FALN and ANGL both invest in fallen angels or recently downgraded non-investment grade corporate bonds. ANGL is the larger, more well-known of the pair, but I think FALN is the stronger investment. A look as to why follows.

Author's note: This article was released to CEF/ETF Income Laboratory members on May 2nd, but numbers have been updated.

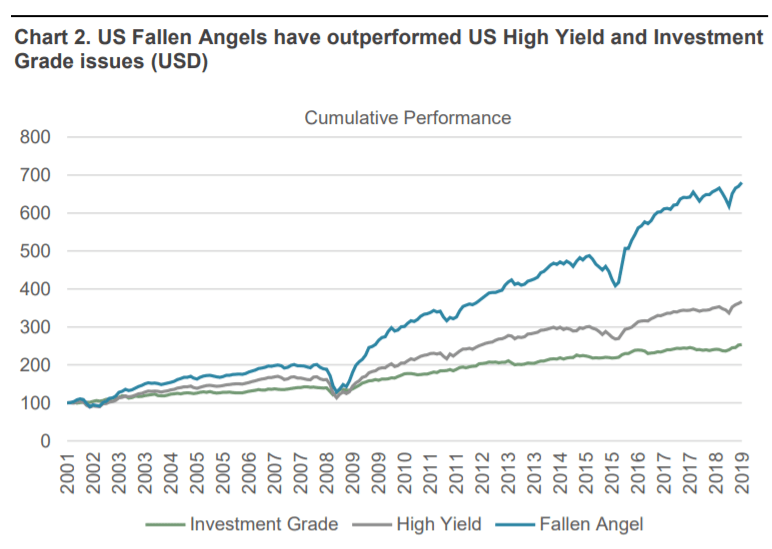

The VanEck Fallen Angel High Yield Bond ETF (NASDAQ:ANGL) and the iShares Fallen Angels USD Bond ETF (NASDAQ:FALN) are both ETFs investing in fallen angels, or recently downgraded non-investment grade corporate bonds. Fallen angels have outperformed high-yield corporate bond benchmarks for decades, as forced selling causes these securities to trade at comparatively low prices, leading to outsized capital gains.

Of the two, ANGL is the larger, more popular fund, with $2.6B in assets, versus $1.5B for FALN. On the other hand, and in my opinion, FALN is quite clearly the stronger investment, due to its lower 0.25% expense ratio, higher 5.3% yield, and slightly better performance. Both FALN and ANGL are good investment opportunities, but FALN is quite clearly the stronger of the two.

FALN and ANGL – Comparison

Investment Strategy, Holdings, and Investment Thesis

Both funds are index funds investing in fallen angels, or investment-grade corporate bonds downgraded to non-investment grade. ANGL tracks the ICE US Fallen Angel High Yield 10% Constrained Index, FALN the Bloomberg US High Yield Fallen Angel 3% Capped Index.

Fallen angels tend to outperform comparable non-investment grade bonds, due to structural issues or peculiarities in bond markets. Let's have a quick look at these before analysing the funds themselves. I have a longer, more in-depth look at these securities Original Post>

Corporate bonds are generally divided into two distinct groups, investment grade, with a rating of at least BBB-, and non-investment grade, with a rating of BB+ and below. Some institutional investors and index funds are constrained from investing in non-investment grade securities, due to their high levels of risk. These same investors are rarely constrained from investing in investment-grade securities, and so tend to invest quite heavily in these. Some focus on BBB-rated securities, to maximise their yield.

Investment-grade bonds downgraded to non-investment grade ratings are known as fallen angels. Lots of institutional investors must, necessarily, sell their fallen angel investments, as they are prohibited from holding non-investment grade securities. Selling means lower prices, and so fallen angels tend to sport comparatively low prices, and comparatively strong yields. Low prices tend to lead to strong capital gains, leading to strong overall returns and outperformance for fallen angels. This has been the case for these securities for decades:

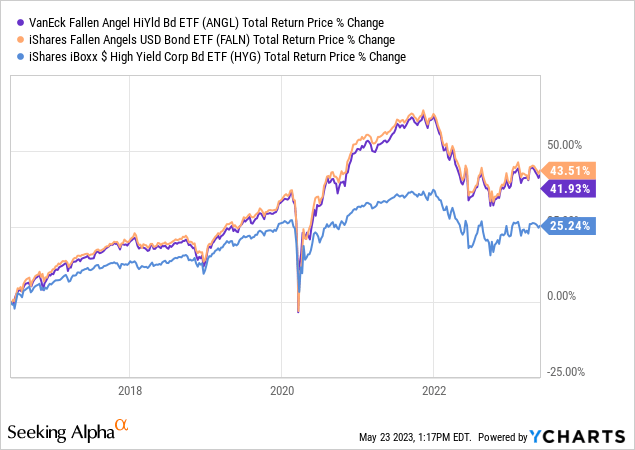

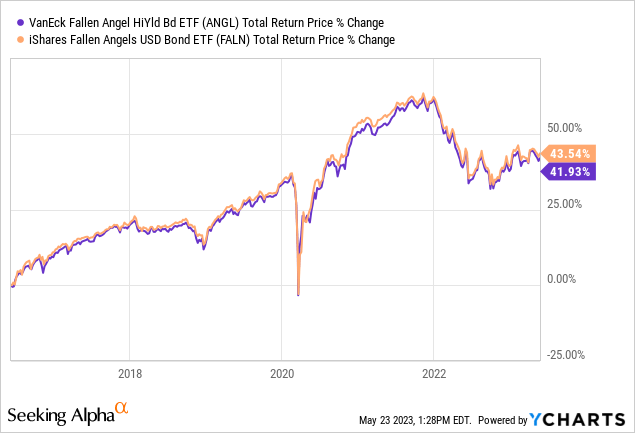

and for both funds since inception:

ANGL and FALN both invest in fallen angels, and so have similar investment strategies, holdings, and investment thesis.

The strategy is the same for both funds: invest in fallen angels.

The holdings are basically the same too: fallen angels. FALN is a bit more diversified, with 268 holdings, versus 207 for ANGL.

The investment thesis is basically the same too: the strong, decades-long track-record of outperformance for these securities and funds.

ANGL and FALN are very similar funds, but there are some differences between them. Let's have a look at these.

Expense Ratio – FALN Clear Winner

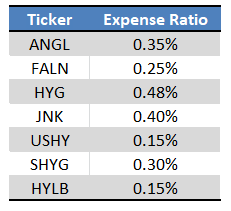

Both funds have reasonable expense ratios, broadly in-line with those of its peers. At the same time, FALN is a bit cheaper, with a 0.25% expense ratio, versus 0.35% for ANGL. A quick table of the expenses of some of the larger funds in this space.

FALN's lower expense ratio directly increases (reduces by less) the fund's yield and total returns, benefitting investors. As the fund is only 0.10% cheaper than ANGL the benefit is small, but it is a benefit nonetheless. As both funds have similar strategies and holdings, going for the cheapest one seems like a sensible idea, and that means going for FALN over ANGL.

Credit Quality – ANGL Slight Winner

No products found.

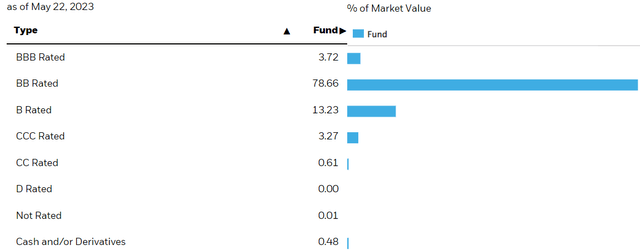

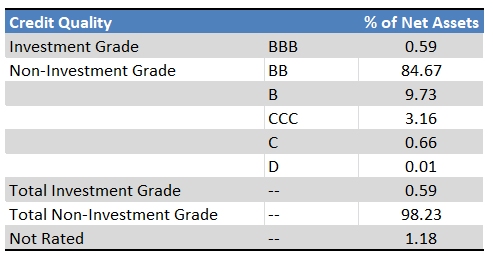

ANGL and FALN have broadly similar investment strategies and holdings, but there are a few minor differences. From what I've seen, it seems that FALN's underlying index is a bit broader, a bit less stringent, which results in a larger portfolio with a bit weaker credit quality. For reference, FALN's credit quality:

and ANGL's:

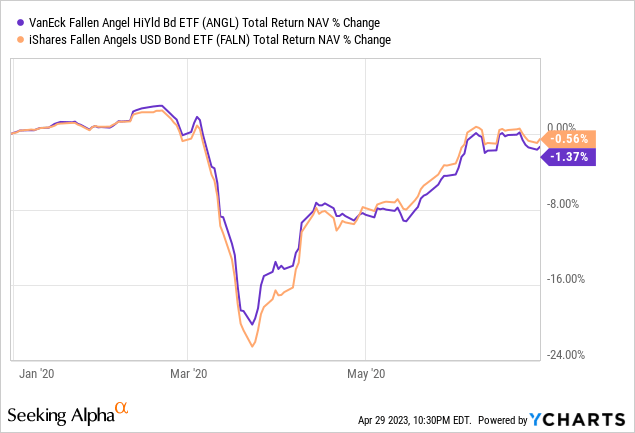

FALN's weaker credit quality should result in marginally higher losses during downturns and recessions. This does not seem to have been the case in early 2020, the onset of the coronavirus pandemic.

As can be seen above, FALN suffered higher losses in the first quarter of that year but recovered from these a bit quicker in the second quarter. I would not characterize the above as FALN underperforming, even though that should have been the case considering the fund's marginally weaker credit quality. In my opinion, the fund's stronger-than-expected performance was due to volatility, and as these two funds are quite similar regardless.

FALN's marginally weaker credit quality increases risk, volatility, and potential losses during downturns and recessions. Although these issues have not materialized in the past, they are still broadly true, and a small negative for FALN and its shareholders.

Dividend Yield – FALN Slight Winner

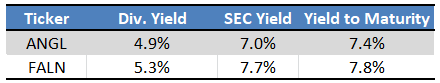

FALN's lower expense ratio and weaker credit quality both serve to increase the fund's yield vis a vis ANGL. This is the case for all relevant yield metrics, including SEC yields, a standardized measure of a fund's underlying generation of income, and which can be construed as something of a forward yield.

FALN's higher dividend yield is a strong, self-evident benefit for investors, and an important advantage relative to ANGL. It should also result in higher total returns moving forward, which brings me to my next point.

Performance Track-Record – FALN Slight Winner

FALN is a bit cheaper, and yields a bit more, than ANGL, both of which boost the fund's total returns. As such, and considering the similarities between these two funds, FALN should outperform ANGL long-term, as has been the case since inception.

No products found.

From the above, it seems that FALN has outperformed ANGL by around 0.20% per year since inception. FALN is 0.10% cheaper and yields around 0.30% more, so results are broadly consistent with fundamentals. Although FALN's outperformance is quite small, it is quite consistent, and an advantage of the fund vis a vis ANGL.

Conclusion

ANGL and FALN both invest in fallen angels, or recently downgraded non-investment grade corporate bonds. In my opinion, FALN's lower expense ratio, higher yield, and stronger performance track-record make it the superior investment opportunity of the pair.