Written by Nick Ackerman, co-produced by Stanford Chemist. This article was originally published to members of the CEF/ETF Income Laboratory on July 12th, 2022.

Nuveen Multi-Asset Income Fund (NYSE:NMAI) may have been created and started to trade in November 2021. However, the fund has a long history if you look at the three funds that resulted in this “newly” created fund. The merger resulted in a larger fund that could potentially add more liquidity through potentially higher trading volume.

Nuveen merged Nuveen Diversified Dividend and Income Fund (JDD), Nuveen Tax-Advantaged Total Return Strategy Fund (JTA) and Nuveen Tax-Advantaged Growth Fund (JTD) to create NMAI. This created a larger, more hybrid fund that can invest in just about anything and anywhere around the globe.

Typically, new CEFs get pushed to a fairly large discount after launching – despite launching as term funds these days. I believe that NMAI is getting pushed to an even deeper discount because it appeared to be a new fund and was created at a bad time. If you look at the charts, it seems to have only rapidly moved downward, but that's just following the broader markets overall.

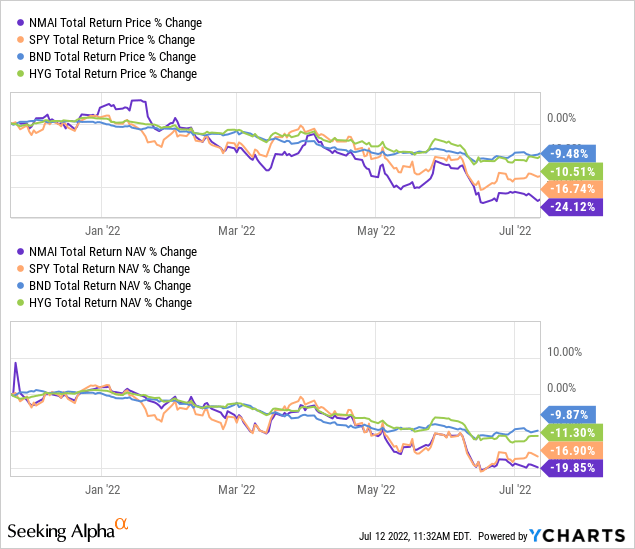

In the chart below, I've also included, for comparison purposes, SPDR S&P 500 (SPY), Vanguard Total Bond Market (BND) and iShares iBoxx $ High Yield Corporate Bond (HYG). NMAI is invested in a mixture of equities and fixed-income, which is further split into investment-grade and non-investment-grade holdings. On both a total NAV return and total share price return, NMAI has lagged, which could be a function of its leverage and poor positioning.

YCharts

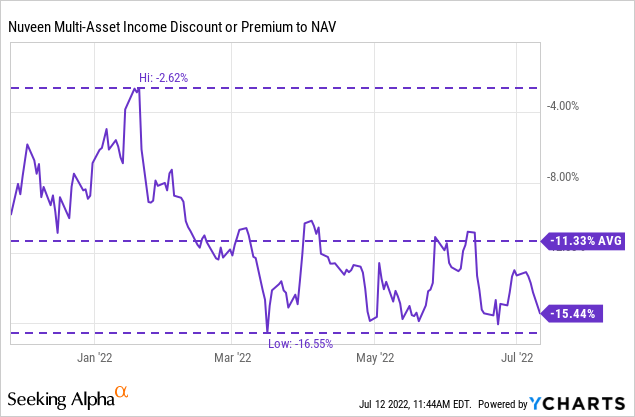

I'm not so concerned with the performance relative to these three indexes. The fund is much more than just common stocks and bonds. That being said, where NMAI is more attractive is the fund's deep discount at this time. It is trading at a nearly 15.5% discount. What level and valuation you buy a fund will determine a lot more on what your personal performance will be than trying to compare against benchmarks. It's also supposed to be a higher-yielding instrument, so that will play a role too. This isn't to suggest trying to time the market, but as I've said before, simply letting valuation guide your investing.

The Basics

- 1-Year Z-score: N/A

- Discount: 15.44%

- Distribution Yield: 10.97%

- Expense Ratio: 1.42%

- Leverage: 33.54%

- Managed Assets: $861.4 million

- Structure: Perpetual

NMAI's investment objective is “to provide attractive total return through high current income and capital appreciation.” To achieve this, the fund “dynamically invests in a portfolio of equity and debt securities of issuers located around the world. This dynamic investment strategy uses a risk-based framework in which any amount can be allocated to an asset class at any time. The Fund may invest in equity and debt securities of any type without limit. The relative allocations of the Fund's managed assets for investment between equity and debt securities, and relative allocations to the different types of equity and income strategies, will vary from time to time, consistent with the Fund's investment objective.”

The fund is pretty highly leveraged, but being that it has a fair bit of fixed-income exposure, this typically wouldn't be a problem. Unfortunately, for 2022, not even fixed-income has been a safe place to hide assets. That is not even in its investment-grade sleeve.

The leverage comes from borrowings and reverse repos. Both of these borrowings will be subject to higher interest rates as the Fed raises rates. The borrowings are at a rate of “Overnight Bank Funding Rate plus a spread that is determined by a portion of the underlying collateral pledged to secure the amount borrowed.” For the last reported period, this worked out to be 0.53%.

Thanks to the fund's merger, the amount of managed assets is respectable. Typically, larger funds have more daily trading volume. In this case, the average daily trading volume comes to ~82.5k. A fairly decent amount and adequate for most retail investors.

Attractively Discounted

While it is harder to find historical discount information from the pre-merged funds, I've covered all three of these funds in some way previously. I have the historical discount information for JDD and JTD. My coverage on JTA was less thorough as it was within the context of looking at multiple tickers. If performance measurement is any kind of guide, JDD and JTA had similar performance historically. (I love SA, it's like a historical archive of information!)

Now, this data is only as good as when the snapshot was taken. In the case of JDD, it was around March 2021. For JTD, it was June 2021. Additionally, NMAI isn't the same exact fund as the funds were previously. That being said, historically speaking, a 15% discount was near the extreme bottom for these funds. The only times JDD and JTD traded at more extreme levels for an extended period of time was during the great financial crisis.

That's why I believe that NMAI's discount now represents a fairly interesting time to consider the fund. The fund wasted almost no time rushing to a discount as soon as the market started its shaky 2022.

YCharts

Distribution – High Distribution Yield

The high distribution yield could be one enticing factor in getting investors to notice this fund. They pay a quarterly $0.35. At 10.97%, the distribution yield is quite elevated based on the rapid decline of the fund's share price. The NAV rate also comes to a fairly elevated 9.28%, which should be kept in mind.

Where it is less attractive is the quarterly payout schedule. Most CEF and income investors lean towards favoring monthly distributions. I wouldn't also say that it is necessarily the most secure payout. They will rely on capital gains to fund the distribution. As those become harder to come by in a down market, it could pressure the fund to cut.

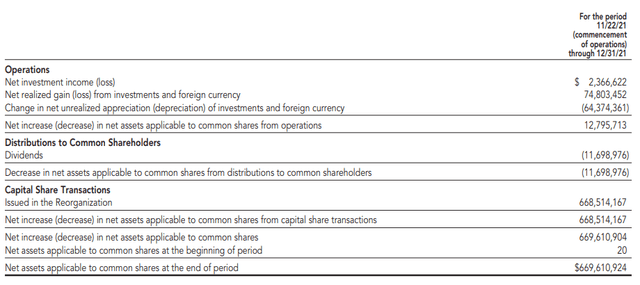

We have only limited data for the fund's earnings until the next report is released. This latest Annual Report is only showing us for a brief period.

NMAI Annual Report (Nuveen)

That being said, we can see that the fund's NII coverage came to around 20% in that period. When a longer period is reflected, I expect this to tick up a bit higher in the next report. That would provide more time for the underlying positions, particularly the fixed-income positions, to start making their interest payments.

One thing that might be lost from the funds previously is the “tax-advantaged” distributions come tax time. This is because JTA and JDD had a particular focus on being tax-advantaged. With a higher bond portion of the portfolio now, we could see more ordinary income classifications for the distribution. On the other hand, long-term capital gains are still likely to make up a good portion of the classifications too. Those would provide a more tax-beneficial tax classification as they are often taxed at a reduced rate.

NMAI's Portfolio

- 5.1-channel 80-Watt powerful surround sound system

- 4K60, 4K120AB and 8K60B HDMI 2.1 with HDCP 2.3 and...

- Dolby Vision, Hybrid Log-Gamma and BT.2020

- Supports enhanced media and gaming - ALLM, VRR

- YPAO automatic room calibration

- Low-Profile Modern Design - Clean silhouettes,...

- Powerful Performance - Brilliant clarity,...

- Simple Setup, Streaming & Control - Get setup and...

- 5.1-Channel Sound - Experience a powerful...

- 6 Total Speakers - Full-range drivers deliver...

Last update on 2024-04-05 / Affiliate links / Images from Amazon Product Advertising API

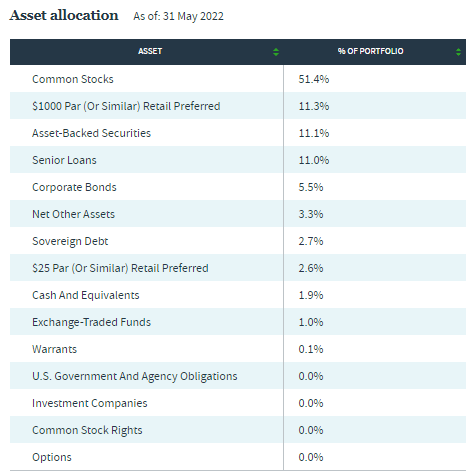

The portfolio is invested mostly in equity positions but is really split amongst a myriad of different types of positions. This includes common stock, preferred of different kinds, loans, bonds and asset-backed securities. Truly, a hybrid fund that can invest “dynamically,” as they suggest. With a number of categories listed as 0%. This either suggests such small exposure that it isn't hitting the radar or just leaving the door open for these types of positions.

NMAI Asset Allocation (Nuveen)

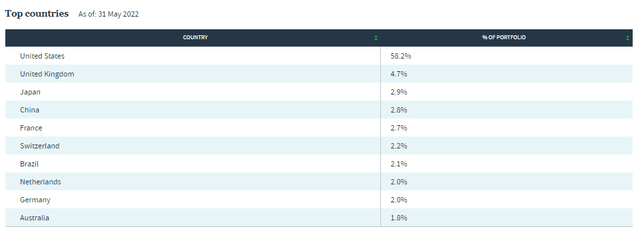

The portfolio is dominated by U.S. positions, which isn't too uncommon. Even for more global-focused funds, sometimes they carry even more than the ~58% we see listed here. With that weighting, we will be getting quite a significant portion outside of the U.S. too.

NMAI Geography (Nuveen)

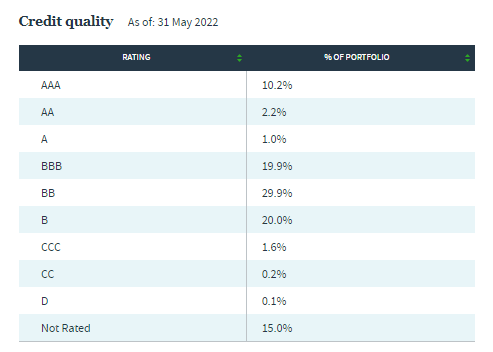

Credit quality is also a hybrid approach for NMAI. We often see funds invested in high yield or investment grades. When talking CEFs, I'd say the most common is high yield bonds. Here, we have a fund that invests a bit heavier in high yield or “not rated.” Investment-grade still makes up a fairly meaningful chunk of assets, though.

NMAI Credit Quality (Nuveen)

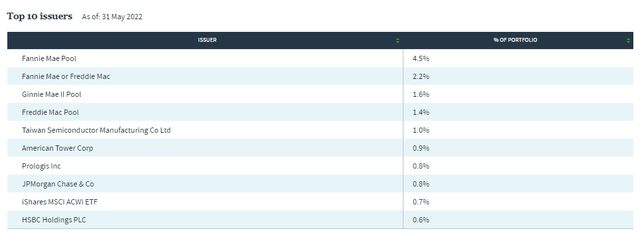

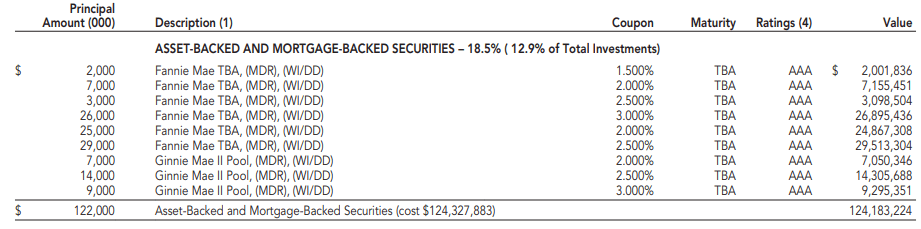

The portion in AAA starts to make more sense when we look at the fund's top issuers. That's where we see agency MBS positions through Fannie Mae, Freddie Mac and Ginnie Mae.

NMAI Top Issuers (Nuveen)

These often have lower yields, but they make that up by being incredibly safe. The coupons on these are between 1.5% and 3%.

- SAMSUNG USA AUTHORIZED - Includes 2 Year Extended...

- Samsung 85 Inch DU8000 Crystal UHD LED 4K Smart TV...

- UHD Dimming | Auto Game Mode (ALLM) | Alexa...

- SAMSUNG TIZEN OS: Stream your favorite shows, play...

- BUNDLE INCLUDES: Samsung DU8000 Series 4K HDR...

- SAMSUNG USA AUTHORIZED - Includes 2 Year Extended...

- Samsung 75 Inch DU8000 Crystal UHD LED 4K Smart TV...

- UHD Dimming | Auto Game Mode (ALLM) | Alexa...

- SAMSUNG TIZEN OS: Stream your favorite shows, play...

- BUNDLE INCLUDES: Samsung DU8000 Series 4K HDR...

Last update on 2024-04-05 / Affiliate links / Images from Amazon Product Advertising API

NMAI Annual Report (Nuveen)

That's why NII might improve with a longer reporting period, but I wouldn't suspect it jumps to anything near enough to cover the payout. This is especially considering that equities also make up a slight majority of the fund.

One last note on the fund's portfolio is that it last listed 1226 positions. This massive number of holdings is reflected in the top ten as the allocations dwindle rapidly as you go down the list. The tenth-largest position here is only 0.6% of the assets. That adds a lot of diversification but will likely limit any type of “outperformance” going forward. Again, which highlights why valuation can be a more important metric in determining potential returns going forward.

Conclusion

NMAI is an interesting fund invested in a broad range of assets, with the policy to invest even more dynamically should the manager choose. The high amount of leverage is a risk here. Some of this risk is offset now with the fund's deep discount. It seems to be about as deep of a discount as was previously exhibited in the pre-merged funds.