DIVZ is an actively-managed low-volatility ETF that has a 3.13% expected dividend yield. It was shortlisted for Active Equity ETF of the Year based on performance and fund flows in 2022.High Energy exposure was a big reason. However, exposure is down to around 15% due to the sector's underperformance YTD. DIVZ also made some key substitutions over the last quarter.DIVZ is now more defensive than ever. Its five-year beta is 0.73, and its fundamentals match up well against passive alternatives like SCHD, VYM, and DHS.

DIVZ: Tactical Adjustments Made To Help Defensive Dividend Investors (NYSEARCA:DIVZ)

Investment Thesis

The manager of the TrueShares Low Volatility Equity Income ETF (NYSEARCA:DIVZ) operates with high conviction and doesn't typically make many changes. However, in the last quarter, I noticed five additions and seven deletions that accounted for 20% of the portfolio and changed the fund's makeup, making it more appealing to defensive dividend investors. This article describes those changes, compares the ETF's current fundamentals with other high-yielding funds, and discusses the type of investor DIVZ is best suited for.

DIVZ Overview

Strategy Discussion

DIVZ's manager, Austin Graff, operates with high conviction. Mr. Graff, a CFA Charterholder, takes a total portfolio approach (i.e., considers how securities interact) and selects 25-35 large-cap U.S. stocks with high margins, high cash conversion rates, low valuations, and solidities growth expectations. The strategy also favors low-volatility stocks, evident in the security selections I've observed in previous reviews. DIVZ's five-year beta in September and November 2022 was 0.85 and fell to 0.80 in February. High-yielding large-cap stocks have low betas, but DIVZ's is still lower than average. That's a good feature if you're a conservative investor.

The low beta is more impressive considering the manager's preference for Energy stocks, which tend to be volatile. Exposure is 16% (down from 18.5% in February), but the manager kept positions in all holdings through the last quarter. I won't re-hash my view that digging in on this sector was a mistake. However, it demonstrates confidence, which may benefit those willing to stick it out over the long run.

Performance and Fund Flows

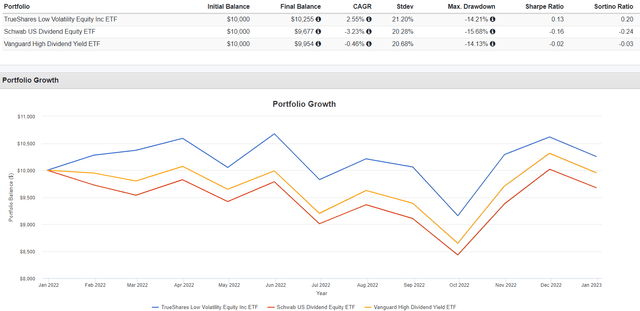

DIVZ was Original Postage/shorlist" rel="noreferrer noopener" target="_blank">recently shortlisted for the “Active ETF of the Year” award based on 2022 performance and fund flows. It was one of the few dividend ETFs to break even that year, beating popular passive funds like the Schwab U.S. Dividend Equity ETF (SCHD) and the Vanguard High Dividend Yield ETF (VYM) by 5.78% and 3.01%. Overweighting the Energy sector was a big part of that. Funds like the WisdomTree U.S. High Dividend ETF (DHS) did even better.

However, fund flows have been down over the last three months. In February, DIVZ had 2.725 million shares outstanding and a $29.15 per share NAV. Today, shares outstanding declined by 11% to 2.420 million, and the NAV per share fell by 5% to $27.71.

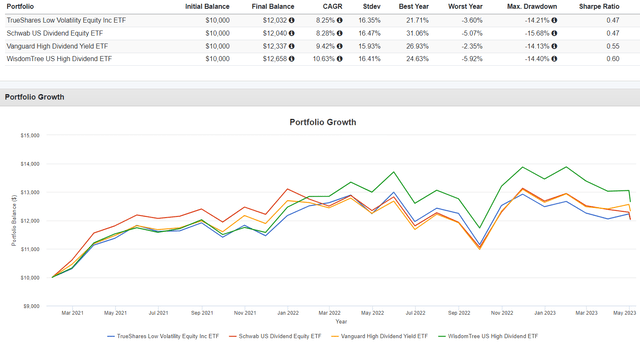

Since its January 2021 launch, DIVZ underperformed SCHD, VYM, and DHS. Relative performance may not be consistent, primarily because of Energy. It's a significant bet on a historically volatile sector, but overall exposure has come down 7.5% since September 2022, so it seems more palatable than before.

DIVZ Analysis

Sector Exposures and Top Ten Holdings

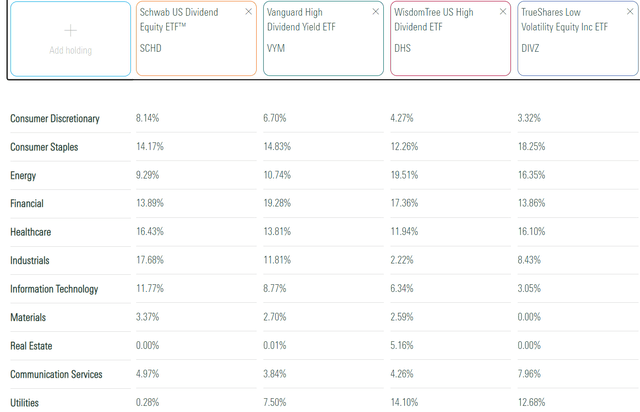

The following table highlights sector exposures for DIVZ alongside SCHD, VYM, and DHS. All these large-cap ETFs have a 9%+ allocation to the Energy sector and yield above 3%, so I consider them suitable passive alternatives.

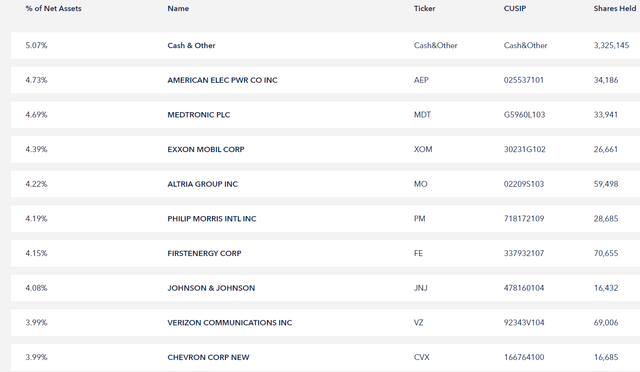

DIVZ also overweights Consumer Staples, Health Care, and Utilities. All three lower the portfolio's beta and offset some of the volatility generated by the Energy holdings. However, DIVZ holds Altria Group (MO) and Philip Morris (PM), two leading tobacco companies. The same applies to AT&T (T) and Verizon Communications (VZ). There are only 30 securities (including cash), so I think greater industry-level diversification would be better. Below are the top ten holdings, which total 44%.

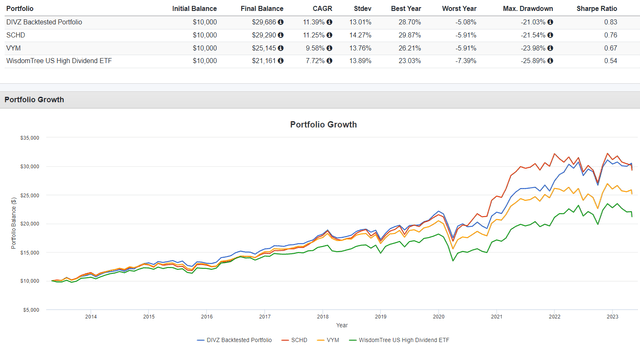

Finally, I ran a backtest of the current equity portion of the portfolio over the last ten years. I caution readers to take this with a grain of salt because it has the benefit of hindsight. Still, it further illustrates how the manager takes the long view. Mr. Graff doesn't get caught up in short-term price swings and believes his approach will pay off in the long run.

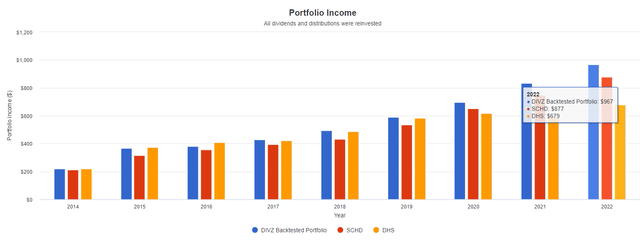

The backtest looks excellent, and most investors would be pleased if these results repeat. The portfolio experienced less volatility than its peers and even outperformed SCHD, a popular benchmark. In addition, portfolio income was high. On a $10,000 investment in January 2014 with reinvested dividends, income grew from $218 to $967.

Key Changes

- Tobias, Andrew (Author)

- English (Publication Language)

- 320 Pages - 04/19/2022 (Publication Date) - Harper...

- Reference Guide, Investment Lawyer's (Author)

- English (Publication Language)

- 46 Pages - 07/12/2019 (Publication Date) -...

Since February, DIVZ added five stocks and deleted seven, as follows:

- Charles Schwab (SCHW): Addition (3.62%)

- WEC Energy Group (WEC): Addition (3.28%)

- Kroger (KR): Addition (3.18%)

- Visa (V): Addition (3.11%)

- Analog Devices (ADI): Addition (2.97%)

- Gen Digital (GEN): Deletion (3.99%)

- Viatris (VTRS): Deletion (3.61%)

- PNC Financial Services (PNC): Deletion (3.09%)

- Microsoft (MSFT): Deletion (3.04%)

- Newmont (NEM): Deletion (2.96%)

- US Bancorp (USB): Deletion (2.22%)

- Union Pacific (UNP): Deletion (0.90%)

In addition, exposure to Exxon Mobil (XOM) and Devon Energy (DVN) decreased by 1.85% and 1.73%, and DIVZ increased its cash position to 5.07% from 1.73%, presumably invested in a money market fund.

DIVZ Fundamentals

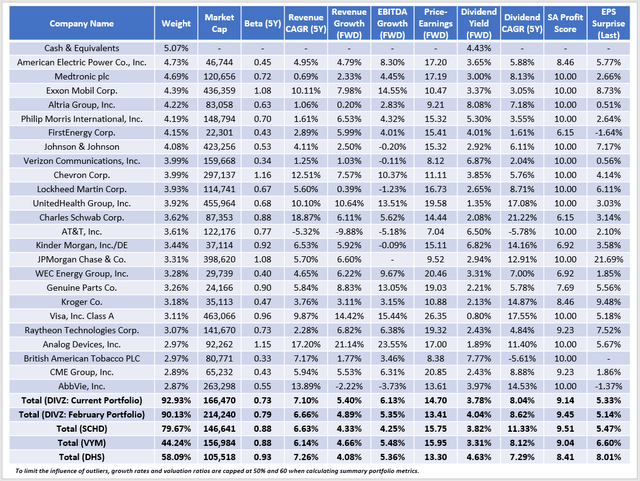

The following table highlights selected fundamental metrics for DIVZ's top 25 holdings. As discussed, the volatility and yield objectives are met. DIVZ has a low 0.73 five-year beta on its equity holdings and yields 3.78% (3.13% net).

DIVZ looks more defensive than before. Its beta declined to 0.73 from 0.79, and the gross dividend yield fell about 0.26%. These changes demonstrate how DIVZ's manager currently prioritizes safety over yield. However, quality was negatively impacted, as indicated by a lower profitability score (9.14/10 vs. 9.45/10 previously). I also consider DIVZ's estimated 5.40% and 6.13% revenue and EBITDA growth rate weak, but that's the case for most dividend ETFs, including SCHD, VYM, and DHS. It's a common problem for dividend funds, so I don't expect as much market outperformance as last year.

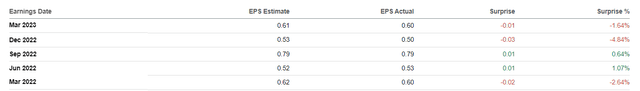

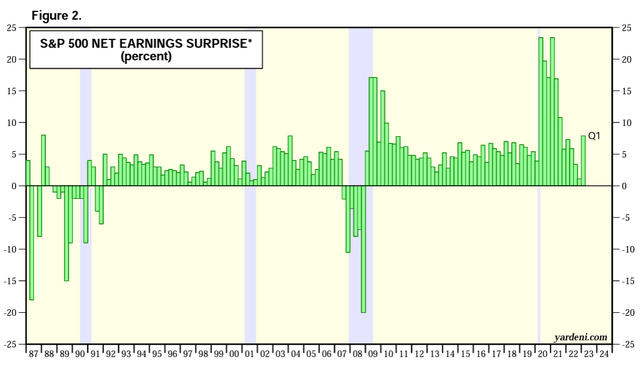

Finally, I want to point out how DIVZ and other dividend ETFs are generally underperforming this earnings season. As shown above, most companies' earnings surprises are in the single digits; some are negative, like FirstEnergy (FE). The stock is down approximately 5% since its 1.64% miss.

Again, DIVZ's manager does not focus much on quarterly results, calling it a flawed approach earlier this week. I disagree because tracking earnings surprises provides a good gauge of sentiment and can inform the direction you want to take your portfolio. For example, substantial earnings surprises in 2009, 2020, and 2021 accompanied huge returns, and factor-based funds typically underperformed. In contrast, a return to a more normal earnings surprise level (5-7%) occurred in Q4 2021, and fundamentally strong portfolios, including DIVZ, performed well afterward. An active manager can use this information to their advantage, so I consider it a missed opportunity.

Investment Recommendation

DIVZ made crucial changes since my February review by swapping approximately 20% of the portfolio and increasing its cash position to 5%. The portfolio's beta dropped from 0.79 to 0.73, and the yield fell by 0.26%. After adjusting fees, I expect a net yield of approximately 3.13%. These changes suggest a more conservative outlook that I think is reasonable.

When deciding on any ETF, investors should agree with the strategy. For actively-managed funds like DIVZ, it's primarily about agreeing with the fund manager's investment philosophy. From what I have seen, DIVZ's manager is committed to bottom-up fundamental analysis, doesn't give much weight to quarterly earnings reports, and is patient. If that sounds like you, DIVZ could be a great fit. Otherwise, there are better choices in the passive space, and I hope I gave a few good suggestions today. Thank you for reading, and I look forward to the discussion in the comments section below