I learned a long time ago that you can be paid for simply investing in other's success. Living off dividends has been a lifelong goal of mine. We look at two of the best managed companies in the United States, in my humble opinion.

Live Off Dividends With 2 Big Income Picks

Co-produced with Treading Softly

When I was in high school, I had a very enterprising friend who started mowing lawns as a business. He was a very hard worker and soon had more interest in his business than he could fulfill himself. He brought on a partner, another of our friend circle, who also was very diligent and a hard worker.

Together they grew it from a two-man operation into a fledging small business with multiple employees, trucks, and other equipment necessary for their business.

As we all reached the age to graduate high school, they both wanted to go off to college and get degrees, so they decided to sell off their business to another company, and they did so successfully.

They learned a lot of valuable life lessons, and both have continued to be successful businessmen thereafter. Yet I learned a valuable lesson as well. They had another partner in their endeavor, a non-working partner who took part in the company's profits as payment for their investment in the company when it was growing and needed additional cash. This quiet investor got paid to do nothing more than support the company. I learned then that I wanted to be in such a place to generate income in this manner.

Not long later, in my college years, I discovered dividend investing, and the beginnings of my Income Method were forged.

The goal: To live off of dividends.

The method: Investing in companies and debt that consistently produces a high yield. Reinvesting a portion to benefit from the powerful magic of compounding on my income.

Let's look at two investments that can help you achieve that goal using this method!

Pick #1: WPC – Yield 5%

Talk about the low-hanging fruit! W. P. Carey (WPC) is a “triple net” REIT with exposure to the U.S. and Europe. Predicting WPC will hike its dividend in 2023 is like predicting that summer will come in 2023. The first dividend hike of 2023 will mark an important milestone for WPC. It will mark 25 years of consecutive dividend hikes. For the past 22 years, WPC has raised its dividend every single quarter.

So it isn't exactly a grand prediction to forecast that WPC will hike its dividend. I'll go out a little bit further: in 2023, WPC will hike its dividend more aggressively than it did in 2022.

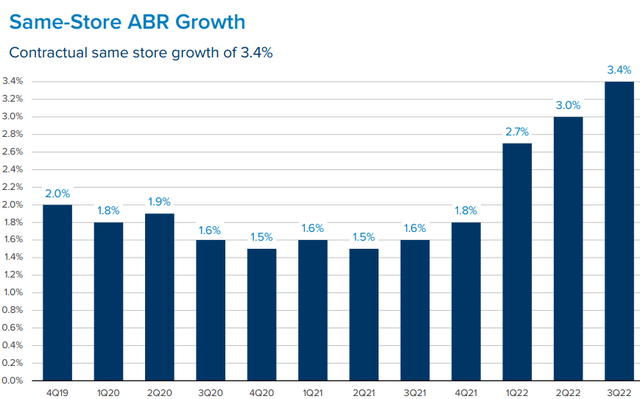

While WPC gets an A+ for consistency, the size of its dividend hikes has been anemic, with its Q4 2022 dividend only 0.95% higher than Q4 2021. The key reason is that rent growth has been low for years.

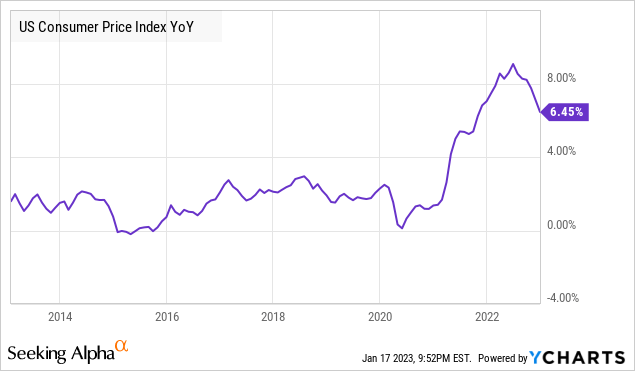

Remember, inflation was low for much of the past decade, usually below the Fed's 2% target, but in 2021 it started spiking up.

When we look at WPC's same-store rent growth, we can see that it did not spike up in 2021 when inflation did. Instead, rent growth wasn't even noticeable until Q1 2022. Source

The reason is that there's a delay between when CPI climbs and when rent increases. Based on guidance, WPC's AFFO is expected to grow by 6% in 2022, and its AFFO payout ratio improved from 85% in 2021 to 80% in 2022.

We can expect AFFO to grow even more aggressively in 2023, as CPI from 2022 starts to show up as rent increases. With the payout ratio down to 80%, WPC has room for dividend hikes to align more closely with AFFO growth.

- Tobias, Andrew (Author)

- English (Publication Language)

- 320 Pages - 04/19/2022 (Publication Date) - Harper...

- Reference Guide, Investment Lawyer's (Author)

- English (Publication Language)

- 46 Pages - 07/12/2019 (Publication Date) -...

AFFO growth will be driven by same-store rent growth. That will drive faster dividend growth.

Pick #2: EPD – Yield 7.6%

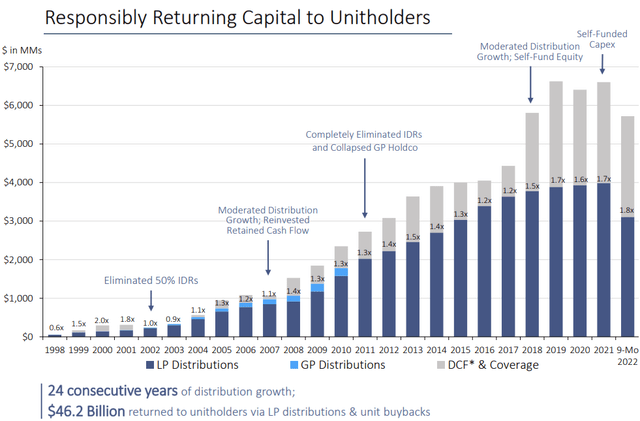

Enterprise Products Partners (EPD) was a fantastic all-around holding for us in 2022. The price went up, and it hiked its dividend twice. EPD has already announced its first hike for 2023, and we think there is a great chance of a second one. EPD now has 25 years of consecutive dividend hikes under its belt.

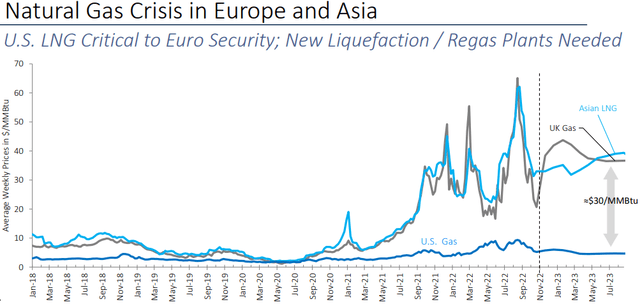

EPD is a diversified MLP, helping to insulate it from the movements of one particular commodity. In 2022, EPD benefited greatly from the demand for Natural Gas and LNG. Source

Energy makes the world go around, and EPD is one of the largest companies that deliver it. Over the years, shareholders have been richly rewarded. Even when the shale boom was derailed and U.S. energy was in the dumps, EPD kept generating a growing distribution and healthy cash flow.

Today, EPD funds all equity from cash flow, along with 100% of capex. This means that EPD is expanding without issuing any additional debt or tapping that capital markets to raise equity. It does all this by maintaining DCF (distributable cash flow) coverage of its distribution above 1.5x. This makes EPD one of the most conservative picks in the energy sector. It's an MLP you can count on to grow its distributions in the good times and the bad. It is a true “buy and hold forever” income investment.

Note: EPD issues a K-1 at tax time

Conclusion

With WPC and EPD, I can enjoy a growing income stream from two of the best-managed companies in the United States. I also get to fulfill my goal of being a passive investor who gets paid from the profits of the companies in which I invest.

Others push the mowers, and I help make it possible for them to do so. They get rewarded for their hard work, and I get rewarded for putting my capital at risk.

As I get older, I recognize the importance that all of us play in the success of one another. Do I still mow my own grass? Yes, currently, I do. However, that isn't always the case. I used to pay for my neighbor's son to mow my grass until he went to college.

I like to help those who have an enterprising mindset and spirit to succeed. It reminds me of my high school days and seeing the enjoyment and determination of those friends who put in the effort to become successful in running a small business.

Now I can be the quiet third partner. I don't need the praise or attention. I enjoy a quiet life reaping my dividend income and spending time with my wonderful wife. I also enjoy engaging with the Seeking Alpha community and engaging with my High Dividend Opportunities community.

You can live off dividends. You can be the third partner as well. Let's do that together as a community.