LVHD is dominated by the utilities and staples sector. Economic and market conditions look troubling. LVHD’s low beta qualities and cheap valuations make it a useful pick in the current environment. Looking for higher risk/reward options trading ideas? I offer this and much more at my exclusive investing ideas service, The Lead-Lag Report.

LVHD ETF: This Lifebuoy May Help Your Portfolio (NASDAQ:LVHD)

ETF Characteristics

The Legg Mason Low Volatility High Dividend ETF (NASDAQ:LVHD), with $600m in assets under management (“AUM”), and a trading history of almost 7 years, is one of the lesser-known defensive products around. The portfolio here is oriented towards 100-odd stocks that provide stable income and exhibit lower price and earnings volatility.

To get to the final portfolio, 3000 stocks from the Solactive US Broad Market Index are put through a proprietary methodology which first involves ascertaining if these stocks have generated the requisite earnings to pay out dividends; to be more specific, these stocks are required to have demonstrated profitability over the last 4 quarters. This is a useful screener in weeding out loss-making names that may have paid out special dividends in light of a stake sale or so.

After that, an aggregate “stable” yield score is computed, whereby stocks with relatively low price and earnings volatility are given greater precedence over those with high price and earnings volatility.

LVHD does well to cap individual stock weights at 2.5%, and despite a rebalancing exercise that is carried out every quarter, you're still looking at a fairly stable portfolio, as exemplified by an annual portfolio turnover rate of just 14% (which is 2x lower than the typical turnover rate of most ETFs).

As noted earlier, LVHD is your classic defensive portfolio, and this is exemplified by the fact that both the utilities sector and the consumer staples jointly account for ~43% of the total portfolio. Subscribers of The Lead-Lag Report would note that in the “Leaders-Laggers” section of this week's report, I've talked up the growing promise of both sectors.

Utilities have typically always served as a good leading indicator of weak market sentiment and their relative strength over the S&P 500 has picked up steam.

Likewise, the consumer staples sector has also been one of the best performing sectors over the past two weeks; a ratio measuring the strength of staple stocks over the S&P 500 had dropped below its 20-day moving average in late July, but this has recently changed, and the ratio looks all set to reclaim its 20-day moving average.

Ongoing Conditions Call For Defensive Positioning

So why should you rotate to LVHD?

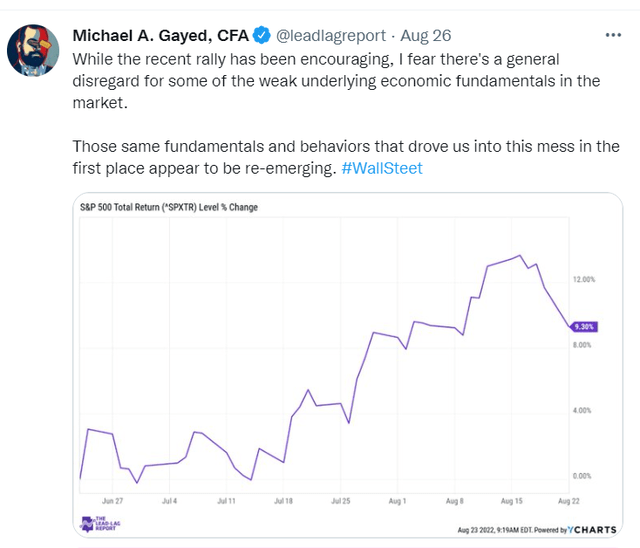

Well, as subscribers of The Lead-Lag Report would tell you, I've been expressing my skepticism over the summer rally for quite a few weeks now and have often wondered if it has legs.

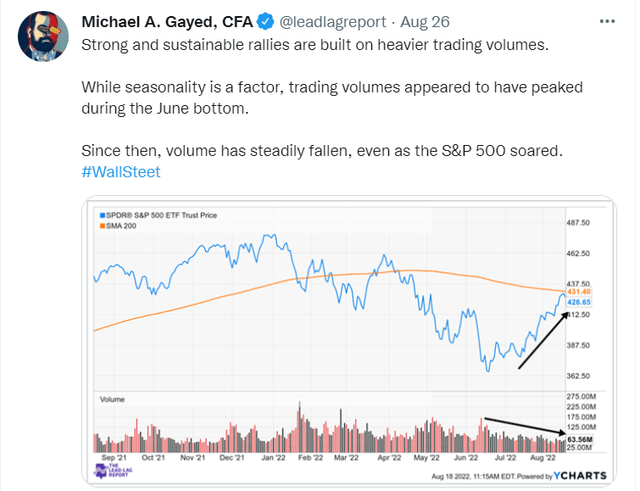

Firstly, this recent rally has been driven by below-par volumes, which have been quite subdued over the last couple of months.

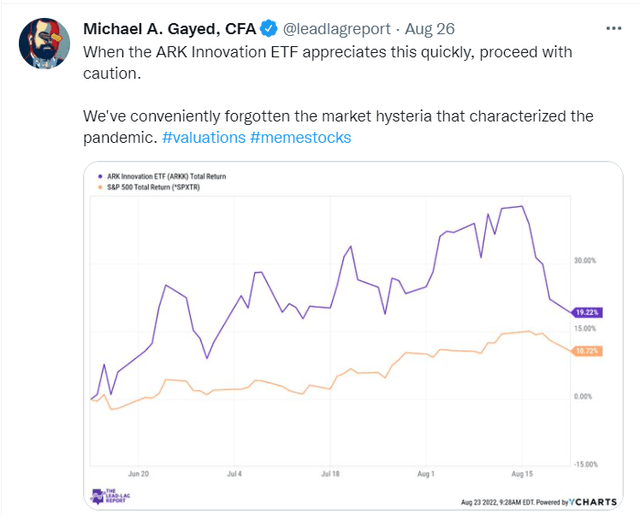

Then, when you have some fairly notorious names such as the ARK Innovation ETF (ARKK) surging so quickly and outperforming the benchmark, it also makes you question the quality of the rally.

- Tobias, Andrew (Author)

- English (Publication Language)

- 320 Pages - 04/19/2022 (Publication Date) - Harper...

- Reference Guide, Investment Lawyer's (Author)

- English (Publication Language)

- 46 Pages - 07/12/2019 (Publication Date) -...

Last update on 2024-04-05 / Affiliate links / Images from Amazon Product Advertising API

In my Lead-Lag Live discussion with options expert – Ming Zhao, we've also brought up the risks associated with market manipulation and a potential gamma squeeze, which can often give one a false illusion of the strength of the market on the surface, even as the fundamentals suggest something else.

All in all, it's hard to reconcile the optimism seen on Wall Street over the past few months when the housing market, which is such an integral part of the economy, appears to be toppling over. Inventories are at worryingly high levels, home sales have been sliding, 30-year mortgage rates are close to the 6% mark; all in all, the supply-demand conditions here don't quite feel right.

Mind, the red flags aren't limited to the housing market alone; think about the latest PMI readings, where both the services and composite gauges are well below the contracting/expansion barrier of 50 and are also incidentally at their lowest points since the COVID recession. The once strong labor market too appears to be cooling, with PWC's recent pulse Original Postulse-survey/managing-business-risks.html">survey only substantiating employers' intent to go slow on hiring.

Then, there's that relentless pest-inflation which does not appear to be going away; after forming an intermediate bottom, breakeven inflation rates have been trending up since the second week of July.

Besides, as noted in The Lead-Lag Report, don't also write off the prospect of what a Chinese invasion of Taiwan could do to already high levels of inflation. To get a better understanding of the China/Taiwan dynamics you may consider listening to my chat with Mick Ryan on Lead-Lag Live where he was able to touch on some tricky nuances.

This also means that Powell and his cronies have limited flexibility on what they'd like to prioritize; avert a recession, or focus on managing inflation. Based on the communications last week, it appears that Powell has little sympathy for the pain that households and businesses are likely to face, but that is easier said than done, and I'd like to see the same sense of bravado when economic conditions really crater. If anything, the recent decline in the yields of long-dated bonds also suggests that recession risks are only growing.

Basically, this cat-and-mouse game between managing inflation and recessionary risks could take volatility levels in the market to an uncomfortable threshold.

Conclusion

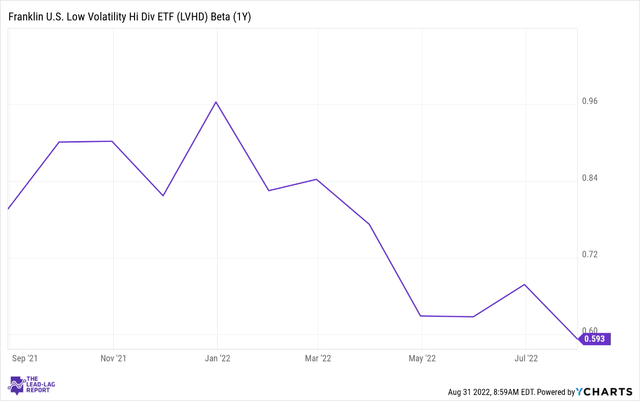

As noted in this article, the outlook for the broader market does not look too appealing, and it would pay to pursue products that are less receptive to the movement of the benchmark. In that light, LVHD comes across as a fine option as its responsiveness to the market, has been steadily dropping in recent months and is at its lowest point in over a year's time.

Also, consider that its forward valuations are a lot cheaper; LVHD can be picked up at 15.2x P/E, whilst the S&P 500 trades at 17.9x. Finally, also note that we could be getting to a point where all four of my inter-market signals could be switching to risk-off; this typically serves as a precursor of stock market declines; that's when you need your lifebuoys, and something like an LVHD may well step up to the plate.