Main Thesis & Background

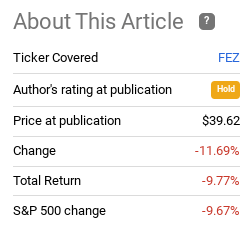

The purpose of this article is to evaluate the SPDR EURO STOXX 50 ETF (NYSEARCA:FEZ) as an investment option at its current market price. This is a fund that invests in large-cap European companies, and one I used to consider when looking for overseas exposure. However, in 2022 my outlook on it has been modest, driven primarily because of concerns over military escalation from the Russia-Ukraine war and general economic weakness. Because of this, I placed a “hold rating on the fund in my last review back in April. In hindsight, this was a reasonable call, with both FEZ and the S&P 500 falling since then:

Given this share price correction since that article, I wanted to take another look at FEZ to see if I should upgrade it to “buy”. After all, cheaper prices often represent better value.

Despite that reality, there are too many headwinds for me to consider plunking cash down at these levels. While the drop we have seen in 2022 probably limits further downside, I don't really see a very bullish backdrop. The war in Ukraine is getting more entrenched, aggravating supply-chains and clouding the energy outlook for the continent. Further, economic activity is slowing, which is often a precursor to a recession. With other developed economies offering value and without these geo-political risks, I will continue to maintain a “hold” rating on FEZ and look elsewhere for value.

Headlines From Ukraine Don't Inspire Confidence For Mainland Europe

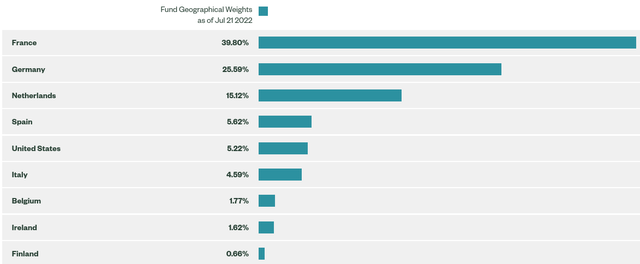

As a recap for readers who may not follow FEZ closely, this is a fund focused primarily on continental Europe – mostly central, western, and southern Europe. In practice, the fund offers exposure to some of the biggest companies in Europe, which means France and Germany are heavily represented. Beyond that, investors would be exposed to nations like the Netherlands, Italy, and Spain, among others:

Of note, this fund excludes the U.K. and has very little exposure in Ireland.

Personally, this is not a “bad” line-up. But it isn't one I really want to be overweight right now. The reason being is that central Europe, especially Germany, are right in the crosshairs of the Russia-Ukraine conflict. As the biggest economy on the continent, they have the most at stake in terms of economic activity, and are close enough to the conflict that a spillover could impact them directly.

Of course, eastern Europe sits in the way. And those nations are mostly considered “emerging”, so they are not included in this fund that focuses on the largest of companies. So that is a positive. But I wouldn't be advocating investing in that region right now either given all the uncertainty.

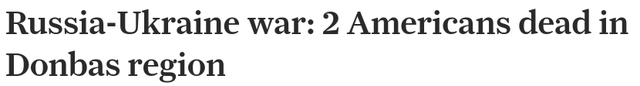

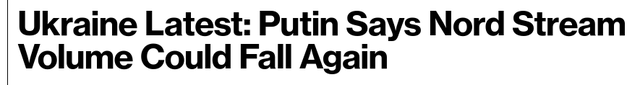

While central and Western Europe are not really at risk of being brought in to a military conflict at this point, they may have to act if Russia extends its ambitions beyond the Ukrainian border. This seemed far-fetched at the onset of the crisis, but it is becoming clear in the Western world that we don't know what President Putin really wants. That makes it a more dangerous situation, and therefore less investable.

To understand why, let us consider some of the recent headlines coming out of the region. This is an on-going, fluid situation, so we don't want to put too much emphasis on any one particular development. But the bottom-line is, there isn't much to get existed about:

The purpose of this is to show the diversity and severity of the recent headlines. They are predominantly negative, and are impacting a range of issues: an unwillingness to abide by ceasefire agreements, foreign casualties, and threats of energy shortages.

What I am getting at is that the breadth of this conflict keeps escalating. It has international implications, and the developments keep on getting more pessimistic. It simply makes Europe an area that I want to be very careful with for the time being. This makes me reluctant to recommend FEZ, a European-focused ETF.

Europe's Economic Activity Is Softening

While my macro-view in the prior paragraph is significant, readers must be thinking “I am not investing in Russia or Ukraine”. That is true. FEZ does not hold a single Ukrainian or Russian company, and eastern Europe is not represented either (just minor direct exposure to Finland). So, in fairness, the problems of Ukraine may not necessarily cloud an investor's judgment on buying international companies based in Germany or France. This is a valid argument, given that those companies are removed from the conflict (for now) and generate a big share of their revenues and profits overseas.

The thought could easily be central and western Europe are not Russia or Ukraine, so there isn't as much risk in buying this fund as meets the eye. Personally, I agree with that sentiment that the Russia-Ukraine conflict is not enough in isolation to avoid Europe entirely. The problem is that this isn't the only issue with buying FEZ. For example, economic activity is slowing across the continent, and this is only partly the fault of the war. The other catalysts are high inflation and rising interest rates. These issues are pressuring business sentiment and, ultimately, activity:

What this is showing is that there is a decline in business purchasing and manufacturing. The expansion that had been gathering momentum has reversed in a big way. This is pressuring the forward outlook for corporate profits in the Euro-zone, and supports my reluctance to buy this fund.

Sentiment Sometimes Speaks

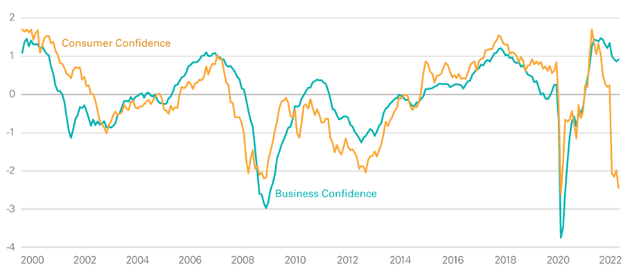

Another sign of weakness is the decline in both business and consumer sentiment. This is not surprising given all that is happening in mainland Europe. Between the war, inflation, and concerns about the winter season because of Covid-19 and restrained energy supplies, who can blame European business leaders and consumers from being pessimistic?

Unfortunately, confidence has dropped dramatically, especially among the consumer class, as shown below:

| Preview | Product | Price | |

|---|---|---|---|

|

Galway Bay Long Sleeve Golf Rain Jacket - Three Layer Long Sleeve Golf Jackets for Men, Lightweight... |

$200.00 |

Buy on Amazon |

Last update on 2024-04-19 / Affiliate links / Images from Amazon Product Advertising API

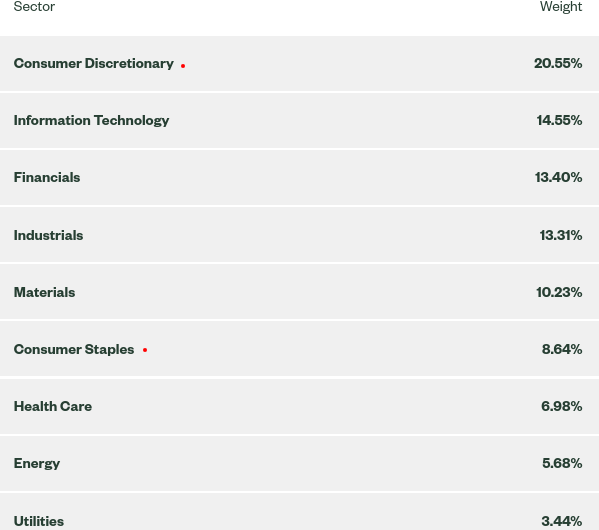

This is a concern for any region where I would consider investing. But it is especially true for a Euro-zone index that FEZ happens to track because this index is very consumer-centric. Consumer Discretionary is the top sector weighting in the fund, and when we add in Consumer Staples we see that over 29% of total assets are directly tied to consumer spending:

The conclusion here is that many of the companies that are held within FEZ's portfolio are impacted by the rising inflation levels and declining sentiment levels. This is a difficult proposition, and reiterates the need for caution when approaching this space.

There Is Inherent Value

My tone so far in this review has been quite negative. Yet my rating is not “bearish” on this fund. While I struggle to come up with a strong investment case, the truth is the year-to-date weakness in this fund does inherently limit how much more downside we can see. Is there a possibility for more losses? Absolutely. But I believe those losses will be contained that I wouldn't advocate outright selling on FEZ or Europe as a whole. Hence the logic for the “hold” decisioning.

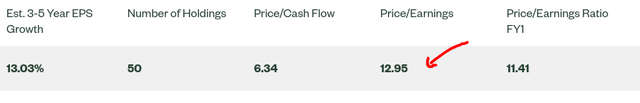

To understand why, let us examine a few simple metrics. One, the P/E ratio on the index FEZ tracks is very low, coming in under 13:

This is markedly lower than the S&P 500, so it gives U.S. investors a valid reason to diversify.

Secondly, FEZ does represent a better value now as an income play. The drawdown in price has coincided with a rise in the distribution level. This represents a much better opportunity for those concerned primarily with a dividend stream. The current yield is around 4%, driven strongly by the dividend growth the fund has seen recently on a year-over-year basis:

| June 2021 Distribution | June 2022 Distribution | YOY Change |

| $.56/share | $.75/share | 33% |

Source: State Street

This is demonstrating that there are some bright spots for FEZ. The story is not all bad and there can be an argument for holding on to positions or even buying a new one. It is not enough for me personally to push this fund in to the buy zone, but the declining premium in terms of the P/E ratio and the rising dividend stream are indeed attractive attributes.

Bottom Line

- 🌴 Material: Chiffon, 100%Polyester ; Lightweight, soft and comfoy material

- 🌴 Features: Long sleeve chiffon lace mini dress for women spring, summer and fall, crew neck, long lantern sleeve, zipper closure, elastic waist, a-line and slim fit style, elegant ruffle design, this cute fall mini dress will make you more beautiful and lovely!

- 🌴 Occasions: Fall casual short dress suitable for you to party, holiday, school, date, cocktail, coming home, and daily life. Believe you will love it and get lots of compliment!

- 🌴 Garment care: Hand wash in cold water recommend, hang dry, low temperature ironing if necessary

- 🌴 Size Note: 0-2, 4-6, 8-10, please refer to our sizing information in the picture description to choose your size. Thanks for your understanding

Last update on 2024-04-19 / Affiliate links / Images from Amazon Product Advertising API

Europe remains in a tough spot right now in terms of geopolitical risks and economic uncertainty. This makes a bull case for FEZ difficult to make. Germany is an important economy for the Euro-zone and for this particular FEZ, and it happens to be among the most exposed economies to the Russian invasion. This is primarily the result of its heavy reliance on Russia for natural-gas supplies. It is pressuring what consumers are paying for energy and limits Germans' ability to negotiate any type of peace treaty. Their leverage is restrained.

French, the country with the highest weighting in this fund, faces similar issues, albeit not to the same degree. This puts the country at risk of a recession, along with the EU-zone as a whole. It seems to me these are areas to avoid for the time being. Is there opportunity when an outlook appears bleak? For sure. But I see the outlook getting bleaker in the months ahead, suggesting a more opportune chance will present itself.

As a result, I will be steering clear of FEZ for now. I will remain focused on the U.S., as well as other developed markets like Canada, the U.K., and Australia. The risk-reward seems more advantageous in those regions, and I would caution readers to be very selective when buying FEZ at this time.