Technological advancements have made video games a more fruitful experience for numerous users across various demographics. Looking forward, developments like the Metaverse and artificial intelligence (AI) could revolutionize the video game space and make it a more attractive investment. Furthermore, esports have risen in popularity since the COVID-19 pandemic. This industry could in the long-term become as prevalent as physical sports, as esports allow aspiring players to feel the rush of intense competition without worrying about bodily injuries and other health concerns.

As a more niche subcomponent of the broader communication sector, the video game market might come with inherent concentration risk that could serve it quite poorly as macroeconomic conditions decline. In the same regard, video game-focused securities likely don't have the same cushioning as those which focus on communication as a whole. For these reasons, I rate the Global X Video Games & Esports ETF (NASDAQ:HERO) a Hold.

The communication sector is quite prevalent in the video game industry, but video games are a relatively less significant part of the communication sector. The video game industry took quite a hit in 2022 as the bear market took over, causing the number of closed deals as well as these deals' value to decline. Video game sales also declined from 2021 to 2022, and I believe consumer spending in this space is due for additional disruption before the end of this year. As recession fears continue to loom, 2023 is likely to be another uphill battle for many digital gaming franchises. Video game revenues are still projected to grow steadily in the long-term, and this form of recreation could develop an even bigger fanbase than it already has. However, the short to medium-term path is looking quite bumpy.

Strategy

HERO tracks the Solactive Video Games & Esports NR USD Index and utilizes a full replication technique. The designated index consists of companies that are poised to benefit from increased consumption in the realms of video games and esports. Such companies identify mainly as video game developers and publishers, as well as content distributors and streaming services. Qualifying companies must derive at least half of their revenues from video games and esports activities. The same companies' market capitalization must also exceed $200mm and their average daily turnover for the last 6 months be at least $2mm. This ETF is re-weighted semi-annually.

Holdings Analysis

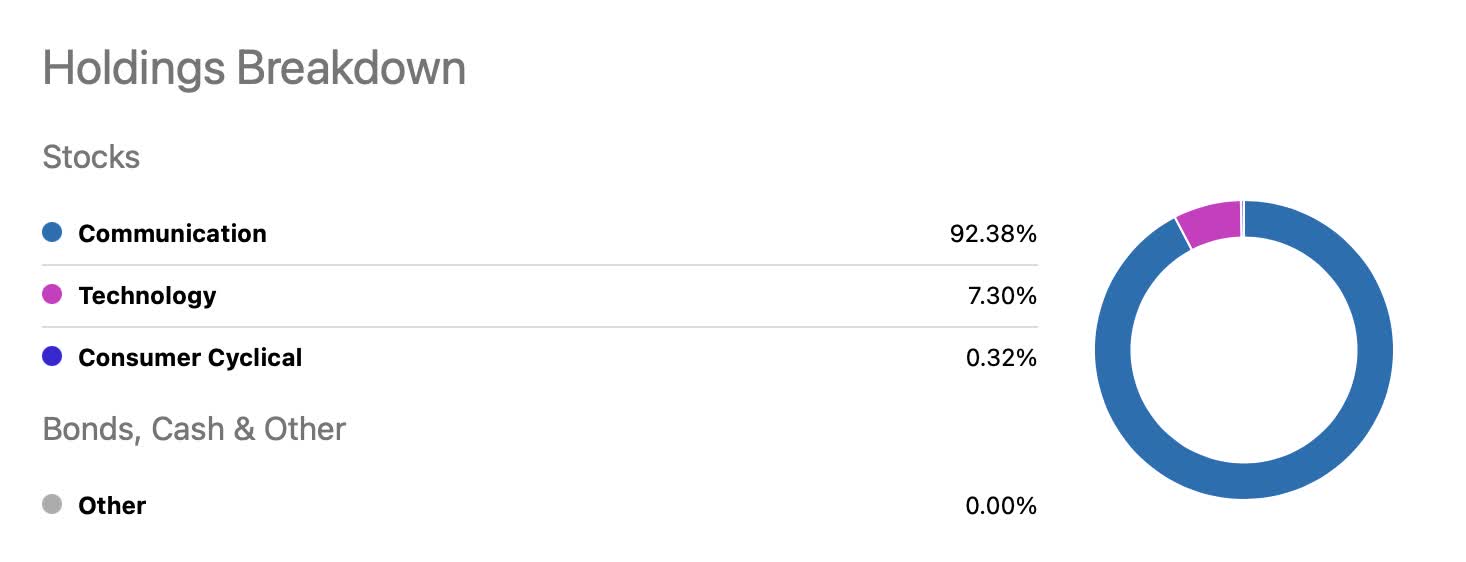

This ETF dabbles mainly in communication with also a small amount of technology and consumer cyclical.

Seeking Alpha

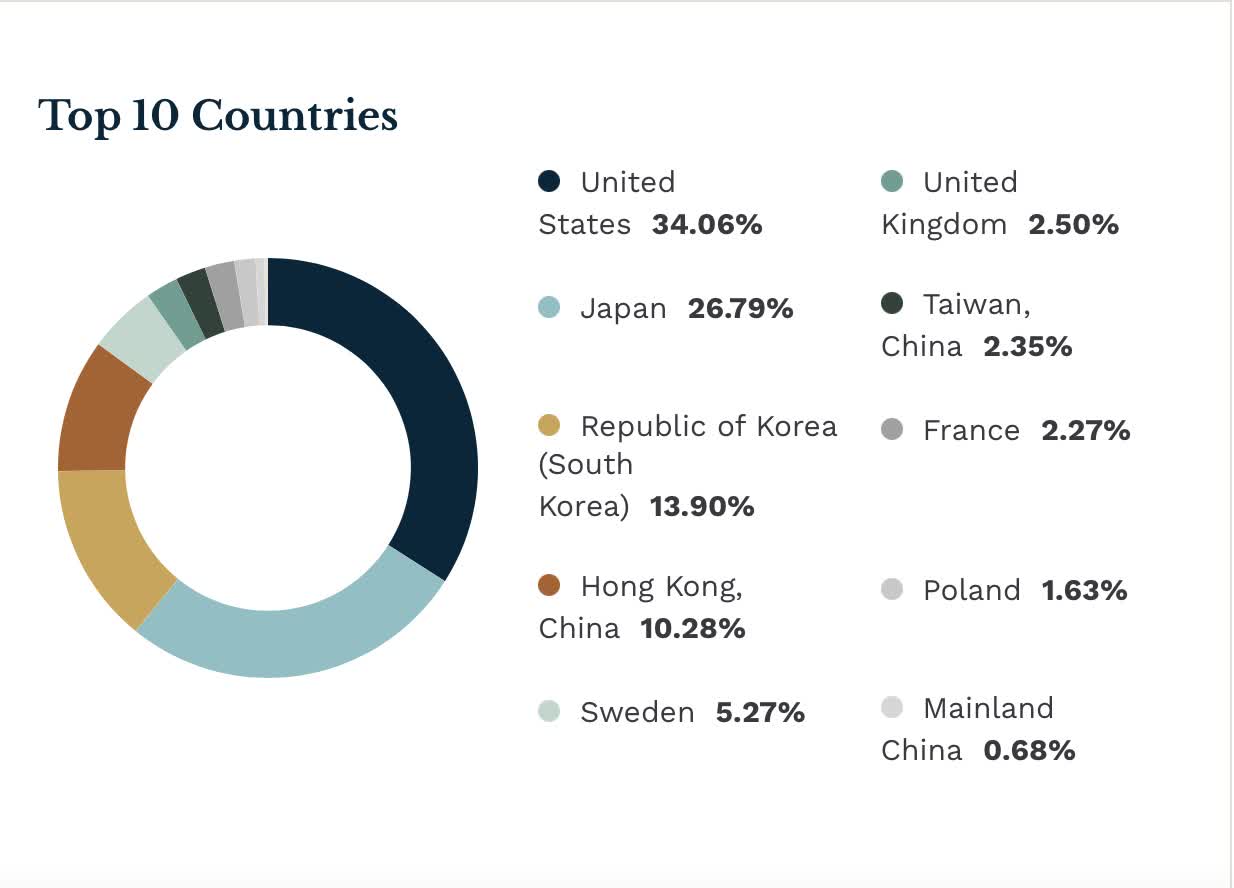

Companies held within HERO are located primarily in the United States as well as East Asia. East Asian countries represented in this ETF include Japan, South Korea, and Hong Kong. Such regions all have relatively lucrative video game industries, hence their prevalence in this ETF.

etf.com

In this fund of just over 50 holdings, the top 10 stocks account just over half of the entire portfolio. The leading four stocks in HERO account for roughly a quarter of this ETF.

Seeking Alpha

Concentration risk may therefore be an outstanding concern within this ETF, and investors may want to assess their confidence in letting just a few stocks do the majority of the moving.

Strengths

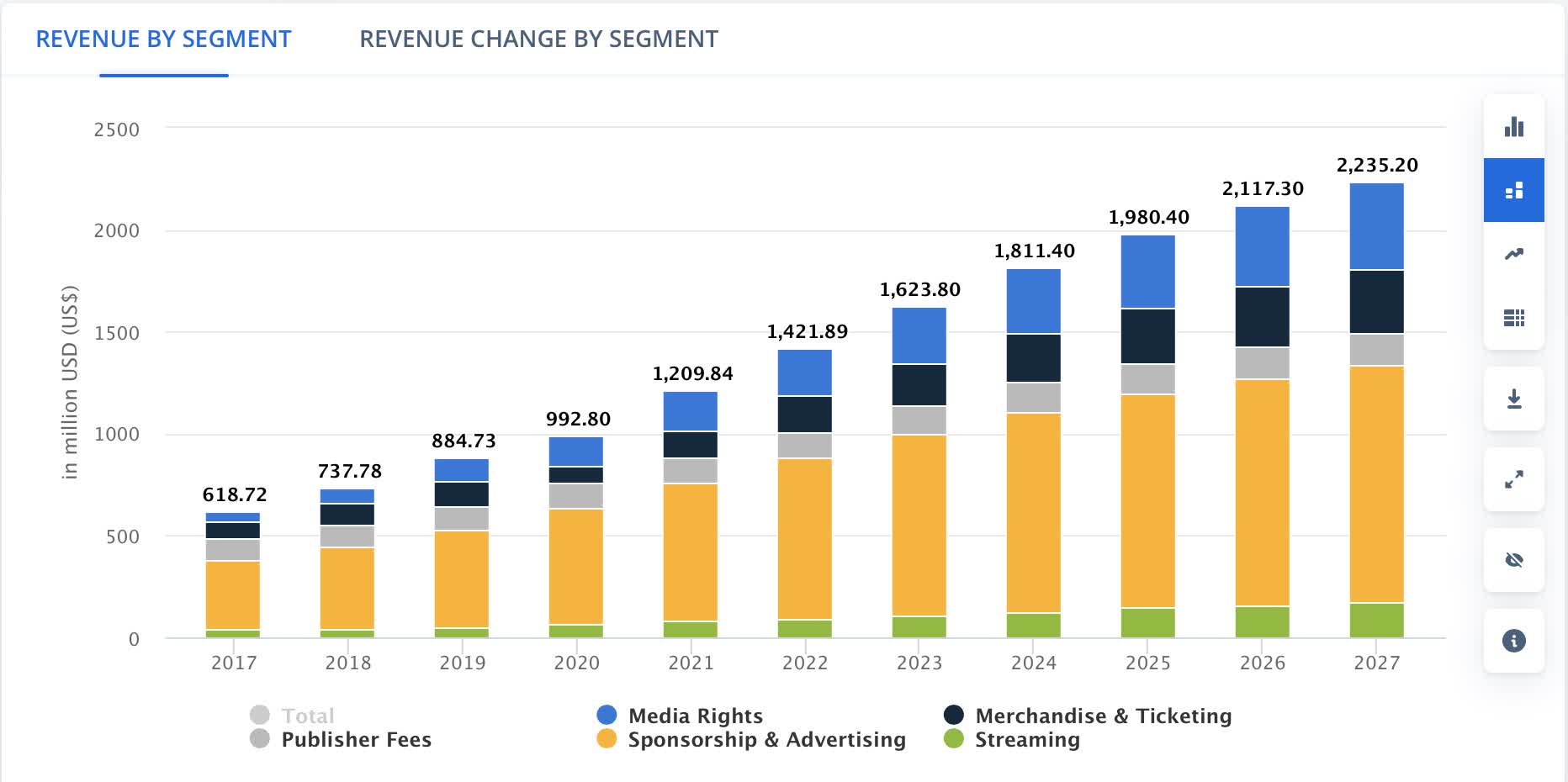

The esports industry is well-positioned for long-term growth and is becoming a more popular scene for competitors and audiences alike. As depicted in the chart below, revenues in this industry could top $2.2B as soon as 2027.

Statista

Growth in the esports industry could catalyze the popularity of and demand for certain video games, which could ultimately boost the price of HERO.

As opposed to an all-encompassing communications fund, this ETF may be a unique alternative for those particularly interested in the videogame space. HERO could therefore offer more narrow exposure compared to certain broadly-focused alternatives, while also providing the benefits of diversification not held in individual video game stocks. This could become a more salient aspect of this ETF as the number of video game enthusiasts is also on the rise.

Weaknesses

HERO has underperformed several of its alternatives with broader focuses. This ETF's narrow focus may appeal to those with more specific interests, but might also get in the way of profits. Depicted below is HERO's performance in 2023 compared to ETFs which cover the general realm of communication services.

- Pfau, Wade (Author)

- English (Publication Language)

- 508 Pages - 03/15/2023 (Publication Date) -...

- Birken, Emily Guy (Author)

- English (Publication Language)

- 240 Pages - 05/11/2021 (Publication Date) - Adams...

- Amazon Kindle Edition

- Holt, Richard (Author)

- English (Publication Language)

- 172 Pages - 07/19/2022 (Publication Date)

Last update on 2024-04-05 / Affiliate links / Images from Amazon Product Advertising API

Data by YCharts

Evidently, HERO's momentum is significantly lagging behind some of its peers. This ETF may have a fundamental problem with momentum compared to funds that strategically grasp the more profitable areas of communication. A notable example of this is the Communication Services Select Sector SPDR Fund ETF (XLC). In the long-term, investors might want to consider how profitable video games are compared to communications in general, and whether HERO's niche weighs against the opportunity cost associated with choosing this ETF over one of its peers.

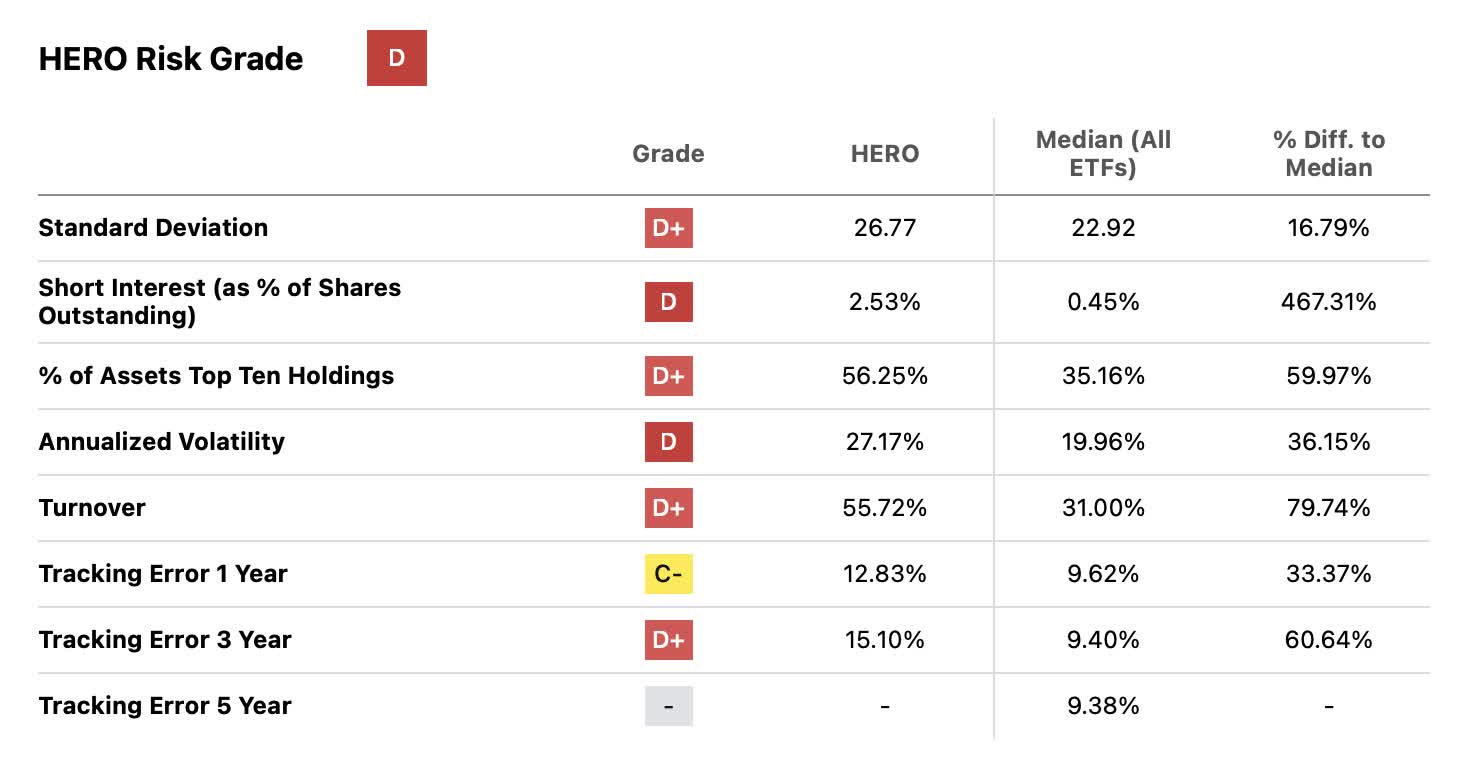

This ETF is also quite volatile, which may stem from its more narrow focus on video games rather than other areas of communication like the internet, broadcasting, and social media that might have more room for lucrative innovation. I have covered the internet as an industry in my piece on the Invesco NASDAQ Internet ETF (PNQI).

Seeking Alpha

Opportunities

Virtual Reality (VR) and Augmented Reality (AR) are increasing in popularity as they may offer a more realistic, immersive experience to gamers. Furthermore, VR and AR have drawn ample amounts of momentum from developments in the Metaverse. I believe Meta (META) has the potential to revolutionize gaming with this project. Therefore, growth in the Metaverse as well as VR and AR could catalyze the demand for video games and boost the price of HERO at the same time.

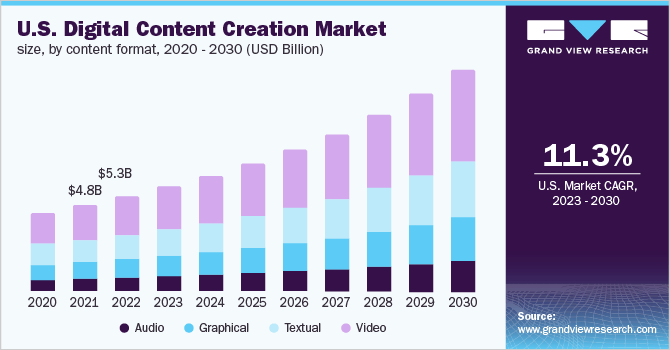

Content creation as an occupation is also rising in popularity, especially among those in younger generations.

GrandView Research

Video games are a primary source of content for such creators. As a result, growth in this industry could laterally prompt growth in the market for video games. This could provide HERO with some much sought-after momentum in the coming periods.

Threats

Video game consoles as well as the games themselves are becoming more expensive and for many, might be more of a luxury than a necessity. As a result, the demand for video games could suffer during an economic downturn. Furthermore, microtransactions are becoming an increasingly integral part of video games. This component has already supplied video game companies with a generous cash boost. However, as prices continue to rise, microtransactions could deter consumers and stifle demand and enthusiasm for video games.

Online multiplayer is a core component of many game franchises and is beloved by many, for it allows players to meet new people and compete against real people rather than computer processing units (CPU). However, this same aspect could be a breeding ground for privacy and security concerns. Especially with increasingly proficient and accessible AI systems, quickly accessing large amounts of user data for exploitative purposes could become much easier and a more prominent threat sooner rather than later.

Conclusion

Video games are likely to become a more popular and fulfilling form of entertainment down the road, but this industry isn't the most recession-proof. Small-cap, niche funds could take off in the long-term just like video games themselves, but in the meantime, I believe the current economic forecast warrants great caution. Amid tighter economic conditions, investors may be better off with more broadly-focused communication funds. Therefore, I rate HERO a Hold.

An ETF to Weigh as E-Sports Show Signs of Growth