Investing in the WisdomTree Emerging Markets High Dividend ETF is one of the best ways to access emerging market equities at a discount. The latest data from Wisdom Tree shows that the fund is trading at slightly over 6x earnings and at around 0.93x book value. One of the key appeals of this fund is that it invests heavily in industries like materials, energy, and industrials, which can be accessed at a much lower valuation.

DEM: Best Way To Access Emerging Markets At A Discount

Overview

Investing in the WisdomTree Emerging Markets High Dividend ETF (NYSEARCA:DEM) is one of the best ways to access emerging market equities at a discount. I prefer this ETF to other ETFs I have covered in the past, as it provides exposure to larger EMs found in the MSCI Emerging Markets ETF and focuses on discounted equities in slightly out-of-favor sectors. However, I think some of these themes could outperform this decade and could be superior to consumer stocks that trade at a higher valuation.

Wisdom Tree ETF Comparison

Wisdom Tree has a variety of ETF products that invest in emerging markets, which can allow you to avoid certain markets (i.e. China) or even certain themes.

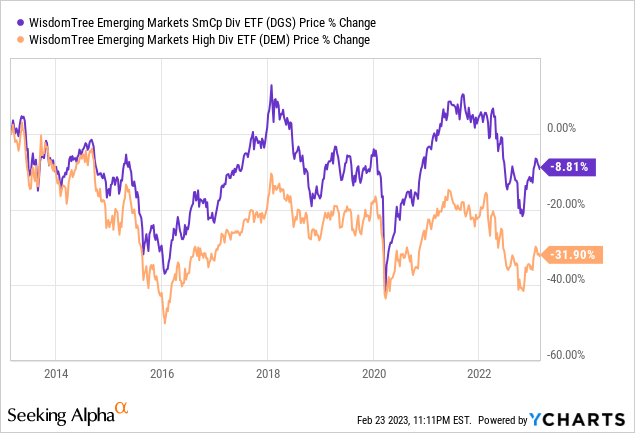

I have previously covered the WisdomTree Emerging Markets SmallCap Dividend ETF (DGS), which has outperformed this ETF during the past decade. However, if I had to bet on relative outperformance during the next decade, I would bet on the WisdomTree Emerging Markets High Div ETF, as I am more bullish on value stocks.

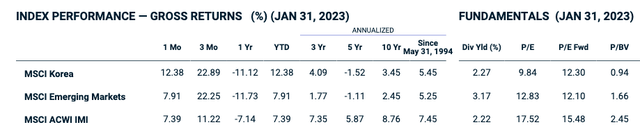

The latest data from Wisdom Tree shows that the fund is trading at slightly over 6x earnings and at around 0.93x book value. This is nearly a 50% discount to MSCI Emerging Markets.

If you want to access emerging equities at a discount, you will usually have to do one of two things:

- Invest in countries with higher perceived political or economic risks (i.e. Brazil) and hope that conditions change or sentiment improves.

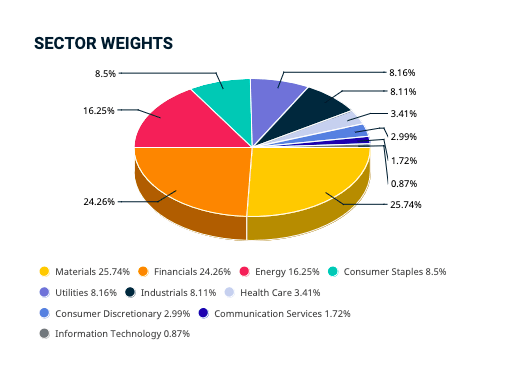

- Invest in themes like materials and energy, instead of consumer stocks, as consumer stocks tend to command a premium to the index.

In this case, this ETF trades at a discount because of its company holdings, which are more heavily concentrated in industries that trade at a discount. Investors can count on consistent dividend income while waiting for these cyclical industries to rebound. I think this is a much safer bet, as risks are currently rising in emerging markets, and large caps could experience a larger correction in some cases.

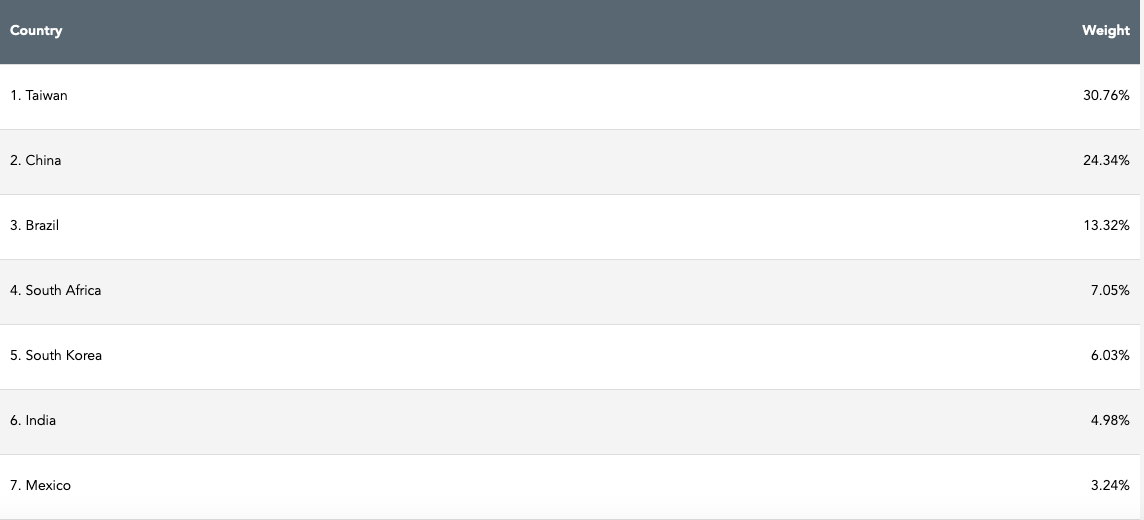

Countries

As previously mentioned, this ETF invests heavily in some of the top MSCI EM countries like China, South Korea, Taiwan, India, and Brazil.

This fund is overweight Taiwan and Brazil, which I think is a good idea, and also underweight China, India, and South Korea. If I bought this ETF, I would add an additional Korean ETF/closed-end fund/ADRs to my portfolio, as I think South Korea is positioned to outperform.

South Korea trades at a substantial discount to global equities, and most of the top companies in the index include consumer or IT companies. Similar to countries like Taiwan, South Korea could benefit from China's economy reopening and global electronics demand recovering. Taiwan: As I mentioned in my latest article on Taiwan, 2023 may be a good time to accumulate equities in this country, as global electronics growth may bounce back. Growth in the country should still be around 2.2% this year, and I believe geopolitical risks with China are less immediate and may come into play more in 2024 or later, if so. Moreover, MSCI Taiwan still trades at a slight discount to MSCI Emerging markets, which adds to its appeal. Brazil: Brazil is one of the cheapest larger emerging markets, which trades at a large discount to MSCI Emerging markets largely due to political risks. However, it is also worth noting the industry weighting of the MSCI Brazil Index, as this index largely includes energy and financial names.

The latest growth projects for Brazil are below 1%. However, Brazil could outperform this growth if commodities perform above expectations, as Brazil's growth depends on commodity exports.

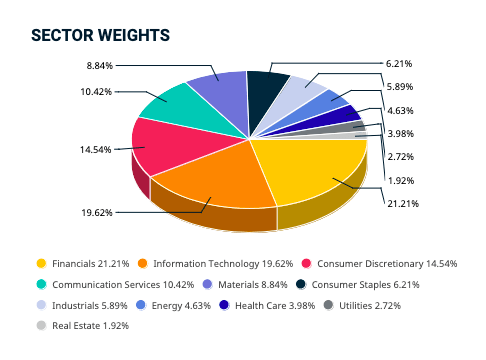

Industries and Companies

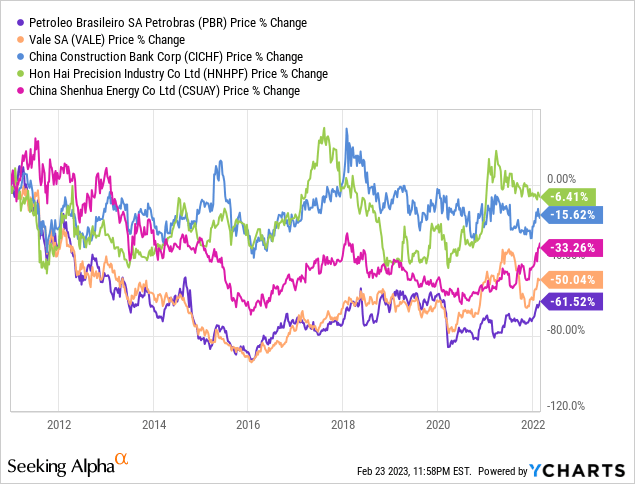

One of the key appeals of this fund is that it invests heavily in industries like materials, energy, and industrials, which can be accessed at a much lower valuation. Stocks like Petrobras (PBR) and Vale SA (VALE) have substantially underperformed this decade, and are down over 50% since 2011.

Some of the ETF's top holdings have underperformed over the past decade.

Particularly themes like energy have underperformed since peaking around 2011-2012 and could perform well if energy stocks do well this decade.

Risks and Catalysts in Emerging Markets

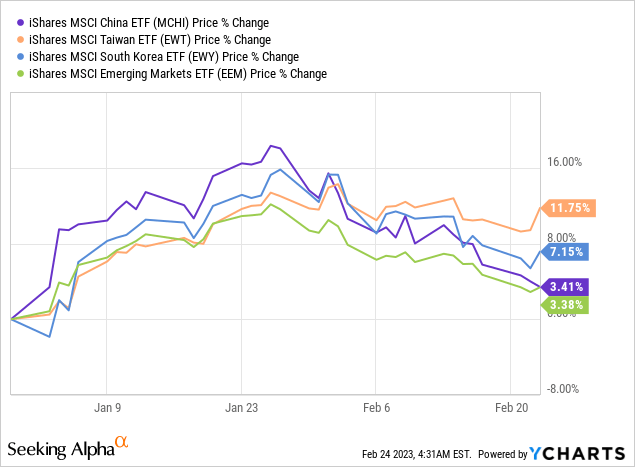

China's economic reopening should help to boost economic activity in the region, which should benefit equities in China and other regional countries. For example, China is Taiwan's largest trading partner, accounting for circa 25% of total trade, while China is South Korea's largest export destination.

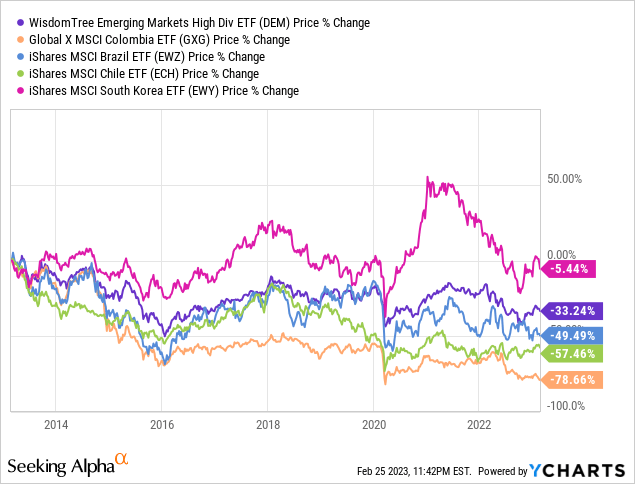

Both South Korea and Taiwan have outperformed other emerging markets, largely due to China's reopening and the perceived recovery of electronics exports.

| Preview | Product | Price | |

|---|---|---|---|

|

Galway Bay Long Sleeve Golf Rain Jacket - Three Layer Long Sleeve Golf Jackets for Men, Lightweight... |

$200.00 |

Buy on Amazon |

Sovereign Debt: One benefit of this fund over other emerging market funds is that it does not have a lot of exposure to the smaller emerging markets with sovereign debt issues (i.e. Sri Lanka and Pakistan).

Geopolitical Risks: Over 60% of the fund's assets are invested in China, Taiwan, and South Korea, so any increased tensions with China-Taiwan in the coming years would likely cause this fund to underperform other emerging markets. However, this could be a serious issue to monitor in 2024 or 2025.

Inflation: Inflation has begun to ease recently, but the worst is not likely over. However, the inflation rate in many of these larger emerging markets is well below that of the United States and Europe.

Latest Inflation Rate

| China | 2.1% |

| Taiwan | 3.0% |

| South Korea | 5.2% |

| South Africa | 6.9% |

| Brazil | 5.8% |

| Mexico | 7.9% |

| India | 6.5% |

Source: Trading Economics (Jan. 2023 data)

Most of the top 5 countries this ETF invests in export a lot of higher-tech electronics, and demand in these areas could be more resilient this decade, especially as competition heats up among lower-cost manufacturing destinations that import components and then manufacture and assemble. Moreover, this fund also has strong commodity exposure, investing in markets like Brazil (#3), South Africa (#4), and Saudi Arabia (#12). Investors bullish on commodities could also add other country-specific ETFs to their portfolio, like the Global X MSCI Colombia ETF (GXG) or the iShares MSCI Chile Capped ETF (Original Post>

Country Portfolio Position # Top Exports Mexico 7 Cars, computers, trucks, and crude oil Malaysia 8 Integrated circuits, petroleum, palm oil, semiconductor, and rubber Thailand 9 Electronics, machinery, and foodstuffs. Indonesia 10 Palm Oil, coal, gold, petroleum, and ferroalloys.

Source: Wisdom Tree/OEC/TE

- 🌴 Material: Chiffon, 100%Polyester ; Lightweight, soft and comfoy material

- 🌴 Features: Long sleeve chiffon lace mini dress for women spring, summer and fall, crew neck, long lantern sleeve, zipper closure, elastic waist, a-line and slim fit style, elegant ruffle design, this cute fall mini dress will make you more beautiful and lovely!

- 🌴 Occasions: Fall casual short dress suitable for you to party, holiday, school, date, cocktail, coming home, and daily life. Believe you will love it and get lots of compliment!

- 🌴 Garment care: Hand wash in cold water recommend, hang dry, low temperature ironing if necessary

- 🌴 Size Note: 0-2, 4-6, 8-10, please refer to our sizing information in the picture description to choose your size. Thanks for your understanding

Overall, most of the holdings are in economies that have diversified away from lower-end manufacturing activities, like textile manufacturing. Moreover, most economies, with the exception of Chile (11th largest country position), Saudi Arabia, and others, are not too dependent on commodities. One could argue that the demand for electronics in Asia may exceed the demand for lower-end textile products in regions like Europe and North America.

Final Thoughts and Risks

This is my favorite emerging market ETF to own at the moment, as I think it is safest to accumulate out-of-favor sectors instead of paying a premium for gaining more exposure to consumer stocks. I plan to invest in this ETF, and other emerging markets like Brazil, South Korea, Chile, and Colombia, as all of these markets trade at compelling valuations.

Latin American equities likely have superior upside potential because of long-term underperformance in the past decade/lower valuation. Cautious optimism and selective shopping are the best tools. Some of the safest bets in emerging markets are cheaper markets with perceived high political risks, rather than stable markets with higher valuations in my view.

While frontier markets and smaller emerging markets seem more vulnerable to threats, in terms of sovereign debt and inflation risks, there could be spill over effects to larger emerging markets if there are more sovereign defaults or inflation remains high. The biggest risk with this ETF, relative to other emerging market ETFs, is the heavy exposure to China and Taiwan.