ProShares Short 7-10 Year Treasury (TBX) ETF aims to profit from declines in U.S. Treasury Bond prices.

ProShares Short 7-10 Year Treasury: Profit From Bond Bear Market

When yields rise, TBX aims to deliver positive returns, and the opposite is also true.

2022 has brought the most vicious bond bear market in 2 generations, yet we feel like many investors don't realize there are ways to profit from it.

TBX is one of a small number of “inverse bond ETFs” that give investors the freedom to attack a bond bear market.

Summary

We rate ProShares Short 7-10 Year Treasury (NYSEARCA:TBX) a buy, since we think the bond bear market is not over. This ETF is a rare type of security that allows investors and traders to try to profit directly from a decline in bond prices, due to a rise in interest rates.

Strategy

TBX is an “inverse ETF,” which means it tries to profit from price declines in some investment, not the rise in price of that investment. In this case, the ICE U.S. Treasury 7-10 Year Bond Index is the target. TBX aims to deliver daily results that perform exactly opposite that of the index.

In other words, if medium term Treasury prices go down (which is what happens when interest rates fall), TBX aims to gain. If prices of those bonds go up in (which is what happens when rates rise), TBX should lose about as much as those Treasury Bonds rise in price.

Proprietary ETF Grades

- Offense/Defense: Defense

- Segment: Inverse

- Sub-Segment: Inverse Intermediate-Term Bonds

- Correlation (vs. S&P 500): Low

- Expected Volatility: Moderate

Holding Analysis

To pursue this strategy, TBX invests buys swap contracts from major banks and brokers, and shorts futures contracts on the index. It backs much of this activity by holding a significant portion of its assets in U.S. T-Bills. This creates a portfolio that tries to track the aforementioned index, which essentially is a mirror image of the price path of 7-10 year U.S. Treasury Notes and Bonds. The T-bills are the collateral for the daily activity of the ETF managers to track the index.

Strengths

As investors have found out in 2022, the bond market can lose just as much money as parts of the stock market, or even more. U.S. Federal Reserve policy has been historically loose for over a decade. That “easy money” environment has existed throughout much of the globe. As soon as the Fed started to change directions from suppressing interest rates to raising them to combat inflation, the inevitable occurred: bond prices fell.

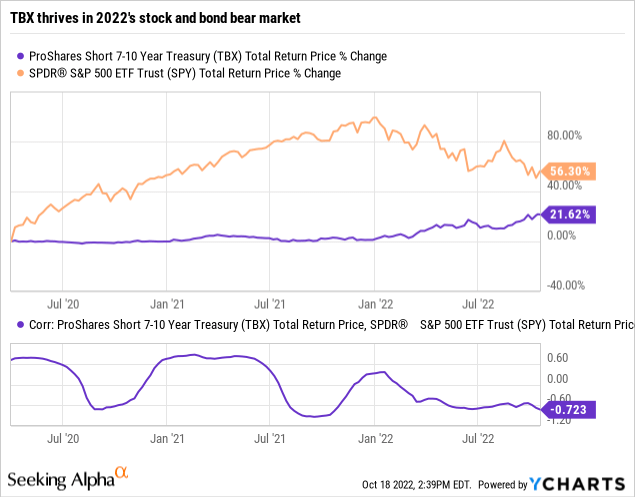

As the chart below shows, TBX has an off-and-on relationship with the S&P 500 Index. From the market rally coming out of the pandemic in April, 2020, throughout most of 2021, the stock market flew higher, and bond rates stayed low. But in 2022, at a rate not seen in over 40 years, bond rates rose. Even Treasuries, which many assumed to be “safe” investments, fell in price significantly. Such environments are what TBX is built for.

Weaknesses

As noted above, any time 7-10 Year Treasury Bond rates decline for an extended period of time (like for much of the past 40 years!), TBX can't make money. It is designed to do one thing in a particular environment: profit from falling rates. Its mandate does not include adjusting to changing market conditions. Instead, it exists to provide investors with a way to profit from a specific scenario, albeit one that we think it very relevant at this point in market history.

Opportunities

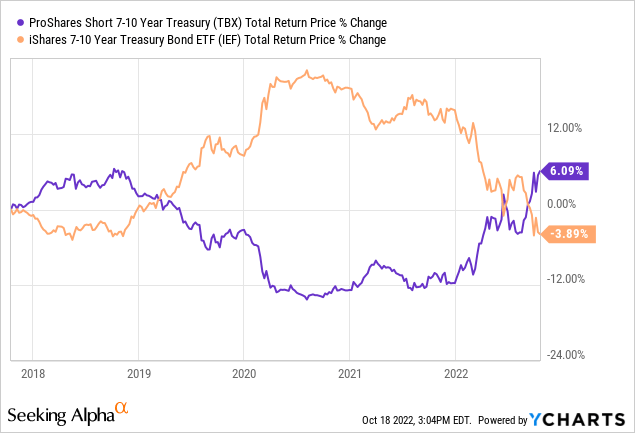

The above chart shows 2 important aspects of TBX that dispel some investment mythology that we wish to bring to investors' attention. First, there is a perception that all inverse ETFs are merely day-trading vehicles. That may be the case for levered ETFs, but TBX has closely mirrored its “long” counterpart, the ETF that tracks 7-10 bonds. Historically, there has not been much slippage in the “-1X” relationship.

No products found.

More to the point of the current market cycle, the chart shows that even if you had invested in TBX to short 7-10 year bonds instead of owning an ETF that holds that type of bond “long,” TBX would have delivered a higher return. This is what happens at the end of a long period of low rates. Low rates are risky enough for investors. But when rates rise from those low levels, it's a perfect storm for bond ETF investors. TBX represents an opportunity to capitalize on that.

Threats

In addition, this ETF uses derivatives, including swap contracts, which rely on counterparties. So, anything that might cause those counterparties to be unable to back their side of the contract is a risk for TBX. We don't think that's a huge risk, but it is sufficient enough to mention.

TBX has become a fairly liquid ETF over time, but that was not always the case. So if investor interest in shorting the bond market declines significantly, this ETF could again be more thinly-traded.

Proprietary Technical Ratings

- Short-Term Rating (next 3 months): Hold

- Long-Term Rating (next 12 months): Buy

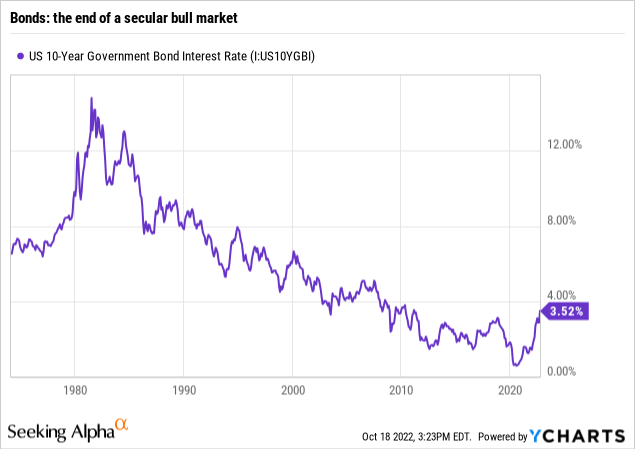

This chart shows the long-term potential for rates to rise, after 40 years of very consistent declines. We have been through a period of historically loose monetary policy. That period is over, and even if the Fed comes to the rescue and prints more money this year or next year, it will only push the problems out into the future. The potential for the 10-year rate to rise by several percentage points between now and the ultimate end of this bond market cycle is the number one reason investors should at least be familiar with inverse bond ETFs.

Conclusions

ETF Quality Opinion

No products found.

While the stock market peeled off during 2022 and bond rates kicked higher and became more volatile, TBX proved to be a viable tool for investors willing to think outside the box. It is what it is: a way to profit from bond market weakness. That makes it one to research and consider part of our “stable” of ETFs we are willing to own at the right price.

Investment Opinion

While the bond bear market is no longer a secret or a potential risk to investors (it is already well underway), there is a good chance that we have not seen the end of rising rates for this cycle. After 4 decades of falling interest rates, bond investors would get off pretty easy if the only pain was a year of rising rates. Inflation and government deficit concerns are not likely to vanish any time soon.

Thus, we rate TBX a Buy. It would be a Strong Buy, but for the head of steam it has already had in 2022, and the risk of an interim pullback at some point. But until we get major fundamental and technical evidence to the contrary, the risk in rates is to upside. That would spell lower bond prices, and continued success for TBX.