Just over halfway through the first quarter of 2023, it’s been mid cap equities outperforming large caps when looking at a pair of major market indexes representative of both. Specifically, it’s been the Russell Midcap index that’s up about 8.5% for the year, beating out the S&P 500’s 6.2% gain. If mid cap equities can sustain their level of performance through the rest of the year, traders can consider leveraging the opportunity via the Direxion Daily Mid Cap Bull 3X Shares (MIDU).

Per its fund description, MIDU seeks daily investment results equal to 300% of the daily performance of the S&P MidCap 400 Index. The fund invests at least 80% of its net assets in financial instruments, such as swap agreements, and securities of the index, ETFs that track the index, and other financial instruments that provide daily leveraged exposure to the index or ETFs that track the index.

When looking at the past 12 months, mid-cap equities have also shown resilience during last year’s inflation-racked downtrend. The same Russell Midcap index was down just under 3% while the S&P fell over 6%.

The S&P 500’s larger loss could be pinpointed to big tech, which comprises a heavy weight in the index. Big tech was one of the largest hit sectors last year as gloomy forecasts and cost-cutting via layoffs plagued tech’s biggest movers and shakers.

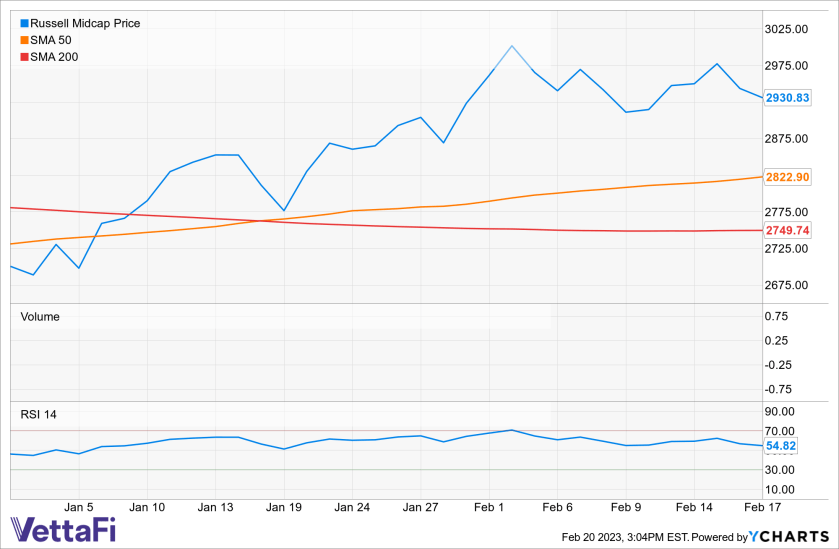

Right now, the the Russell Midcap index is exhibiting long-term and short-term strength from a technical standpoint. The index is trending above the 200- and 50-day moving averages.

It appears there’s still some momentum to run as well. The relative strength index (RSI) is currently between overbought and oversold levels.

- ➤【 HIGH-PERFORMANCE CAR JUMP STARTER...

- ➤【 SMART CORDLESS INFLATOR WITH LCD SCREEN 】...

- ➤【 ESCORT YOUR SAFETY 】Thanks to the...

- ➤【 ALL-IN-ONE JUMP STARTER 】Say goodbye to...

- ➤【 WHAT YOU GET & WARRANTY 】YabeAuto YA70...

- 【UNIVERSAL FIT KIT】- The kit contains 23 types...

- 【TOP QUALITY】- These car retainer clips are...

- 【PREFECT FOR WHAT YOU NEED】 - Up to 680 pieces...

- 【BONUS ACCESSORIES】- We provide different size...

- 【WIDE APPLICATION】- Professional push clips...

- Powerful Car Jumper Starter - The Scatach 011 jump...

- Advanced Safety Features - Easy to opearte, and...

- Portable Design - This portable car battery...

- Respond to Emergencies - Portable power bank with...

- What will you Get ? - Scatach 011 Car Starter...

- 【What You Get】1*Tactical Molle Seat Back...

- 【Military Molle System - Lots Of...

- 【Durable and Long Lasting】 MOLLE seat back...

- 【Tactical Seat Covers Universal】 The size of...

- 【Guarantee】If you're not 100% satisfied with...

Diamond in the Rough

Given the strong performance of mid caps, unfortunately, most investors don’t have enough allocation to these mid cap companies. They don’t receive as much market attention as their larger cap counterparts, making them somewhat of a diamond in the rough.

“It’s long been the case that mid-cap stocks aren’t as widely followed by sell-side research analysts as their large-cap counterparts,” a John Hancock investment management blog noted. “Larger-cap companies have historically attracted more analysts, and the trading volume of the largest companies in large- and mid-cap indexes reveals a decided tilt toward large-cap stocks. Most investors, it turns out, are underexposed to mid-cap stocks.”

For more news, information, and analysis, visit the Leveraged & Inverse Channel.