Aerospace and defense could become a more profitable area as the United States becomes increasingly caught up in geopolitical tensions with China and Russia. In the long-term, spaces like technology and industrials could become breeding grounds for international competition, which could increase certain nations' inclination to outcompete their opponents. With all of this in mind, I could see the United States pouring more capital into defense technology down the road. I rate the SPDR S&P Aerospace & Defense ETF (NYSEARCA:XAR) a Buy.

The United States' safety has become a salient topic this year amid their involvement in the ongoing Russia-Ukraine conflict, and after events like the Chinese spy balloon in January. As much as this threatens public safety, it could be quite beneficial for companies focused on military technology and operations. Furthermore, military infrastructure and technology could see notable improvements and innovations as technology progresses. Emerging technological systems like 3D printing and Artificial Intelligence can make military action quicker and more effective. XAR could allow one to profit directly from military innovation and indirectly from advances in technology.

Strategy

XAR tracks the S&P Aero&Defense Select Industry TR USD Index and uses a representative sampling technique. Companies held in this index must have a float-adjusted market capitalization of at least $500 million with a float-adjusted liquidity ratio of at least 90%. Companies may also have a market capitalization of just over $400 million if they have a float-adjusted liquidity ratio of at least 150% to make up for it. Such holdings are subject to removal if these two key metrics fall below $300 million and 50%, respectively. XAR also has rather low expenses as well as attractive liquidity due to its high AUM. Therefore, this ETF doesn't necessarily require investors to pay a hefty premium, and may also spare some worry regarding the inability to sell shares amid an economic downturn.

Holdings Analysis

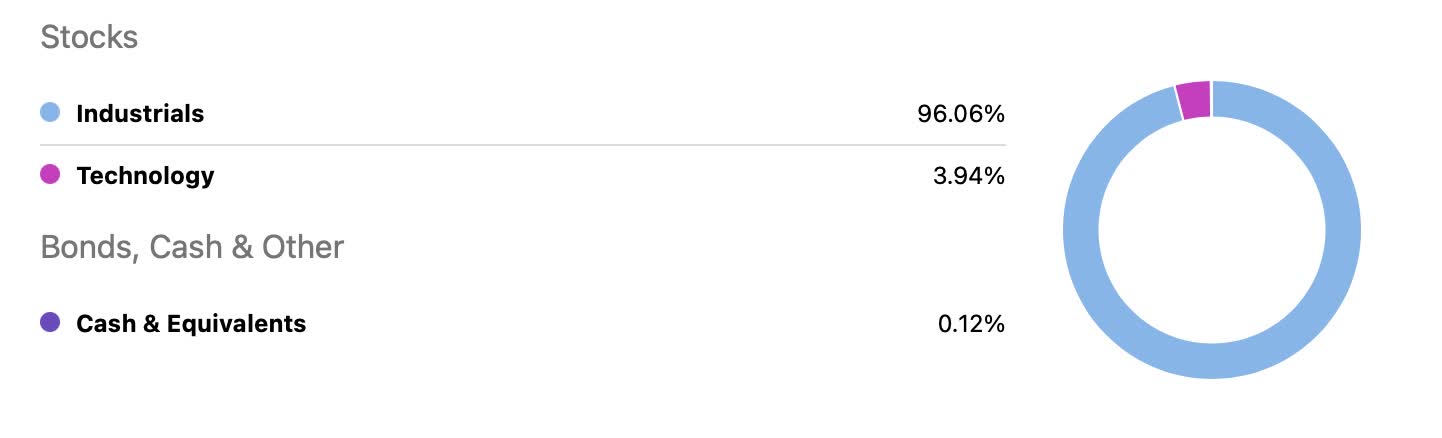

This ETF invests almost entirely in industrial companies plus a miniscule technology allocation. Such companies reside exclusively in the United States.

Seeking Alpha

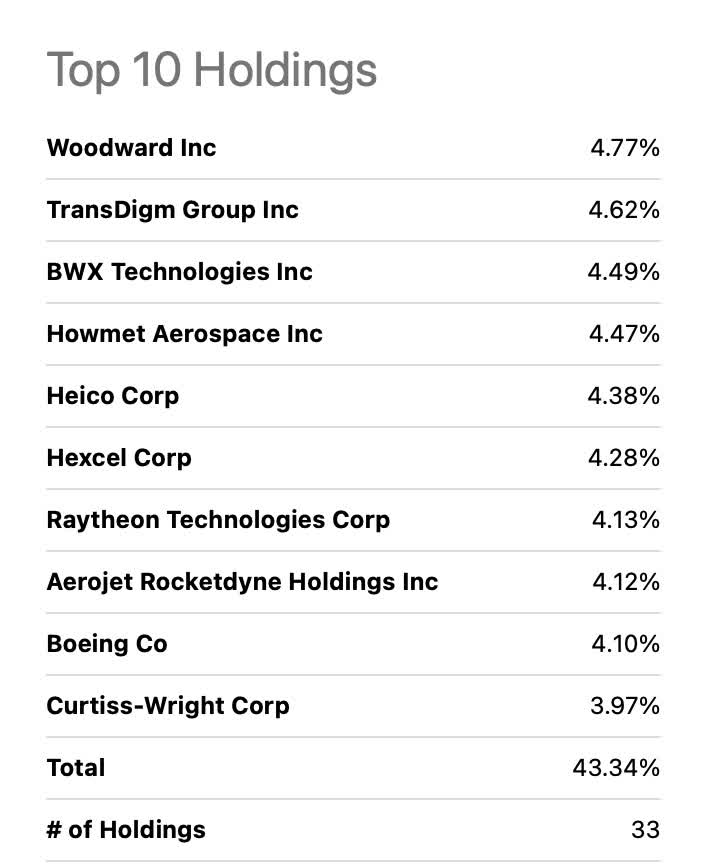

As an equal-weight ETF, not one holding accounts for more than 5% in this fund of 33 securities.

Seeking Alpha

This ETF might spare investors the concentration risks found in similar funds and provide more dispersed exposure to aerospace and defense.

ETF Performance and Future Implications

Historical Underperformance

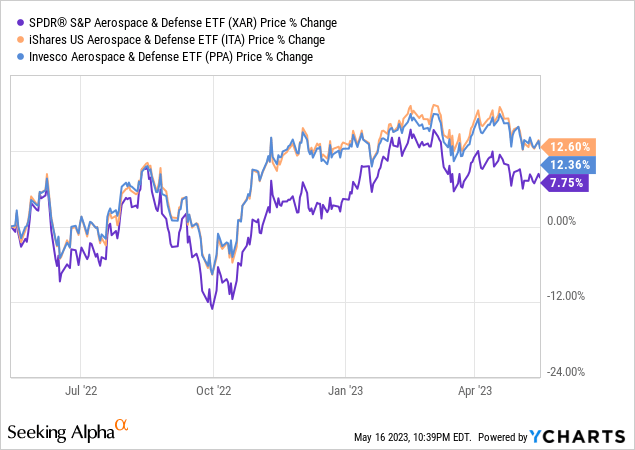

Compared to some of its peers, XAR has had trouble in the past few years attaining similar momentum. Potential alternatives to XAR include but are not limited to the iShares U.S. Aerospace & Defense ETF (ITA) and the Invesco Aerospace & Defense ETF (PPA).

Data by YCharts

- Tobias, Andrew (Author)

- English (Publication Language)

- 320 Pages - 04/19/2022 (Publication Date) - Harper...

- Reference Guide, Investment Lawyer's (Author)

- English (Publication Language)

- 46 Pages - 07/12/2019 (Publication Date) -...

XAR may be well-positioned for long-term gains, but investors may still want to consider the possible opportunity costs of choosing XAR over ITA or PPA.

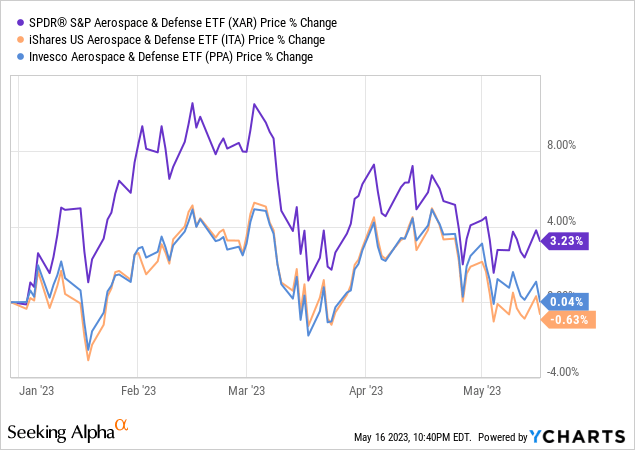

YTD Outperformance but Volatility Stands

When looking at XAR's performance year-to-date, this ETF has surpassed its peers and reached heights almost twice as high as that of ITA and PPA. However, this ETF's movements are still relatively erratic, and its declines are sudden and sharp.

Data by YCharts

I believe XAR is a security that could produce generous returns in several years as the military-industrial complex becomes a more profitable investment, but this process will likely require patience and robust risk tolerance.

Geopolitical Tensions: United States in The Crosshairs

United States and Russia

Tensions between the United States and Russia could worsen as the United States continues to arm Ukraine amid the ongoing war between Ukraine and Russia. As both sides apply pressure, U.S. markets could see an increased demand for military technology and equipment as well as more government spending on armaments and defense. This could drive up the price of XAR.

United States and China

The United States and China's tensions have cooled off slightly as the two nations have resumed communication, but the coast is hardly clear. For example, China disclosed in March that they were preparing for war and ramping up their defense budget. This could cause the United States to also focus more heavily own defense, which could boost the price of XAR.

Artificial Intelligence in The Military

Artificial intelligence (AI) could make military technology more efficient and profitable. Most notably in recent time, Palantir (PLTR) demonstrated how its AI Platform was capable of swiftly scanning a battlefield and detecting enemy forces and equipment up to 30km away from friendly forces. As such technology's potential and ethical implications become clearer, I believe AI-powered defense systems could become a prime target for investors.

Negative Outlook and Long-Term Concerns

High Interest Rates

The recent April CPI data may have taken some pressure off the Fed, but inflation remains high and future hikes are not out of the question. I don't believe the Fed is afraid to induce a recession and may even desire one. High interest rates could put pressure on government budgets. This could threaten aerospace and defense as these companies are often capital-intensive and rely heavily on government funding. This could drive down the price of XAR.

Arms Races

Though heightened geopolitical tensions could enhance cash flows for defense companies, excessive tensions could prompt arms races and throw spending over the edge. An arms race between the United States and a foreign belligerent could increase military spending to the point where sectors like healthcare and education are underfunded. This might momentarily pump ETFs like XAR but is ultimately bad for the greater economy and could later indirectly harm the defense sector and affiliated ETFs. Furthermore, the geopolitical uncertainty generated by arms races may reduce investor sentiment and make investors less willing to dabble in the defense sector.

Conclusion

This ETF could in the coming periods be at the forefront of developments in the aerospace and defense domain. Though XAR has struggled to gain the same momentum as ITA and PPA during the past year, its YTD performance may reflect a rebound of sorts. The military may also receive more funding as technological advantages may take defense systems to new heights. Such developments could boost the price of XAR sooner rather than later. Therefore, I rate this ETF a Buy.

Take Advantage of U.S. Defense Spending in 2023 With This ETF