Inflation may currently be a hard focus for many advisors and investors with the looming Fed meeting this week to discuss tapering off the stimulus bonds, but recent data shows that investors have been hedging against it for the past year.

Source: Original Postress-this.php?">Are Inflation ETFs the Craze Right Now?

mericans’ view of the economy has taken a downward dive, particularly in the last month with supply chain issues causing an increased crunch on the economy and rising prices in goods, reports AP News. Only 35% of Americans surveyed reported that they believed the economy to be good, with 65% calling it poor, in a recent poll conducted by the Associated Press-NORC Center for Public Affairs Research.

Consumer prices rose 5.4% in September according to the Labor Department, the largest increase in a single year since 2008. Given the shortage of goods, a looming holiday season that will feature sky-high prices, and fears of inflation, 47% of Americans are now reporting that they anticipate a worsening economy within the next year.

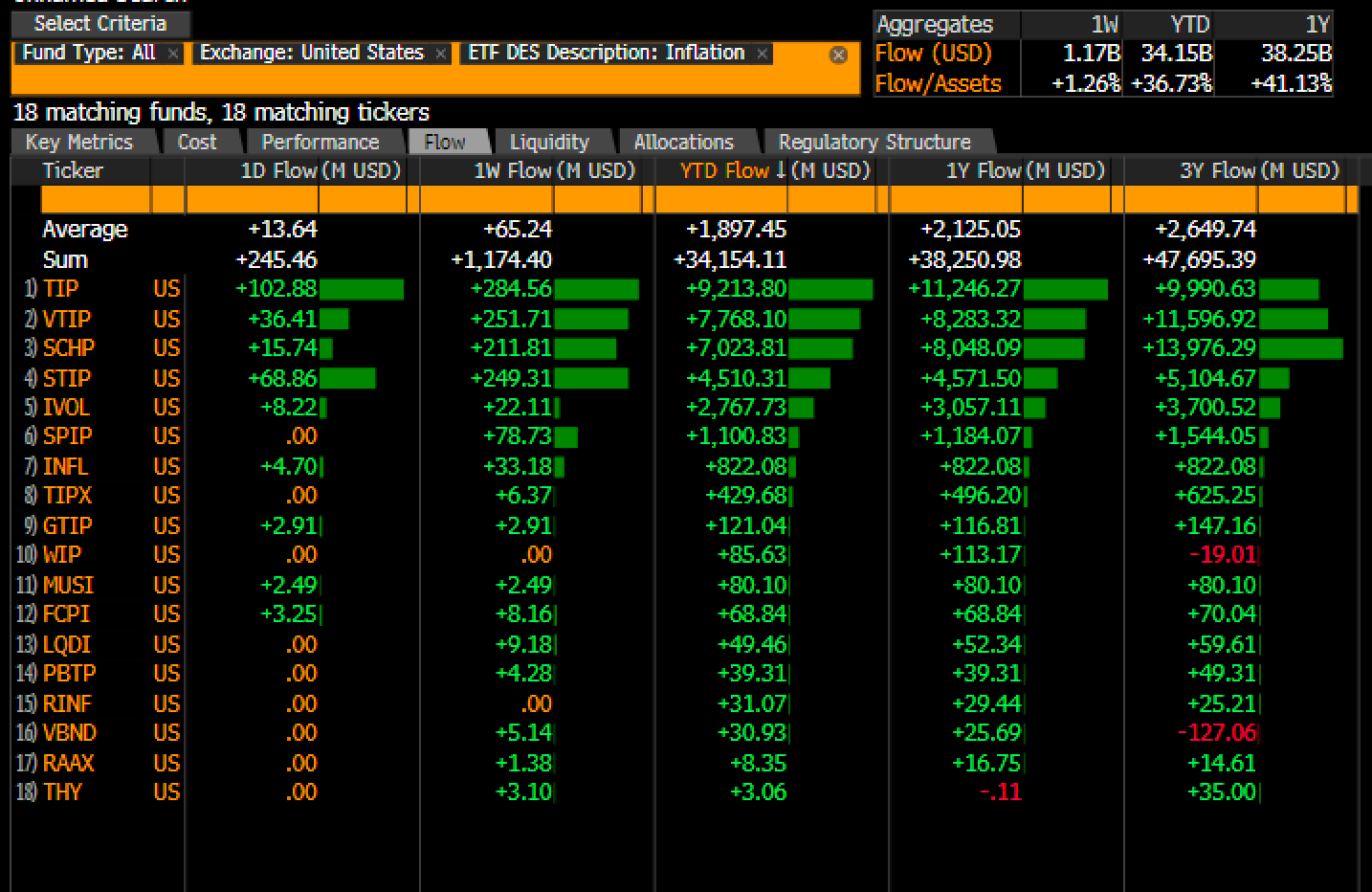

Rising prices and inflationary fears have been driving investors to hedge against the potential for growing inflation this year. Eric Balchunas, senior ETF analyst for Bloomberg, reported on his Twitter that there are over $34 billion in flows into ETFs this year that carry “inflation” in the name, representing “a 36% organic growth rate” that is more than three times the growth rate of all ETFs.

Image source: Courtesy of Eric Balchunas’ Twitter

It’s a trend that is “worthy of our ‘craze’ label,” Balchunas tweeted.

Hedging Against Inflation With IVOL

The Quadratic Interest Rate Volatility and Inflation Hedge ETF (IVOL) from KFAFunds, a KraneShares company, ranks fifth in flows for inflationary ETFs, bringing in nearly $2.77 billion year-to-date. This particular ETF is designed to have a twofold hedge against an increase in fixed income volatility and/or an increase in inflation. The fund also seeks to maximize on yield curve increases, either brought about by long-term interest rates increasing or short-term interest rates falling; both are tied to big equity market declines.

- 5.1-channel 80-Watt powerful surround sound system

- 4K60, 4K120AB and 8K60B HDMI 2.1 with HDCP 2.3 and...

- Dolby Vision, Hybrid Log-Gamma and BT.2020

- Supports enhanced media and gaming - ALLM, VRR

- YPAO automatic room calibration

- Low-Profile Modern Design - Clean silhouettes,...

- Powerful Performance - Brilliant clarity,...

- Simple Setup, Streaming & Control - Get setup and...

- 5.1-Channel Sound - Experience a powerful...

- 6 Total Speakers - Full-range drivers deliver...

IVOL is the first of its kind in active and passive options that offers access to the OTC fixed income options market, the mechanism it uses for long interest rate volatility. The fund invests in a mix of U.S. Treasury Inflation-Protected Securities (TIPS) of any maturity, U.S. government bonds whose principal amount increases with inflation.

It also invests in long options that are directly tied to the shape of the U.S. interest rate swap curve, which steepens when the spread between longer-term debt instrument swap rates and shorter-term debt instruments grows larger, flattens when the spread grows smaller, and inverts when the spread is negative.

Options are purchased up front with a premium in the OTC market, which typically has greater flexibility in terms between the buyer and seller, but there are fewer protections than on an exchange and no daily price fluctuation limits. Counterparties do not have to post variation margins, and there is no possible extra cash outflow or future liability for the fund under the options. The only risk is the premium that is paid up front, as well as IVOL’s options contracts being open to counterparty risk, a risk of non-performance by an options counterparty.

IVOL is actively managed by Quadratic Capital Management, an alternative asset management firm with experience in the options and volatility markets. It expects to invest less than 20% of the fund in option premiums and seeks to purchase options with a time-to-expiration between six months and two years.

- SAMSUNG USA AUTHORIZED - Includes 2 Year Extended...

- Samsung 85 Inch DU8000 Crystal UHD LED 4K Smart TV...

- UHD Dimming | Auto Game Mode (ALLM) | Alexa...

- SAMSUNG TIZEN OS: Stream your favorite shows, play...

- BUNDLE INCLUDES: Samsung DU8000 Series 4K HDR...

- SAMSUNG USA AUTHORIZED - Includes 2 Year Extended...

- Samsung 75 Inch DU8000 Crystal UHD LED 4K Smart TV...

- UHD Dimming | Auto Game Mode (ALLM) | Alexa...

- SAMSUNG TIZEN OS: Stream your favorite shows, play...

- BUNDLE INCLUDES: Samsung DU8000 Series 4K HDR...

IVOL carries an expense ratio of 1.05% and has $3.6 billion in assets under management.

For more news, information, and strategy, visit the China Insights Channel.