On the basis that we assume returns on equity drop steadily over time, our earnings growth rate beyond year one would be very low if we were to take inspiration from Original Postortfolio">Morningstar's consensus analyst estimate for three- to five-year earnings growth of 11.36% for VGT. If I assume just 2% earnings growth from year 2 (as a minimum), my average earnings growth figure over this same forecast horizon is 5.78-8.38%, underneath the consensus. This also results in an IRR of approximately 6.86%, holding most factors the same, and offering a 50% buyback rate.

That suggests an implied equity risk premium of around 5.58%. VGT is large enough to be considered 1x beta, although its historical beta relative to the S&P 500 is actually about 1.14x. So, you could argue the underlying ERP is actually 4.90%, which is still healthy.

Tech stocks generally beget tighter ERPs on the basis that they historically tend to out-perform. They have performed poorly recently as the Federal Reserve has been hiking rates and drawing out liquidity from the system. Before the fall in stocks through 2022, I recall ERPs being sub-4% per my calculations. In any case, tech stocks with higher growth-rate potentials and strong underlying returns on equity do tend to earn lower equity risk premiums (i.e., higher valuations). This is not necessarily irrational, or at least it hasn't been historically.

If I were to bring earnings growth rates in alignment with the consensus, my IRR gauge would improve further. However, I don't think I need to prove the point already made, which is that VGT offers a healthy IRR even if we assume only nominal 2% earnings growth from year two. VGT's valuation offers plenty of upside potential: an IRR of circa 10% on the basis of the portfolio's instrinsic value, coupled with the potential for positive earnings surprises.

- Pfau, Wade (Author)

- English (Publication Language)

- 508 Pages - 03/15/2023 (Publication Date) -...

- Birken, Emily Guy (Author)

- English (Publication Language)

- 240 Pages - 05/11/2021 (Publication Date) - Adams...

- Amazon Kindle Edition

- Holt, Richard (Author)

- English (Publication Language)

- 172 Pages - 07/19/2022 (Publication Date)

Last update on 2024-04-05 / Affiliate links / Images from Amazon Product Advertising API

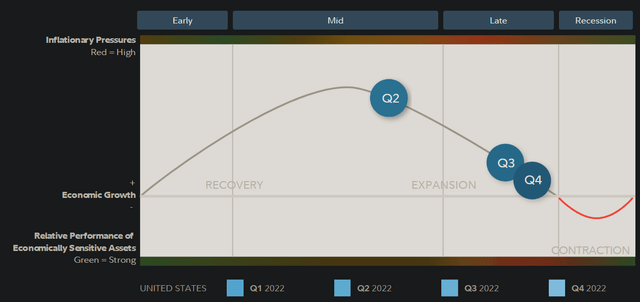

It would seem, therefore, that the market is pricing in some kind of recession, which I would also argue is not irrational. Fidelity research suggests that the next cyclical phase for the United States will be recession.

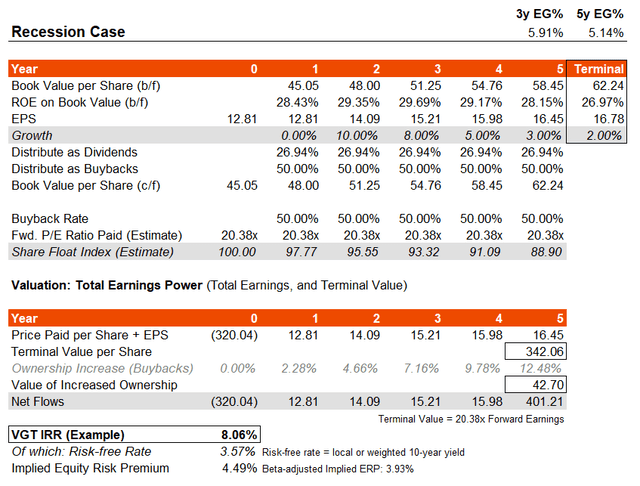

Still, if I override my assumptions and drive earnings growth down to 0% instead of the forecast figure of over 22%, and then allow earnings growth to characteristically jump back into its trend (into a new business cycle), the IRR can still fall into line. Obviously this is dependent on the assumption that VGT's portfolio and earnings power is fundamentally robust, flexible, and adaptive.

For longer-term investors, recessions are not inherently scary, or at least they shouldn't be. There is an exception: if recessions fundamentally harm businesses' underlying earnings power. I think that is a fair fear to have for a small business owner. However, I do not think that VGT's largely large- and mid-cap portfolio is vulnerable in the same way. I would argue a recession could in fact help these companies by taking the wind out of the sails of wage inflation and other key cost drivers; think of it like pain today but gain tomorrow (rather than a potentially consistently painful five years ahead).

Having said all this, I think VGT is probably fairly priced and does not deserve a significant ramp, unless earnings growth rates turn out to be even better than expected. On the basis that the current 2023 figure looks like it is over 20%, I would imagine VGT will not improve upon this; therefore, you are looking at either 2024 for a stronger-than-10% rebound, and/or much lower inflationary pressures in 2023. The latter would help valuations in 2023 above my IRR expectation, as this would enable the Fed to pivot, thus lowering risk-free rates and allowing valuations to expand. A drop in the 10-year from 3.57% currently to say 3% would help lift valuations by circa 10-15% by holding other factors mostly constant.

The perfect scenario for 2023 would be falling inflation/risk-free rates, and earnings for VGT coming in line with forecast (or even just below forecast). The worst scenario would be higher inflationary pressures, driving the country into recession and hitting earnings growth rates harshly. Yet as I alluded to before, long-term VGT shareholders should probably feel comfortable regardless, because in the long run, you own a share in some of the strongest companies (by earnings power) in the world.