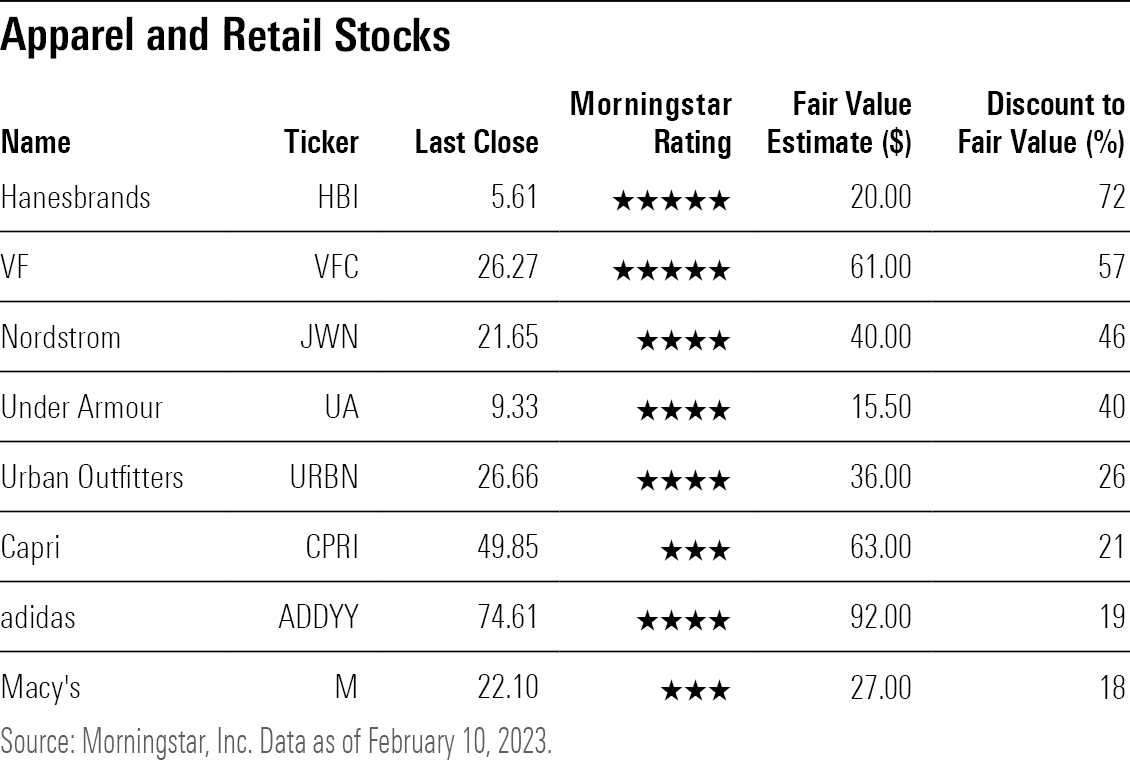

A string of dismal earnings reports and outlooks in the past few weeks from the likes of Capri Holdings CPRI, Adidas ADDYY, VF VFC, Hanesbrands HBI, and Under Armour UA, among others, led to a sharp selloff in these apparel stocks and sent shock waves throughout the sector that accelerated late last week.

For the week ended Feb. 10, 2023, the Morningstar Global Apparel Manufacturing Index, which includes VF, Hanesbrands, Under Armour, and Ralph Lauren RL, fell 7.1% compared with a weekly loss of 1.4% for the Morningstar US Market Index.

“People were expecting a stronger bounceback after a tough second half of 2022, but it is probably a ways off,” says David Swartz, senior equity analyst at Morningstar. “The reports so far suggest the outlook for the first half of 2023 is poor.”

After a stellar 2021, retailers ordered “too much too early” in 2022, before slashing orders in the second half, says Swartz. Slower sales, supply chain kinks, inflation, and shifts in fashion trends made it difficult to control inventories, he explains. The excess inventories hit the industry just as consumer spending on apparel was slowing down, he says, and resulted in heavy discounting at Christmas, hurting profits.

Woes at the manufacturer level have led to concerns about clothing-focused retail stocks, including Macy’s M, Urban Outfitters URBN, and Nordstrom JWN, which are set to report quarterly results in early March. These retailers offered cautious outlooks for the fourth quarter

Outlook Could Improve for Clothing Stocks in Late 2023

Swartz notes that the apparel and retail stocks could show improvement in the second half of the year as inventory levels are reduced and lower cotton prices and shipping costs take some of the pressure off.

An exception to the rest of the pack: Ralph Lauren, which delivered better-than-expected results in its fiscal third quarter 2023, increasing revenue and net income and posting solid margins despite the difficult environment. Ralph Lauren also stands out for its strong balance sheet and its 2.4% dividend yield. Its stock recently traded near Swartz’s fair value estimate of $124, though the analyst intends to raise his target based on the strong performance.

Although most of the companies Swartz covers are trading well below their fair value estimates, he continues to be cautious on their near-term outlook. He points out, too, that many are in turnaround mode and transitioning to new leaders.

Facing lower sales and profits, squeezed margins, bulging inventories, and continued supply chain issues, many of the companies are taking drastic measures to preserve capital and reduce debt.

8 Apparel and Retail Stocks With Out-of-Style Results

VF

VF, whose brands include The North Face, Timberland, Vans, and Dickies, described conditions in its fiscal 2023 third quarter as “increasingly challenging.” It was hurt by slower sales in some product lines, higher inventory levels, and lingering supply chain issues.

The company was also stung by an $876 million tax judgment related to its 2011 acquisition of Timberland that required it to take out a $1 billion term loan. As a result, VF cut its quarterly dividend by 41% to $0.30 a share from $0.51. Among other cost reductions, VF also said it was exploring the sale of some noncore assets, including its Kipling, Eastpak, and JanSport brands. Moreover, VF is searching for a new chief executive to succeed Steve Rendle, who resigned suddenly in early December amid the company’s struggles.

Revenue declined by 3% to $3.5 billion from the prior year, its gross margin and operating margin fell, and earnings per share on an adjusted basis dropped 17% to $1.12 a share.

VF stock fell 8% initially after the earnings release. At a recent $26.27, VF stock is down 59% over the past year.

Hanesbrands

The clothing manufacturer reported that its fourth-quarter sales dropped 16% from the year earlier, posted a net loss of $418 million, or $1.19 a share, and said cost pressures squeezed its operating margins. Hanesbrands omitted its dividend to dedicate all its free cash flow to reducing debt. Its aim is to reduce its leverage ratio to “a range that is no greater than 2 to 3 times net debt/adjusted EBITDA, or earnings before interest, taxes, depreciation, and amortization, from the 4.6 times it reported in the fourth quarter. Hanesbrands said it also amended a credit agreement to strengthen its balance sheet and provide greater near-term financial flexibility given current economic uncertainties. It also expects to refinance its 2024 debt maturities in the first quarter, subject to market conditions.

Hanesbrands stock dropped 25% after releasing earnings and hit a new 52-week low of $5.57 on Feb. 13 before bouncing back to close at $5.82 a share.

Adidas

The athletic clothing and footwear stock fell more than 11% after disclosing that sales could drop by EUR 1.1 billion and operating profit by EUR 500 million in 2023 based on the levels of unsold Yeezy merchandise tied to the German company’s former partnership with singer Kanye West. Adidas severed its partnership with West in October after repeated antisemitic remarks by the singer.

Adidas said if it can’t sell the Yeezy stock, it will take a write-off that would lower the company’s operating profit by an additional EUR 500 million on top of a previously disclosed EUR 200 million write-off related to its streamlining efforts.

Adidas stock has fallen nearly 47% in the past year to a recent $74.61 a share.

Capri Holdings

- Tobias, Andrew (Author)

- English (Publication Language)

- 320 Pages - 04/19/2022 (Publication Date) - Harper...

- Reference Guide, Investment Lawyer's (Author)

- English (Publication Language)

- 46 Pages - 07/12/2019 (Publication Date) -...

The owner of the Michael Kors, Jimmy Choo, and Versace brands saw its stock plummet 25% after posting a 6% drop in its fiscal 2023 third-quarter revenue to $1.51 billion. Net income fell 30% to $225 million, or $1.72 a share, and its operating margin fell to 15.6% from 20.6% in the prior year. Capri said net inventories rose 21% from year-ago levels to $1.19 billion.

For its fiscal fourth quarter, the company expects to report revenue of $1.275 billion, an operating margin of 8.5%, and earnings per share of $0.90 to $0.95.

At a recent $49.85 a share, Capri stock is off 24% in the past year.

Under Armour

The athletic apparel company beat expectations in its fiscal third quarter 2023 on revenue and earnings but said inventory ballooned by 50% to $1.2 billion year over year and gross margins shrunk by 6.5% to 44.2%. Revenue rose 3% to $1.58 billion compared with the $1.55 billion that Wall Street estimated as double-digit growth in Europe, Middle East, and Africa offset a 2% drop in sales to $1 billion in its North American segment. Apparel revenue, its biggest category, declined by 2% to $1 billion.

Under Armour stock lost 8% after reporting earnings. At a recent $9.48 a share, Under Armour stock has shed nearly 47% in the past year

Nordstrom

The retailer described its holiday season as “highly promotional” and said it took additional markdowns to end the year with lower inventory levels, which it expects to be down by a double-digit percentage from year-ago levels. The company said consumers are being more selective, though its higher-end shoppers are showing more resilience.

Nordstrom revised its fourth-quarter revenue growth guidance to the low end of its previously issued outlook of 5% to 7%. Nordstrom now expects earnings per share of $1.33 to $1.53 versus the prior outlook of $2.13 to $2.43, excluding any repurchase activity.

Although Nordstrom stock has soared in 2023 by 36% to a recent $22.03 per share, it has fallen 8.5% over the past year, with a loss of 9% coming in the past five days.

Macy’s

The venerable department store chain cautioned investors to expect sales in the low- to midrange of $8.2 billion to $8.5 billion for its fourth quarter. It maintained its outlook for earnings per share of $1.47 to $1.67. Inventories are expected to be slightly below that of year-ago levels, the company said.

“Black Friday and Cyber Monday sales were in line with our expectations, while the week leading up to and following Christmas were ahead,” the company said. Still, Macy’s added that “the lulls of the nonpeak holiday weeks were deeper than anticipated.”

Macy’s stock at a recent $22.36 has climbed 7% year to date but is still down more than 18% in the past year.

Urban Outfitters

The retailer said its net sales increased 2.3% during the holiday season, with strength in its Free People and Anthropologie Groups offset by weakness at its flagship Urban Outfitters. Sales in its wholesale segment fell 22% owing to “a decrease in sales to department stores.”

Urban Outfitters stock has risen 14% year to date to a recent $27.29 a share but is down 11% in the past year.