Our recent paper Why Does the S&P 500® Matter to the U.K.? argues that the S&P 500 presents an opportunity for U.K. investors to diversify their revenue exposure and sector weights across geographies. Since British investors typically suffer from a substantial home bias, such diversification presents an opportunity to improve the risk/return profile of a domestic equity allocation.

Both U.K. companies and U.K. investors are exposed to the same set of domestic macroeconomic conditions. When a large proportion of a company’s revenue is reliant on its domestic customer base and an investor in turn overweights his allocation to U.K. equity, it creates a domestic feedback loop. This means that positive and negative shocks in the U.K. are amplified for a local investor who is not properly diversified.

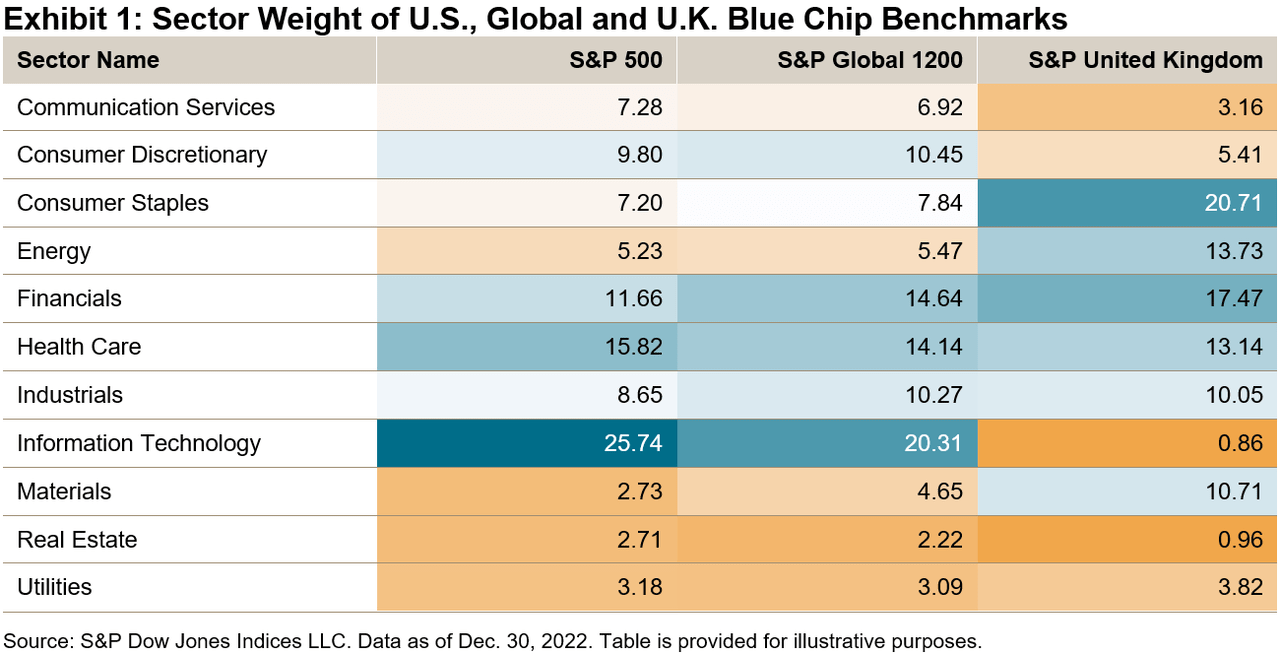

Moreover, the U.K. has more significant over- and underweights than the S&P 500 relative to a global benchmark. Exhibit 1 compares the sector weights of the S&P 500 and S&P United Kingdom versus the S&P Global 1200. The S&P United Kingdom had larger sector weights than the S&P Global 1200 in Consumer Staples, Energy and Materials, and a far lower weight in Information Technology. On the other hand, the S&P 500 was overweight IT and Communication Services. Hence, incorporating U.S. equities could help a U.K. investor alleviate domestic sector biases by providing exposure to different sectors.

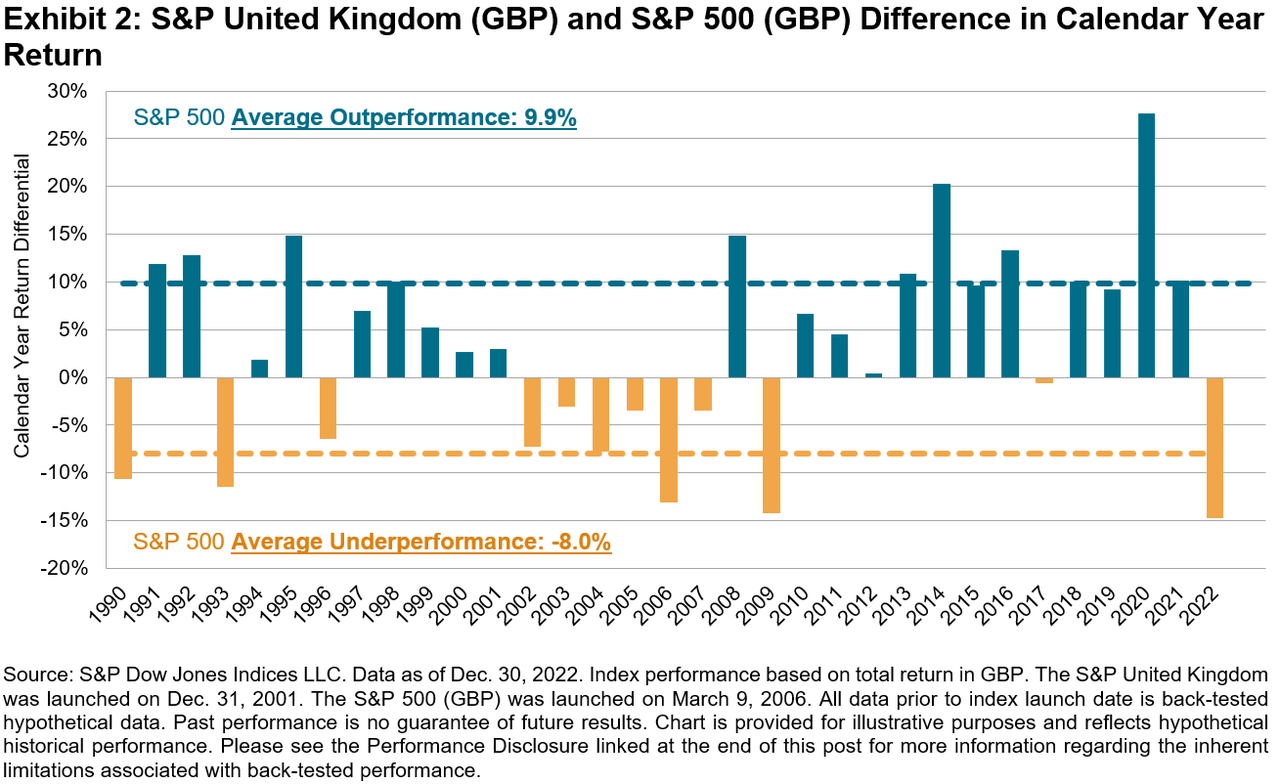

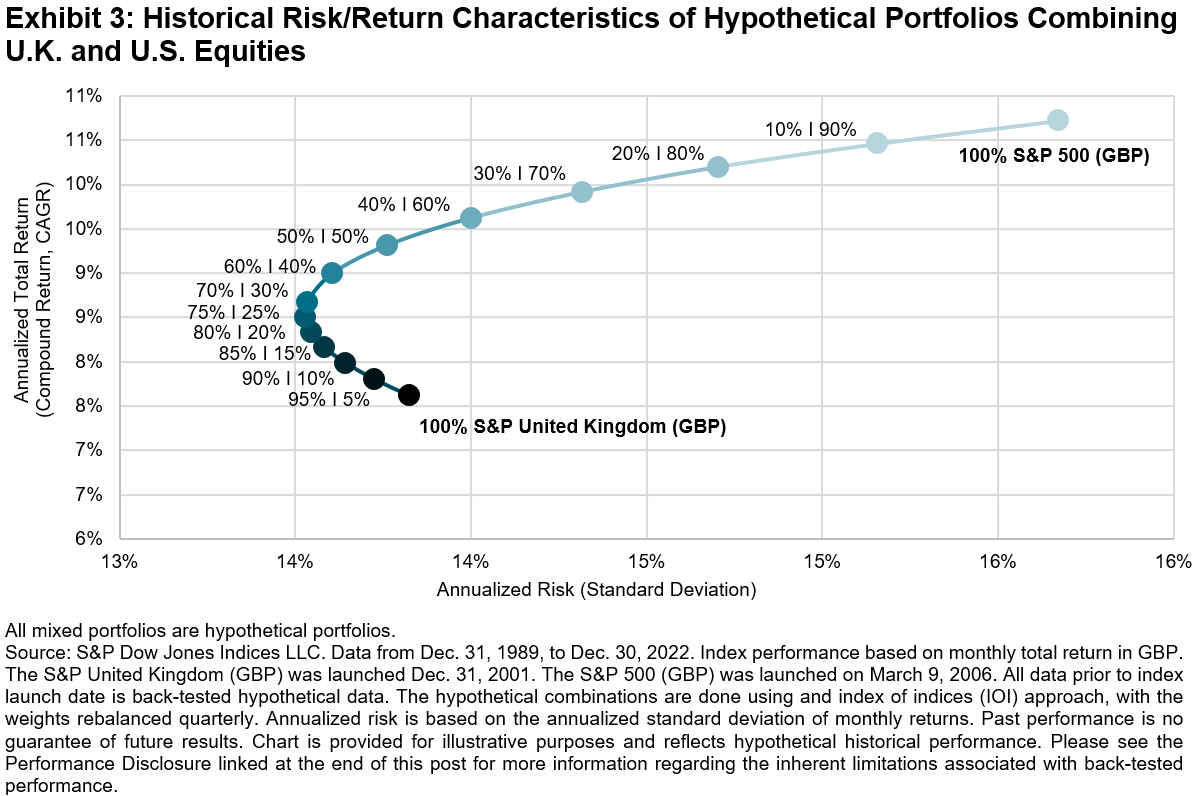

From a performance perspective, U.S. large caps have outperformed their U.K. counterparts most of the time and by a larger magnitude when they do. Over the past 33 calendar years, the S&P 500 has outperformed the S&P United Kingdom two-thirds of the time, as shown in Exhibit 2. In the years when the S&P 500 outperformed, it did so by a higher margin on average, at 9.9%, compared to the U.K.’s 8%. This has meant combining the S&P 500 and the S&P United Kingdom (as shown in Exhibit 3) has historically improved the risk/return profile and provided a higher return per unit of risk than a U.K. investment in isolation.

| Preview | Product | Price | |

|---|---|---|---|

|

Galway Bay Long Sleeve Golf Rain Jacket - Three Layer Long Sleeve Golf Jackets for Men, Lightweight... |

$200.00 |

Buy on Amazon |

Disclosure: Copyright © 2022 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. This material is reproduced with the prior written consent of S&P DJI. For more information on S&P DJI please visit www.spdji.com. For full terms of use and disclosures please visit www.spdji.com/terms-of-use.

- 🌴 Material: Chiffon, 100%Polyester ; Lightweight, soft and comfoy material

- 🌴 Features: Long sleeve chiffon lace mini dress for women spring, summer and fall, crew neck, long lantern sleeve, zipper closure, elastic waist, a-line and slim fit style, elegant ruffle design, this cute fall mini dress will make you more beautiful and lovely!

- 🌴 Occasions: Fall casual short dress suitable for you to party, holiday, school, date, cocktail, coming home, and daily life. Believe you will love it and get lots of compliment!

- 🌴 Garment care: Hand wash in cold water recommend, hang dry, low temperature ironing if necessary

- 🌴 Size Note: 0-2, 4-6, 8-10, please refer to our sizing information in the picture description to choose your size. Thanks for your understanding

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.