Value stocks and related ETFs have maintained their momentum on Friday, as the markets pushed higher for a second consecutive session.

Source: Value ETFs that Capture Resurgent Cyclical Sectors

Lifting economically sensitive stocks, IHS Markit data revealed U.S. business activity rose in May amid strong domestic demand, but uncompleted work is increasing as manufacturers struggle to find raw materials and labor, Reuters reports.

The markets turned around on Thursday after labor market data showed the fewest U.S. weekly jobless claims since the coronavirus pandemic upended the economy in 2020, reflecting a pick-up in employment.

“There was some relief that the labor market recovery is under way in the U.S. and we’re seeing some nervousness about inflation ebbing away,” Kiran Ganesh, a multiasset strategist at UBS Global Wealth Management, told the Wall Street Journal.

Investors are now betting that cyclical or more economically sensitive sectors will lead the rebound to pre-pandemic levels.

- Tobias, Andrew (Author)

- English (Publication Language)

- 320 Pages - 04/19/2022 (Publication Date) - Harper...

- Reference Guide, Investment Lawyer's (Author)

- English (Publication Language)

- 46 Pages - 07/12/2019 (Publication Date) -...

Last update on 2024-04-05 / Affiliate links / Images from Amazon Product Advertising API

“If we can get a combination of confidence that inflation is under control, and signs of economic momentum coming through, I think there is still good opportunities to be had, in the reopening type of sectors in particular,” Ganesh said, adding that stocks that performed poorly during the pandemic could become the new drivers that lead major indices higher.

Investors who are interested in a targeted approach to the value segment can look to the American Century STOXX U.S. Quality Value ETF (VALQ). VALQ’s stock selection process includes a value score based on value, earnings yield, and cash flow yield, along with a sustainable income score based on dividend yield, dividend growth, and dividend coverage.

The American Century Focused Large Cap Value ETF (FLV) tries to achieve long-term returns through an investment process that seeks to identify value and minimize volatility. FLV holdings and value stocks usually trade at lower prices relative to fundamental measures of value, like earnings and the book value of assets.

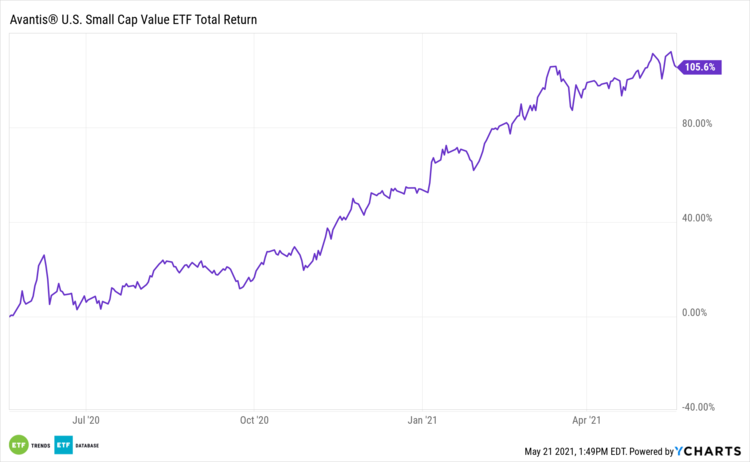

Lastly, the Avantis U.S. Small Cap Value ETF (AVUV), an actively managed ETF, seeks long-term capital appreciation. The fund invests primarily in U.S. small cap companies and is designed to increase expected returns by focusing on firms trading at what are believed to be low valuations with higher profitability ratios.

For more news, information, and strategy, visit the Core Strategies Channel.