Interest rates and inflation have skyrocketed since early 2022. Asset prices are down across the board. These and other developments have important implications for XYLD and its shareholders. A look at these follows.

Four Important Developments For XYLD And Its Investors (NYSEARCA:XYLD)

I've written about covered call funds since late 2020, owing to their strong yields and popularity. These articles generally focus on fundamentals, benefits and drawbacks, which have remained roughly the same for years. Strategies and underlying market condition do sometimes change, so thought a quick article looking at these was in order.

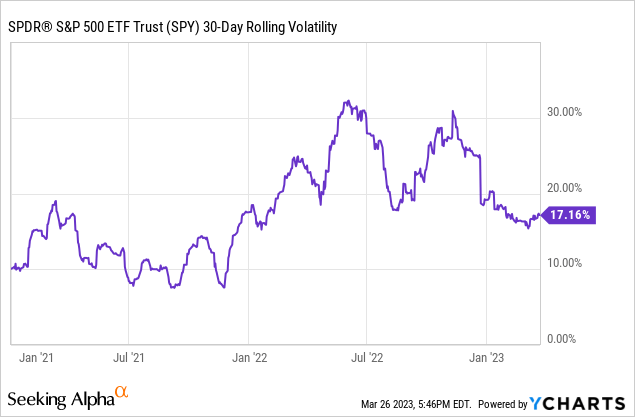

Equity volatility has increased, leading to higher option premiums, and higher covered call fund yields.

Equities have seen lower capital gains, reducing the impact covered call fund reduced capital gains have on total returns.

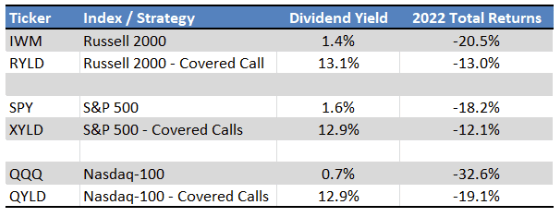

Due to the above, covered call fund total returns have materially improved, with these generally outperforming broader equity indexes these past few years.

Global X covered call ETFs are also selling covered calls closer to the money, which means returns have become more dependent on option premiums and volatility, less dependent on equity capital gains.

I'll be focusing on the Global X S&P 500 Covered Call ETF (NYSEARCA:XYLD) in this article, but these trends should apply to most other covered call funds too, including the Global X Russell 2000 Covered Call ETF (RYLD) and the Global X NASDAQ 100 Covered Call ETF (Original Post>

XYLD – Quick Overview

Quick overview of the fund before a more in-depth look at recent developments.

XYLD invests in all S&P 500 components and sells covered calls on its holdings.

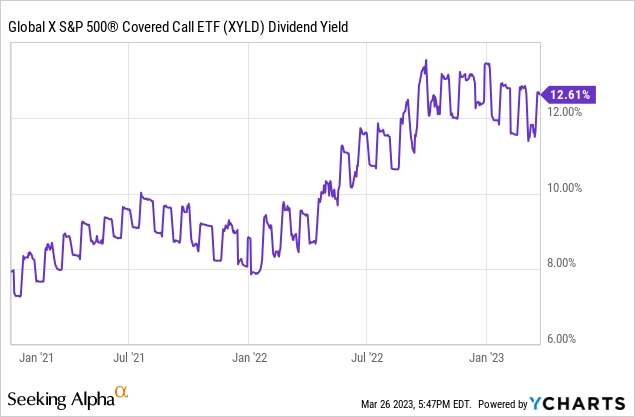

Doing so generates significant premiums, some of which are then distributed to shareholders. Said premiums boosts the fund's yield to 12.6%, a positive for investors.

Doing so significantly reduces potential capital gains, and means the fund sees very little benefit from higher equity prices, a negative for investors.

The net effect is dependent on the (relative) magnitude of distributions and capital gains. When distributions are higher than capital gains, so during most bear and flat markets, the net effect is positive. When distributions are lower than capital gains, so during most bull markets, the net effect is positive.

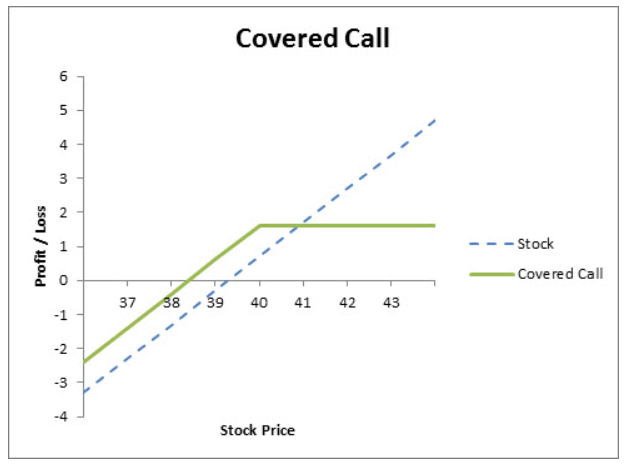

A quick table looking at covered call option profits. Take special note of the fact that selling covered calls is net profitable when equity prices are low (so no capital gains).

Selling a covered call always has a similar impact. Graphing the profits would always look like above. Specifics do vary. Let's have a look at how, exactly, these have varied these past few years.

Covered Call Strategies and Funds – Recent Developments

Option Premiums and Dividends

XYLD sells covered calls for a price. Option prices are dependent on many factors. Volatility is key, with higher volatility leading to higher option prices, and hence option premiums. Equity volatility spiked during the pandemic, and doubled in early 2022, as inflation skyrocketed. Inflation has started to normalize these past few months, but remains elevated, and likely to remain so as long as inflation remains a pressing issue.

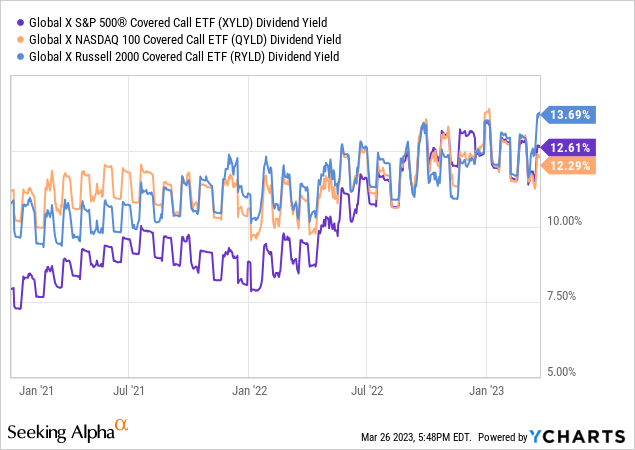

Higher volatility meant higher option prices, which meant greater option premiums for XYLD, and higher distributions for its shareholders. XYLD's yield has increased from 7.9% in early 2021 to 12.6% today.

Approximately all covered call funds should be seeing higher option premiums these past few years. Yields should be increasing too, although these are somewhat dependent on distribution policies, and other fund-specific factors. XYLD, QYLD, and RYLD have all seen higher yields, as expected.

Distribution policies for the three funds are relevant to these issues. These funds have capped their monthly distributions at 1.0% of fund assets. Excess premiums are retained and re-invested in the funds, leading to asset growth and increased income. Said cap was reached in mid-2022, with these funds retaining a significant portion of their premiums since, equivalent to more than 1.0% of fund assets per year.

Retaining so much in premiums could, in theory, lead to strong capital gains and income growth. In my opinion, this is very unlikely, as these funds are structurally predisposed towards long-term capital losses / lower share prices, but the possibility is still there. None of these funds have seen significant, sustained capital gains since option premiums spiked, as expected.

Capital Gains

XYLD's covered call strategy leads to significantly reduced capital gains when equity prices are up. The impact of this is strongly dependent on how much equity prices are up.

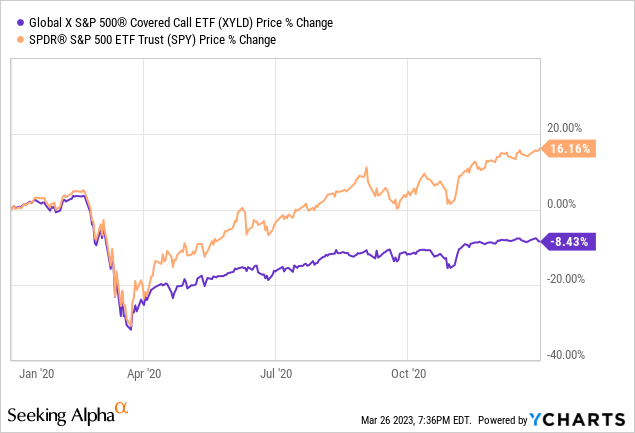

When equity prices are up by a lot, the impact is incredibly detrimental. As an example, the S&P 500 saw price gains of 16.2% during 2020, compared to losses / share price reductions of 8.4% for XYLD. That massive 24.6% differential was due to XYLD seeing significantly reduced capital gains as equity prices recovered starting from March.

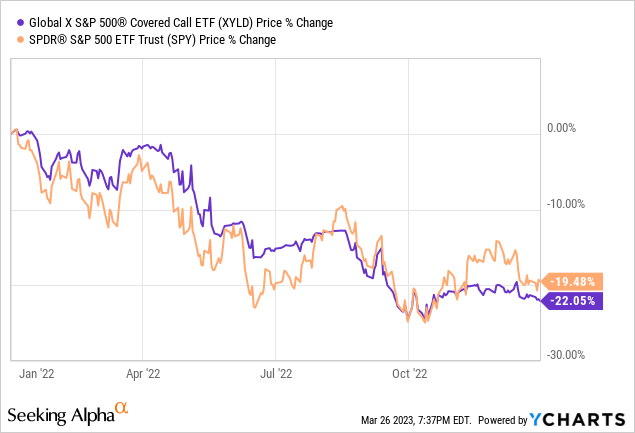

When equity prices are barely up the impact is quite low, if still negative. As an example, the S&P 500 was down 19.5% in 2022, during which XYLD was down 22.1%. XYLD saw reduced capital gains during the months in which equity prices rose, including from October to December, but gains were quite tepid, so the impact from said reduction was small.

- 5.1-channel 80-Watt powerful surround sound system

- 4K60, 4K120AB and 8K60B HDMI 2.1 with HDCP 2.3 and...

- Dolby Vision, Hybrid Log-Gamma and BT.2020

- Supports enhanced media and gaming - ALLM, VRR

- YPAO automatic room calibration

- Low-Profile Modern Design - Clean silhouettes,...

- Powerful Performance - Brilliant clarity,...

- Simple Setup, Streaming & Control - Get setup and...

- 5.1-Channel Sound - Experience a powerful...

- 6 Total Speakers - Full-range drivers deliver...

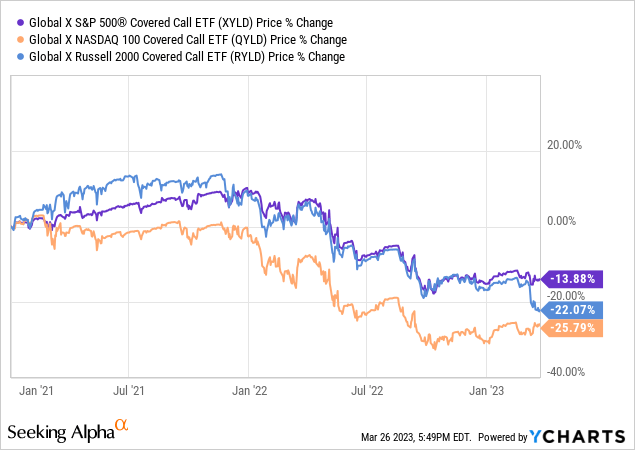

Approximately all covered call funds should benefit on a relative basis, or be harmed by less, from lower equity capital gains.

As an aside, although the above is pretty obvious, I did think it was important to explicitly mention. XYLD generally does worse than the S&P 500 index on capital gains / share price appreciation grounds, but the gap has narrowed a lot in the recent past.

Total Returns

XYLD's dividends have seen very healthy growth these past few years. Share prices have remained stagnant or decreased depending on the specific time period in question, although the same is somewhat true for broader equity indexes too.

The result from these two trends should be covered call fund outperformance, as was the case in 2022, and as has been the case for several other recent time periods too.

Covered Calls Sold Closer to The Money

Global X covered call ETFs have begun to sell covered calls closer to the money in the past year or so.

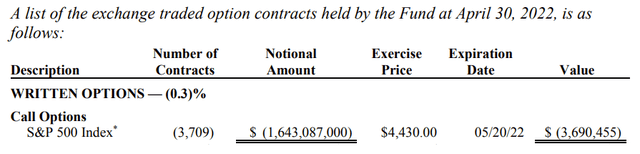

As an example, in April 2022 XYLD's call options had a strike price of $4,430.

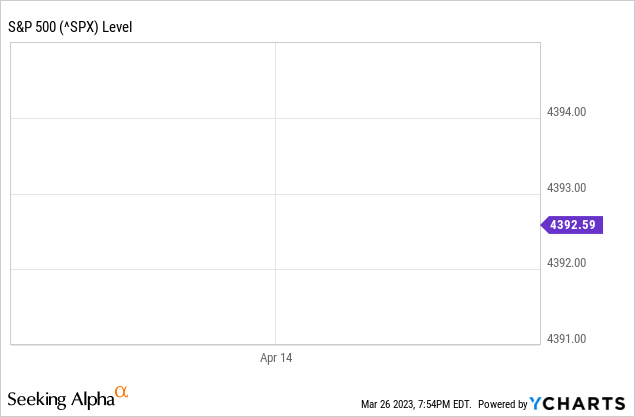

These were bought when the S&P 500 was at $4,392.

XYLD's call options had a strike price which was 1% out of the money in April 2022.

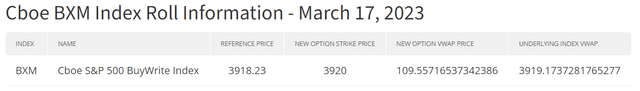

Today, XYLD has call options with a strike price of $3,920, and these were bought when the S&P 500 traded at $3,918, or less than 0.1%.

The above means higher option premiums for the fund and its shareholders, but lower capital gains from higher S&P 500 prices or levels.

- SAMSUNG USA AUTHORIZED - Includes 2 Year Extended...

- Samsung 85 Inch DU8000 Crystal UHD LED 4K Smart TV...

- UHD Dimming | Auto Game Mode (ALLM) | Alexa...

- SAMSUNG TIZEN OS: Stream your favorite shows, play...

- BUNDLE INCLUDES: Samsung DU8000 Series 4K HDR...

- SAMSUNG USA AUTHORIZED - Includes 2 Year Extended...

- Samsung 75 Inch DU8000 Crystal UHD LED 4K Smart TV...

- UHD Dimming | Auto Game Mode (ALLM) | Alexa...

- SAMSUNG TIZEN OS: Stream your favorite shows, play...

- BUNDLE INCLUDES: Samsung DU8000 Series 4K HDR...

Higher option premiums does not readily translate into higher fund dividends, as these are capped at 1.0% per month, and the cap was reached close to one year ago.

Lower potential capital gains do not readily translate into lower fund share prices, as the fund is retaining a significant portion of their option premiums.

The above does mean that fund total returns are less dependent on S&P 500 price movements, but much more dependent on option prices. Expect weaker returns if volatility and option prices decrease, stronger returns if these increase. As mentioned previously, volatility is currently at somewhat elevated levels, and most covered call funds have seen stronger performance, in-line with expectations.

In my opinion, selling covered calls closer to the money is something of a negative, as it means performance could deviate much more strongly from that of equity indexes, and makes performance dependent on niche, hard to forecast factors. I can't say I'm an expert on stock market volatility, and I believe the same is true for most readers and retail investors. XYLD's performance is more dependent on volatility now than in the past, and I can't say I see that as a positive.

Conclusion

XYLD has seen higher dividends and total returns these past few years. Although capital gains remain non-existent, the fund does comparatively better in this regard too. As the fund is selling calls closer to the money, performance is more dependent on volatility, less dependent on equity price movements.