HDGE Vs. SH: Two Approaches To Profit When Stock Prices Decline

- The AdvisorShares Ranger Equity Bear ETF shorts stocks and can use ETNs. While beating the inverse S&P 500 Index isn't listed as an objective, their benchmark is that Index.

- The ProShares Short S&P 500 ETF use derivatives to earn the inverse performance of the S&P 500 Index.

- HDGE depends on the skill of the managers to short the right stocks, and that strategy will be difficult to execute successfully during Bull markets, as we will see.

Introduction

Some investors are looking for vehicles to either make money during Bear markets or to hedge some of their long equities exposure. Thus were born inverse exchange-traded funds (“ETFs”) that use derivatives to go up when their selected index goes down. There are some that try to do that at a factor of 2x or even 3x. Because of the way they reset daily, the multiple versions seldom achieve their goal if held for any length of time but otherwise perform well when markets are falling.

Other funds try making money anytime by investing in stocks that they find compelling to short. One I wrote about and tried was the AdvisorShares Dorsey Wright Short ETF (DWSH). It worked great during the early months of the COVID crash, but even with its recent bounce, is down almost 75% from the COVID peak.

This article will review another shorting ETF from the same Advisor, the AdvisorShares Ranger Equity Bear ETF (NYSEARCA:HDGE) and a popular inverse ETF, the ProShares Short S&P 500 ETF (NYSEARCA:SH). None of the three ETFs has done well since COVID, though the past year they have provided investors with a positive return.

AdvisorShares Ranger Equity Bear ETF review

Seeking Alpha describes this ETF as:

The investment seeks capital appreciation through short sales of domestically traded equity securities. The Sub-Advisor seeks to achieve the fund's investment objective by short selling a portfolio of liquid mid- and large-cap U.S. exchange-traded equity securities, ETFs, ETNs and other exchange-traded products. HDGE started in 2011.

Source: seekingalpha.com HDGE

HDHE has $158m in assets and has only made one payout in its history. As is typical of funds that short, it has an extremely high fee structure: 520bps, broken down as such:

| Management Fee | 1.50% |

| Other Expense | 3.40% |

| Acquired Fund Fees | 0.30% |

| Expense Ratio | 5.20% |

Other expenses is mostly caused by the costs associated with shorting stocks. This is how the managers describe HDGE:

The investment objective of the AdvisorShares Ranger Equity Bear ETF (HDGE) is capital appreciation through short sales of domestically traded equity securities. HDGE is sub-advised by Ranger Alternative Management, L.P. (“Portfolio Manager”). The Portfolio Manager implements a bottom-up, fundamental, research driven security selection process. In selecting short positions, the Fund seeks to identify securities with low earnings quality or aggressive accounting which may be intended on the part of company management to mask operational deterioration and bolster the reported earnings per share over a short time period. In addition, the Portfolio Manager seeks to identify earnings driven events that may act as a catalyst to the price decline of a security, such as downwards earnings revisions or reduced forward guidance.

Source: advisorshares.com HDGE

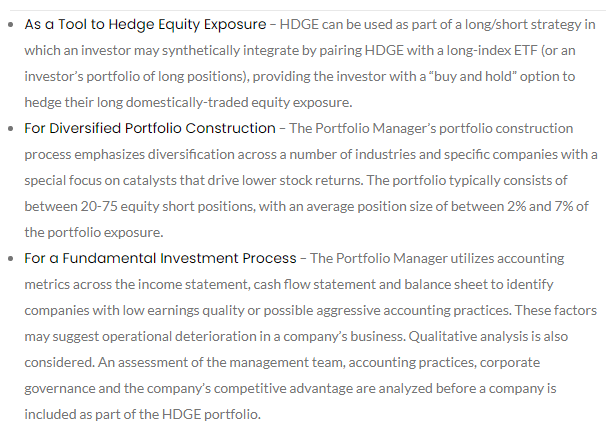

They also listed three reasons to invest in HDGE:

Even for investors who like the shorting strategy, they listed four reasons why they believe their process works best:

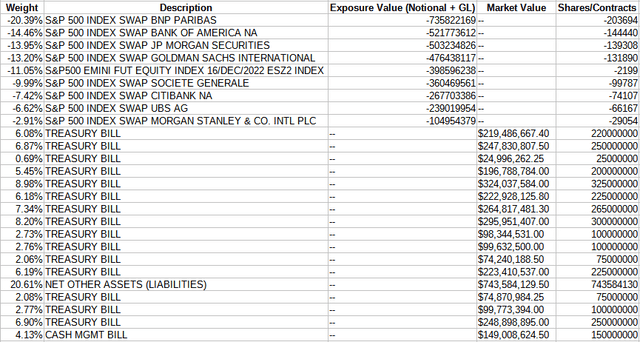

Holdings review

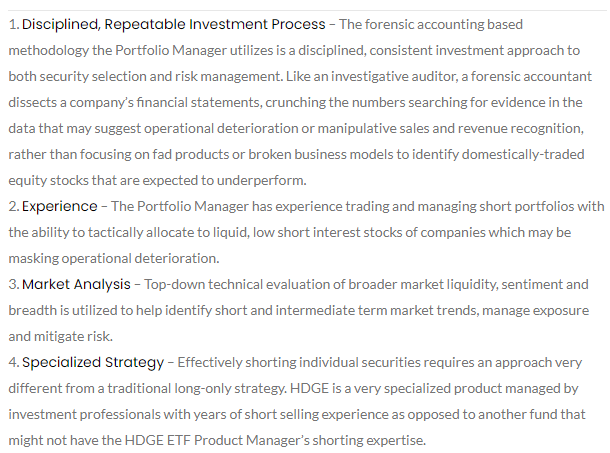

The above pie charts are from 8/31/22. They show that while HDGE is almost 50% in Large-Cap stocks, they also have over 17% in Small-Cap ones. HDGE is betting against Information Technology bigtime, with over 43% of the weight in that sector. Making more sense is the 22.9% weight in Financials, which suffer when short-term rates climb faster than long-term rates, and the 11.3% in Consumer Discretionary, which is having supply chain issues and won't do well if we are in a recession.

Top holdings

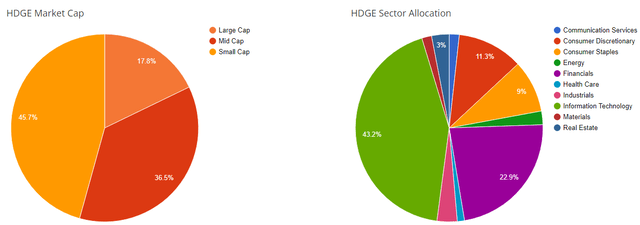

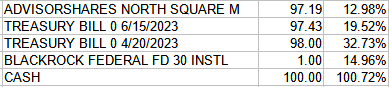

The total weight of the short positions is -81% and consists of 66 positions. About 11% of the short weight is in foreign stocks. HDGE also holds other assets that come to 181%, netting to 100%.

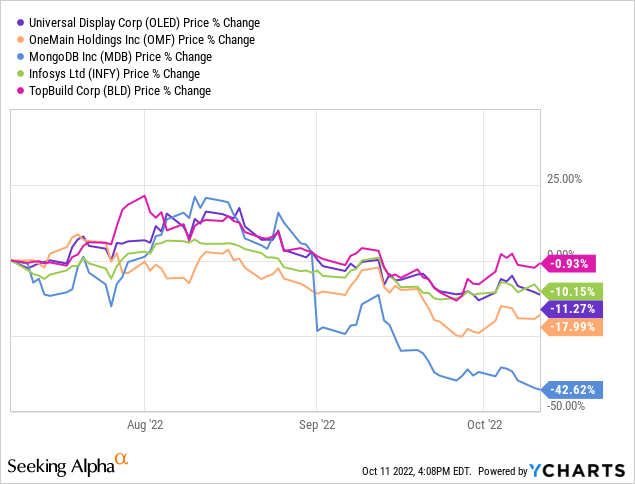

Rising interest rates should increase earning from all the cash and equivalents the ETF holds. Here is how the top 5 stocks have done recently.

Whether these were the top holdings 3 months ago is uncertain but the top two were held at the end of the 2nd quarter.

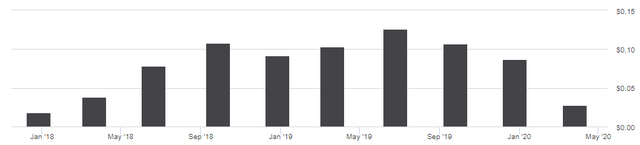

Distribution review

The HDGE website lists that HDGE made one distribution, a penny, at the end of 2019.

ProShares Short S&P500 ETF review

One of the other plays is to “short the market” by using an inverse ETF such as SH. Here is how Seeking Alpha describes this ETF:

The investment seeks daily investment results that correspond to the inverse (-1x) of the daily performance of the S&P 500® Index. The fund invests in financial instruments that ProShares Advisors believes, in combination, should produce daily returns consistent with the fund's investment objective. SH started in 2006.

Source: seekingalpha.com SH

SH has $3.8b in assets and a much more reasonable fee of 89bps. The expense ratio listed has a contractual waiver ending 9/30/23. SH has made a distribution since COVID hit. ProShares lists three reasons to consider an inverse ETF for:

- Seek to profit from a market decline

- Help to hedge against an expected decline

- Underweight exposure to a market segment

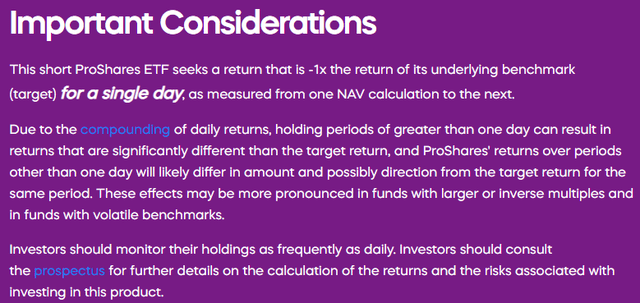

They also provide a warning based on how daily performance is calculated for an inverse ETF:

That daily compounding effect is multiplied for inverse ETFs designed to move 2X or 3X an index.

Holdings review

- 5.1-channel 80-Watt powerful surround sound system

- 4K60, 4K120AB and 8K60B HDMI 2.1 with HDCP 2.3 and...

- Dolby Vision, Hybrid Log-Gamma and BT.2020

- Supports enhanced media and gaming - ALLM, VRR

- YPAO automatic room calibration

- Low-Profile Modern Design - Clean silhouettes,...

- Powerful Performance - Brilliant clarity,...

- Simple Setup, Streaming & Control - Get setup and...

- 5.1-Channel Sound - Experience a powerful...

- 6 Total Speakers - Full-range drivers deliver...

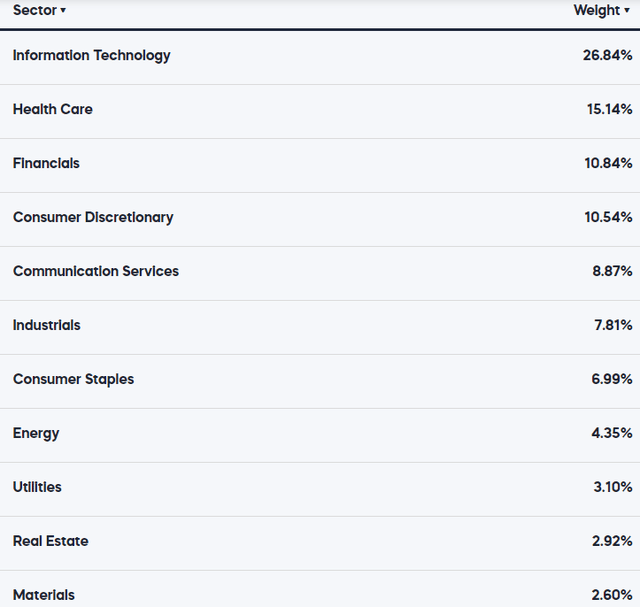

Since SH is based on the S&P 500 index, its sector exposure mimics that of the index.

Holdings listing

This lineup is common amongst inverse ETFs. Hold safe T-Bills to back the Swap contracts, which they spread across issuers to reduce default risk (think Lehman Brothers).

Distribution review

As noted above, the last payout was in early 2020.

Comparing ETFs

Viewing holdings points out how differently the two ETFs execute their strategy to profit when prices are falling. SH takes the simple approach of using SWAP contracts against the complete S&P 500 index. This also means they are “sector neutral,” as opposed to HDGE which can differ when compared to the S&P 500 Index since it is actively managed. HDGE is also dependent on the skill of the managers or the “black box” they use to pick and weight their limited holdings by.

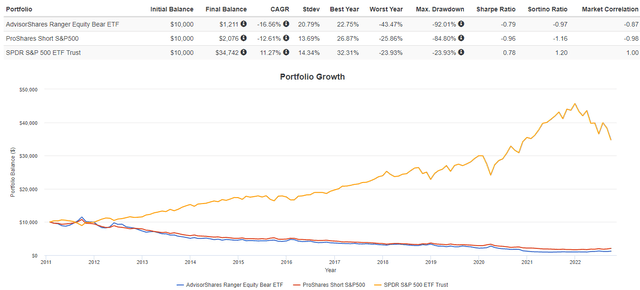

This is how both have performed compared to the SPDR S&P 500 ETF (Original Post>

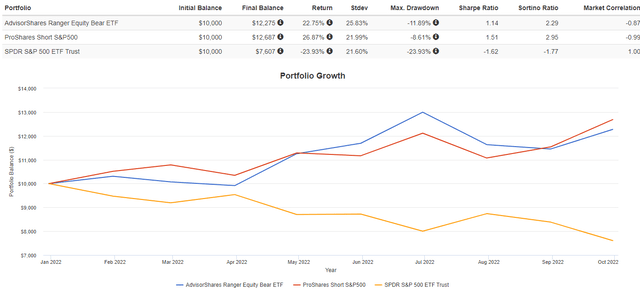

In 2022, they have provided investors with positive returns.

Of course, one has to either have a good forecasting model or be willing to take the good with the bad when owning either of the ETFs reviewed here.

Backtest Portfolio Asset Allocation

Portfolio strategy

As one would suspect, HDGE does best when the whole market is going down, not when HDGE is swimming against the tide. HDGE seems to agree as they include this chart on the CEF page.

To show what HDGE did during the periods between the above dates, I used dividendchannel.com data.

| Starting date | End date | HDGE | SPY |

| 10/4/2011 | 5/21/2015 | -23.8% | 21.74% |

| 8/26/2015 | 11/2/2015 | -10.43% | 8.76% |

| 2/12/2016 | 1/25/2018 | -40.73% | 58.07% |

| 2/9/2018 | 9/19/2018 | -9.26% | 12.31% |

| 12/26/2018 | 2/18/2020 | -40.19% | 40.04% |

| 3/24/2020 | 1/2/2022 | -64.92% | 100.5% |

Good in down markets, miserable to own in up markets.

2nd strategy possibility: StdDev reduction

- SAMSUNG USA AUTHORIZED - Includes 2 Year Extended...

- Samsung 85 Inch DU8000 Crystal UHD LED 4K Smart TV...

- UHD Dimming | Auto Game Mode (ALLM) | Alexa...

- SAMSUNG TIZEN OS: Stream your favorite shows, play...

- BUNDLE INCLUDES: Samsung DU8000 Series 4K HDR...

- SAMSUNG USA AUTHORIZED - Includes 2 Year Extended...

- Samsung 75 Inch DU8000 Crystal UHD LED 4K Smart TV...

- UHD Dimming | Auto Game Mode (ALLM) | Alexa...

- SAMSUNG TIZEN OS: Stream your favorite shows, play...

- BUNDLE INCLUDES: Samsung DU8000 Series 4K HDR...

Even if not a stand-alone good investment long-term, would holding a small percent provide risk reduction benefits? This is what I found.

Both ETFs did reduce the StdDev over a pure SPY portfolio. For those who look at Sharpe and Sortino ratios, all three portfolios had the same values. Another question would be the effect on drawdowns, which I show next.

I would have desired better protection during down markets from what I see, but there was some.

Final thought

Except for investors with good market timing skills, owning HDGE or SH for long periods is a losing bet. For investors willing to trade return for less volatility, adding a small allocation to either ETF does provide benefits in that respect.